BalkansCat/iStock Editorial via Getty Images

TELUS Corporation (NYSE:TU) has not made any major moves since our last neutral piece on it.

Seeking Alpha

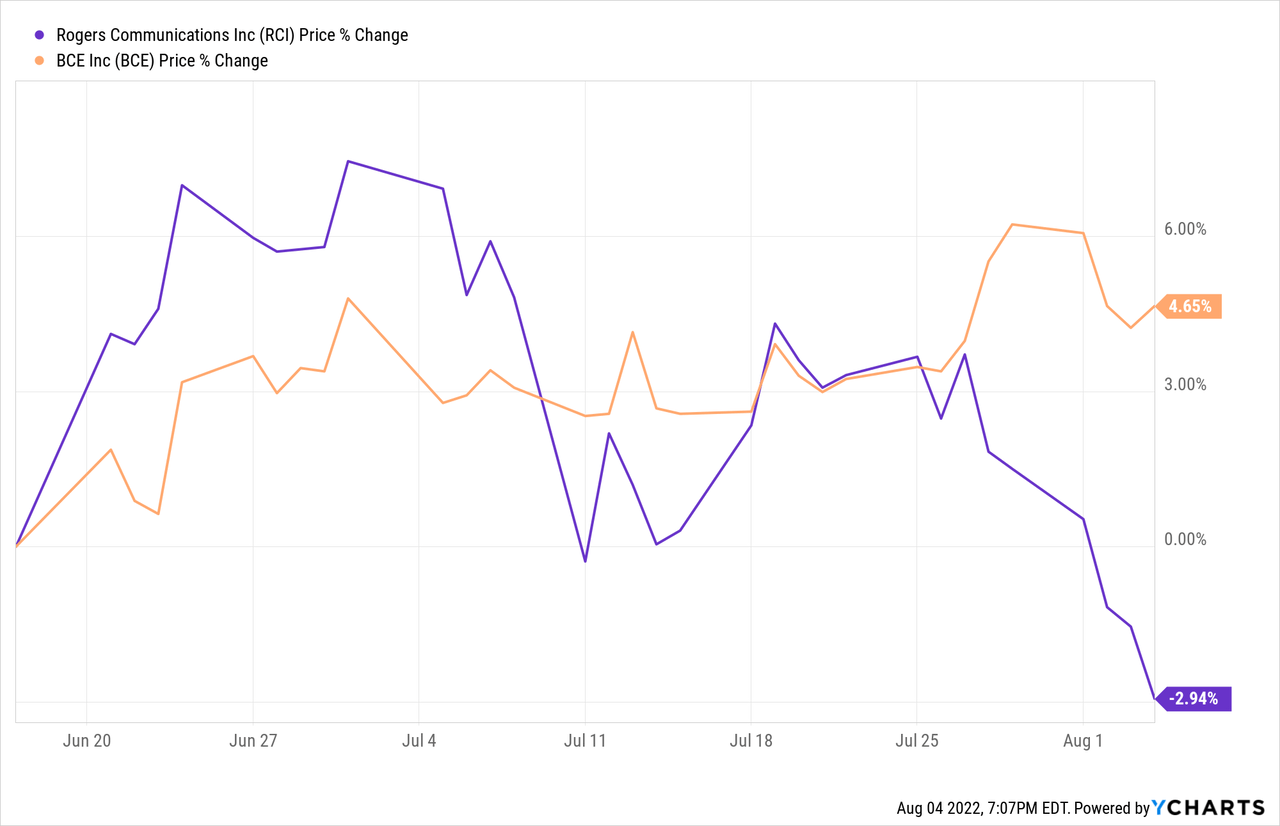

On the bright side for this stock, its competitor Rogers Communications Inc. (RCI, OTCPK:RCIAF) continues to remain dead in the Canadian arena.

While we were not ready to go long TU the last time around, we were open to going long at a higher yield and said as much in our conclusion.

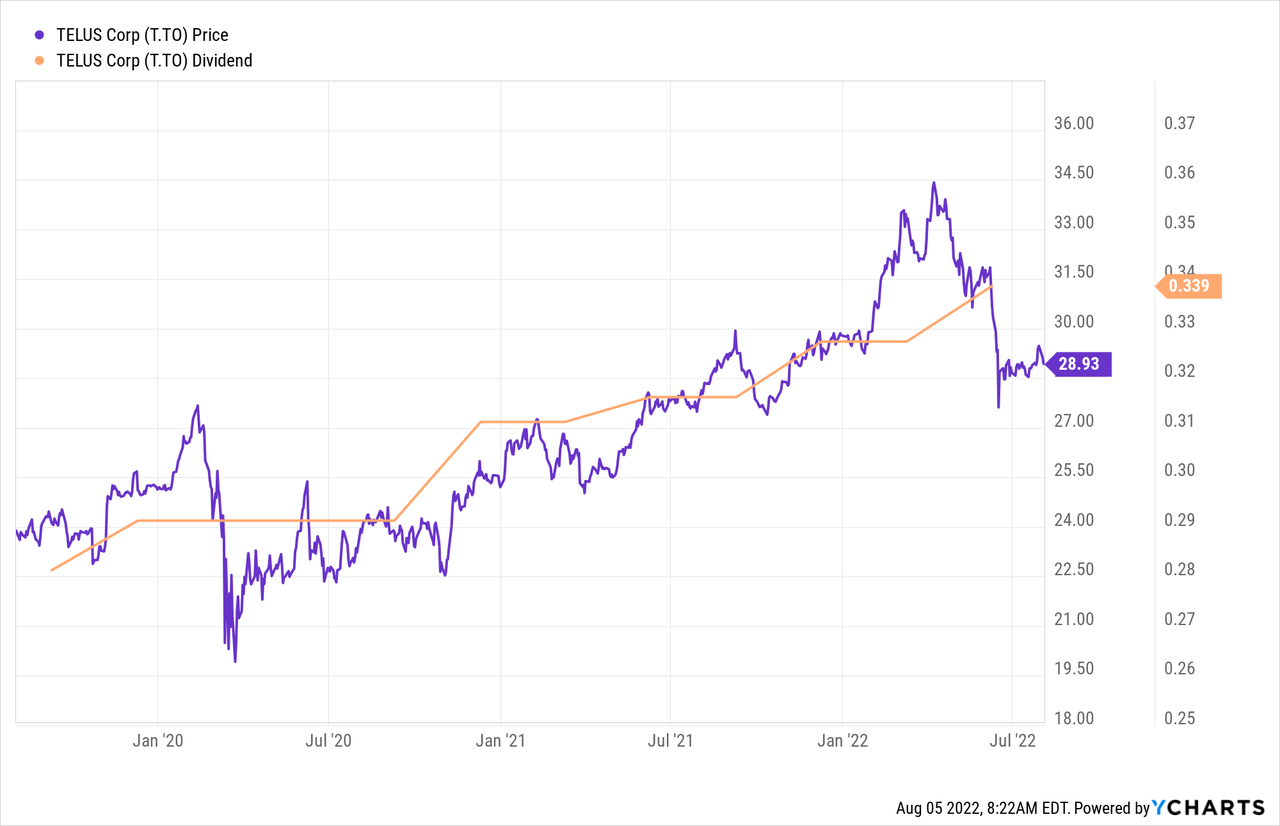

TELUS continues delivering steady results and its key competitor Rogers Communications Inc. (RCI), remains distracted with a host of issues. The acquisition of LifeWorks was expensive, but that was partially mitigated by using its own expensive shares for the purchase. Dividend yield appears appealing until you realize that the 5-Year GIC in Canada (what you Americans call Bank CDs) now yield 4.4%. Overall, we think valuation has compressed modestly and the roll-forward to 2023 helps us move this to a Neutral/Hold. We would only be excited to buy this if we see a 6% plus dividend yield alongside improvement in other valuation measures.

Source: TELUS Why You Think This Is A Good Deal

The needle has not moved enough on the yield, so we are not there yet. The results are out, though, so let us take this opportunity to go over the numbers and provide an update to our prior thesis.

Q2-2022

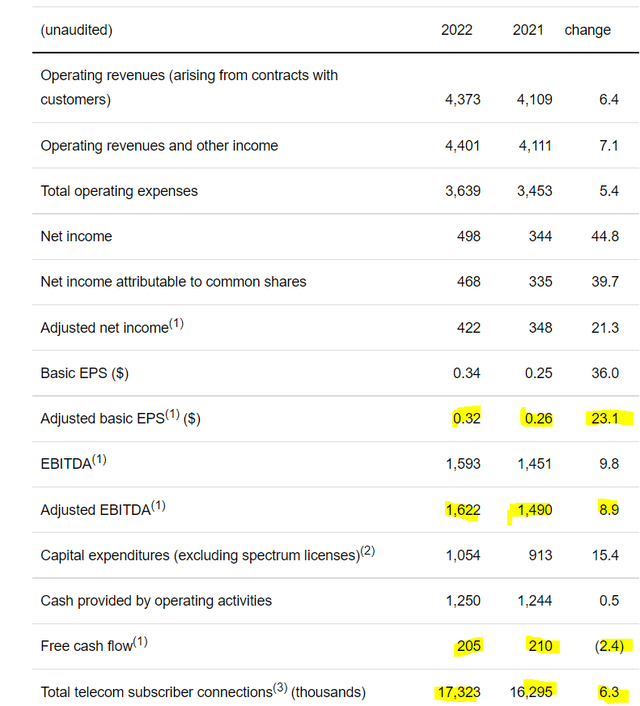

TELUS had a strong report. Revenues were up 7.1% and net adds of customers were at a similar 6.3% year-over-year. This part is not surprising in a full employment market.

While expenses rose as well, they grew slower than revenues and allowed TELUS to open a nice gulf between the two. The critically watched adjusted EBITDA number came in at 8.9% and earnings per share grew almost by a quarter. One negative for investors was the free cash flow, which contracted by a tiny amount. While we have some idea on the Capex TELUS is aiming for, we do see some lumpiness from quarter to quarter and this can be attributed solely to that.

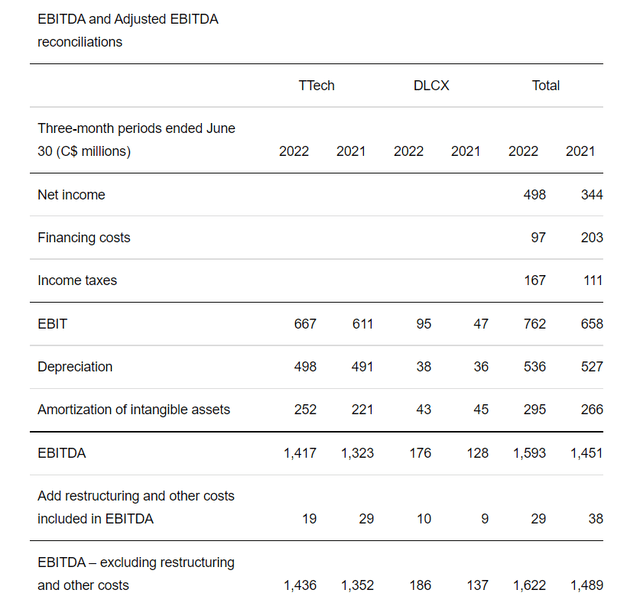

Growth investors have been closely watching the TTech and DLCX segments which we have previously covered. It was here that numbers came in a bit below expectations from the TTech side, although DLCX was above expectations.

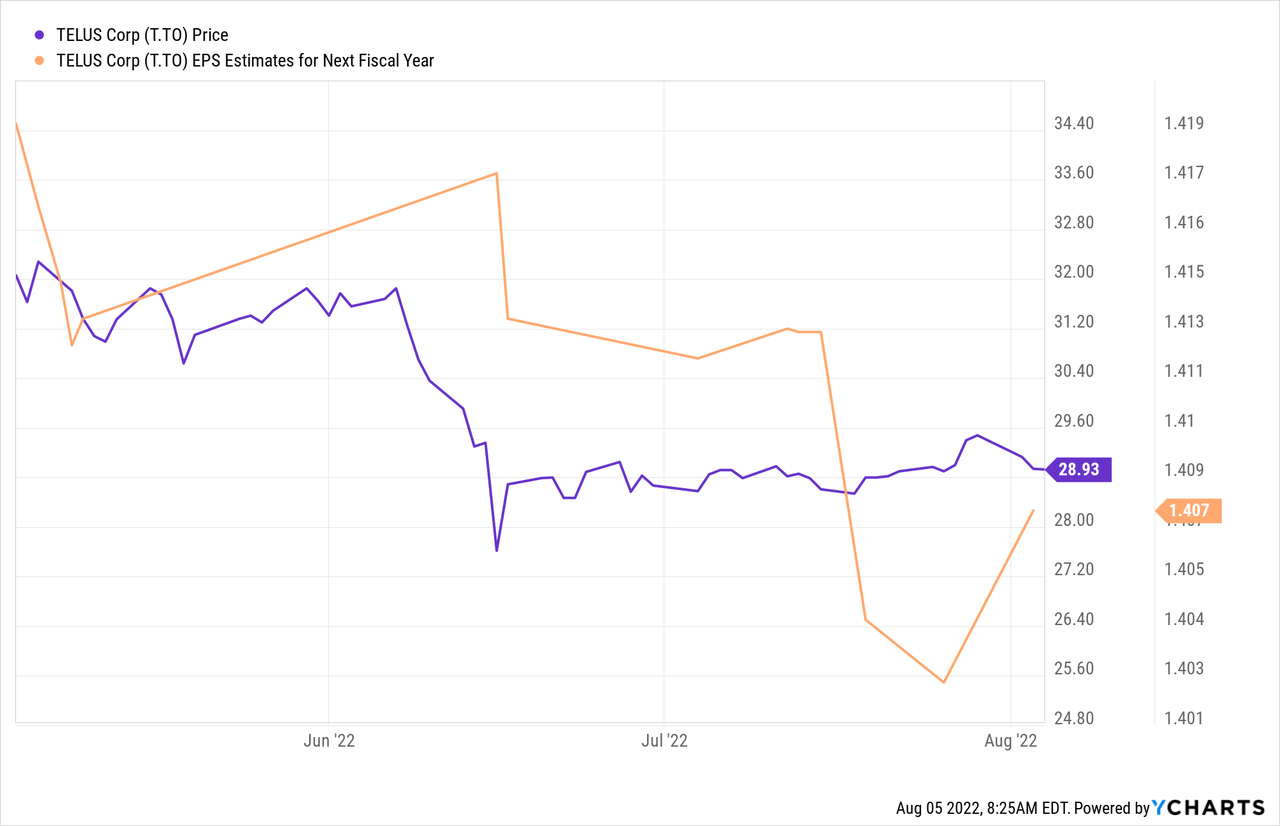

The Street had a $1.450 billion plus number for TTech, and this is the second quarter where numbers have been a little weaker versus expectations. This is a little on the concerning side as the high valuation premium for TELUS versus other stocks has always been attributed to its growth story. To us, this was a case of paying too much for a weak story. We can see that in the quarter here too, where despite EPS moving up by 25% it still does not cover the declared dividend. Yes, TELUS has moved the dividend (price and dividends shown in CAD) up recently.

But we would refocus on the primary story here. That story is that the $1.43 EPS reported in 2019, won’t be exceeded even in 2023.

We can again bet that no one is pricing in a recession into these numbers, because if we hit one, you can bet you will see an easy 25% drop in these estimates.

Key Development

Rogers announced that it would sell Freedom Mobile to Quebecor Inc. (OTCPK:QBCRF). This is a very interesting development that Rogers has undertaken, at a below-market price, to appease the Competition Bureau and smoothen its takeover of Shaw Communications (SJR). While this has still not completely appeased them, the odds are high that a deal can be reached. Freedom under Quebecor will be a competitive fourth national carrier, and we will likely see some pricing pressure in 2023. The opposite view here is that a strong fourth competitor, who is unlikely to price very aggressively, is better than foreign carriers trying to make inroads in Canada. No doubt the latter would have very strong support at the government level and would impact profitability for years to come. Our view aligns more on the negative side here, and think that if Freedom does go to Quebecor, we will see a good cut to profit margins over the medium term.

Verdict

The results were good overall. Canadian GDP was still soaring in the first half of 2022, so we would expect no less. The slowdown with the rate hikes in the pipeline will hit soon, though. Canadian job numbers were extremely weak, and 30,000 jobs were lost versus the 20,000 gain expected.

DailyFX Aug 5, 2022

That is why we expect the visuals to shift towards valuation.

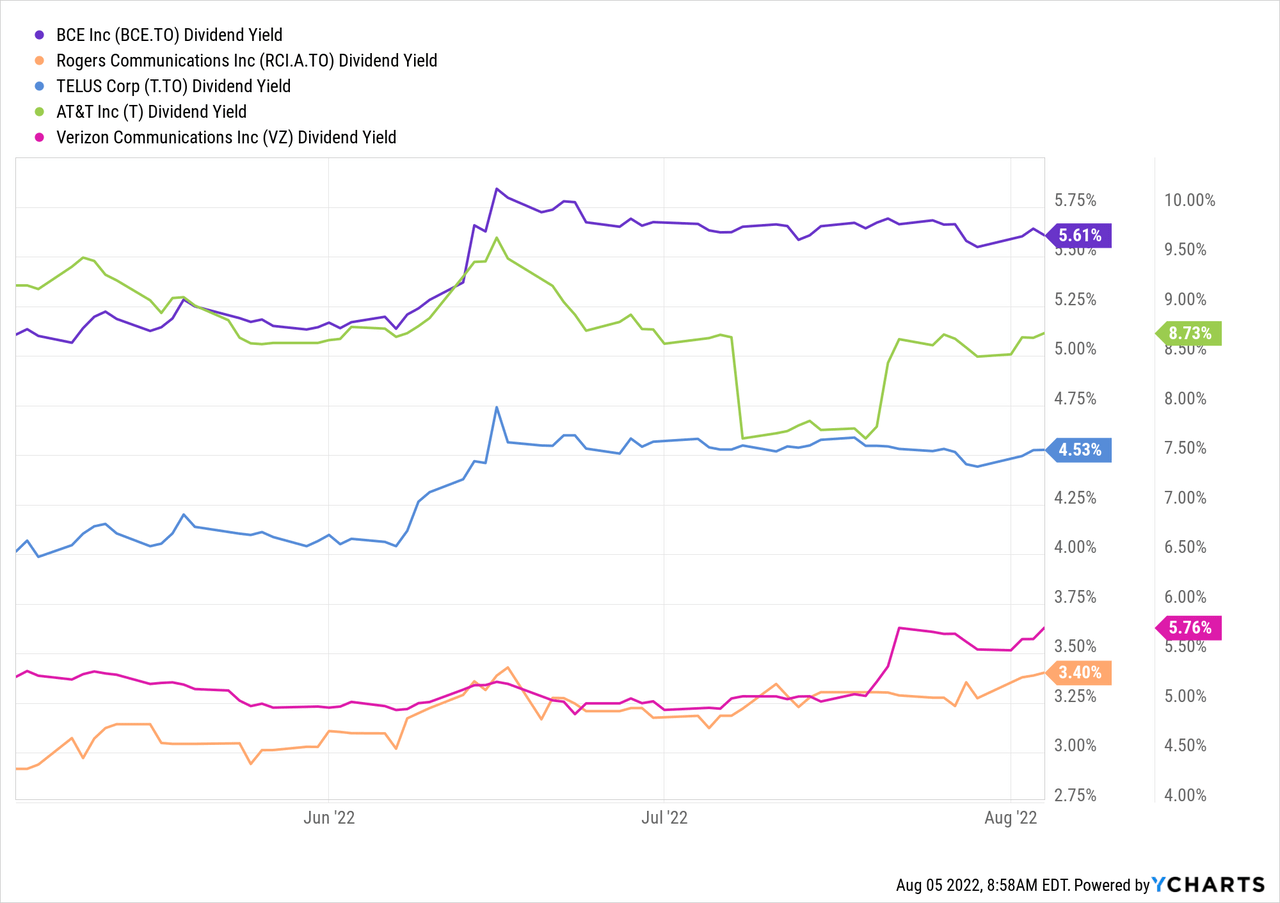

TELUS stands behind all the carriers in the U.S. and Canada on valuation. We think the weaker than expected 2023 numbers will show this valued at 9X EV to 2023 EBITDA. Even on the U.S. side, if we add additional cable provider comparatives like Comcast Corporation (CMCSA) at 6.5X EV to EBITDA or Charter Communications (CHTR) at 7.5X EV to EBITDA, we are looking a big differential on multiples. TELUS has the advantage from the point of a stronger (although as yet uncovered) dividend yield vs those two. But even that yield is the second lowest among the telecoms.

The gap versus AT&T Inc. (T) and Verizon Communications Inc. (VZ) is almost comical at this point, with both trading at half the P/E ratios of TELUS.

The growth story is still “working” for the investor who has not checked all the way to 2019. So that provides a relative support here. That, too, only works as long as the results come in fine and the debt markets don’t throw a fit. This might sound like a silly thing to say, but Lumen Technologies (LUMN) and TELUS will have about the same debt to EBITDA for 2023, and there is a huge gulf in the bond yields between these two communications stocks. Sure, LUMN has its issues, but it covered its 9.5 % dividend yield by 2X free cash flow. Run that against TELUS. Our thinking stands that we can get a bounce, but we don’t see this as a longer-term buy opportunity. We maintain a neutral rating and think we will see a lot of weakness in pricing within 6-12 months.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment