wellesenterprises

Note: Amounts are in Canadian Dollars or US Dollars and indicated as such.

When we last covered TELUS (NYSE:TU) we gave another sober assessment of the valuation challenges ahead.

The growth story is still “working” for the investor who has not checked all the way to 2019. So that provides a relative support here. That, too, only works as long as the results come in fine and the debt markets don’t throw a fit. Our thinking stands that we can get a bounce, but we don’t see this as a longer-term buy opportunity. We maintain a neutral rating and think we will see a lot of weakness in pricing within 6-12 months.

Source: Solid Quarter But Look For Growth To Fizzle Out

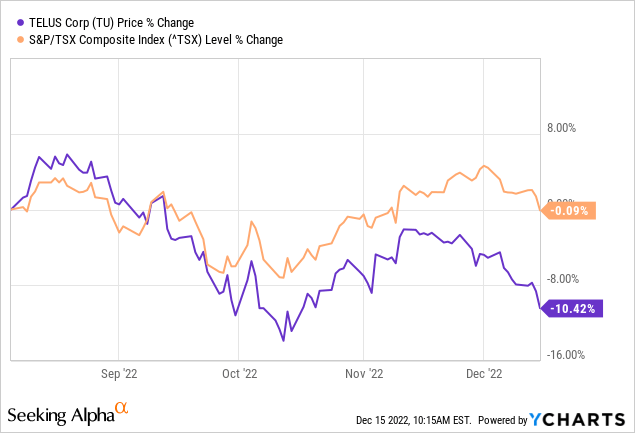

While we gave it a “hold/neutral”, and that was an improvement from the “Strong Sell” earlier in the year, we were nowhere close to endorsing the company. That rejection has worked and TELUS is now 10.5% lower since the August 5 article.

With Q3-2022 results in the bag alongside several macro developments, we took a look to see if we could make an honest investment out of this one.

Q3-2022

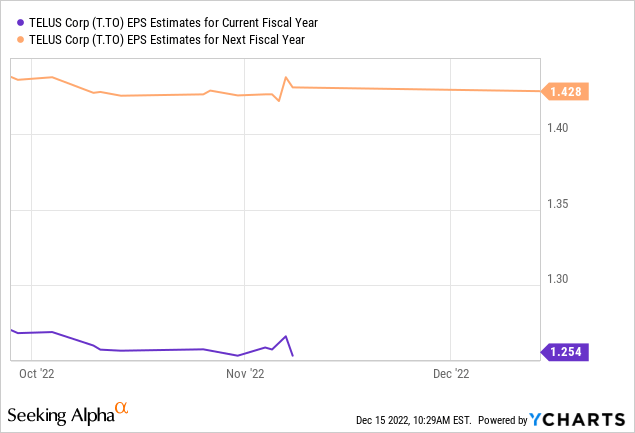

The third quarter was a mixed bag to us. While there was plenty to cheer from high mobile services subscriber growth and sizzling wireline customer additions, the 2022 earnings estimates were revised a bit lower. This was after Q3-2022 adjusted EPS actually beat analysts’ estimates. Earnings are now expected to be close to $1.25 CAD and 2023 is expected to come in at $1.43 CAD.

The lowered guidance came primarily from lower equipment sales, but TELUS did bump up its free cash flow outlook slightly.

Considering TI’s updated revenue outlook, and lower than expected mobile equipment revenues, offset by the inclusion of LifeWorks, we are updating our 2022 guidance. We are now targeting consolidated revenue growth of approximately 8 per cent, tightening upwards adjusted EBITDA growth of 9 to 10 per cent, and capital expenditures of approximately $3.475 billion CAD, inclusive of LifeWorks. For free cash flow, we are increasing our target to approximately $1.3 billion CAD.”

Source: TELUS Q3-2022 Conference Call Transcript

Our take here is that the intense competition phase, alongside a weakening economy, are hitting TELUS simultaneously. Equipment sales is where you would see pressures first as purses tighten. It should spread to other areas in 2023.

Our 2023 Outlook

Earnings estimates are still too optimistic here considering the economic headwinds. Weakness will be partially seen in revenues but more so in margins as competition heats up. We believe TELUS will struggle to clear the $1.40 CAD in earnings mark. That $1.40 CAD is also where the dividend currently stands ($1.4044 CAD). The good news for patient investors is that after many years of poor earnings, TELUS will come close to covering the dividend from earnings. The bad news is that after four years of “growth”, the 2019 earnings of $1.43 will likely still not be exceeded.

Despite these headwinds, there is likely to be a sigh of relief from those watching the most important metric – Free Cash Flow. While TELUS was struggling to cover the dividend from earnings, the bigger worry was the big deficit in free cash flow. This was dealt with to some extent with DRIP share issuance. Nonetheless, it is important in the long run for companies to cover their dividends strictly from free cash flow. It is here that TELUS delivered on its promise during the Q3-2022 conference call.

Our balance sheet strength will be further enhanced in 2023 with a meaningful increase in cash flow generation. At the end of 2022, our accelerated broadband build will wind down, setting ourselves up to see a meaningful positive impact to cash flow with capital expenditures declining by approximately $1 billion CAD beginning in 2023,” concluded Doug.

Source: TELUS Q3-2022 Conference Call Transcript

This is a big deal as the $1 billion in reduction means about $2.6 billion CAD in capex for 2023 and an approximate $2.4 billion CAD in free cash flow (our estimates). This covers the dividend of about $2.1 billion CAD and allows TELUS to better deal with any challenges from the macro side.

Valuation & Verdict

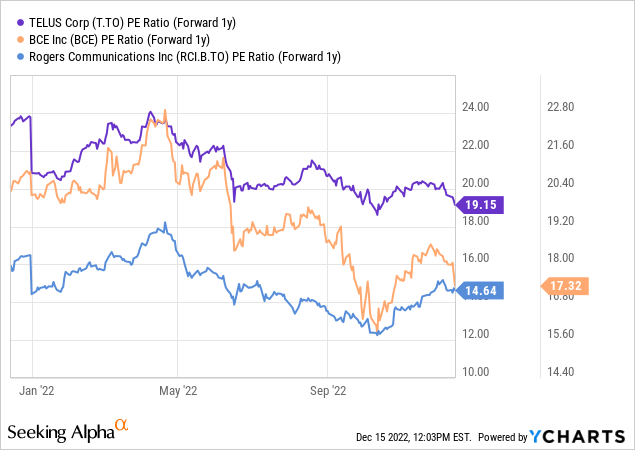

TELUS has lost a lot of the baggage froth from early 2022. At 19X earnings you could probably argue that this is fair, if we were still in a zero-interest rate environment.

Equally problematically for TELUS, its two major competitors, Rogers Communications (RCI) and BCE Inc. (BCE) remain quite undervalued relative to TELUS. Of course, there is likely to be someone in our audience who still says “but growth premium…”. Yes, TELUS is growing off that smashed 2020 base and likely has some better tailwinds there from TELUS health. The current multiples discount that, by a lot.

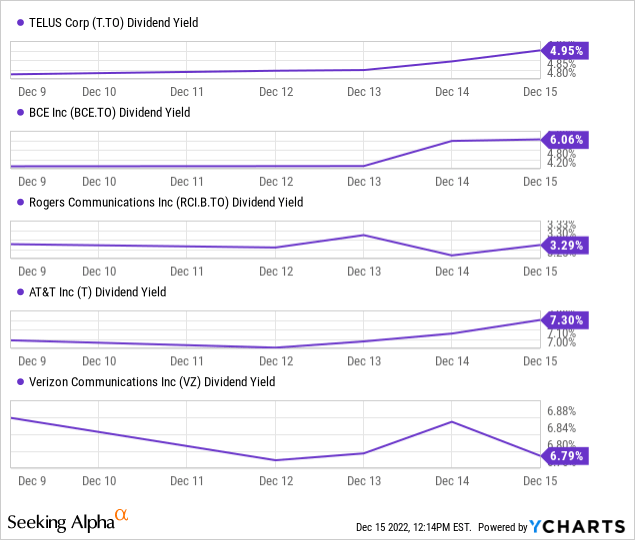

Perhaps it is the dividend that attracts you. Again, that has improved since early 2022 and with a 4.95% yield covered by free cash flow, you are certainly getting paid to wait. But it is middle of the pack amongst telecoms and BCE is a better choice, even for those not wanting to venture south of the border.

So where would we buy this? A great entry point would be somewhere where we got a 6% dividend yield. That would get us about 20% lower, which would be close to $16.00 USD or about $22.00 CAD. Another way to look at it would be to aim for a 15X number on possible 2024 earnings ($1.50 CAD). That would again get us to about $22.50 CAD. That would be a solid buy point and one we are watching for.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment