imaginima

Once Telesat (NASDAQ:TSAT) obtains further financing for its Telesat Lightspeed project, and more investors check TSAT’s figures, in my view, the demand for its stock may increase. Besides, further demand due to the use of the internet and 5G could even become a revenue catalyst. Under my discounted cash flow model, I obtained a valuation that is higher than the current market price. Even considering the risks, the company is a must-follow stock.

Telesat

Based in Canada, Telesat bills itself as one of the world’s most innovative satellite operators. I believe that the company runs an interesting business model that does not receive enough attention.

The most recent quarterly report included stable revenue and very decent EBITDA margins. If the company continues to report stable financial figures, and more investors review the stock, the demand for the stock could increase:

Telesat continues to expect its full year 2022 revenues to be between CAD740 million and CAD750 million. Source: Quarterly Report

Telesat continues to expect its Adjusted EBITDA to be between CAD545 million and CAD560 million in 2022. Source: Quarterly Report

Besides, I believe that successful financing of the company’s Telesat Lightspeed project will likely bring more liquidity, and lower the cost of equity. In this regard, the lines reported by management were quite optimistic.

In the quarter we progressed discussions with our suppliers and financing sources on Telesat Lightspeed, our revolutionary planned Low Earth Orbit satellite constellation. We continue to believe that we will have greater clarity on the financing of the program around year end and that Telesat Lightspeed represents a transformative growth opportunity for the company and a highly compelling value proposition for the communications enterprise user community. Source: Quarterly Report

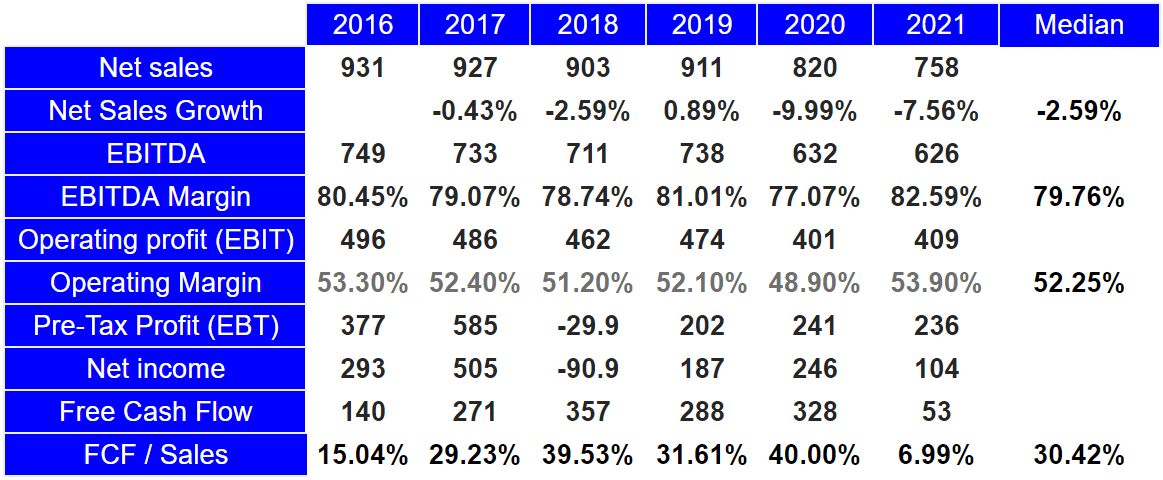

Declining Sales Growth, But Massive EBITDA Margin And Free Cash Flow Margin

The numbers in 2021 were not beneficial, however, the company has reported stable margins for a number of years. In 2021, net sales were CAD758 million together with a net sales growth of -7.56%. The median sales growth was close to 2%.

2021 EBITDA was equal to CAD626 million with 2021 EBITDA margin of 82.59%. The median EBITDA margin in the past was close to 79%. In addition, 2021 operating profit stood at CAD409 million with an operating margin of 53.90%, which is close to the median operating margin reported in the past.

2021 free cash flow was CAD53 million with 2021 FCF/sales of 6.99% and median FCF margin of 30%. I believe that the company’s figures in the future will look a bit like those reported in the last four years. With this in mind, now have a look at the following figures because I have used some of them in my financial models.

Source: SA

Balance Sheet

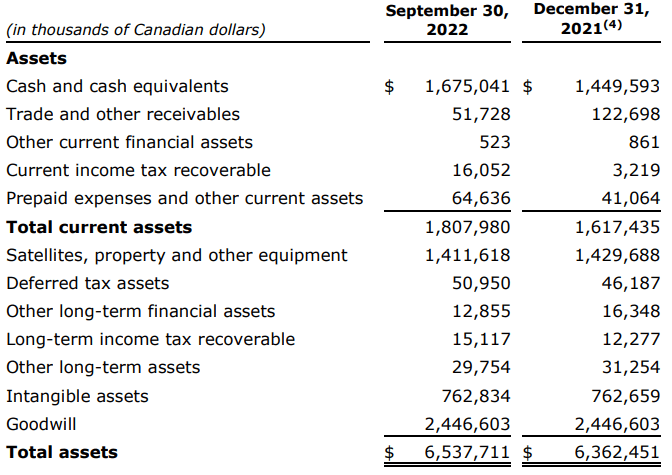

As of September 30, 2022, Telesat reported cash of CAD1.675 billion with trade and other receivables worth CAD51 million. In addition to current income tax of CAD16 million, prepaid expenses and other current assets stand at CAD64 million. Total current assets are equal to CAD1.8 billion, significantly higher than the total amount of liabilities. I have not identified any liquidity issue.

Satellites, property and other equipment were CAD1.4 billion, with deferred tax of CAD50 million and other long-term assets of CAD29.754 million. In addition, intangible assets stand at CAD762.834 million with goodwill worth CAD2.4 billion. With these figures in mind, I believe that an impairment of goodwill could occur in the coming years. Finally, total assets stand at CAD6.53 billion, and the asset/liability ratio is equal to 1.3x. In my view, the balance sheet appears stable.

Source: Quarterly Report

Telesat’s liabilities include trade and other payables worth CAD38.512 million, other current financial liabilities of CAD70.109 million, and other current liabilities of CAD91.525 million. I don’t see a liquidity issue, but I do believe that the total amount of debt may worry certain investors. The long-term indebtedness was CAD3.9 billion, with a deferred tax liability of CAD282 million and total liabilities of CAD4.78 billion.

Source: Quarterly Report

5G, IoT, Backhaul, And Data Transport In Aviation Could Imply A Valuation Of CAD17 Per Share

In my view, Telesat Corp will likely enjoy market growth given that the IP-traffic is expected to grow at a CAGR of 24% until 2027. More demand for the internet means that the world will likely need more satellites.

Global broadband demand is increasing exponentially as the world is becoming increasingly digital. Applications and programs that are critical to individuals, businesses and governments are built to run on the fast, low latency terrestrial networks that serve the majority of users in developed economies. Forecasted rates in IP-traffic are expected to grow from 137 exabytes per month in 2018 to 838 exabytes per month in 2027, a 24% compound annual growth rate, on a global basis. Source: Prospectus

Telesat Corp believes that the company’s GEO business could reach a target market of US$18 billion by 2023. The company cited 5G, IoT, and backhaul as the main drivers of future business expansion.

We estimate that the total addressable market, or TAM, for our GEO business will reach approximately US$18 billion by 2023.3 Telesat Lightspeed will significantly increase our TAM, up to an estimated total of approximately US$365 billion in 2023, which we project will nearly double in light of the demand drivers that exist today (e.g., 5G, IoT, backhaul, and operational data transport in aviation). Source: Prospectus

There are other drivers of free cash flow growth that Telesat could be using. Overall, in my view, successful satellite replacement and expansion programs could help. Besides, I would also be expecting operating efficiency to play a major role in increasing Telesat’s FCF margins.

We will continue to focus on increasing the utilization of our existing GEO satellite capacity, maintaining our operating efficiency and, in a disciplined manner, using our strong cash flows to strengthen our business. We will continue to be disciplined in our satellite replacement and expansion program, seeking to secure high-quality, long-term customers to anchor any new or replacement geostationary satellites in advance of committing to the construction of such satellites. Source: Prospectus

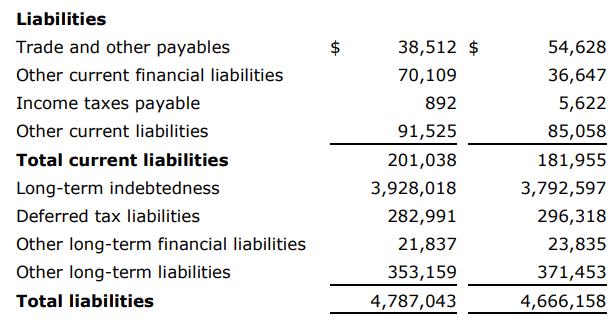

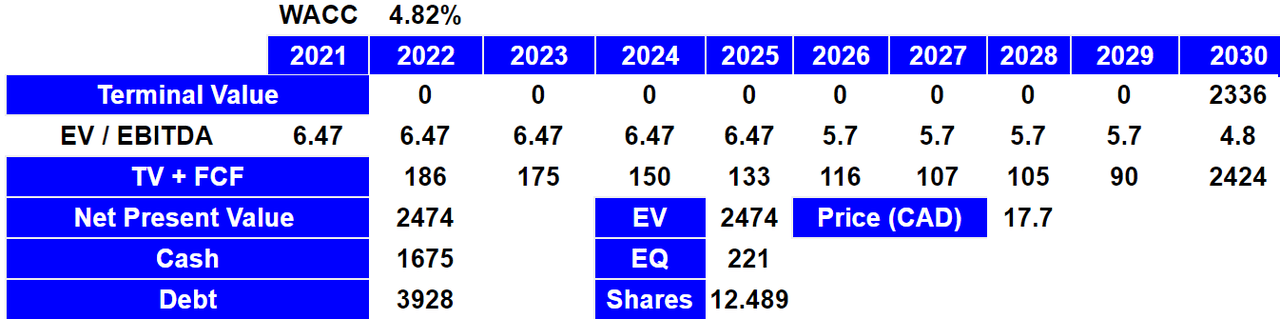

Under this case, I assumed 2030 net sales of CAD632 million, together with a net sales growth of -2%, EBITDA of CAD487 million, and an EBITDA margin of 77%. In addition, 2030 free cash flow would stand at close to CAD89 million with FCF/sales of 14%.

Source: Author’s Financial Model

With a conservative EV/EBITDA of 4.8x, I obtained a terminal value of CAD2.36 billion, which would imply a net present value of future FCF of CAD2.474 billion. If we also assume cash of CAD1.675 million and debt of CAD3.9 million, the implied enterprise value would be close to CAD2.47 billion, and an equity valuation value would CAD221.2 million. Finally, with a share count of 12.489 million, the implied price would be CAD17.7 per share.

Source: Author’s Financial Model

Operational Anomalies, Less Consumption Of Television, Or Orbital Maneuver Life Of Satellite Could Bring The Stock Price Down To CAD3.5

Telesat could suffer a number of failures, which may harm the company’s agreements with clients. As a result, the revenue line will likely decline, which may also bring the company’s fair valuation down.

Telesat’s in-orbit satellites may fail to operate as expected due to operational anomalies resulting in lost revenues, increased costs and/or termination of contracts. Source: Prospectus

Telesat Corporation produces highly complex satellites that incorporate leading-edge technology. Telesat Corporation’s products are complex and are designed to be deployed across complex networks, which in some cases may include over a million users. Because of the nature of these satellites, there is no assurance that Telesat Corporation’s pre-launch testing programs will be adequate to detect all defects. Source: Prospectus

Management also warned about the implications of lower demand for traditional television services. As a result, available satellite capacity may increase, which would diminish the prices of satellite services.

Changes in consumer demand for traditional television services and expansion of terrestrial networks have adversely impacted the growth in subscribers to direct-to-home television services in North America, which may adversely impact future revenues. Fluctuations in available satellite capacity could also adversely affect Telesat’s results. Source: Prospectus

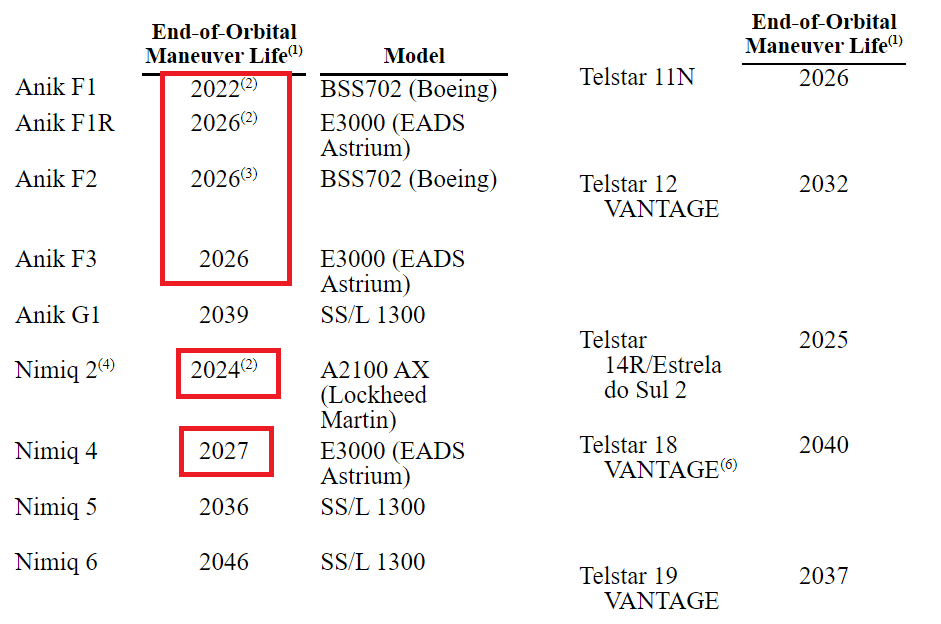

I also believe that the end of orbital maneuver life could affect Telesat’s FCF line. Keep in mind that the company would have to make capital expenditures to replace the old satellites. In line with these thoughts, let’s note that the company reported a few satellites with orbital maneuver life close to 2026.

For the year ended December 31, 2021, Telesat Corporation’s top five customers together accounted for approximately 64% of its revenues. Source: Prospectus

Source: Prospectus

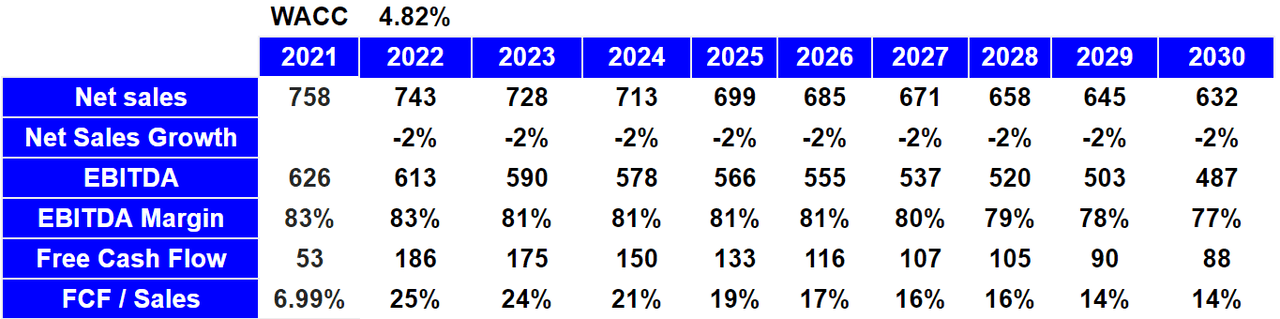

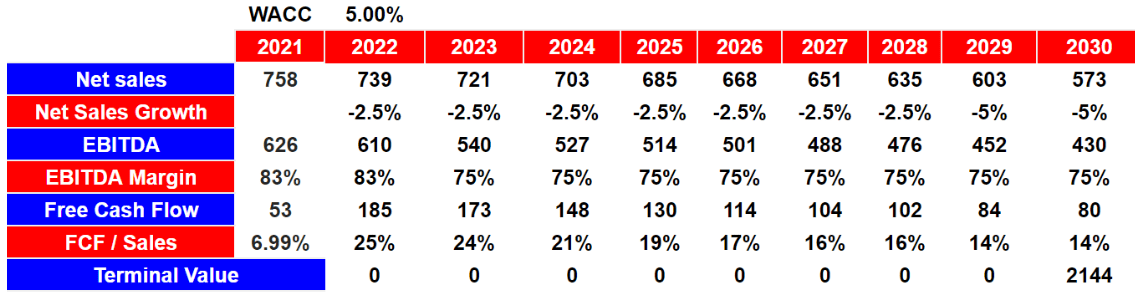

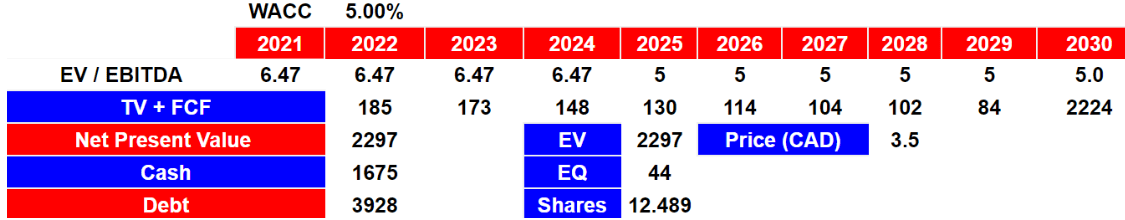

In the worst case, for 2030, I assumed net sales of CAD573 million with a net sales growth of -5%. I also assumed an EBITDA of CAD430 million, with an EBITDA margin of 75% and free cash flow close to CAD80 million.

Source: Author’s Financial Model

With an EV/EBITDA of 5x, the sum of future FCF discounted at 5% implies a valuation of CAD2.3 billion. Besides, if we also use cash of CAD1.675 billion and debt of CAD3.9285 billion, the equity would stand at CAD44.5 million, and the fair price would be CAD3.5.

Source: Author’s Financial Model

Takeaway

Telesat runs a sophisticated business model with stable revenue and massive EBITDA margins. I believe that further increase in the use of the internet, 5G, and the demand of IoT could boost up the company’s business model. I don’t believe that enough investors understand the potential of Telesat Corp. With very conservative assumptions that include declining sales growth and declining EBITDA margins, I obtained a valuation that is significantly higher than the market price. I do see risks from the total amount of debt and operational anomalies, but I don’t believe that they will pose a serious problem.

Be the first to comment