Baloncici/iStock Editorial via Getty Images

I’ve written about Telenor (OTCPK:TELNF) (OTCPK:TELNY) a few times. For the past few months and since the Ukraine invasion though, things have become progressively more interesting for this 177B NOK market cap company. There are outlook risks in the company – specifically related to its market exposure in secondary geographies as well as a few other things we’ll talk about.

However, nothing can hide the underlying fundamental quality that this company has, and that will continue to guarantee payments of 6-7% yield for the future. Now that AT&T (T) has reduced its post-split-up dividend, Telenor is one of the safest yields in the entire sector – globally.

Let’s look at what we have.

Telenor – Revisiting the Telco

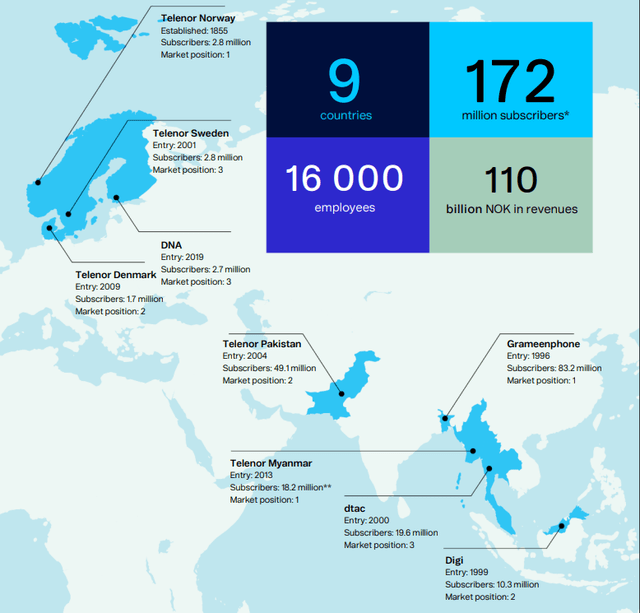

Telenor is a global business. Ending 2021, the company’s geographical exposure looked like this.

Telenor Geographical Exposure (Telenor IR)

The company mixes attractive legacy markets with an incumbent position with growth markets in Asia that, unlike competitors/peers, the company has managed to grow rather well. For the fourth quarter and the full year, the company reported an impressive FCF of 13B on a full-year basis, an incoming merger process in Thailand that will merge the company operations with the operator true, and an increased dividend of 9.30 NOK per share.

The work in legacy geographies such as Norway continues to be impacted by cord-cutting and copper/legacy declines. However, the copper-based revenues are now finally approaching an end level. From 2018 and 3.5B in revenues, the company’s copper revenues are set to be below 0.5B in 2022. Finland and Denmark came in strong, driven by mobile upselling and subscription growth, with Sweden mainly flat at stable revenues.

The big question is pandemic-affected Asia, which at 4Q21 started easing up a bit, seeing subscription and traffic revenue growth in both Bangladesh and Pakistan, with strong data growth portfolio-wide. The company’s priorities for 2022 are, of course, continued 5G rollout in the Nordic, strengthening its market positions in the Asian market, and like other companies, looking into solutions for its infrastructure.

This is a trend ongoing in all of Europe at this time, and it’s one of many reasons why I’ve taken a very strong position in favor of European (and international) telcos. My entire exposure to communications is now over 20% on a portfolio-wide basis. I believe the sector to be crucial for the future, as we move into an increasingly globalized and communicative world, and the services provided are no longer optional.

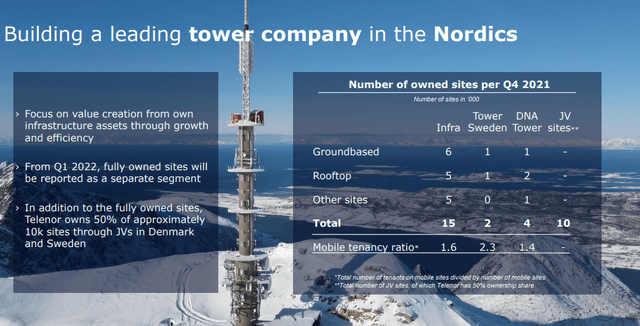

Telenor, like other players, is moving along with plans to set up a leading Nordic TowerCo. Like other Nordic telco leaders, the company owns a substantial amount of infrastructure, which by themselves have seen 12% revenue growth since 2019 alone.

Like Orange (ORAN) and Vodafone (VOD), Telenor is looking to split up these operations. I view this as an appealing prospect.

The company’s plan for handling inflation cost increases is modernization. Staff expenses have been cut through structural modernization and workforce reduction, which have allowed salary increases for staff that remain, while at the same time saving over 500M NOK on an annual basis in Salary/personnel costs.

Energy costs meanwhile are mitigated through automatization, machine learning, more solar, and energy-saving initiatives. While the organic EBITDA is down 0.2% for the year and net income was heavily impacted by Myanmar impairments, gain on disposals, and a large amount of FX, the underlying appeal of this company continues.

The company’s fundamental leverage is still below 2.2X net debt/EBITDA and stood at 2.05X ending 2021.

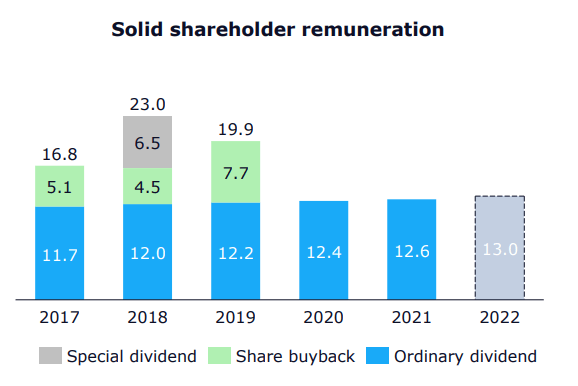

A 3% ordinary dividend growth might not be much, but it’s a covered 7%+ dividend in a world where safe, high dividends are very rare indeed. It’s also a good payout in a long tradition of dividend increases.

Telenor Dividends/Returns (Telenor IR)

2022 isn’t looking to be a particularly strong year – and the current share price and valuations reflect that. EBITDA was even disappointing for the company. There is the chance for a post-pandemic normalization in Asia for the year though, which has the potential to really boost the company’s results here.

I continue to view Asia as a strength for Telenor, as opposed to weakness, due to its strong experience and operational history here. The company is clearly strengthening its position in the Asian market through mergers, which could signify a coming global merge with Axiata. The Malaysian combination will have revenues of NOK24.5B with an EBITDA margin of 46%. Axiata and Telenor will be equal partners with a 33.1% ownership stake each.

So, although the group still remains affected by the pandemic and the drop in tourism in Asia, 2022 could be better than the poor outlook given suggests.

The released 2021 results have no fundamental impact on my overall positive view of the company as a “BUY”. I have lowered my dividend growth estimates in my model, however, and shifted a few numbers around in the DCF to better reflect the new forecasts and realities we’re facing as these global conflicts, inflation, and uncertainties grow.

Valuation for Telenor

Telenor’s valuation is of course impacted by 2021 results. As with previous looks at the company, the company isn’t all that cheap when we look at Book multiples or NAV relationships. This makes sense because when looking at the company’s legacy assets and markets, Telenor is little more than a high-yielding bond proxy with growth. I don’t see either Telenor, Telia (OTCPK:TLSNF), or Tele2 (OTCPK:TLTZF) dominating any of the Scandinavian markets in full. They all have attractive qualities and in aggregate, I own hundreds of thousands of dollars in these companies.

They provide me with a very good yield, throwing off thousands of dollars every year, and also have given me very good capital appreciation. Tele2 alone is up more than 50% since I invested in it a few years back.

Still, I don’t own these companies for “growth”. But Telenor’s upside from a 125-130 NOK is, at least in part, based on growth. Assuming even a below-GDP growth of 1% in EBITDA and only a 2% terminal growth rate per year, as well as a 1.2% CapEx growth, the company, comes in at an implied EV of well over 250 NOK/share. This is because of the company’s low WACC of 5.54% due to its low cost of debt, it’s low gearing, and its appealing home geography. The company might be more volatile than your typical telco because of its Asian projects, but the fundamental substance of the company is beyond stable.

Telenor is A-rated but has used its cash to drive for accretive M&As over the past few years. Much of what the company could deliver over the next 5 years is still percolating, and investors should view an investment into Telenor as a mid-term investment at the very least – if not very long-term.

At a 6-7% yield, that’s not a hard sell to me.

Public comps include virtually every telco in Europe. The average for these peers is around 12X P/E with a 5.7X EBITDA and a 1.21X book multiple. However, its massive yield and now below-average P/E means that on a comp basis, Telenor is a very buyable business. Due to the company’s home geographies and solid histories, as well as its credit rating, I assign a 5% premium to the public comparisons for Telenor here. The company’s higher upside is primarily growth-driven, as well as being one of the lower-traded telcos in a collection of low-valued Telcos on the European market.

Given the company’s legacy strategies which are working, combined with the search for growth in Asia, I’m comfortable assuming an annual revenue growth trend of at least 2% per year – this is what forms the basis for my assumptions about Telenor.

Telenor ASA has a valuation target range from S&P Global of between 114 NOK and 175 NOK on the high end. Neither of these valuation assumptions takes into account a full success of growth in Asia, which would push the premium up above 230-250 NOK. The 114 NOK is essentially assuming a complete failure in anything but the home market, while the 175 is a balanced approach between growth and legacy. Current averages are 150 NOK per share.

The company’s current valuation is below my cost basis of around 135 NOK. However, it’s clear to me that Telenor is in a negative market momentum at this time, so the price could go even lower. I don’t particularly mind this, as I know the company’s qualities and upside – it could go to 50 NOK if it wanted to, and I’d buy more.

Asia is making most analysts more cautious than I believe they should be given the cheap price you’re paying for a guaranteed yield in a yield-starved, inflation-driven world, while at the same time getting the potential for growth from Asia.

My weighted price target for Telenor is 155 NOK/share, and this is well below equity analyst averages of 180 NOK (Source: AlphaValue), and close to the S&P Global targets.

Even assuming only a post-pandemic reversal followed by single-digit EPS increases for the company, this would be based on normalized 5-year P/E averages result in an annual RoR of well over 15% until 2024. Yes, Asia and one-offs turn the company’s net income levels/EPS into a fairly lumpy affair, but once this stock grows, it has the potential to hit that 180 NOK mark, which would deliver growth of well above 25%.

I’m a “BUY” for Telenor with a PT of 155 NOK, which is a conservative price target given where the company might go.

Thesis

Those who follow me know my investment liking for Telco’s, and I continue this tradition with my stance on Telenor. I really don’t mind Telco’s going down, as it allows me to invest in infrastructure at cheap prices. The only exception to this rule is AT&T, where structural issues and management really harmed the company prior to the currently-planned split. But even with AT&T, I was able to stake most of my position at below $27/share, which I view as very likely giving me a multi-year forward appeal as AT&T’s strengths crystallize.

The same is true for Telenor. I see a significant forward upside at 125-130 NOK/share, and I bought more this morning. My position is now slightly north of 4% of my TPV, and should it drop more, then I’m looking to add a few thousand more here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Be the first to comment