FG Trade/E+ via Getty Images

Investment Thesis

Teladoc (NYSE:TDOC) reported Q4 guidance that was not a disappointment. Yes, this is really how low the bar has gotten. As Teladoc went into the earnings print with the stock down 80% in the past year and more than that from its highs, this stock has been a serious disappointment.

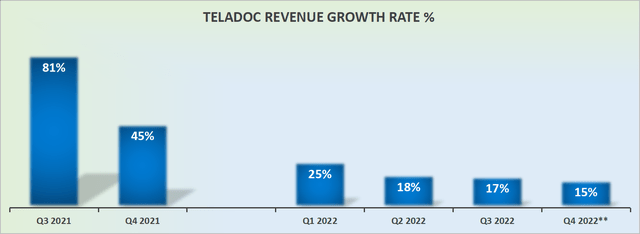

It’s not only that its strong revenue growth rates have fizzled out since 2021. Although that of course doesn’t help matters.

The overarching bear case facing the stock is that Teladoc simply has no clear path to strong profitability. Nevertheless, on the back of these results, bears have now been pushed back.

Q3 Results, What is Going On?

As noted in the introduction, it wasn’t so much that there was anything particularly positive from its Q3 results. It is more the case that looking ahead, investors believe that this is the end of the pain trade.

If one were to assume that we are now at peak inflation and that 2023 should see more subdued inflation, then consumer confidence should increase, and this would be advantageous for Teladoc.

TDOC Q3 2022

But is that really enough to get everyone super excited about Teladoc’s prospects? I’m not sure it is.

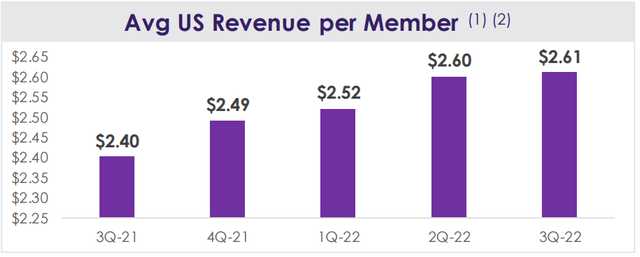

For instance, the average US revenue per member only increased by less than half of 1% from Q2 2022 to Q3 2022, compared with close to 4% for the same sequential period a year ago.

On the other hand, even now, despite the tough Covid comps, total US visits were up 15% y/y. Thereby showing that there’s still life left in Teladoc’s bull case.

Looking Ahead, Teladoc’s Revenue Growth Rates Expected to Stabilize

TDOC revenue growth rates

At this point, there’s no point looking back and remembering Teladoc’s growth rates in 2021. What investors have to attempt to form a view on is whether or not Teladoc can get its revenue growth rates reaccelerate to around 20% CAGR in the near-term.

Even Teladoc’s balance sheet carries around $900 million of cash, this is offset by approximately $1.5 billion of debt.

Consequently, I can’t foresee Teladoc resuming its acquisition spree any time soon. Not only because of how Livongo turned out. But also since Teladoc’s balance sheet simply doesn’t have much room to maneuver.

So, with few options left at its disposal, Teladoc will have to truly sharpen its pencils and stay focused on its core growth strategy of providing profitable digital health solutions.

Adjusted EBITDA Could Improve by 85% From 2021

At the high end of Teladoc’s adjusted EBITDA guidance, its adjusted EBITDA is expected to increase 27% y/y to $98 billion. Could this mean that in 2023 Teladoc’s adjusted EBITDA could come close to $500 million?

That would be an approximately 85% jump in adjusted EBITDA compared with the full year 2021.

For a company, whose share price is down nearly 85% from the highs set in 2021, a potential 85% improvement in adjusted EBITDA over a 2-year period, doesn’t strike me as aligned with the share price trajectory.

TDOC Stock Valuation – 4x EBITDA

Teladoc is a highly shorted stock. With both bulls and bears having equally vocal views on the company’s prospects.

Consequently, any time that ”risk assets” are in favor, Teladoc does well. But when the market turns gloomy, Teladoc is thrown out with the bath water.

That being said, looking at Teladoc objectively, it looks like the stock is priced around 4x next year’s potential EBITDA. That’s starting to look very cheap.

The Bottom Line

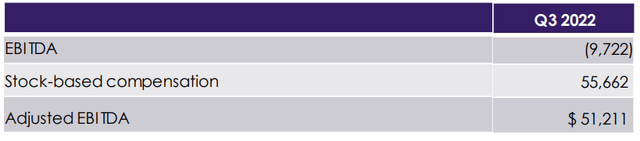

The difficulty I have with getting bullish on Teladoc is that more than 100% of its adjusted EBITDA is made up of stock-based compensation.

TDOC Q3 2022

Anyone that has followed Teladoc knows that the bull case had been that Teladoc was going to moderate its stock-based compensation.

But as this figure is actually up 9% sequentially from Q2 2022, even though revenues are only up 3% sequentially, I am forced to question whether the bull case is getting enough traction. Yes, I admit that this is an over-simplistic way of looking at the matter. But it’s still vaguely correct.

In essence, I simply can’t get enough confidence that Teladoc is going to gain enough scale any time soon for it to be a highly profitable company reporting clean GAAP profits.

Be the first to comment