FatCamera

After the bell on Wednesday, we received Q2 results from tele-health provider Teladoc (NYSE:TDOC). The company was one of the biggest beneficiaries of the pandemic, but growth has cooled since and shares have plunged dramatically from their highs. Unfortunately for investors, the latest report wasn’t that great, sending shares much lower again in the after-hours session.

For Q2, total revenues of more than $592 million were up nearly 18% over the prior year period, and beat street estimates by more than $5 million. However, it is appropriate to point out that expectations had come down a bit given poor guidance at prior reports. Over the past 6 months, the average revenue estimate was down by about 6.7%, which translates to almost $40 million. Access fees revenue grew 20% to $518.7 million and visit fee revenue grew 7% to $66.7 million. Unfortunately, the beat was overshadowed a bit by guidance, and the following quote from management regarding 2022:

The company is maintaining its previously issued revenue and adjusted EBITDA outlook for the fiscal year ending December 31, 2022. However, based on current trends in the market, management now expects results to be toward the lower end of those ranges.

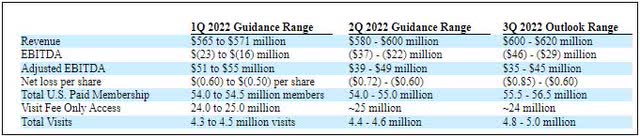

When focusing on the near term, guidance fell short of expectations. Teladoc guided to Q3 revenues in a range of $600 million to $620 million, while analysts were looking for $618.4 million. Should these market trends continue, it would not surprise me to see the top end of this year’s revenue guidance reduced at the Q3 report. What worries most is the progression we’ve seen in guidance so far this year, as detailed in the graphic below. Despite revenues rising sequentially from period to period, EBITDA, Adjusted EBITDA, and net loss per share guidance have been getting worse from quarter to quarter.

Teladoc Quarterly Guidance (Company Earnings Reports)

Another item that worries me is the company’s overall financial situation. When counting capitalized software in capex, free cash flow in the first half of the year was a negative $14.9 million, as compared to a positive $8.3 million in last year’s first half. The company has also written down almost $10 billion worth of goodwill in the first half of 2022, which has brought the total asset base on the balance sheet down from $17.7 billion to $8.1 billion. That could limit financial flexibility a bit moving forward, especially as 83% of the company’s total assets are either goodwill or intangible assets. The company had almost $884 million in cash at the end of Q2, but it also more than $1.53 billion worth of convertible debt.

One of the things I’ll be watching the most in the coming days is the reaction from Cathie Wood and the ARK Invest team. The active ETF CEO has been one of Teladoc’s biggest supporters in recent years, calling Teladoc the next category killer like Amazon (AMZN) recently was. The ETF firm currently owns about 1 in every 8 shares outstanding of the company. Four of ARK Invest’s active ETFs own Teladoc, seen below, with the stock’s position within each ETF as of Tuesday as follows:

- ARK Innovation ETF (ARKK): 5th largest, 5.19% weight.

- ARK Next Generation Internet ETF (ARKW): 6th largest, 5.21% weight.

- ARK Genomic Revolution ETF (ARKG): 2nd largest, 5.37% weight.

- ARK Fintech Revolution ETF (ARKF): 11th largest, 3.97% weight.

Going into Wednesday’s report, the street was slightly bullish on Teladoc shares. The average price target on the street stood at $45.98, a little less than $3 away from the day’s close. My guess is that we’ll see some target cuts coming thanks to the weak guidance. Shares lost almost a quarter of their value after the report, dropping back down to the low $30s in Wednesday’s after-hours session. As the chart below shows, this would put the stock again under its 50-day moving average (purple line). This key technical trend line will likely start rolling over again if the stock doesn’t rebound rather soon, which could provide even more resistance. The multi-year low stands at $27.38 currently, so we’re not there just yet.

Teladoc Last 6 Months (Yahoo! Finance)

In the end, shares of Teladoc crashed after the company’s Q2 results. While the firm did beat heavily lowered estimates for the June quarter, Q3 guidance was a bit weak and management technically lowered revenue and adjusted EBITDA guidance for the full year. It will be interesting to see if major supporter Cathie Wood and her ARK team buy more on the plunge, despite owning more than 12% of the company already. Shares are back below the 50-day moving average currently, and just $6 away from their multi-year low.

Be the first to comment