Lisa-Blue

A couple of weeks ago, Teekay Tankers (NYSE:TNK) announced its Q3-2022 earnings. Results were a bit below analysts’ expectations, but the company is solid and it has a bright future ahead in my opinion. In this article, I will provide an overview of the results and I will explain why I believe Teekay Tankers is a buy opportunity.

If you have never heard of Teekay Tankers, you can have a look at my previous article where I provided a detailed overview of the company.

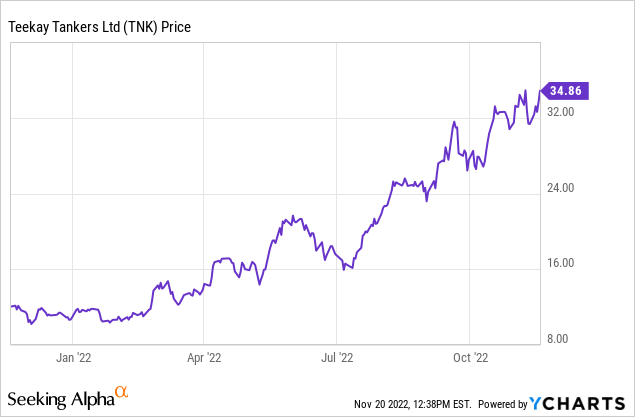

Stock performance

Teekay Tankers is currently trading at $34.86/share, equivalent to a market capitalization of $1.18 billion and it is up 25% from my previous buy recommendation. The stock is up 220% year-to-date and 189% year-on-year. The 52-week maximum was recorded on November 8th, 2022, at $34.89/share while the 52-week minimum was $10.22/share, recorded about one year ago, on December 3rd, 2022.

Teekay Tankers Financials

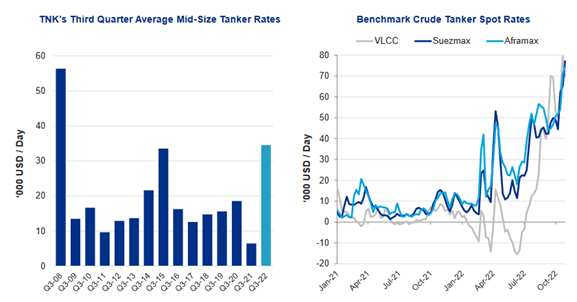

During Q3-2022, Teekay Tankers generated revenues of $279M, up 141% versus the same quarter of the previous year ($115M). The large increase in revenues is mostly due to higher time-charter equivalent (TCE) rates per day with the Suezmax averaging a $33k TCE revenue per day in Q3-2022 vs $25k in Q2-2022 and only $6K in Q3-2021. Daily rates increased also for the other vessel classes with Aframax vessels averaging $34K in Q3-2022 (vs $24k in Q2-2022 and $9K in Q3-2021) and LR2 vessels at $37k TCE revenue per day in Q3-2022 (vs $26k in Q2-2022 and $9k in Q3-2021).

Clarksons

Total operating expenses (excluding write-downs) were $212M, 35% higher than in Q3-2021 ($156M) mostly due to the increase in voyage expenses (+72% year-on-year, $135M in Q3-2022) that include port expenses and bunker fuel expenses. Other relevant cost items are the vessel operating expenses at $35M (-8% year-on-year) and D&A at $24 (-6% year-on-year).

Earnings for Q3-2022 were $69M vs a net loss of $52M reported in Q3-2021. The same positive trend is confirmed if one looks at the first nine months of 2022 with Teekay Tankers reporting a total net income of $82M in 9M-2022 vs a loss of $202M in 9M-2021.

Analyzing cash flows, one can see that cash flow from operations was $48M in the first nine months (vs -$81M in the previous year) while financing cash flow was negative at -$75M and it was the result of different financing actions including the prepayment of long/short term debt (-$245M and -$159M) and the sale and leaseback of some vessels (+$288M). Investing cash flow was +$55M due to the sale of a vessel.

At the end of September 2022, cash amounts to $83M while net debt is $486M (ca 41% of the capitalization), $66M less than the previous quarter.

Q4-2022 Financial Outlook

The increase in spot rates that has been generating strong revenue growth is not over yet. The outlook for the last three months of 2022 is extremely positive with rates for all vessel classes further increasing if compared with Q3-2022:

- Suezmax Q4-2022 outlook rate: $40.0k (+20% vs Q3-2022)

- Aframax Q4-2022 outlook rate: $36.6k (+2% vs Q3-2022)

- LR2 Q4-2022 outlook rate; $44.7k (+19% vs Q3-2022)

So far, Teekay Tankers has already booked more than one-third of Q4-2022 spot ship days available with Suezmax booked at 43%, Aframax at 38% and LR2 at 36%.

These data are a clear sign that Teekay Tankers will likely be able to continue with a strong free cash-flow generation in Q4-2022 as well.

Opportunities arising from EU sanctions on Russian oil

In less than a month, from December 5th, EU sanctions on Russian crude oil will enter into force with EU countries that will no more be allowed to import oil from Russia. Currently, about 1 million oil barrels per day are still flowing from Russia to the EU: these volumes will need to be rerouted to other countries, likely Asian countries such as India and China, with the EU that will have to find replacement oil from other producers (West Africa, US GoM, Middle East). These dynamics will further increase the need for oil tankers and, considering that there is a limited supply of tankers in the market, day rates are likely to further surge. This situation of tankers scarcity is likely to persist for all of 2023 and it is the result of few orders for new vessels being placed in the last couple of years, with 2022 being at the historical minimum in terms of new orders.

Risks

I see two main risks that could be associated with Teekay Tankers. The first one – potentially disruptive but not very likely to happen – is represented by a potentially large drop in oil demand. In case of a strong reduction of oil demand, demand for oil tankers will decline as well leading to lower revenues and lower free-cash-flows.

The second risk is more associated with Teekay Tankers itself: currently, Teekay’s average fleet age is 13 years and, sooner or later, the Company will have to renew the fleet with large capital expenditures to be deployed in a time of inflation and high raw material costs. However, for the time being, Teekay Tankers’ management sees this as an opportunity to divest some of the older vessels to generate cash flows rather than a risk.

Conclusion

Overall, Teekay Tankers is a robust company and operates in a sector that will benefit from the current geopolitical and macroeconomic context. The Company has a solid cash flow generation and it is likely to continue on this path in the next quarters. Leverage has been reduced to around 41% of the market cap and once it will reach the target of 30%, I do not exclude the possibility that the company will start paying dividends.

At the current price of $34.86/share, I believe that Teekay Tankers is a buy opportunity.

Be the first to comment