Povozniuk

Thesis

The Direxion Technology Bear 3x Shares (NYSEARCA:TECS) is an ETF falling in the leveraged funds category. The vehicle seeks daily investment results 300% of the inverse performance of the Technology Select Sector Index. Like any leveraged vehicle TECS should be utilized as a trading tool rather than a buy-and-hold investment. A retail investor who buys TECS needs to have a very distinct thesis for the purchase and a clear-cut short-term holding period. Do not attempt to hold a leveraged ETF for periods longer than 6 to 12 months because the vast majority of them will generate significant losses long term.

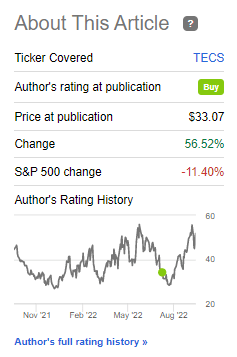

Our view outlined here was:

We believe the July market re-bound was the result of oversold conditions from June and we are going to resume the move lower in this bear market. The catalyst for the tech outperformance we saw post Covid, namely zero rates, is no longer there, and in effect will be a headwind going forward. Rates will stay higher for longer in today’s inflationary environment. An active, sophisticated investor can take advantage of a potential -10% leg down in tech stocks via the leveraged TECS vehicle and make a 30% return if that view materializes.

We were spot on with our thesis and the Fed did not pivot and we saw the vicious bear market resume. As the Nasdaq (QQQ) resumed its downtrend, the leveraged vehicle TECS outperformed, being up more than +50% since our rating:

Author Performance (Seeking Alpha)

As we said above, when trading leveraged vehicles, a retail investor needs to be extremely regimented about entry and exit points due to the high volatility associated with such instruments. If we look at the TECS performance for 2022 we can see the fund was up +100% earlier in the year, only to go back down to 0% during the July/August bear market rally:

We cannot emphasize enough the necessity to be regimented around targets and exit points for leveraged funds. Our target of +30% having been met we are moving from Buy to Hold on this name. Leveraged funds are great trading tools and a sophisticated retail investor can make significant returns during a fiscal year if the macro environment is traded actively with such funds.

Performance

The fund has had a very volatile performance given its leveraged profile:

1Y Total Return (Seeking Alpha)

We can see that in the past year the vehicle has swung from -40% to +100% within months. Do not expect a smooth performance for a 3x fund! And you should always trade such a vehicle with the understanding that it is a short-term trade. Let us look at a 3-year performance for this name:

We can see that during 2020 and 2021, as Tech rallied, the fund lost almost its entire value. TECS is not a buy and hold name!

Rates Market

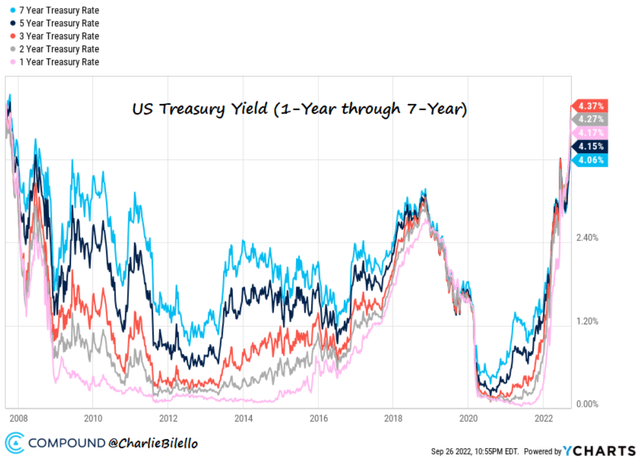

This year has seen an unprecedented spike in yields across the Treasury tenor curve:

Curve Yields (Compound Advisors)

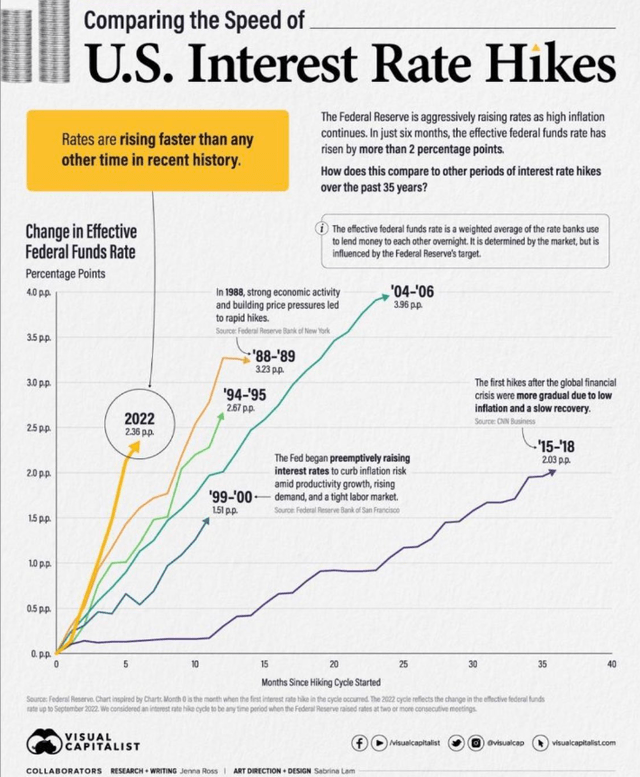

On the back of a rampant inflation picture the Fed has been raising rates at an unprecedented velocity:

Hike Speed (Visual Capitalist)

Higher rates are negative for tech stock valuations because the discount rates used for the long-term earnings are higher. When you discount a $10 EPS to be received in 8 years at 4%, you get a much lower present value than when discounting the same EPS at 0.5%. Historically high inflation, rising interest rates and the onset of Quantitative Tightening policies are strong negative factors affecting tech and growth stocks. Higher rates can also slow down businesses’ cash flows and halt their reinvestment into innovation and growth prospects. During times of uncertainty, investors turn towards more steady companies, just as they generally look to the fixed income markets to invest in safer assets such as Treasuries.

The correlation between tech stocks and rates is inverse, meaning an investor should always expect further weakness in tech if rates keep going up. Back in August, we correctly identified the fact that the Fed was not going to pivot, which resulted in our view on TECS. Is the move over then in QQQ and TECS? Probably not. However, as a leveraged vehicle, TECS should never be held above the target level.

Conclusion

TECS is an inverse leveraged ETF, providing for the daily results equivalent to 300% of the inverse performance of the Technology Select Sector Index. When the Nasdaq sells off significantly, like in 2022, TECS provides for outsized gains. We are of the opinion that leveraged funds like TECS should be used as trading instruments rather than buy and hold vehicles, with distinct holding periods and targets in mind. We view TECS as an efficient capital allocation tool for investors that have sectoral views for defined periods of time. During the August bear market rally we correctly identified the lack of a pivot by the Fed and the weakness to come in the technology sector. With a tight +30% target in mind having been met, we are moving from Buy to Hold on TECS ETF.

Be the first to comment