Ari Widodo

Investment Thesis

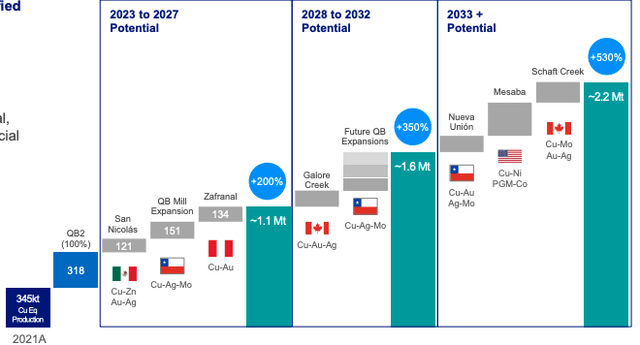

Teck Resources (NYSE:TECK) is a natural resources mining firm primarily mining metallurgical coal, copper, and zinc. It is the second largest seaborne export producer of metallurgical coal worldwide and the largest zinc producer in the world. Teck is planning a large shift toward copper, with the opportunity to become a top 10 producer with expansion plans that could increase output by an estimated 530% by 2032.

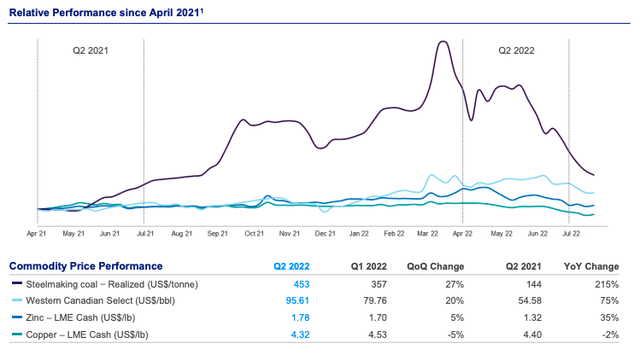

Teck reported record high earnings per share in 2Q22, roughly 5x higher year over year at $3.12 a share. By sector, the largest increase came from zinc at a 155% gross profit increase year over year. Again, this was driven by soaring prices – where zinc prices have increased 35% year over year.

With a significant portfolio shift planned toward metals used in decarbonization globally such as zinc and copper, along with several brown and greenfield investment opportunities, TECK has the opportunity to become a key player in the copper market in our opinion.

|

Teck Resources |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

1.0 |

1.0 |

1.2 |

|

Price-to-Earnings |

2.3 |

3.1 |

4.4 |

|

Estimated Yield |

3.4% |

3.4% |

3.4% |

Estimated Fair Value (EFV) = PE of 7 times Normalized (E2023) EPS of $5

= 7 X $5.00 = $35 per share

Repositioning to Copper

Teck is a significant producer of copper within the Americas. The primary producing asset is Quebrada Blanca Mill 2 (QB2) in Chile, and as low-carbon metals come more into demand with electrification, there is significant room for expansion. There is expected to be a significant uptick in demand for copper in the coming years, with Teck estimates putting it at a 26% CAGR to 2030. Currently, only 23% of revenue is from copper, but as the rebalancing of the portfolio happens it is expected to reach 34% once QB2’s full potential is realized in 2026. Copper and copper equivalent (CuEq) production growth for Teck is expected to roughly double (479kt CuEq – 861kt CuEq) from 2021-2023, with cash costs reducing significantly with economies of scale.

Teck Investor Presentation July 28th

Quebrada Blanca has significant room for expansion, with a new mill being expected to open in 2026 allowing a 50% increase in throughput without expanding footprint or requiring regulatory oversight.

Other Metals

Zinc makes up approximately 26% of revenues for Teck but is a declining share. Long-term outlook for zinc is strong with global decarbonization initiatives, but global investment in zinc remains low compared to other metals. Teck has long been the largest zinc miner in the world and could potentially take advantage of economies of scale to further develop zinc through its portfolio of undeveloped high-grade zinc deposits. Over the next 4-6 years, Teck expects to develop zinc assets that offer a fast path to monetization. The primary candidates are Red Dog (Alaska), Teena (Australia), and Cirque (Canada, BC) all of which were chosen because of local synergies – whether that be through a partnership or existing Teck infrastructure nearby.

Steelmaking coal (also called Metallurgical or Coking Coal) is coal whose grade is high in carbon content but low in moisture, making it perfect for blast furnaces. Teck is the second largest seaborne exporter and makes a significant 47% of revenue from coal from just a single mine on the border of Alberta and BC. Despite the hard shift away from thermal coal, metallurgical coal will be needed for the foreseeable future. Demand forecasts and announced expansion produce a supply shortfall beginning in 2030 and intensifying as time goes on. This should result in a favorable price environment for steelmaking coal and open up possible expansion opportunities. This is already beginning to be realized with the average realized price reaching a 215% increase year over year.

Much smaller projects include oilsands in Alberta, which make up under 4% of Teck’s revenues – from royalties from an interest held in the mine. This is the remainder of the withdrawn application to build a massive oil sands field marred with controversy from both First Nations advocates and environmental activists. Often times gold is found next to copper deposits and Teck has approximately 32 million ounces of gold reserves.

Dividend Policy and Capital Returns

The annual base dividend has been increased from $0.20 per share to $0.50 per share. A variable dividend of $0.50 was paid in March. Assuming no more variable dividends the annual total dividend is running at $1.00 per share for FY22. The variable dividend is declared yearly and depends on cash generation and capital expenditures. The capital structure emphasizes the base dividend of $0.50 per share first, then buybacks, with the final remaining cash flow going toward variable dividends.

With regards to stock buybacks, each year the Board will review the free cash flow regulatory approval of a renewed normal course issuer bid program. Teck intends to purchase shares opportunistically. The company will determine the timing of any purchases and may repurchase fewer or a greater number of shares. In April and July, Teck announced additional buybacks amounting to roughly $1 billion in stock repurchase program of which about $800 million remains.

The company expects to rebalance its portfolio towards the previously discussed low-carbon metals like copper. This will result in additional capital spending and dampen dividend increases and stock repurchases over the next few years.

Risk

Teck Investor Presentation July 28th

Prices across all commodities are historically elevated for numerous factors including COVID-19 supply disruptions, the war in Ukraine, supply chain shortages, and quantitative easing-induced inflation. This price remains advantageous for mineral companies like Teck, but Teck will see some compression of revenues as prices pull back to normal levels; however, this will be partially offset by Teck’s strong organic growth profile. Demand is currently expected to outpace supply as decarbonization moves forward globally. In commodities, high prices bring on supply and reduce demand; however, the pricing environment should remain favorable as it takes years to bring on green field resources.

Teck has previously been the center of attention for pollution controversies related to mines operating in Canada and the US. However, Teck has made significant improvements since renaming itself from Teck Cominco and environmental factors are likely priced in.

Long-Term Outlook and ESG

Teck has made significant strides in its environmental pledges in the last decade. It has reduced accidents significantly and boasts 96% renewable power operations today. Its ESG score ranks within the top 10% of the resources industry by MSCI, and it is rated the best North American mining company by Moody’s ESG Solutions.

Teck maintains an industry-leading growth portfolio for copper with an expected doubling of production by 2023 with the opening of QB2. The company already has the assets on hand to add a 5x increase to the current copper production which would put them into the top 10 global producers of copper.

This broader shift toward low-carbon metals will provide better cost-adjusted cash flows and an estimated 5-year EBITDA margin of 41%. With pricing advantages sustaining despite a weakening economic environment compounding this shift’s successes, we believe that Teck can achieve its repositioning while keeping its balance sheet to an EBITDA ratio below 1.0x (currently, 0.4x) – ensuring dividends and repurchases remain strong.

Be the first to comment