Andrzej Rostek/iStock via Getty Images

Investment Thesis

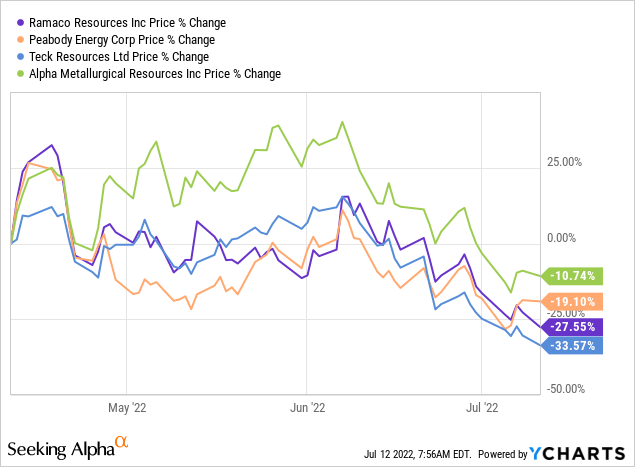

Teck Resources (NYSE:TECK) is yet another commodity company that has substantially sold off in the past month. Investors are concerned over Chinese demand for coal and copper commodities, not to mention the big unknown of whether or not we are going to stay in a prolonged global economic downturn.

Or perhaps those concerns are now ”known knowns”?

There are a lot of different ways this could now unfold. A lot of uncertainty and poor visibility. But to avoid investing in commodities right now simply because they are perceived to be ”too profitable” doesn’t make sense either.

Ultimately, Teck is priced at 4x free cash flow. A multiple that I believe is compelling. Hence, I’m rating this stock a buy.

Recent Developments

Teck preannounces its Q2 results by noting that the total volume of coal shipped was at the low end of its guidance of 6.3 million tonnes. That’s the bad news.

The good news for investors is that the average realized steelmaking coal price in the Q2 2022 reached $453 per tonne. This is a jump of 28% from prices seen in Q1.

And that’s really the biggest bullish consideration. Right now, coal prices are showing no signs of coming down. Even as countless other commodities have dramatically sold off in the past month, demand for steelmaking coal remains very strong.

A lot of investors have reached out to me and asked me why coal companies keep sliding lower? And on that front, I’ve read some rumors. Countless rumors.

I’ve read that investors believe that there’s a recession, meaning that demand for energy will come down substantially. I’ve also heard that coal companies had soared strongly and were overdue a pullback.

While I don’t fully agree with those arguments, the fact remains that these stocks have pulled back.

To illustrate, as you can see above, the market is completely disenchanted with coal companies, even though the underlying fundamentals are very strong.

What Other Bearish Considerations Are At Play?

For Teck in particular, there are other concerns too. In fact, keep in mind the following insight:

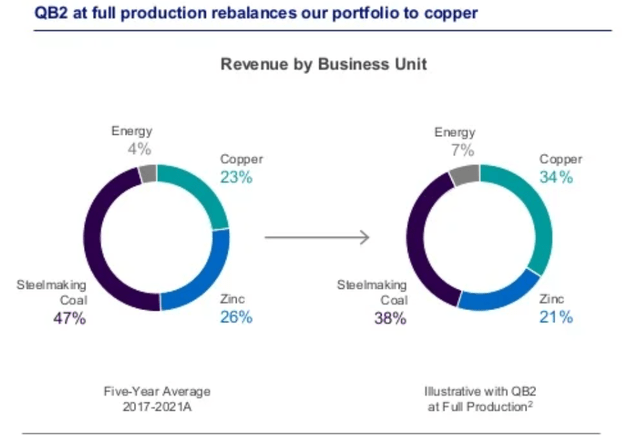

As you can see above, on the back of Teck’s QB2 project, Teck expects to double its consolidated copper production by 2023. This will leave the business significantly more exposed to a commodity that is seriously out of favor with investors right now.

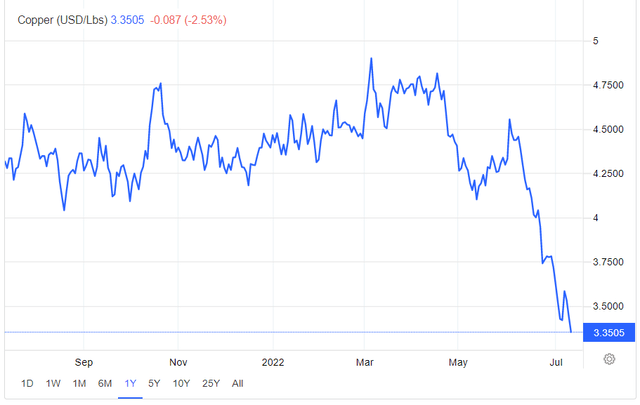

The driving force behind this sell-off is of course China. China is always the biggest unknown went it comes to commodities. And with China’s zero-covid policy, there are going to be ongoing lockdowns that will slow down its economy and dampen demand for copper.

Unless of course, China decides to pivot on its government’s stance on zero-covid policy.

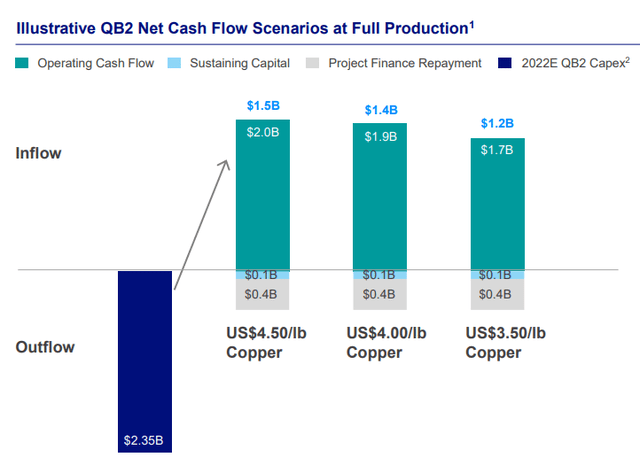

The carrot for investors is that once Teck’s QB2 project is up and running, it can make a significant amount of cash flow to shareholders.

However, with copper prices now trading at close to $3.30 per pound, one can surely understand the lack of investor enthusiasm for this project.

TECK Stock Valuation — Cheap at 4x Free Cash Flow

Further complicating the bull case here is that Teck’s balance sheet has approximately $5.6 billion of net debt. This figure will probably come down to around $5 billion when Teck reports its Q2 earnings in a few weeks.

Nevertheless, there is some debt that will get in the way of the multiple that investors will look to pay for this commodity company.

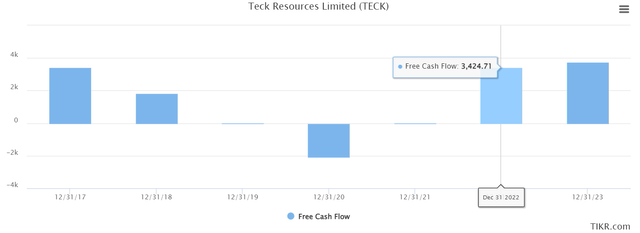

All that being said, Teck is priced at close to 4x free cash flow. Even if we assume that its profitability stagnates at this level in 2023, before retracing significantly lower in 2024, right now, this multiple is seriously low.

In the worst case, investors today would only get at least 1 year of strong profitability, 2022, before entering a big unknown.

The Bottom Line

In the absolute ideal scenario, rather than repurchasing shares, it would be great if Teck would meaningfully increase its dividend payout. However, for now, Teck is not interested in materially increasing its dividend payout.

To sum up the analysis. It’s never a great setup for investors when a company is deploying precious capital into growth capex projects.

There’s so little investor appetite for commodities over the past several years. But right now, with countless commodities tumbling in price, many investors are understandably put off from deploying previous capital into this highly volatile space.

This is a bet that demand for commodities does not fall off a cliff in 2023.

Be the first to comment