Lim Weixiang – Zeitgeist Photos

Thesis

TechPrecision Corporation (OTCQB:TPCS) is having a successful year with growing sales and profit margins. Despite the financial improvements, and the share price being down on the year, the stock remains overvalued compared to peers on an EV/EBITDA basis, as EBTIDA is still depressed, implying that there is potential of up to 50% downside from current pricing, unless improvements continue to be made at a significant pace.

Intro

TPCS is a manufacturer of high-precision fabricated metal components and systems across the US, operating through two segments, Ranor and Stadco. The end markets include industrial and defence industries, such as use on ships and submarines, aerospace equipment, power plants, and components for medical systems.

The company’s share price is currently trading at around $1.75 USD per share, down almost -8% in the past year, significantly better than the overall market decline.

(Source: Seeking Alpha)

Financial Analysis

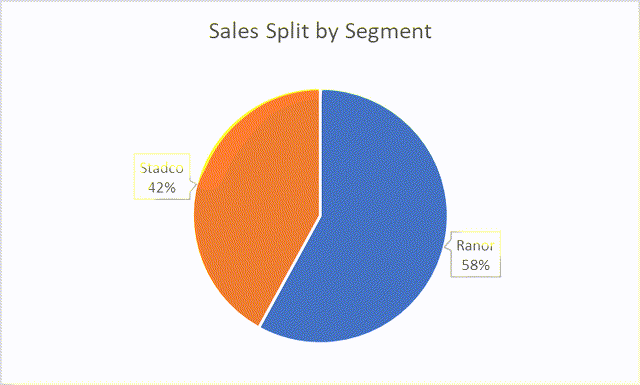

As stated, TPCS’s revenue is split across two segments, Ranor and Stadco.

(Source: 10-Q)

Ranor accounts for almost 60% of revenue.

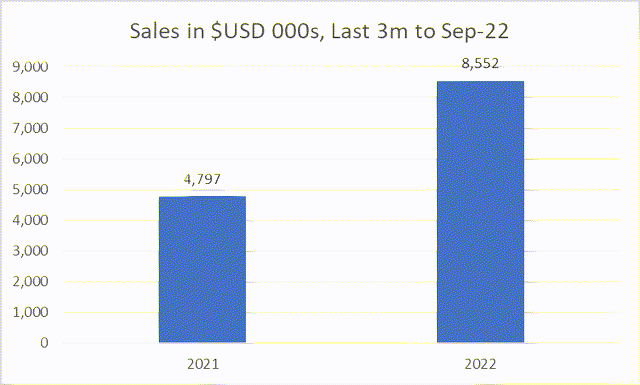

Sales for the period (last 3 months ending September 2022) grew $3.7m, a massive increase of almost 80% growth from the year prior, driven by very strong growth in defense markets (growing $4m). Unfortunately, sales from precision industrial markets declined by $0.3m, offsetting a small portion of growth

Ranor sales grew 39% which was primarily repeat sales, as defense backlog for Ranor remains strong as new orders also come in, including the US Navy submarine programmes. Stadco sales grew substantially more, at almost 200% growth compared to the year prior, as the new order book is robust, especially as there is high demand for components for heavy lift helicopters, for example.

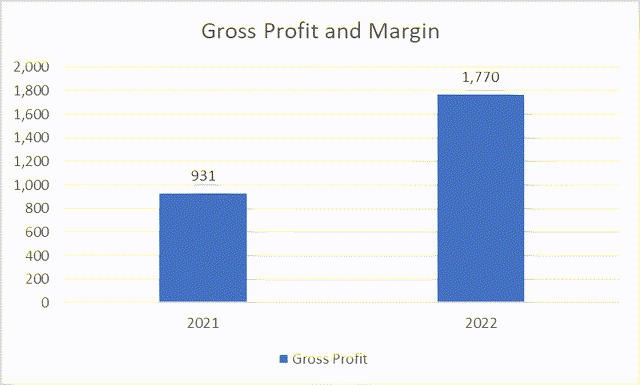

While cost of sales also grew at a significant pace (due to inflationary pressures on raw material, labour, subcontracting costs, etc.), growing at around 75%, sales managed to outpace costs, leading to an improvement in gross margin by 100bps, from 19.4% in the period for 2021, to 20.4% in 2022.

However, the majority of growth in both sales and cost was driven by the full quarter of business activity for the Stadco segment, as only 5 weeks was reported in the period a year ago. On the other hand, the improvement in gross margin is positive especially as gross margin for Stadco specifically was negative in 2022.

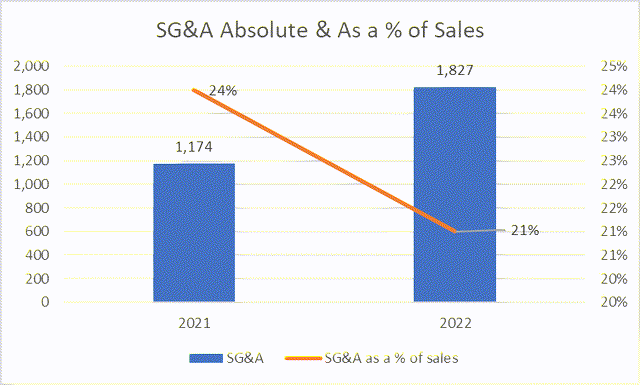

In regard to operating expenses, SG&A costs as a % of sales decreased in all segments, declining from 7%, 3% and 14% as a % of sales for Ranor, Stadco, and Corporate respectively, to 6%, 5%, and 10%, an improvement seen across the board despite the higher inflation environment.

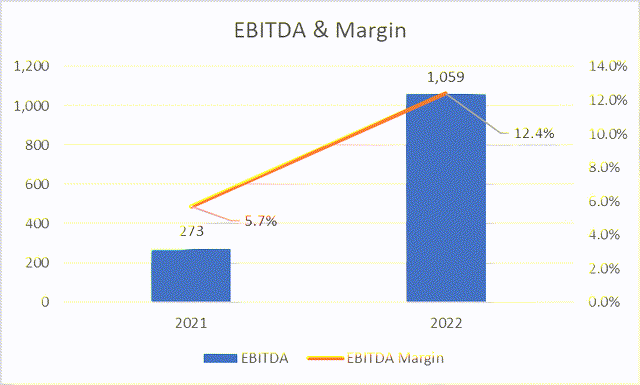

While operating loss improved from around -$243k to -$87k for the period, due to the improvements discussed above, EBITDA looks substantially better. If we account for D&A and exclude one off items (despite the positive impact) of refundable employee retention tax credits and income tax benefits, EBITDA grows from around $273k to over $1m, give or take due to rounding errors. This gives an EBITDA margin improvement from around 5% the year prior to above 12% today, a strong improvement to cash flow (and a much more positive picture than if we only looked at operating profit alone)

Now, given that EBITDA margin has more than doubled over the past year, surely this would be reflected in the share price, unless investors are only taking operating profit at face value and not looking deeper at underlying cash flow.

Unfortunately this is not the case, as the company’s share price is overvalued.

Valuation

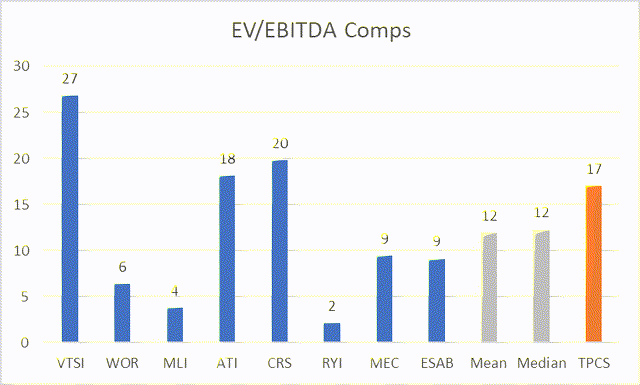

If we use ONLY this quarter’s EBITDA figure of around $1m, then the company is currently trading at around 70x EBITDA. If we use an example EBITDA figure of $4m as a forecast for the full year, then the company is trading at around 17x EBITDA.

If we collate a list of comps and compare them on an EV/EBITDA basis, the picture is less positive for TPCS. TPCS looks to be overvalued with a potential downside of almost 50% from current pricing. This is if we take $4m as the full-year EBITDA figure. If the figure is much lower, a likely scenario given the inflationary pressures, then we could see even further downside for the company’s share price

Cash Flow

The company is also currently in a little trouble with cash, but it’s not a major issue. Cash at the end of the period was around $235k, but while current EBITDA is around $1m per quarter, this should not be a huge concern as cash flow remains positive despite the recent drop in cash position from last quarter as a large portion of the outflow of cash in the last quarter was a revolver repayment, operating cash flow remains strong. Therefore there is unlikely to be a case for new issues of share and therefore limited risk of dilution.

Risks

- One risk to the thesis would be continued improvements in EBITDA, sales are clearly outpacing the rise in costs, and the order book and contracts remain robust, so an improvement in EBITDA would lead to a more normalised EV/EBITDA figure, and potentially imply that TPCS is closer to a fair valuation, dependent on how much EBITDA improves.

- A second risk would be an improvement in EBITDA and thus valuations for peers. EBITDA margins are currently depressed for most players, and thus a step up in EBITDA figures would bring peers in line with TPCS’s valuation, limiting the downside in TPCS’s share price.

Conclusion

Overall, TPCS is having a successful year where sales are growing at a significant pace (faster than the rise in the cost of sales), and operating expenses are improving across all divisions. This has led to an improvement in EBITDA and EBITDA margin, achieving over 12% in the last quarter, even with the negative operating profit. Despite these improvements, and the fact that the share price is down on the year, TPSC remain overvalued compared to peers, as EBITDA is still not at a high enough figure to provide a rational valuation. Last quarter’s EBITDA was around $1m, and if we take $4m for the full year, the company trades at around 17x EBITDA, which is far higher than peers, implying that there is a potential downside of almost 50% in the share price from current levels. However, if EBITDA continues growing at a strong pace, and operating profit becomes positive, then we could see things change.

Be the first to comment