TE Connectivity has a tailwind from e-mobility

Blue Planet Studio

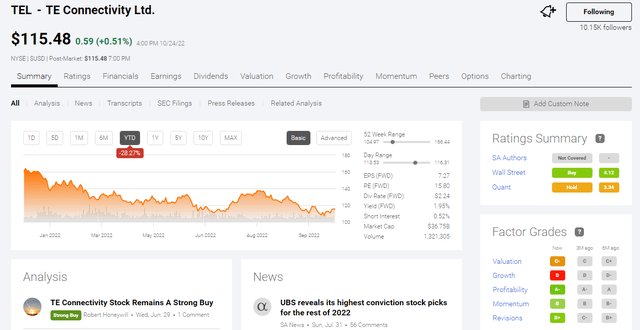

I am going to do better than the Hold rating by Seeking Alpha Quant for TE Connectivity (NYSE:TEL). This company deserves a buy recommendation. The -28.27% YTD drop has made TEL more affordable. The “Electrification of Everything” propaganda slogan signifies TEL has a reliable tailwind from the $82.91 billion global vehicle electrification industry.

Seeking Alpha

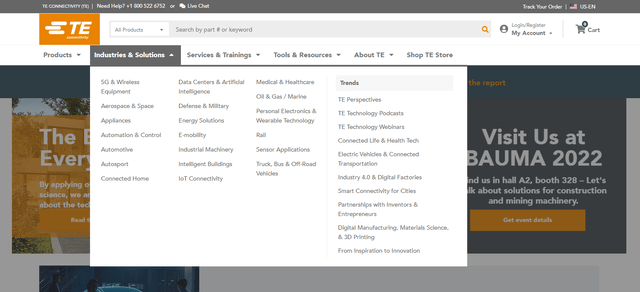

The well-diversified products & solutions made TEL a profit-generator. Study the screenshot below. TE Connectivity is engaged in 5G, aerospace, appliances, and so many more, and due to this multi-range of products and services, I believe TEL’s topline and bottom line will always show positive growth, but revenue growth could be hampered by over-diversification, which I’ll talk about in a bit.

Te.com

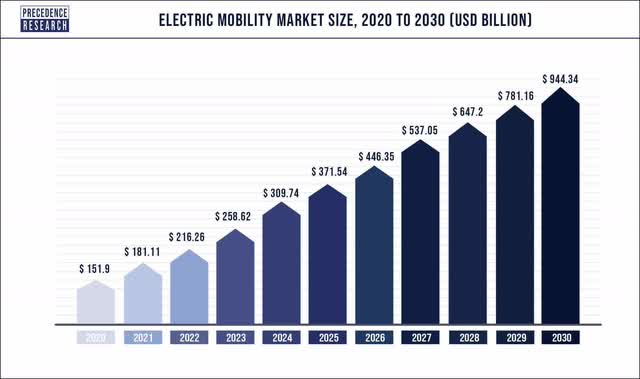

E-mobility is something new to me. I investigated it and found e-mobility means using electric powertrain technologies and in-vehicle AI/cloud computing to propel cars and other types of vehicles. The term ‘powertrain’ usually applies to full electric and hybrid vehicles as well as fuel cell vehicles that convert hydrogen into electricity. The global electric mobility market was $151.90 billion in 2020. Its CAGR is 22%. A laser-focus on the fast-growing and massive e-mobility industry could be a strong tailwind for TE Connectivity.

Precedence Research

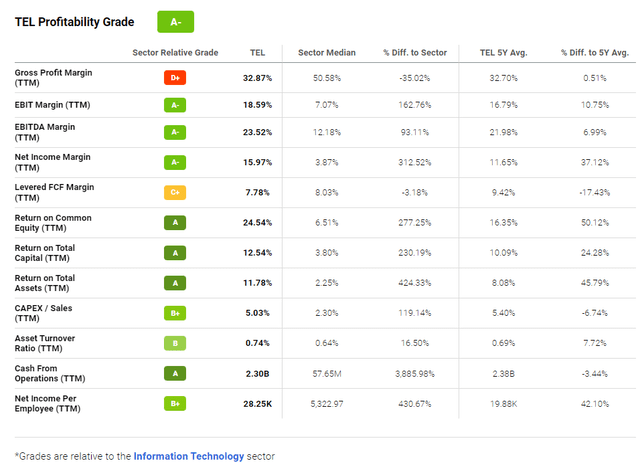

The first good quality of TEL therefore is its high profitability grade of A-. I believe you should be long TEL because its electronics-related business model produces a TTM net income margin of 15.97%. This is higher than the information technology sector’s average of 3.87% by 312.52%. The 15.97% net margin is also much higher than TEL’s own 5-year average of 11.65%.

Seeking Alpha Premium

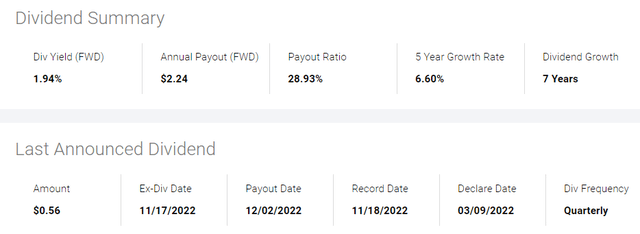

The second-best quality of TEL is that it shares its profitability with shareholders. So, the second reason to be long TE Connectivity is its excellent dividend history. The chart below illustrates that TE Connectivity has a generous dividend history. It has grown dividend payments for the past 7 years at an attractive average of 6.6% over the most recent 5-year period.

Seeking Alpha Premium

Excellent Financials

The dividend payments are not a drag on the financial health of TE Connectivity. The levered free cash flow of this company is $1.22 billion. Its net operating cash flow is $2.3 billion. TEL does not have any difficulty paying off principal and interest payments on its $4.20 billion debt.

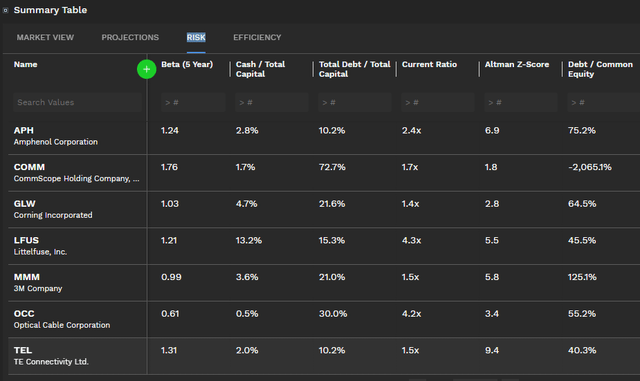

The Altman-Z score of TEL is 9.4. The safe Z-score is 4. The current ratio of 1.5x is not a deal breaker. The chart says TE Connectivity’s peer Corning Incorporated GLW has a lower 1.4x current ratio. 3M Company (MMM) has 1.5x current ratio.

Finbox.io Premium

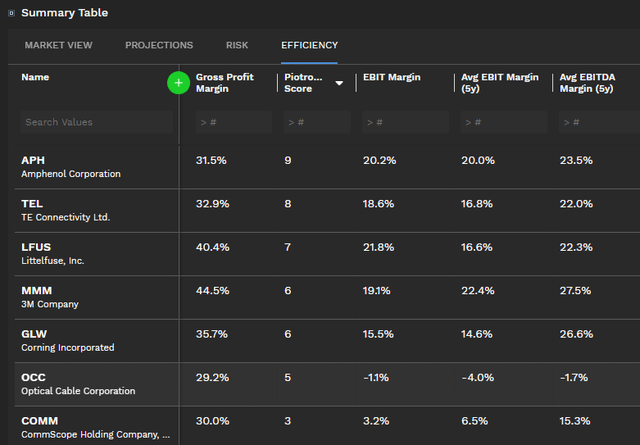

My favorite metric when evaluating stocks is the Piotroski F-score. This metric allows me to see the fair value and efficiency of a particular company. TEL touts an F-score of 8, almost perfect. TE Connectivity has a higher F-score than MMM (6) and GLW (6).

Finbox.io

The safe investment quality and high efficiency of TEL offsets its low growth CAGR.

Downside Risk

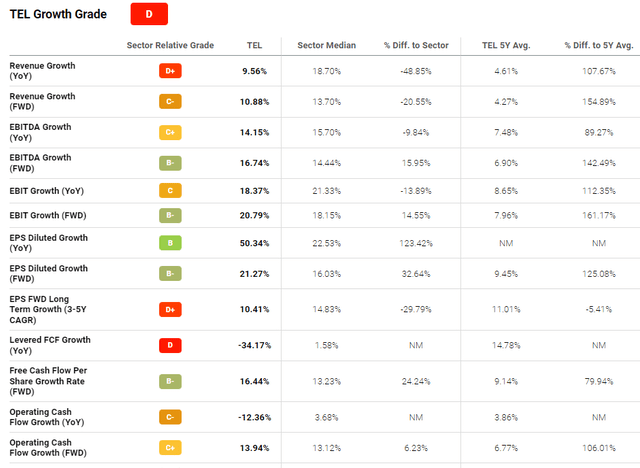

The unappealing feature of TEL is its low revenue CAGR. The chart below illustrates that TE Connectivity’s 5-year average revenue CAGR is only 4.61%. Its TTM revenue growth is 9.56%. Growth performance/potential is usually the No. 1 factor for most investors. The slow-growth category of TEL means not many growth-centric investors will find the stock attractive.

Seeking Alpha Premium

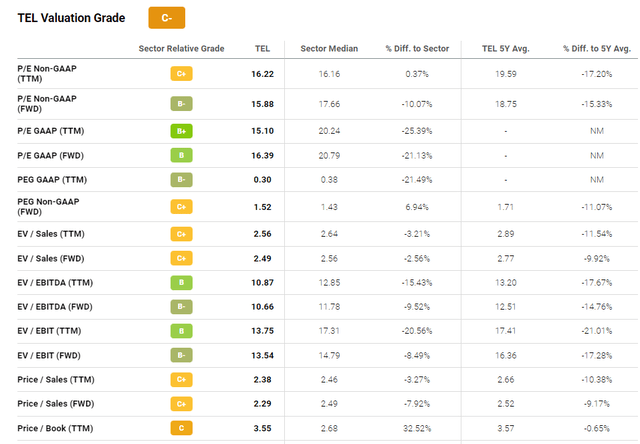

The slow-growth attribute of TE Connectivity has not made the stock significantly overvalued. Compared to its sector peers, TEL’s forward P/E of 16.39x is 20% lower than the sector median of 20.79x. TEL is therefore relatively undervalued based on forward P/E metric.

seekingalpha.com

Conclusion

English is not my native language but I hope this buy thesis is clear. Experienced Seeking Alpha editors taught me that my investing ideas could be seen without bias if I also discuss what I don’t like. TEL is a buy because the big -28.27% YTD drop has made it more affordable. TE Connectivity is profitable and it pays dividends.

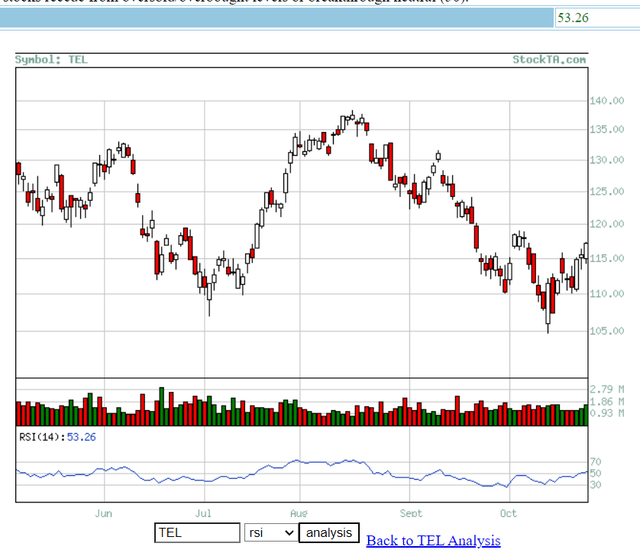

The RSI chart below also hints that TEL is on the upside trend. TEL’s RSI score is 53.26, a bit above the neutral score of 50. My confident assessment is that you should go long TEL before the RSI score hits 70 (oversold).

stockta.com

The low TTM 9.56% revenue CAGR of TEL could eventually improve. The 22% CAGR of that $151.90 billion global e-mobility industry should inspire TE Connectivity management. A strong focus on this fast-growing niche market is highly desirable. I like diversification. Unfortunately, TE Connectivity might have over-diversified itself to the point that its revenue is getting slowed down.

TEL is comparable to my failed programming career, I was an underpaid programmer because I took lower pay for HTML, CSS, PHP, MySQL, JavaScript, and Python even though I should have learned and mastered C#.

I will have to drink lots of Ginebra San Miguel to forget all those six programming languages. This is so that I can learn to program in C# starting January 2023.

The analogy here is that TE Connectivity should sacrifice some products to focus on one product that has great long-term growth potential. Selling or discarding low-paying assets in order to gain a long-term catalyst is judicious. Tesla (TSLA) only makes passenger cars and trucks (for now), presumably because it does not want to complicate its business by making and selling electric motorcycles, bikes, tricycles, airplanes, boats, and helicopters. That’s my thesis in a nutshell.

Be the first to comment