HT Ganzo

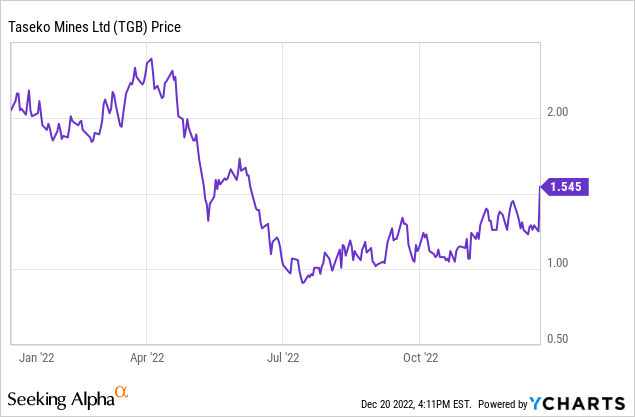

In my last article about Taseko Mines (NYSE:TGB) – “Taseko Mines: Ore Grade Improvements In Q3 And A Potential Near-Term Catalyst”, I highlighted an asset-level transaction at the Florence project as one of the ways to unlock value. Now that Taseko has entered into such a deal, the details and the potential implications for shareholders are worth being discussed.

What happened?

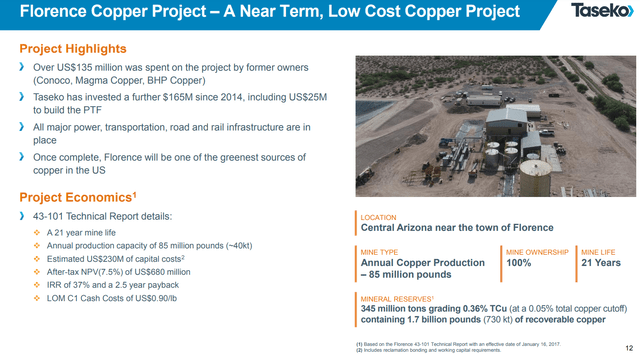

On 20 December, in a press release, Taseko announced that it had entered into an agreement with the US subsidiary of the Japanese conglomerate Mitsui & Co (OTCPK:MITSF) – Mitsui & Co. [USA], regarding the Florence copper project. The deal is initially for a 2.67% copper stream from Florence, which considering 85Mlbs of annual production indicated by TGB is around 2.27Mlbs of copper. In exchange, Mitsui will pay US$50M of upfront payments, which will be paid into file equal installments, triggered when the EPA issues the final UIC permit, which is the last hurdle before construction at Florence could begin. The US subsidiary of the Japanese conglomerate will also pay 25% of the market price at the time for every pound that it receives under the streaming agreement. In addition, an offtake contract for 81% of production from Florence was included in the deal between the two companies. While the terms of the offtake were not specified in the release, I would assume that they should be closely linked to market price, otherwise it wouldn’t make sense for Taseko to enter into such a transaction.

The Florece copper project (Taseko Mines)

The interesting part of the agreement comes as optionality – Mitsui will have the option to pay additional US$50M and to convert the streaming agreement into a 10% equity stake in Florence. The option will have a three year exercise period, following the full completion of the construction works at the project. However, if Mitsui chooses not to exercise its right, Taseko will have the right to repurchase the streaming agreement at full. It’s worth noting that if the streaming agreement is not converted into equity or repurchased, it will expire when 40Mlbs of total production are delivered under the contract. Looking more closely, this figure would equate for a bit less than 18 years of production x 2.27Mlbs, while the Florence mine life is estimated at 21 years.

What are the implications for Taseko?

The deal with Mitsui is very significant for Taseko, as the price jump of more than 20% would indicate. The reason is that with this contract, an independent third party, which happens to be a multi-billion dollar conglomerate, has reaffirmed the value of the Florence project. I assume that the chances of option exercise are quite high, given that otherwise Taseko would be able to repurchase the streaming agreement and copper shortages are expected to be worsening towards the end of the decade, implying higher market price of the commodity. So to get that 10% equity stake, Mitsui would have to pay US$100M in total. Depending on the timing of option exercise, the subsidiary of the Japanese conglomerate could receive up to 7Mlbs of copper under the agreement, while paying only 25% of the market price for it. But at the same time, every year that the right is not exercised, Taseko will have a hold of 100% of the profit so the timing of the potential conversion into equity stake will depend on the market environment at the time.

Non-dilutive construction at Florence

The US$50M under the streaming agreement will help Taseko to complete the construction of the Florence project, without the need to tap equity markets. As of Q3’22, cash and equivalents on the balance sheet are around US$105M. In addition, TGB has access to up to US$50M of undrawn credit facility and the operating Gibraltar mine is generating cash at current prices. At the same time construction costs of Florence are indicated at US$230M, while management has indicated that around US$80M of them are already committed. As far as I understood, not all of those US$80M are expensed yet and the project will likely be hit by inflation. But even then, the US$200M+ of available liquidity supported by the cash flow generating potential of Gibraltar should be more than enough to tackle the likely increase in the initial CAPEX.

Implications for valuation

Paying US$100M for a 10% stake would put the entire Florence project at US$1B, which is a lot higher than the estimated NPV of the property of US$680M. It’s also higher than the EV of Taseko, which stands at around US$740M, considering share price of US$1.55 and net debt of about US$295M.

In addition to the Florence project, Taseko has a 75% ownership of the operating Gibraltar mine, which has an estimated NPV of CAD$1.1B (approx. US$800M). This puts the total indicated value of these two assets to US$1.8B. In order for the EV of Taseko to reach that level, the share price should go towards US$5.2, which is 3.3x to current levels. Of course, full closure of the discount to the value of the assets is not likely, but it’s worth mentioning that Taseko has other assets as well, although they will likely face a lot of challenges in order to be put into production.

Now that affirmation of Florence’s value by a third party happened, the only other company-specific upside trigger would be the UIC permit from the EPA. I think that, given the overwhelming public support for the project, the decision will be positive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment