Sundry Photography

Investment Thesis

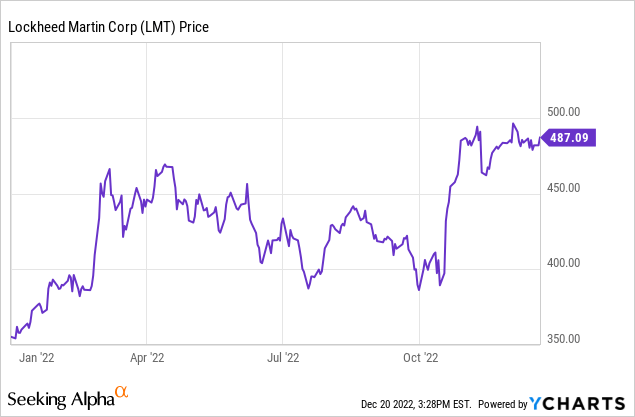

Lockheed Martin (NYSE:LMT) is a global defense and aerospace company that has a long history of providing advanced technology and services to government and commercial customers. The company’s stock has performed well in recent years, making it a potentially attractive investment option for many investors. More specifically, the company’s share price increased by more than 37% YTD while the market is down more than 20% over the same period.

One of the reasons for Lockheed Martin’s strong stock performance has been the company’s consistent financial results. The company has consistently delivered strong revenue and earnings growth, which has helped to drive share price appreciation. In addition, the company’s strong balance sheet and cash flow generation have also been factors in its stock performance.

Financial Performance

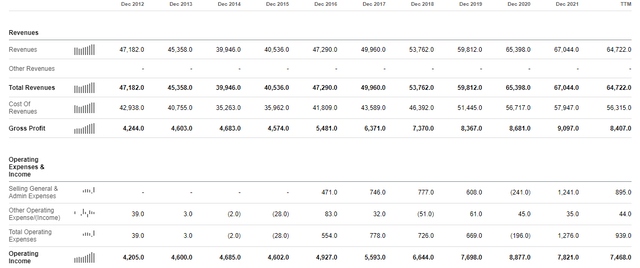

Over the past five years, Lockheed Martin has consistently delivered strong financial results. The company’s revenue has grown at a compound annual growth rate of 3.6% over this period, while its earnings per share have increased at a compound annual growth rate of 8.5%.

Lockheed Martin’s strong financial performance is due in part to its diverse business portfolio, which includes aerospace, defense, and security products and services. The company’s defense business accounts for the majority of its revenue, with the U.S. government being its largest customer. However, the company also has a significant presence in the commercial aerospace market, with its aeronautics business unit producing a range of aircraft, including the popular F-35 Lightning II fighter jet.

In addition to its diversified business portfolio, Lockheed Martin has a strong balance sheet and generates significant cash flow. The company has a debt-to-equity ratio of less than 1, which is relatively low, and has consistently paid dividends of 2.46% to its shareholders.

Company’s Sustainability And Innovation

One interesting aspect of Lockheed Martin that many investors may not be aware of is the company’s focus on sustainability.

Sustainability

fdf.org.uk

In recent years, the company has made significant efforts to reduce its environmental impact and improve its sustainability practices.

For example, Lockheed Martin has set a number of ambitious sustainability goals, including reducing its greenhouse gas emissions by 50% by 2030 and using 100% renewable energy at its facilities by 2030. The company has also invested in a range of technologies and practices to reduce its environmental impact, including the use of electric vehicles and the development of more efficient products and processes.

In addition to these efforts, the company has also made a commitment to increasing diversity and inclusion within its workforce. This includes initiatives to hire and retain a more diverse workforce, as well as efforts to create a more inclusive culture and support the development of underrepresented groups within the company.

Lockheed Martin’s focus on sustainability and diversity may be of interest to investors who are looking for companies with a strong commitment to social and environmental responsibility. Such efforts can not only improve the company’s reputation, but they can also help to drive innovation and long-term growth.

Innovation

Another interesting fact about Lockheed Martin is that the company has a long history of innovation and technological advancement. It was founded in 1912 as the Lockheed Aircraft Company, and over the years it has developed a wide range of products and services for both military and civilian applications. Some examples of its innovative work include the development of the first successful US military jet fighter, the F-80 Shooting Star, and the SR-71 Blackbird, a high-altitude reconnaissance aircraft that still holds the record for the fastest air-breathing manned aircraft.

In more recent times, Lockheed Martin has continued to be at the forefront of technological innovation, with a focus on areas such as advanced manufacturing, artificial intelligence, and space exploration. The company is also involved in a number of research and development projects with the goal of finding solutions to some of the world’s most pressing challenges, such as climate change and global security.

While these aspects of the company may not always be well-known to investors, they illustrate the depth and breadth of Lockheed Martin’s expertise and its commitment to making a positive impact on the world.

Future Of The Company

As a leading global aerospace, defense, and security company, Lockheed Martin is likely to continue to be a significant player in these industries in the future. The company’s products and services include aircraft, missiles, space systems, naval systems, radar systems, and other advanced technologies, which are in high demand around the world.

In the coming years, the demand for these types of products and services is likely to continue, as countries look to modernize their military capabilities and invest in new technologies. In addition, the company is also involved in various research and development initiatives, which could lead to the development of new products and technologies that could drive future growth.

However, it is important to note that the future performance of any company, including Lockheed Martin, is subject to a wide range of risks and uncertainties that could impact its financial performance. For example, the company’s financial results could be impacted by changes in government defense spending, international political and economic conditions, and technological developments in the aerospace and defense industries. Thus, Investors should carefully consider the risks and uncertainties inherent in any investment, and make sure to conduct their own due diligence before making any investment decisions.

Risks and Challenges

Like all companies, Lockheed Martin faces risks and challenges that could potentially impact its financial performance and stock price. One of the main risks for the company is its reliance on government contracts, which account for the majority of its revenue. Changes in government spending or shifts in political priorities could potentially impact the company’s business.

Another risk for Lockheed Martin is the highly competitive nature of the aerospace and defense industry. The company faces competition from other large defense contractors, as well as from smaller companies that may be able to offer more specialized or cost-effective products and services. Having said that I believe that Lockheed Martin is going to continue monopolizing the market as long as it keeps innovating and being competitive.

Conclusion

Overall, Lockheed Martin is a well-established and financially strong company that has a diverse business portfolio and a history of delivering strong financial results. The company’s stock has performed well in recent years and has outperformed the S&P 500 index. However, the valuation that is currently trading at is a bit more wealthy than the growth potential can justify so I am going to wait for it to fall to around $350 and then start a position. For now, at $488 per share, I rate the company as a HOLD.

Be the first to comment