hapabapa

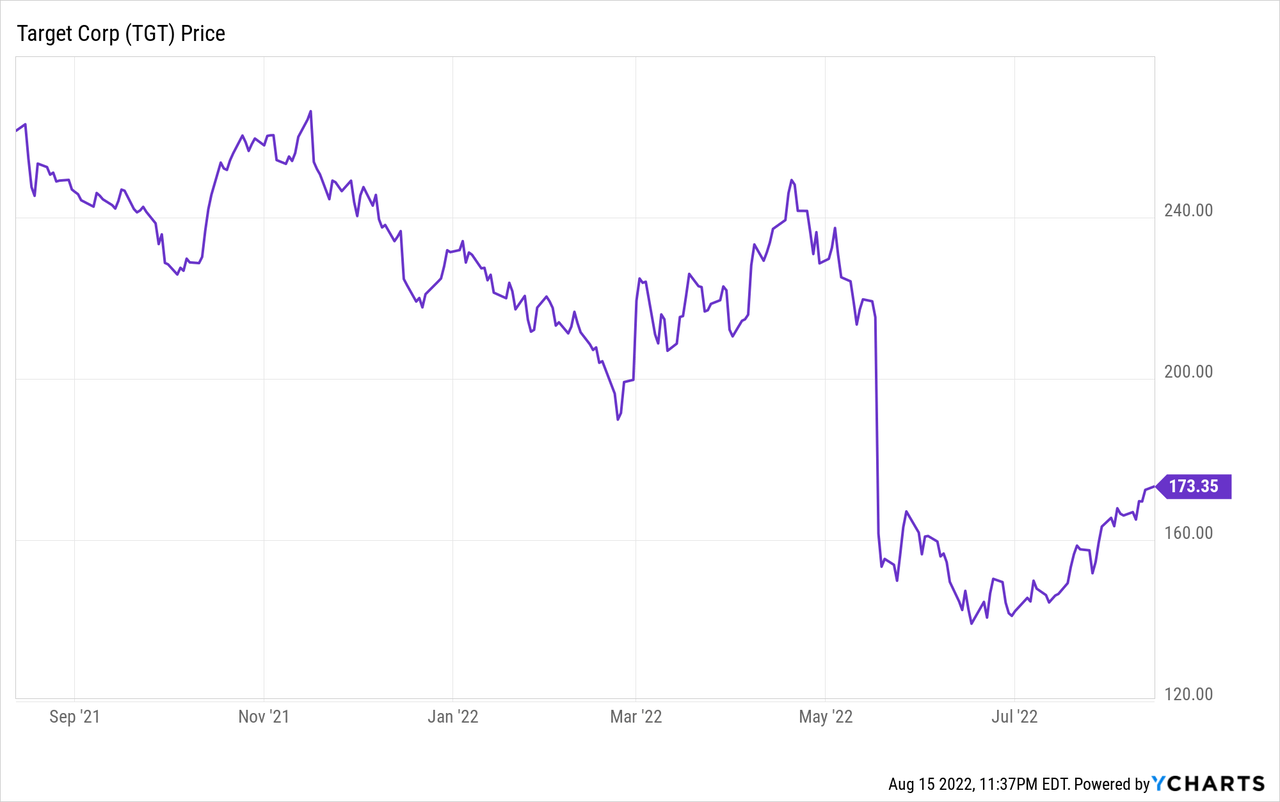

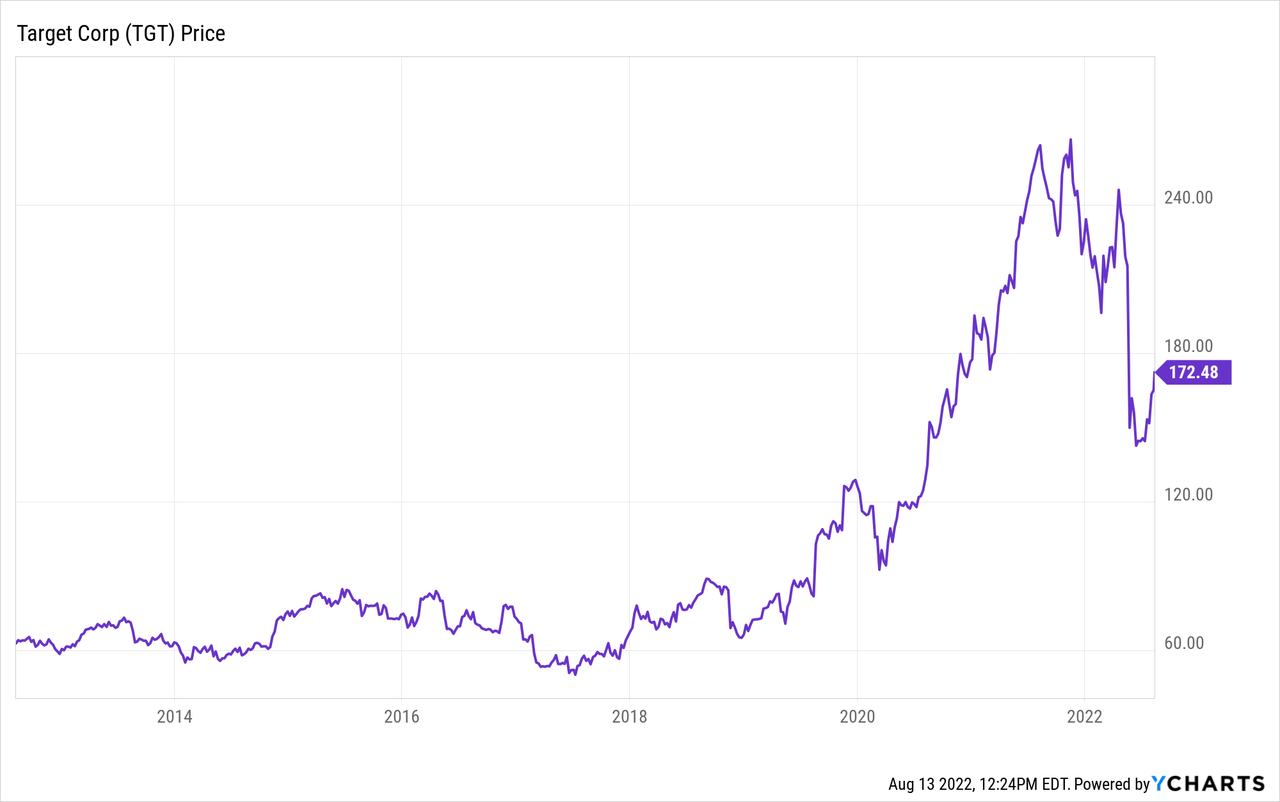

I last covered retailer Target (NYSE:TGT) in May, warning that the company’s steep drop after its earnings miss was the start of a bigger downturn in the firm’s trajectory.

And, indeed, the company once again warned on its outlook in June, saying it would have to discount inventory further and take an additional hit to profit margins to get its operations back on track. However, after the June profit warning, Target stock bottomed and has now recovered meaningfully off the lows.

While the share price may be making some gains, the fundamentals remain on a more uneven footing. As such, it’s worth looking at the company’s situation heading into its next earnings report.

Target’s Rapidly Falling Earnings Outlook

In my May article, a primary argument was that earnings estimates were too high and set to come down. That has happened. Let’s compare Target’s consensus earnings estimates in May 2022 with today.

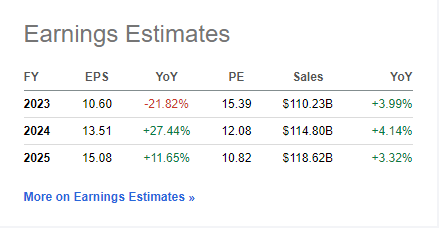

Here is how analysts saw Target’s numbers looking less than four months ago:

Target earnings estimates May 2022 (Seeking Alpha)

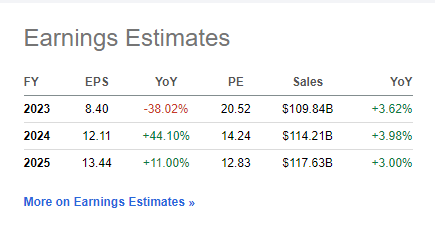

And now, let’s fast forward to the current analyst earnings estimates for Target as of August 12th:

Target earnings estimates Aug. 2022 (Seeking Alpha)

That’s a massive drop in expectations! For fiscal year 2023, analysts slashed estimates from $10.60 to $8.40 per share. It’s not just 2023, either. The 2024 and 2025 estimates were also trimmed by around 10% each.

I’d also note that revenue estimates have barely declined at all. Analysts aren’t really factoring in a broader recession or slowdown in consumer spending yet. This is simply margin pressure due to Target’s issues with managing its inventory and forecasting consumer demand within various product categories.

And, more broadly, it highlights the risk in buying this sort of apparent value stock after the first earnings miss. Back in May, shares probably looked cheap at 15 times FY 23’s projected earnings and 12 times the next year’s earnings. Now, however, we’re up to 21 times FY ’23 earnings, not because the stock price has gone up much, but rather because the company’s net income is sliding.

How Far Can Earnings Fall?

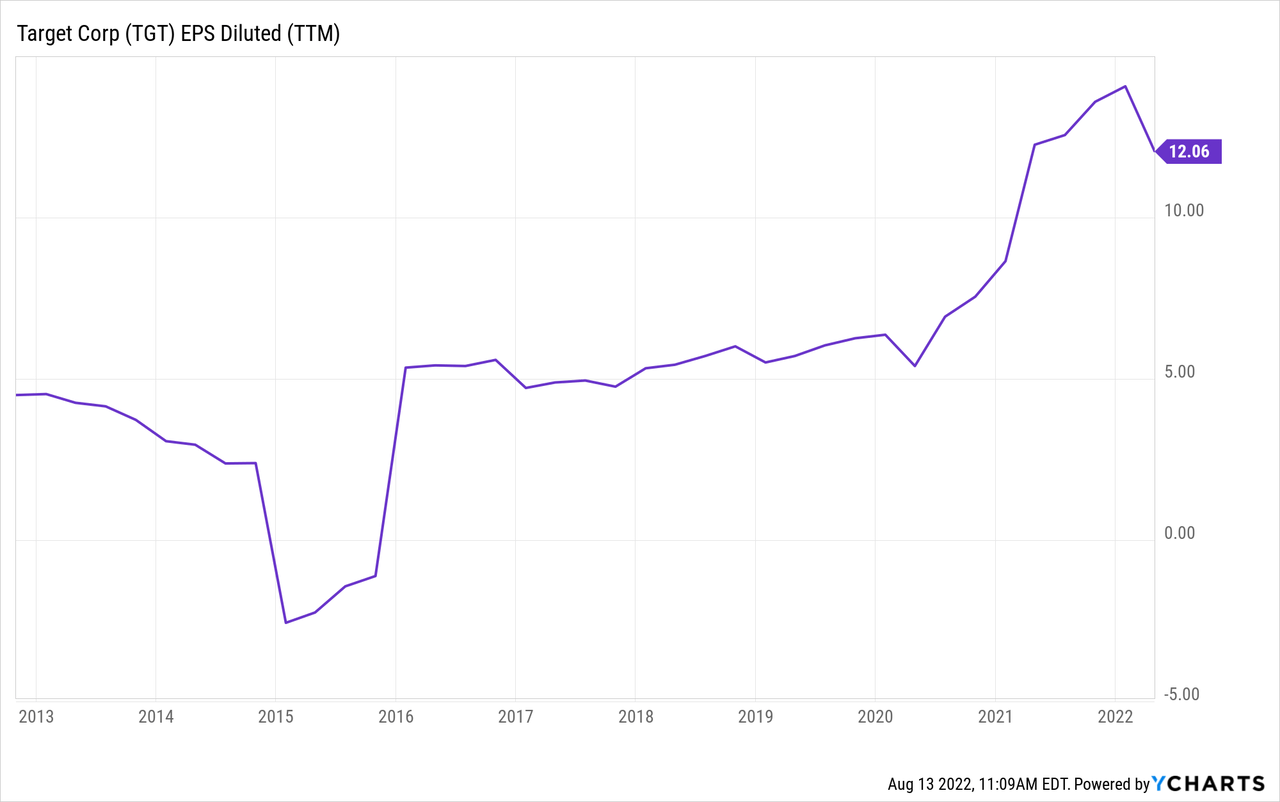

I’d like to highlight the fact that all these earnings estimates still seem ambitious. To show why, consider Target’s longer-run earnings per share trajectory:

Aside from the one-off loss in 2015, Target has historically earned around $5 per share per year. In fact, it was remarkably consistent in earning $5 per share give or take a buck for almost the entire decade.

Investors, judging by Target’s stock price, were betting that the company’s incredible profit margin expansion in 2021 would be a permanent feature.

I’m not the only one questioning whether Target’s earnings are going to swiftly move back up or not. Here’s a Seeking Alpha summary of why Evercore recently issued a negative call on TGT stock:

“[Evercore’s] concern is that margins are likely to remain under pressure into the second half of the year to ultimately question the earnings power quickly recovering to +$12 EPS in 2023 – which appears to be quickly pricing into the stock at its current level.”

Evercore has a $155 price target on Target, which suggests significant risk heading into earnings.

We already saw Walmart (WMT) recently slash guidance, further lowering its already falling earnings outlook. It added to that with corporate layoffs as the company hunkers down for a much more complicated operating environment going forward. That’s hardly the only consumer peer facing adversity. Last week, Best Buy (BBY) announced layoffs at its stores and in its home-entertainment planning operations due to falling consumer spending on discretionary items.

Store traffic at rival big box locations has been falling as well. Data from geolocation data firm Placer.ai showed that foot traffic to Costco (COST), BJ’s (BJ), and Walmart’s Sam’s Club are down 9%, 8% and 6% respectively in July ’22 versus the same month of 2021.

Why Hasn’t Target Stock Fallen Farther?

Given these negative data points, why has Target stock held up so well over the past month? Some of that is probably because the overall stock market has rallied significantly in recent weeks. Certain retailers such as Bed Bath & Beyond (BBBY) have soared, seemingly tied to the return of meme stock movement. Perhaps this optimism is bolstering retail peers like Target as well.

However, another more fundamental reason for Target’s strength is that the company has guided to a swift recovery. Here’s the company’s statement from June when it offered its weaker second quarter outlook:

“[B]ased on the Company’s current expectations for the economy and consumer environment, Target now expects its second-quarter operating margin rate will be in a range around 2%. For the back half of the year, Target now expects an operating margin rate in a range around 6%, a rate that would exceed the Company’s average Fall season performance in the years leading up to the pandemic.“

I see this as the single most important data point in Target’s upcoming earnings and the company’s outlook for the rest of 2022. From my vantage point, it seems unlikely that Target will see its operating margin recover not only to normal levels but rise back above pre-2019 results.

Given the dour results we’ve seen from the likes of Walmart, along with the big inventory build, inflation, and falling foot traffic, and I just don’t see why we’d expect Target’s results to suddenly inflect so sharply to the upside in the back half of 2022.

If management can actually pull it off, more power to them and my bearish outlook will be wrong. As it stands today, however, I see investor sentiment and analyst estimates as too high, and bound to drop further once Target lowers its forecasts for the rest of the year.

Target Stock’s Bottom Line

The current base case on Target assumes that its earnings dip quickly ends and that the company returns to record 2021 levels of prosperity and then rises even above that point. As Evercore’s analyst said, people appear to be pricing in at least $12 per share of earnings next year.

But, does that really make sense? As shown above, the company never generated more than $6/share of earnings annually prior to the pandemic. Assuming that the company’s earnings base has now doubled sustainably going forward is a rather aggressive view.

I suspect the first round of analyst earnings estimates reductions we’ve seen are just the beginning. What happens if, say, Target’s earnings go to $9/share and hold at that level going forward? This would still be up dramatically from what the retailer earned prior to 2020.

At $9 of earnings, however, on a 15 times P/E multiple, that gets to a stock price of just $135. Again, against the historical backdrop of where Target has traded, $135 is hardly a bearish price target:

In fact, granting the company $9 of earnings per share versus the $5.51 it did in 2019 is a fairly generous assumption on my part. And 15 should be a reasonable P/E multiple for a mass market retailer. At those variables, however, the stock is significantly overvalued today and also faces sharp intermediate-term headwinds from inflation, supply chain issues and falling consumer demand. I see no reason to rush into the stock at this valuation.

What would change my outlook?

As detailed above, Target suggested that it can return its operating margins to above average levels by the end of the year. This seems quite difficult given the current operating environment.

If Target can actually make it happen, though, then my view of the business would be improved. If Target can earn above-average margins while well-run rivals like Walmart are flailing, that would be quite the accomplishment. For now, however, I remain skeptical and see shares as holding more risk than reward at the current price.

Be the first to comment