JHVEPhoto

Introduction

As one of the few immediate beneficiaries of Covid and the subsequent reopening of society, Target Corporation (NYSE:TGT) saw its share price rise 200% in just 2 years. That came on top of the fact that the stock had already doubled from mid-2017 to 2020. A remarkable increase in the share price considering the size of the company. As earnings have started to normalize, investors should consider whether it is still worth buying today.

Target Corporation is an American retailer with 1,938 stores in the United States. With its impressive amount of stores, it secures the title as the 7th largest retailer in America. The company has stores spread across all 50 US states and employs +400,000 people.

Fundamentals

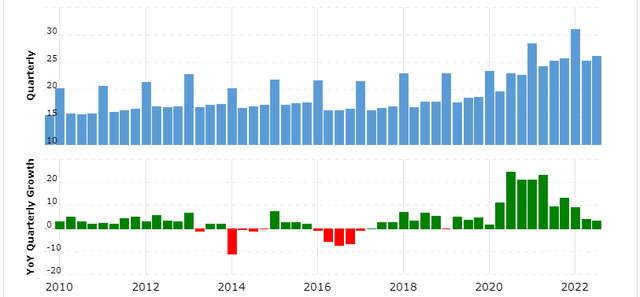

Target Corporation benefiting from Covid is clearly seen in the growth in revenue. The company before 2020 only grew revenue by ~2% a year, barely keeping up with inflation. The low growth is understandable, as the company does not reinvest much back into the business itself.

Equity, excluding one-off charges, has remained stable. All earnings have been spent on share buybacks and dividend payments in recent years, so the low top line growth is understandable.

However, Covid shook things up by increasing demand for some of the products that Target Corporation sells. This demand led to a sudden increase in revenue, which in recent quarters has begun to normalize. Investors should not expect much growth beyond matching inflation going forward, as the company is still not reinvesting capital back into the business.

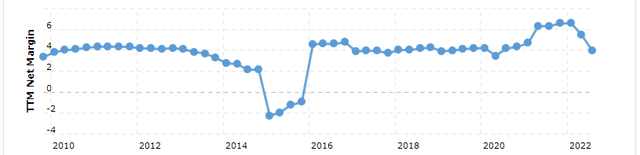

Net income, excluding non-cash charges of $5.4 billion in 2015 related to exit from Canada, has been very stable. It has averaged 4% over the last 20 years, which is within the norm of the industry. Again, as Covid temporarily increased demand for Target Corporation, net profit rose above the 4% mark. As things normalize, the net profit margin is now back to its average.

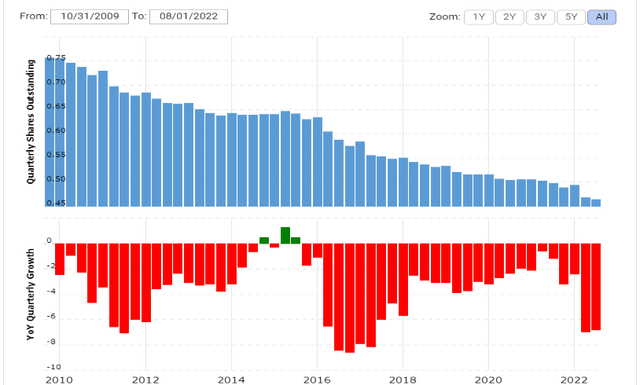

The consistency in the stream of earnings has, in recent years, been primarily used to pay the dividend, which typically makes up a payout ratio of ~50%. However, the payout percentage has been falling in recent years, due to dividend increases not having caught up with earnings yet.

The rest is used to buy back shares. Since the value from share buybacks depends on the market value of the company, a lower earnings multiple would be preferable.

The buybacks have been done every year for the past decade, and I expect that to continue. Given the size of the company, meaningful acquisitions are unlikely. They don’t seem to be able to reinvest back into the business at an attractive rate. Share buybacks and dividend payments are therefore one of the few tools left.

Valuation

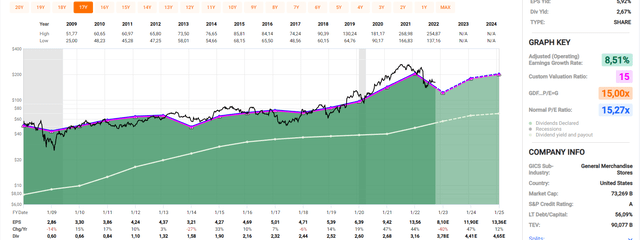

The stock price of Target Corporation has followed the standard earnings multiple of 15 closely. The average multiple in the previous 14 years has been 15.27. The stock has rarely deviated far from the 15 multiple, which has made it a stable and consistent performer.

The growth rate from 2008 – 2022 has averaged 10.55%, far above what I would have expected and definitely not sustainable. To estimate an appropriate growth rate going forward, we must look at how the company allocates capital. Figures during the Covid boost should not be included, as they are inflated and not sustainable.

Given that the stock has been valued close to a 15 p/e, the share buybacks made over the past decade, if all of the earnings would have been spent on buying back shares, could only contribute 6.6% to annual EPS growth. In this case, approximately half of the earnings went to buybacks, which have contributed ~3.3% to annual earnings per share growth. As we saw earlier, revenue grew by ~2% a year before Covid. The net profit margin has been stable, meaning the bottom line grew by 2% per year as well.

The 2% annual EPS growth from net income growth + the ~3.3% from share buybacks would put annual EPS growth at ~5.3%.

Comparing the estimated ~5.3% annual EPS growth to the period of 2008-2020, it comes very close to the actual annual average EPS growth rate of 5.58%.

Assuming they can maintain their current revenue, and the historically stable 4% net profit margin can be achieved, then the current p/e for Target Corporation is close to ~17. An above-average earnings multiple with only and estimated ~5.3% annual growth going forward.

The estimated decline in earnings is in line with analysts’ expectations, as seen in the image below.

Stock Chart

Quick disclaimer: A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

Target Corporation is an excellent example of just how powerful, moving averages can be. The 50- moving average has been respected numerous times in the past, thus providing several opportunities for a decent entry. The 200-moving average, which is typically only touched during market crashes or if the company’s fundamentals deteriorate severely, has been touched twice. It happened during the financial crisis and during 2017. Both times, the fundamentals of Target Corporation remained solid with future prospects intact.

The stock is currently above both moving averages. I would therefore suspect the stock to be unattractive, which I believe is true based on the above analysis of the company’s finances.

Final Thoughts

While the previous year’s growth in the stock price of Target Corporation is undoubtedly impressive, I do not believe it is sustainable. As growth in fundamentals has started to normalize, I see only mid-single digit EPS growth going forward. This assumes that the stock remains close to its 15 earnings multiple and that the company continues to buy back shares with approximately 50% of earnings.

Annual growth of ~5.3% is likely to be the norm going forward, bringing the total return including dividends to ~8%. Regardless of whether 8% is in the range of what you’re looking for, I think the lack of a margin of safety makes a buy rating for this company hard to justify.

Be the first to comment