ljubaphoto

Investment Thesis: Growth for Target Hospitality (NASDAQ:TH) could be modest in the short to medium-term as a result of inflationary pressures.

In a previous article back in July, I made the argument that while Target Hospitality has shown strong growth across the Government segment, investors will expect further growth to justify upside at current price levels.

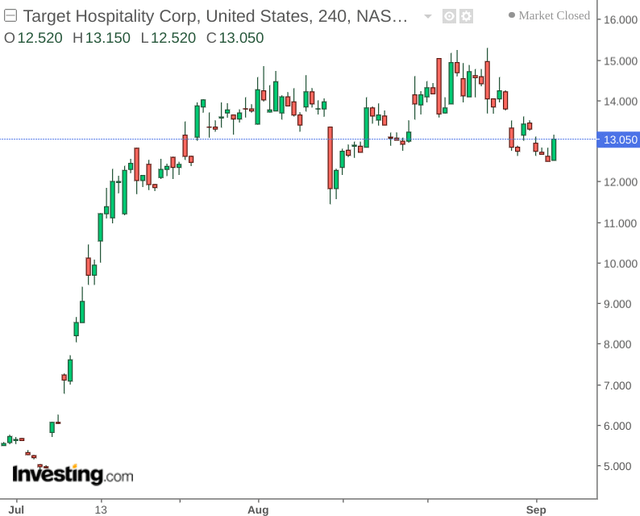

Since the strong surge in July, we have seen price plateau at just over the $15 mark – with the stock up by just under 8% since my last article:

The purpose of this article is to explore whether Target Hospitality has the capacity to see further upside given recent performance.

Performance

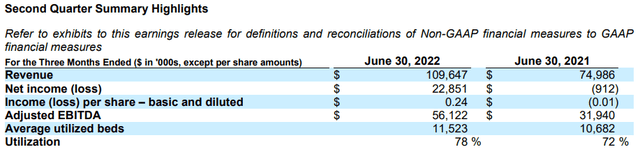

When looking at performance for Q2 2022, we can see that revenue is up significantly, while income per share has rebounded into positive territory and utilization has increased:

Target Hospitality Second Quarter 2022 Results

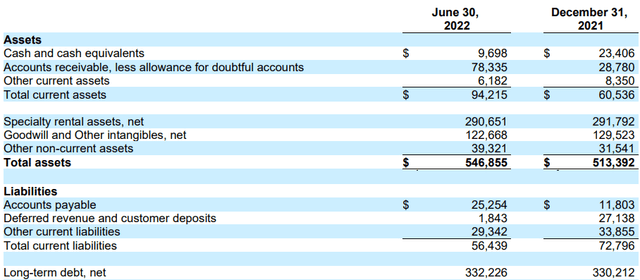

From a balance sheet standpoint, we can see that long-term debt for June 2022 has increased slightly from that of December 2021.

Target Hospitality: Second Quarter 2022 Results

The company’s quick ratio (as measured by cash and cash equivalents plus accounts receivable all over total current liabilities) has increased from 0.71 in December 2021 to 1.56 in June 2022.

On the surface, the higher ratio would indicate that Target Hospitality is in a good position to fund its current liabilities. However, it is notable that there has been a substantial drop in cash and an even greater rise in accounts receivable – this indicates that the company has seen a large increase in payments that are due but not yet received.

This is likely to be a point of concern for investors. Even if Target Hospitality is able to bolster revenue and earnings growth – difficulties in collecting payments on time and converting revenue into cash flow could be cause for concern.

Looking Forward

Going forward, Target Hospitality’s fortunes are likely to remain dependent on the Government segment – with July 2022 having executed an Expanded Humanitarian Contract – which contributed to the Government segment as a whole accounting for 68% of Target’s revenue for Q2 2022.

With that being said – the boost in revenues from the Government segment also incurs increased capital expenditures. In the case of the Expanded Humanitarian Contract specifically, the need to construct a new campus with appropriate facilities for humanitarian support resulted in an increase in capital expenditures to $36.9 million.

Going forward, inflation could be a risk in that capital expenditures for new infrastructure projects could increase due to higher cost of real estate construction.

Moreover, there is no particular guarantee that funding for humanitarian contracts will continue to be readily available across the Government segment – with inflation having already resulted in a scaling back of hunger-relief programs worldwide. Inflation could also affect the propensity of government to continue investing in humanitarian aid domestically – while the higher cost of infrastructure projects may cut into profitability across the Government segment.

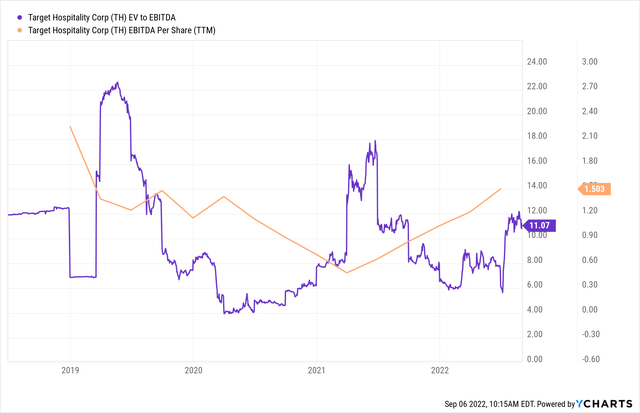

From an earnings standpoint, we can see that while EBITDA per share has been rebounding since 2020, the stock’s EV to EBITDA ratio has also risen – indicating that the stock could be more expensive from an earnings standpoint.

While I anticipate that Target Hospitality should continue to see growth in revenue and earnings – inflation could still see a plateau in growth.

Conclusion

To conclude, Target Hospitality has seen continued growth in revenue across the Government segment. However, investors will want to see evidence of an ability to convert earnings to cash flow while also seeing a reduction in long-term debt.

Inflationary pressures could make achieving these goals more challenging. For this reason, I take the view that Target Hospitality could see modest growth in the short to medium-term.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment