Talaj

My last article about Target Corporation (NYSE:TGT) was published in February 2022. In that article, I called Target undervalued. While I was right for a few weeks with my rather bullish call, the stock tanked in May after earnings were reported and lost about 25% of its value in a single day.

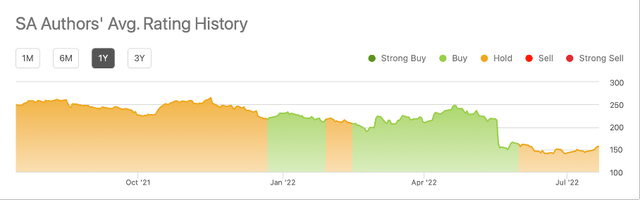

And while sentiment for Target as an investment changed in the following weeks (and SA authors being rather neutral), I am still bullish about Target long-term. I will explain why I am bullish about Target and why I think Target is a good investment right now.

Target: Rather inflation-proof

Target being rather inflation-proof is the first reason why the company and stock might be a good investment right now. And when considering that the last quarterly results were terrible and inflation was often cited as one of the reasons for the results, this statement might be a bit surprising.

When looking at first quarter results for fiscal 2022, Target could beat revenue expectations (by about $700 million), but missed expectations for earnings per share by $0.87, which came as quite a shock. Target could also increase total revenue by 4.0% year-over-year from $24,197 million in the same quarter last year to $25,170 million this quarter. And while revenue could still increase, operating income declined from $2,374 million in Q1/21 to $1,346 million in Q1/22 – resulting in a 43.4% decline. And diluted earnings per share also declined 48.2% YoY from $4.17 in the same quarter last year to $2.16 this quarter.

And Target is citing actions to reduce excess inventory as well as higher freight and transportation costs for the lower operating income. Additionally, Target obviously did not expect sales shifting that quickly and that probably led to high inventory levels as customers were shopping differently than Target expected. During the last earnings call, management stated:

“In our other three core merchandise categories: apparel, home, and hard lines, we saw a rapid slowdown in the year-over-year sales trends beginning in March, when we began to annualize the impact of last year’s stimulus payments. While we anticipated a post-stimulus slowdown in these categories and we expect the consumers to continue refocusing their spending away from goods and into services, we didn’t anticipate the magnitude of that shift.”

But in a press release from June, Target announced several actions to reduce inventory levels:

The Company is planning several actions in the second quarter, including additional markdowns, removing excess inventory and canceling orders. The action plan also includes the addition of incremental holding capacity near U.S. ports to add flexibility and speed in the portions of the supply chain most affected by external volatility; pricing actions to address the impact of unusually high transportation and fuel costs; and working with suppliers to shorten distances and lead times in the supply chain.

And the company also adjusted its guidance as results of the different steps to reduce inventory levels:

“In light of the decisions announced today, and based on the Company’s current expectations for the economy and consumer environment, Target now expects its second-quarter operating margin rate will be in a range around 2%. For the back half of the year, Target now expects an operating margin rate in a range around 6%, a rate that would exceed the Company’s average Fall season performance in the years leading up to the pandemic.

The company continues to expect full-year revenue growth in the low- to mid-single digit range, and expects to maintain or gain market share in 2022.“

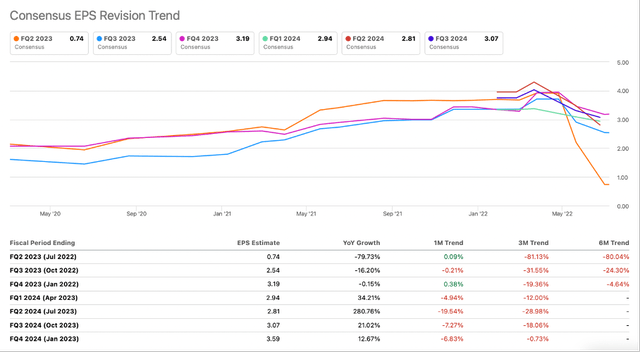

As a result of these negative news, analysts also lower estimates – especially for the next few quarters.

But despite these troubles Target is currently facing with its inventory levels and high costs, I would still consider Target rather inflation-proof as the business will be able to adjust prices over time and customers will have to pay the prices as we are talking mostly about essential, everyday items.

Target: Rather Recession-Proof

Target can not only be seen as rather inflation-proof, it can also be seen as rather recession-proof. And considering the likelihood of a global recession in the coming quarters, this is an important aspect. When considering that Target is mostly selling essential everyday items, we must assume the business being recession-proof. However, different products from the “apparel” and “home” categories might not be completely essential and as stated during the earnings call, the missing of stimulus checks already led to a declining demand. In case of a recession with even lower disposable income, we can assume a declining demand for these products. However, Target is selling rather “cheap” apparel, and people also need clothes during recessions.

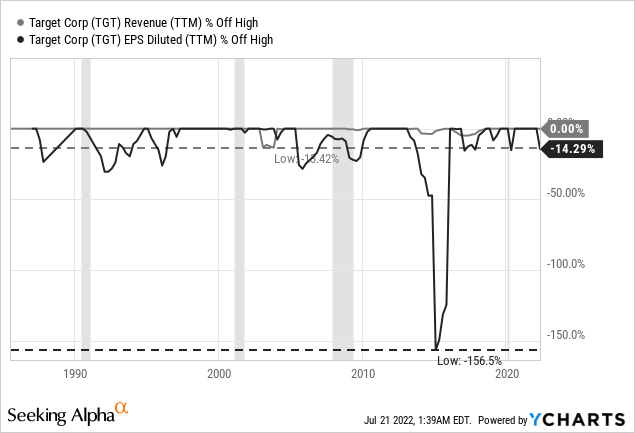

And when looking at the performance of Target during the last few decades, we also can underline the statement of Target being recession-proof. Especially when looking at revenue we hardly see any declines during the last few decades, which is a good sign. And when looking at earnings per share, we only see one really steep decline, but the reason for that decline was not a recession. It was Target’s failed Canada expansion. Keeping the performance of the last few decades in mind, we should be quite optimistic about Target being able to keep revenue at least stable and minimize EPS drawdowns.

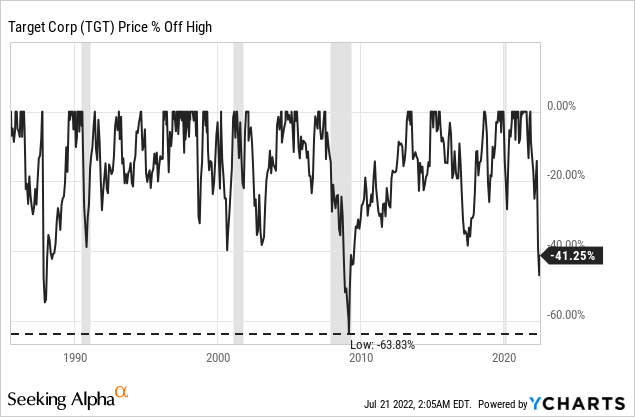

When looking at the stock performance in the past few decades, we can see that Target declined about 40% to 50% several times, but when excluding the Great Financial Crisis the current sell-off is actually one of the steepest for Target. This is of course not an argument, that Target can’t get cheaper, but at least a hint that the decline might be over for now – a point which can also be made, when looking at valuation metrics.

Target: Undervalued

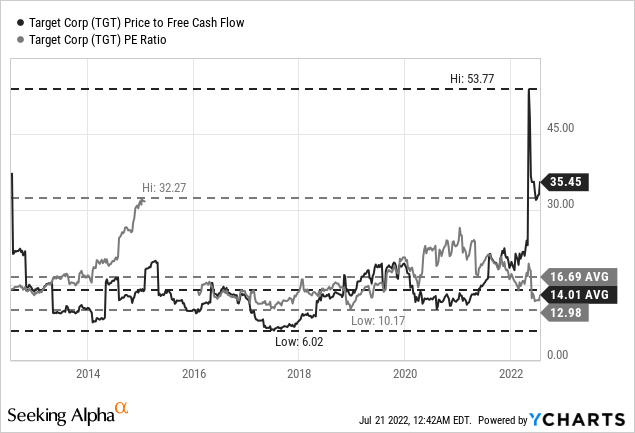

In my opinion, Target was never extremely overvalued in the past few years (I rated the stock a “hold” here and here), but stock prices above $200 were certainly not cheap. However, Target is now trading for 13 times earnings. And not only is this below the average P/E ratio of the last ten years, which was 16.69, it is also a low valuation multiple for a great business that can grow with a stable pace.

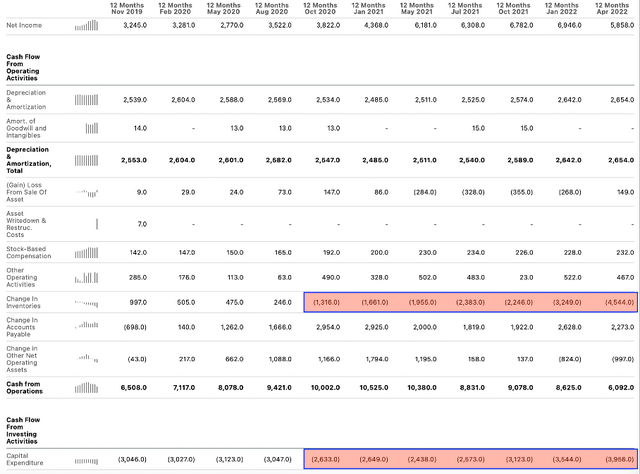

While Target might seem cheap when looking at the P/E ratio, it seems quite expensive when looking at the price-free-cash-flow ratio: Right now, Target is trading for 35.5 times free cash flow, which is clearly above the 10-year average of 14.01. But we must look at these numbers in more detail as there is a simple reason for this high P/FCF ratio. First, cash from operations declined in the last few quarters as “change in inventories” had a negative impact. Second, capital expenditures increased over the last few quarters. And both have a negative effect on the free cash flow, which is explaining the high P/FCF ratio.

And the question we must answer – also for a potential discount cash flow calculation – is if free cash flow will be higher again in the years to come. For capital expenditures, we must expect similar high spending in the next few years, as Target’s CFO explained during the last financial community meeting. Michael Fiddelke is expecting Target to spend about $4 billion on new stores, remodels, supply chain and front-end optimization. However, we can expect the negative impact of “change in inventory” to ease during the next few quarters.

For our intrinsic value calculation let’s assume $8 billion in cash from operations (which is a realistic assumption in my opinion when assuming that inventory issues might be resolved in a few quarters from now). For growth rates we assume 5% annually (which seems achievable by the combination of revenue growth and share buybacks). Additionally, we assume $4 billion in capital expenditures for the next five years and for the following years we assume capital expenditures of 36%.

When calculating with these assumptions and 5% growth till perpetuity (after the next 10 years) and assume a discount rate of 10% as well as 468 million outstanding shares, we get an intrinsic value of $211.95 for Target. And we can make several different assumptions in our calculation, but I would assume an intrinsic value above $200 being realistic for Target.

Target: Great Business

Target probably does not have a wide economic moat around its business as it is difficult for a retailer to create an economic moat. But the company is a solid, well-run business with the potential to grow in the years to come – and this is for example demonstrated by Target’s status as dividend aristocrat.

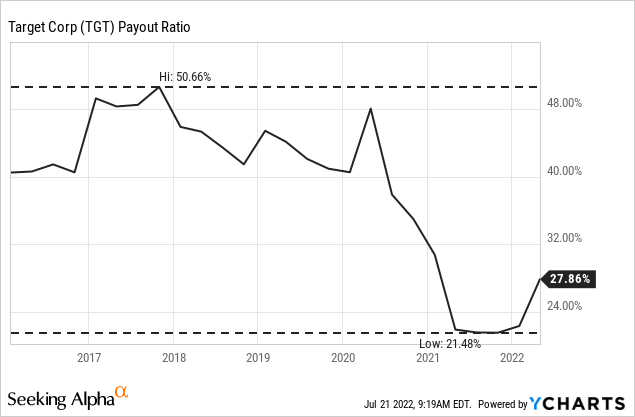

Not only could Target grow its dividend for 54 consecutive years, Target also announced the second high dividend increase in a row. After the dividend was increased 32% last year, Target announced another dividend increase of 20% and hiked the quarterly dividend from $0.90 to $1.08. And Target has the potential to increase the dividend in the years to come as the payout ratio is still rather low. When looking at the payout ratio calculated by using TTM numbers, Target paid out only 27% of earnings per share. And even when calculating with the new annual dividend of $4.32, we get a payout ratio of 36% leaving still room to increase.

And being able to increase the dividend for 54 consecutive years underlines that we are dealing with a well-run business. Being able to increase the dividend every single year – no matter the economic environment – is showing stability and consistency.

Conclusion

Although we must expect higher capital expenditures, which will have a negative effect on free cash flow, Target seems undervalued as the company should be able to generate a higher free cash flow in the years to come than in the last four quarters. Additionally, Target is a solid, well-run business, and in my opinion one of the better long-term investments right now.

Be the first to comment