Sitthipong Pengjan

Apparel stocks had an amazing end to last week. Risk-on behavior swept over the markets following the soft CPI print on Thursday morning, and anything that is interest-rate sensitive took off to the upside. The thinking with apparel stocks goes that lower rates of inflation will help margins in the coming quarters, boosting profits. That means higher share prices, and we certainly saw that on Thursday and Friday.

One name that was a big beneficiary despite uninspiring guidance in its earnings report was luxury brand conglomerate Tapestry (NYSE:TPR). The stock shot up 8.7% on Friday to outpace its peer group, and while I don’t want to chase it here, I do think TPR has long-term upside from its growth and valuation.

The last time I covered Tapestry was almost two years ago, prior to a massive run in the stock. I think we may be on the cusp of something similar today.

Charting the course

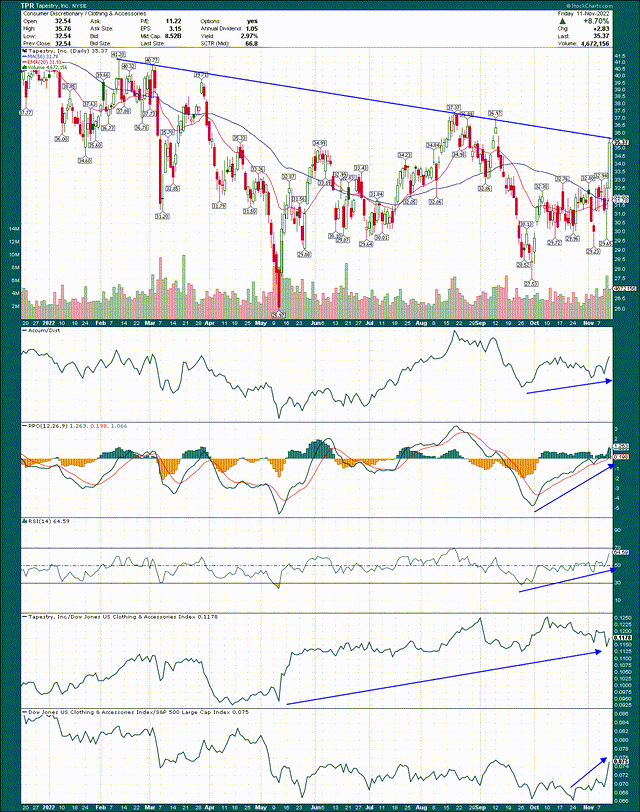

We’ll begin with a daily chart, and as you can see, one of the things I’ve annotated is the long-term downtrend line that has been in play for all of 2022. The stock finished almost exactly at that line on Friday. As with any uptrend or downtrend line, it should be considered an obstacle until it’s broken. In other words, I am assuming there’s going to be some sort of pullback off of that line, even if this is the last time the stock tests it before ultimately breaking out.

Ideally, we’d get a rejection of the trendline, then a test of the rising 20-day EMA that sees the stock bounce and finally break through that line. That would be extremely bullish, but we’ll have to wait and see what path the stock takes.

Apart from that, I see a ton of bullish action here. The accumulation/distribution line looks good (but not great), as big money is buying throughout the day. The PPO is back to the centerline and rising sharply. Downtrends are marked by unsuccessful centerline tests so this, like the downtrend line, is a test for the bulls. We need to ultimately see the PPO above the centerline and trending upwards. I believe we’ll get that; it’s just a matter of whether that’s now or a week or two from now.

We see similar behavior with the 14-day RSI, although I’ll say that indicator looks better than the PPO. The 14-day RSI is a shorter-term look at momentum than the PPO, and it is looking more bullish to me. On any pullback, we want to see the centerline hold for the 14-day RSI.

Finally, relative strength has been outstanding. The apparel group has been horrible for most of 2022, but TPR is a clear outperformer, and in a big way. I don’t expect that to change, so if this is the start of a rally for apparel, TPR is likely to be among the largest beneficiaries.

Q1 supports the bulls

Tapestry’s Q1 results, to my eye, look pretty good. The company’s estimates have been falling for several quarters as buyers of luxury goods have waned somewhat into 2022. After all, the prospect of a global recession has taken center stage in most developed countries given pointed efforts to fight inflation.

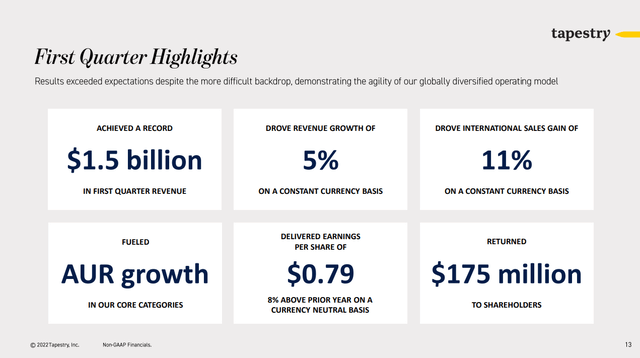

However, the company managed 5% constant currency revenue growth in Q1, and international sales soared 11% on a CC basis. That speaks volumes to the staying power of Tapestry’s brands because global consumers of luxury goods have every reason to be cautious right now. These results, however, show that at least for Tapestry, its offerings still resonate. This is surely at least part of the reason the stock has so vastly outperformed its peers.

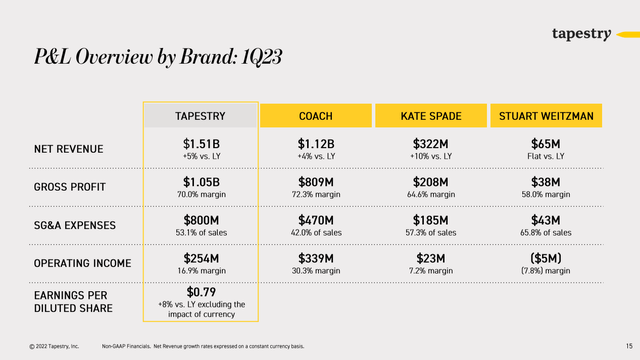

I’ve wondered ever since the company bought Stuart Weitzman back in 2015 why the company did so. It’s a small brand, and it has terrible profitability metrics compared to the rest of Tapestry. Even seven years on, those things are still true. We see 30% operating margins for Coach and 7% for Kate Spade, but -8% for SW. It’s been like that forever, and even on the top line, SW simply isn’t close to the rest of the portfolio. I honestly think Tapestry could add a billion or two to its market cap by selling Stuart Weitzman, or even just shutting it down. It’s a drag on this business, but for what it’s worth, the company is still managing to be highly profitable with that constant drag. Coach is an absolute rockstar of a brand and so long as it remains that way, Tapestry will be strong.

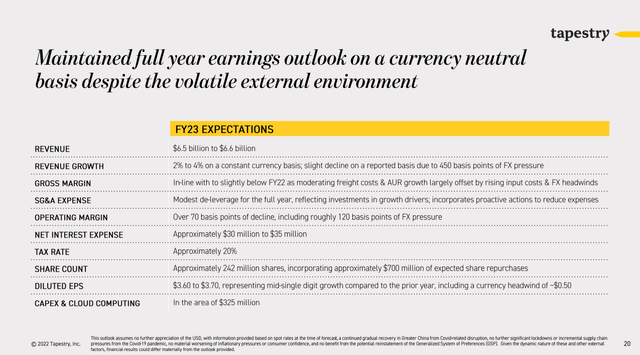

The company maintained its full-year earnings outlook on a currency neutral basis, which includes a massive headwind of 50 cents per share just from currency translation. The US dollar has rolled over in recent weeks, and as I’ve said before, I think it has meaningful downside from current levels. Should that occur, that headwind of 50 cents could easily become 40 or 30 cents, which would mean a big boost to estimates for this year. Something to keep an eye on as we move forward as I think we have a much better chance at higher estimates than lower, based on Q1 results.

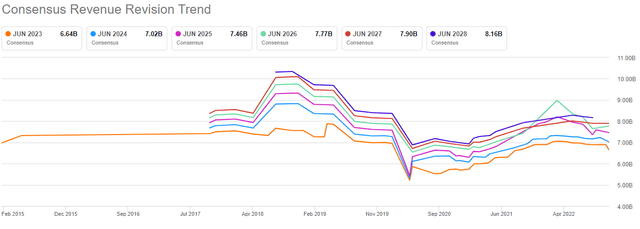

Speaking of revisions, let’s start with revenue, which we can see has been through some ups and downs recently.

Revenue estimates plunged into COVID, which is no great shock. However, the recovery appears to have ended early in 2022. For the past several months, we’ve seen lower sales estimates, but it is my belief that strong Q1 results portend the end of these downward revisions. Tapestry continues to execute in a very tough environment, so if conditions ease even a little, I believe we’ll see these squiggles start to make their way higher again.

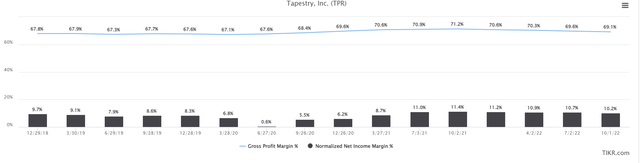

I’ll also note that Tapestry’s profitability is better now than it has been in years past, even with the drag of Stuart Weitzman. Below we have trailing-twelve-months gross and net income margins to illustrate this point.

We see gross margin doesn’t move much, but that’s okay because it’s ~70% of revenue generally. Net income margin, however, has improved markedly from pre-COVID levels which is something I’m not sure the market is valuing right now. This is another reason SW should be divested in some way, because it would immediately boost the margin profile of the company.

As an example, we saw above that consolidated operating income was 16.9% of revenue in Q1. If we exclude SW, operating income would have been 25% of revenue. Investors would pay more for this stock if that were the case.

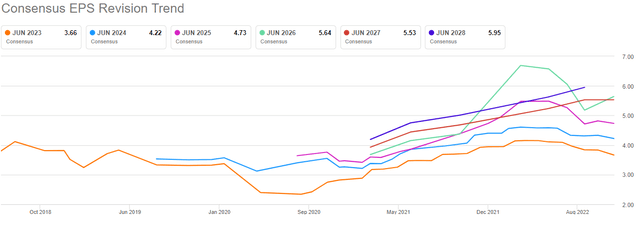

At any rate, if we look at EPS revisions, we see similar behavior to revenue.

It is my belief that much of the decline we’ve seen in EPS for this year is from currency headwinds. We know the company believes that will be ~50 cents this year. Thus, if I’m right and the US dollar has some downside, we should see these estimates go higher in the months to come. That should equate to a higher share price, all else equal.

Cash is king

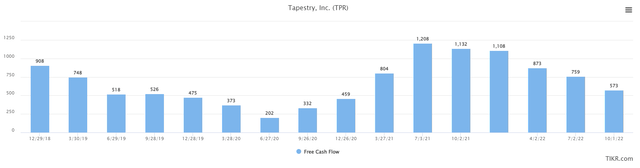

Before we get to the valuation, let’s spend a minute on the balance sheet and the company’s free cash flow. Tapestry has done a lot in terms of returning capital to shareholders. It does this via dividends and share repurchases, and the stock has a very respectable yield right now of 3%. But paying dividends and buying back stock requires cash generation, and as we can see, FCF has been dwindling in recent quarters on a TTM basis.

The company goes through ebbs and flows of FCF generation, but it’s nearing the point where the company either cannot deliver on its buyback and dividend targets, or will have to borrow to do so. In terms of risks, this is a big one for me. Investors would do well to monitor FCF in the coming quarters for this reason.

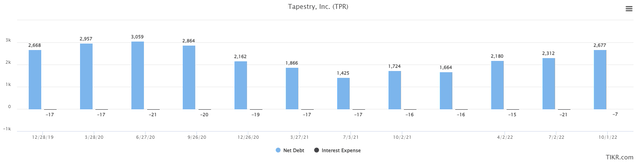

In addition, Tapestry has taken on quite a lot of debt, as we can see below with its net debt profile for the past few years.

Net debt is up to $2.7 billion, which is a lot for a company this size. However, interest expense is small, coming in under $20 million in most quarters. That sort of cost is totally manageable, but if the cost of debt rises in the years to come, it could start taking a larger bite out of earnings. Again, not a problem now, but something to watch going forward.

Let’s value this thing

It is my belief that Tapestry is in a great spot to grow in the years to come. The Coach and Kate Spade brands have great margins, and obvious momentum with global consumers. I’ve made my feelings on Stuart Weitzman clear, as it is neither of those things.

I’ll also reiterate that margins are much better now than they were pre-COVID, but if we look at the valuation of the stock, it seems to be ignoring that critical fact.

Shares go for 9X forward earnings, which is nearly as low as it has been apart from a brief spike during the initial COVID panic. We can see the stock traded for 15X+ earnings regularly pre-COVID, and even right before, was about 12X.

Where the ultimate fair value is for this stock is in the eye of the beholder. However, given that margins are so much better as we saw above, I think 12X to 14X earnings is quite reasonable. If the company divests SW, that could be 16X or 18X.

To wrap this up, I see a very bullish chart and a stock that is vastly outperforming its peers. I see the possibility of much higher earnings estimates, and a higher valuation. All of that points to a higher share price, and as a result, I’m slapping a buy rating on the stock following Q1 earnings.

Be the first to comment