mladenbalinovac

Between mid 2014 and December 2019, the energy sector struggled, losing over 38% of its value, before falling even further in the early 2020 COVID Crash. However, since that bottom, energy has had a huge bounce back, rising to nearly its mid 2014 value:

YCharts

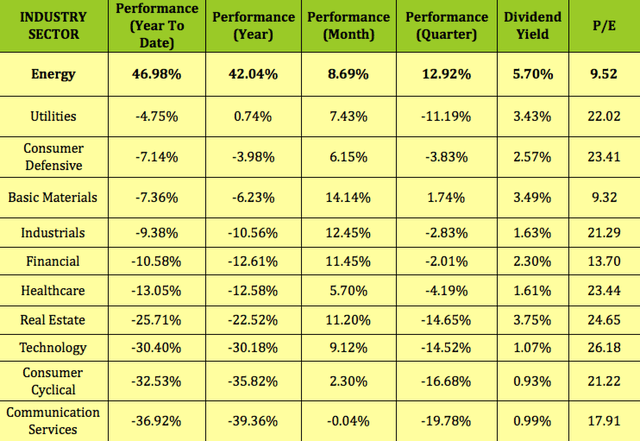

Energy has led all other sectors by a big margin over the past year and so far in 2022., where it’s up ~47% In fact, it’s the only sector with a positive performance in 2022.

That’s certainly great if you hold some energy stocks in your portfolio, but another big plus is that energy is still the highest yielding sector, with an overall dividend yield of 5.70%.

Also, even after its meteoric rise from the ashes, energy also has the second lowest P/E of all sectors, at 9.52, while most other sectors have double-digit P/Es far above that of energy’s:

Hidden Dividend Stocks Plus

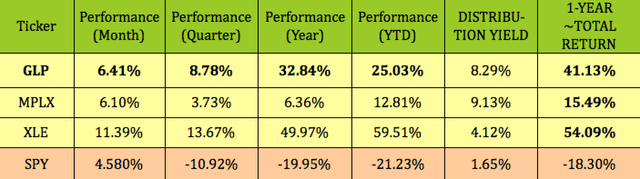

This article profiles two high-yield energy stocks, Global Partners LP (GLP) and MPLX LP (MPLX), both of which have outperformed the S&P 500 over the past month, quarter, year and year to date.

GLP, with its one-year total return of ~41%, has had a much stronger performance during most of these periods than MPLX, but still, MPLX’s 15% total one-year return certainly outstrips the S&P’s -18% one-year total return:

Hidden Dividend Stocks Plus

Company Profile – GLP:

Global Partners LP was founded in 2005 and is based in Waltham, Massachusetts. The original company has been around since the 1930s.

It’s one of the largest fuel distributors in the New England area, selling via retail and wholesale divisions. It’s also involved in the transportation of petroleum products and renewable fuels through rail from the mid-continent region of the United States and Canada, and has a rail and waterborne terminal on the West Coast, in Oregon. GLP’s GDSO, (gasoline distribution and station operations), portfolio consisted of 1,700 sites comprised of 343 company operated sites, 292 commission agents, 196 leasing dealers, and 858 contract dealers.

GLP also owns 24 petroleum terminals, with 10M barrels of capacity, and distributes an average of 369K barrels daily:

GLP site

The GDSO operations accounted for 75% of GLP’s product margin in Q3 ’22, followed by Wholesale, at 22%, and Commercial, at 3%. The GDSO segment’s product margin jumped by 47% in Q3 ’22, to $262M, while Wholesale’s margin rose by 88%, to $79M, and Commercial’s margin more than doubled. These big margin gains were primarily due to higher fuel markets and an increase in volume sold, due to recent acquisitions.

Management expanded GLP’s GDSO footprint in the mid-Atlantic, with the acquisition of Tidewater Convenience, and its portfolio of 15 retail fuel and convenience store locations in Virginia. “Our retail site count in Virginia has increased nearly sevenfold in the past year from 13 locations at the end of Q3 last year to 89 at the same point in 2022.” (Q3 2022 call)

Earnings:

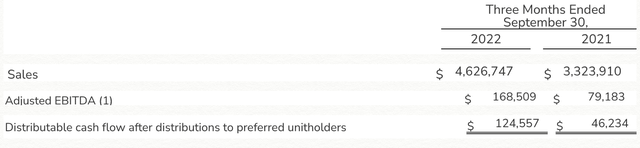

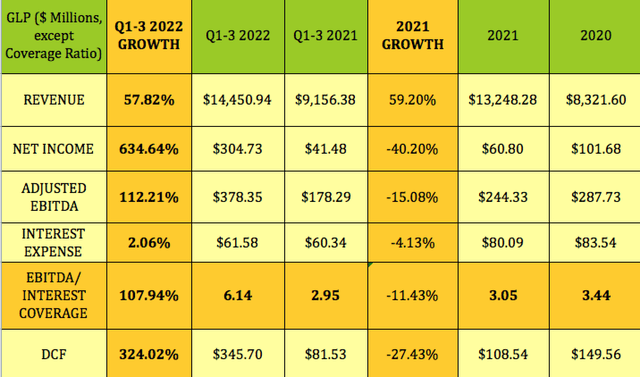

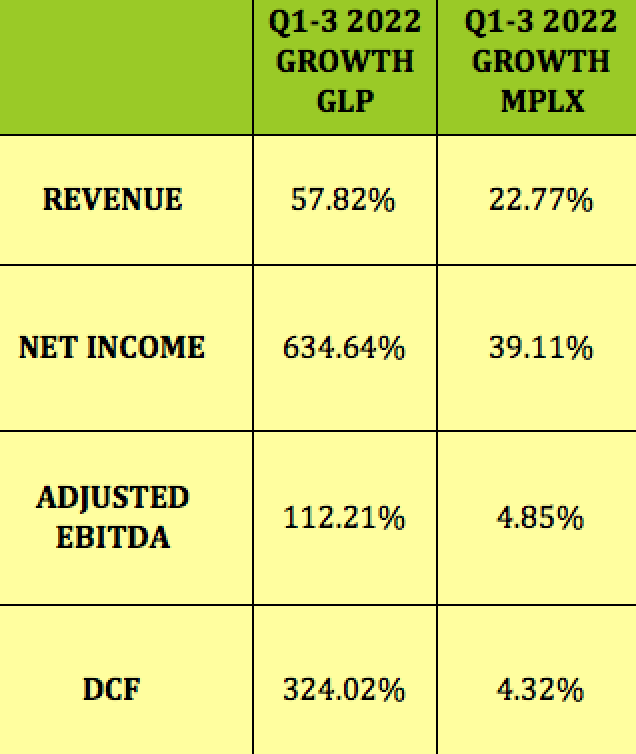

After a challenging year in 2021, as COVID demand destruction slowly began to subside, GLP has bounced back big time in 2022, with 57% revenue growth, and triple-digit net income, adjusted EBITDA, and distributable cash flow, DCF, growth.

Meanwhile, Interest expense only rose 2%, which helped GLP’s Interest coverage factor to more than double in Q1-3 ’22, to a very strong 6.14X factor, vs. 2.95X in Q1-3 ’21.

GLP had robust sales growth in Q3 ’22, with revenues rising 39%. Adjusted EBITDA and DCF also surged vs. Q3 ’21, up 113% and 169%.

GLP site

Hidden Dividend Stocks Plus

Company Profile – MPLX:

MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, exchange, storage, and marketing of natural gas liquids; transportation, storage, distribution, and marketing of crude oil and refined petroleum products, as well as other hydrocarbon-based products; and sale of residue gas and condensate. (MPLX site)

Earnings:

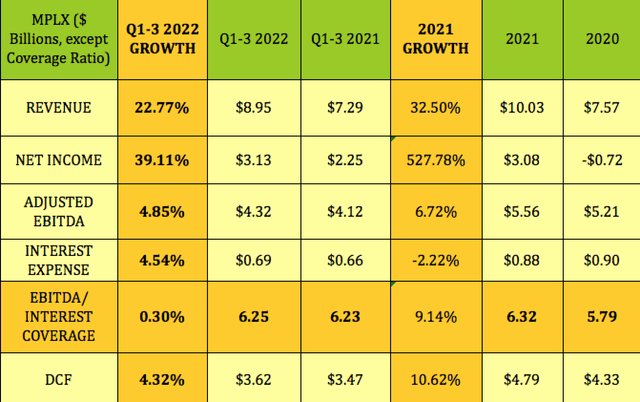

MPLX had a much stronger 2021 than GLP, with 32% topline growth, ~7% EBITDA growth, and 10.6% DCF growth, in addition to its Net Income swinging from a negative -$.72B to a positive $3B.

Growth has continued in 2022, with revenue up 22.8%, net income rising 39%, EBITDA up !5%, and DCF up over 4%.

Hidden Dividend Stocks Plus

While MPLX had a much stronger 2021, GLP’s Q1-3 2022 turnaround vs. 2021 has been much more dramatic, which would account for GLP’s stronger price performance figures.

Hidden Dividend Stocks Plus

Dividends:

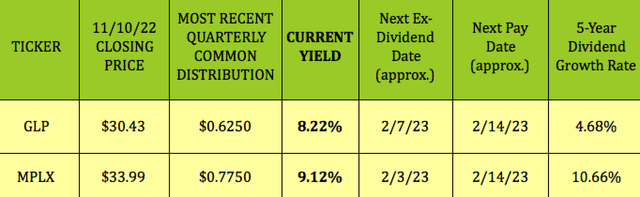

MPLX has a somewhat higher yield, at 9.12%, vs. 8.22% for GLP. Like most energy stocks, they both go ex-dividend and pay in a Feb/May/Aug./Nov. schedule. MPLX has a much higher five-year dividend growth rate, at 10.66%, vs. 4.68% for GLP.

Hidden Dividend Stocks Plus

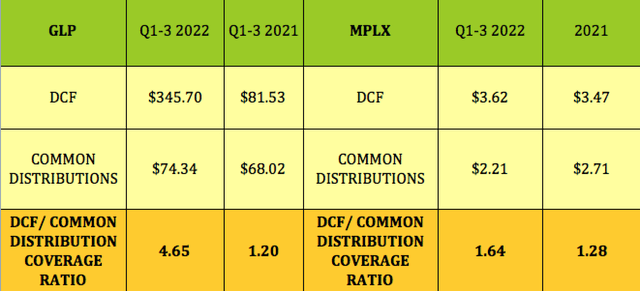

Both companies have good common distribution coverage, but GLP’s coverage has tripled in 2022, hitting a very high 4.65X, vs. 1.2X in Q1-3 ’21.

MPLX’s coverage factor improved to 1.64X in Q1-3 ’22, vs. 1.28X in Q1-3 ’21:

Hidden Dividend Stocks Plus

Taxes:

Both companies’ distributions are reported on a Schedule K-1.

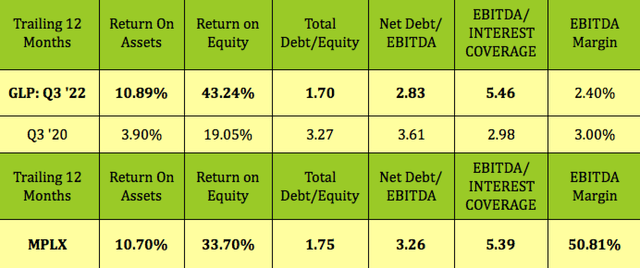

Profitability and Leverage:

GLP’s profitability has improved dramatically in 2022 vs. Q3 ‘2020 pre-COVID figures, with ROA and ROE both hitting much higher %’s. net debt/EBITDA and debt/equity leverage have both improved, especially Debt/Equity, which fell from 3.27X to 1.7X, while net debt/EBITDA fell from 3.6 to 2.8X. GLP’s trailing Interest coverage is a strong 5.46X.

Even though they have two distinct asset bases, MPLX and GLP have very similar ROA, debt/equity, interest coverage figures, whereas GLP’s ROE is much higher, and MPLX’s EBITDA margin is much higher.

Hidden Dividend Stocks Plus

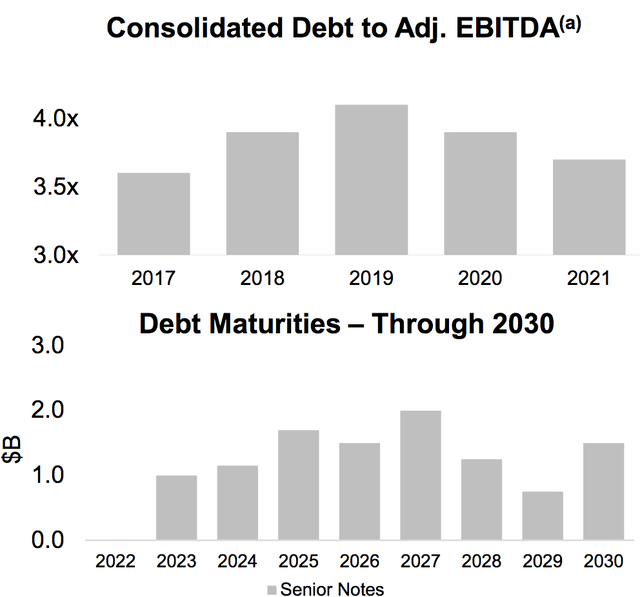

Debt and Liquidity:

GLP has strong liquidity. As of 9/30/22, GLP had total borrowings outstanding under its credit agreement of $99 million. This consists of zero borrowings under the $1.1 billion working capital revolving credit facility, and $99 million under the $450 million revolving credit facility. The credit agreement matures on May 6, 2024. It also has $400M in senior notes due 2027, and $350M in senior notes due 2029. GLP was in compliance with its debt covenants at September 30, 2022.

MPLX’s management has been deleveraging since 2019, bringing its debt/EBITDA ratio down from over 4X to ~3.3X as of 9/30/22. Its debt maturities look well laddered out into the future. Management has redeemed ~$1B in Senior Notes in 2022.

MPLX site

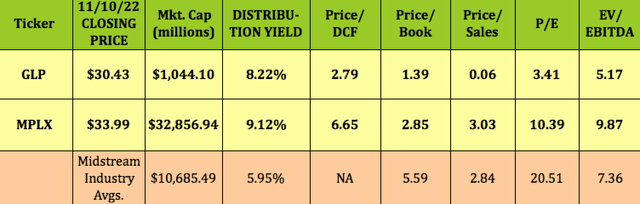

Valuations:

MPLX’s ~$32.8B market cap dwarfs GLP’s $1.4B cap. However, GLP has much lower valuations for Price/DCF, P/Book, P/Sales, trailing P/E, and EV/EBITDA.

Hidden Dividend Stocks Plus

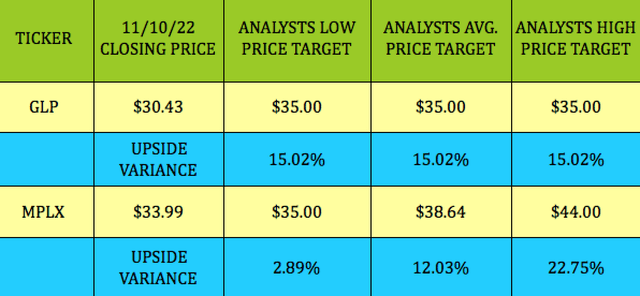

Analysts’ Price Targets:

As a much smaller cap stock, GLP only has one analyst with a current price target. GLP just received an upgrade from Hold to Buy from Stifel research on 11/8/22 – they also raised the price target from $28.00 to $35.00.

At its 11/10/22 closing price of $30.43, GLP was 15% below that $35.00 price target.

At its 11/10/22 closing price of $33.99, MPLX was ~3% below analysts’ $35.00 lowest target, and 12% below the $38.64 average price target.

Hidden Dividend Stocks Plus

Parting Thoughts

We rate GLP as a buy, based upon its entrenched business profile, its low valuations, its attractive growth, and its very well-covered distributions.

MPLX is also a worthy investment vehicle, but we’d wait for another price dip before jumping aboard.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment