IGphotography

Tanger Factory Outlet Centers, Inc. (NYSE:SKT) is a well-managed shopping center-focused real estate investment trust that provides a covered 4.5% dividend yield and a strong recovery in funds from operations to passive income investors.

The fundamentals of the trust are strong, from occupancy to FFO growth, and I believe that the trust’s safe dividend ensures that passive income investors are getting a good deal here.

Portfolio Positioning And Growth

Tanger Factory owned and managed 37 shopping centers in the United States and Canada as of September 30, 2022, with a total portfolio size of 14 million square feet.

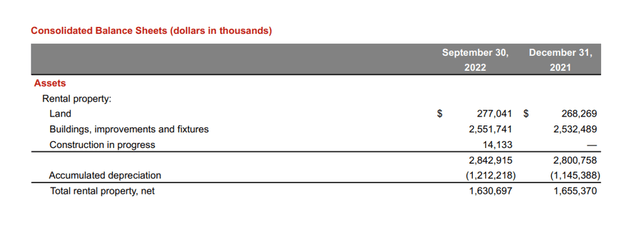

The trust’s real estate is primarily concentrated in large metropolitan areas, with 90% of its assets anchored in the Top 50 MSA markets. The majority (95%) of the real estate assets in the real estate investment trust are open-air shopping centers. At the end of the September quarter, Tanger Factory had real estate, including land, valued at $1.6 billion, net of depreciation.

Consolidated Balance Sheet (Tanger Factory Outlet Centers, Inc.)

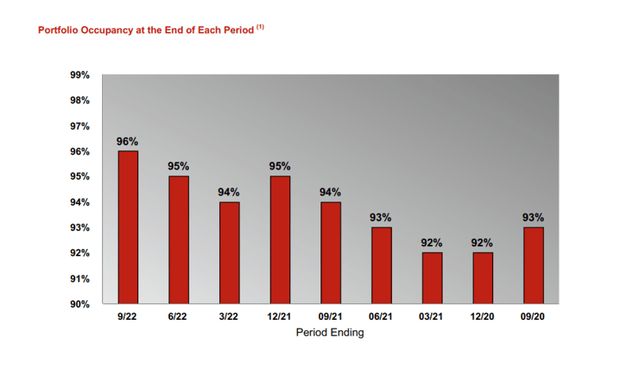

The trust’s business is experiencing strong recovery trends. In 2020, the Covid-19 pandemic decimated the retail landscape, resulting in a temporary drop in occupancy.

Tanger Factory’s portfolio fundamentals, on the other hand, have steadily improved over the last two years, with the trust’s occupancy now exceeding 96% in the September quarter. Occupancy is not yet fully restored to pre-pandemic levels (97-98%), but the trend is encouraging.

Occupancy Rates (Tanger Factory Outlet Centers, Inc.)

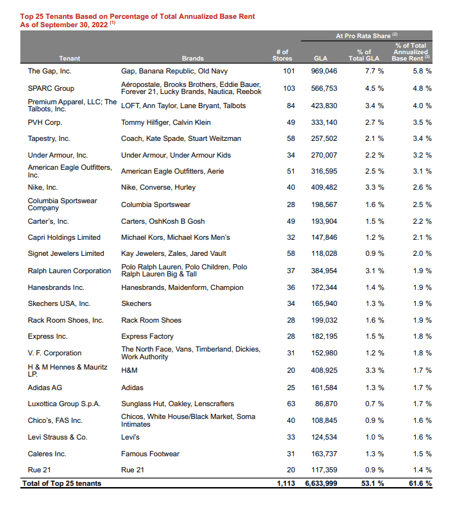

Tanger Factory leases space in its open-air outlet centers to many of the country’s largest retail brands, including The Gap (GPS), Under Armour (UA), Nike (NKE), adidas (OTCQX:ADDYY), and Ralph Lauren (RL), among others. The top 25 customers account for 61.6% of the trust’s annual rental income, indicating that the trust is very well-diversified.

Top 25 Tenants (Tanger Factory Outlet Centers, Inc.)

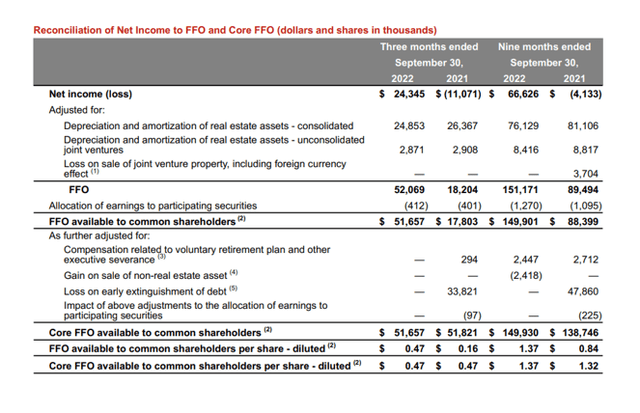

FFO, Pay-Out Ratio And Dividend Growth

In the third quarter, Tanger Factory earned $0.47 per share in funds from operations while paying out $0.20 per share. Tanger Factory paid out less than half of its FFO in 3Q-22, according to the trust’s dividend pay-out ratio of 43% (the same ratio Tanger Factory presents for the first nine months of 2022).

Amid strong recovery trends in its business, the real estate investment trust increased its fourth-quarter dividend by 10% to $0.22 per share per quarter, resulting in a forward dividend yield of 4.5%.

FFO (Tanger Factory Outlet Centers, Inc.)

Tanger Factory’s FFO Potential

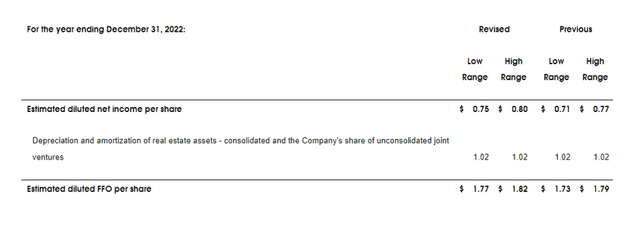

Tanger Factory’s FFO guidance for 2022 has been raised yet again, this time from $1.73-1.79 per share to $1.77-1.82 per share. Tanger Factory raised its FFO forecast for 2022 by $0.035 per share, or 2%, at the midpoint. The trust earned $1.29 per share in FFO in 2021, implying a 39% YoY increase in 2022, owing primarily to a robust and long-lasting recovery in the real estate sector.

FFO Per Share (Tanger Factory Outlet Centers, Inc.)

Tanger Factory’s stock is trading at an FFO multiple of 10.9x based on the trust’s revised diluted funds from operations guidance for 2022.

Tanger Factory’s funds from operations could grow by 4-5% in 2023 if the shopping center market remains stable, implying a forward FFO level of $1.87 to $1.88 per share (calculated based on Tanger Factory’s revised guidance at the midpoint). Tanger Factory is valued at 10.5x funds from operations based on this FFO range.

Tanger Factory’s competitors include Kimco Realty Corporation (KIM) and Simon Property Group, Inc. (SPG), which trade at FFO multiples of 14.3x and 10.2x, respectively, based on their respective FFO range midpoints. Tanger Factory is not a bad buy from a valuation standpoint for passive income investors.

Why Tanger Factory Could See A Lower/Higher Valuation

Even during Covid-19, the trust’s occupancy rate did not drop significantly. It fell slightly, to 92.2%, a 4.9 percentage point drop at the time, but the occupancy rate recovered quite consistently in the succeeding quarters.

Having said that, portfolio trends are very positive, and the rebound in FFO contributes to lower FFO and portfolio risks. Two risks that passive income investors should be aware of are a real estate recession and an unexpected increase in portfolio occupancy.

My Conclusion

Tanger Factory is a well-managed shopping center-focused real estate investment trust that provides investors with a stable and safe dividend with the potential to grow in the future, owing to Tanger Factory’s extremely low pay-out ratio of 43%.

Tanger Factory benefits from a fundamental recovery in its portfolio’s occupancy as well as strong funds from operations growth driven by an underlying recovery in the real estate market following Covid-19. The dividend is paid out of funds from operations, and the stock is trading at a reasonable multiple of my FFO estimate for 2023.

Be the first to comment