lucigerma

This article was co-produced with Wolf Report.

Few REITs have seen such opposing professional assessments as Tanger Factory Outlet Centers, Inc. (NYSE:SKT).

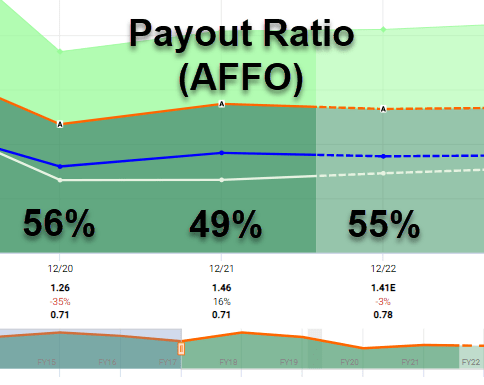

The reasons for this aren’t that hard to find once you start delving into the financials. This real estate investment trust (REIT) was part of a subsector that had to slash its 2020 dividend by almost 50%.

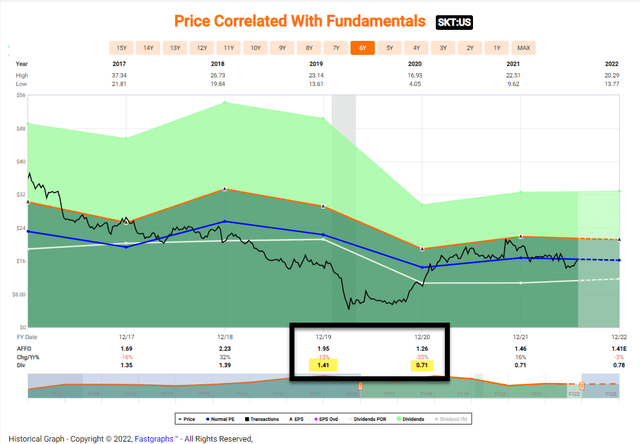

(F.A.S.T. Graphs)

Since then, it’s sad but true that Tanger has been trading at a very unfavorable overall valuation. At one point, it was down to no more than 2x-3x funds from operations (FFO) for an extensive period of time.

That’s not to say we objected too much, taking advantage of the mispricing in the Cash is King Portfolio. And, sure enough, shares bounced from there.

(Sharesight / Cash is King Portfolio)

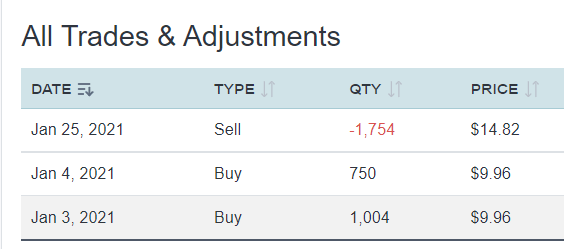

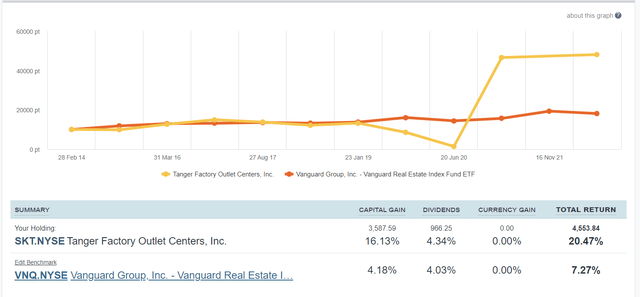

We still hold a position in Tanger today for the Durable Income Portfolio. And as shown below, we used dollar-cost-averaging during the pandemic to generate solid returns in Tanger:

(Sharesight / Durable Income Portfolio)

Today, we’re seeing details that make us want to look again. That’s why Wolf Report and I are taking a closer look at Tanger – before it reports earnings after the market closes on August 8.

Tanger Factory Outlet Centers: A Pure-Play Outlet Landlord

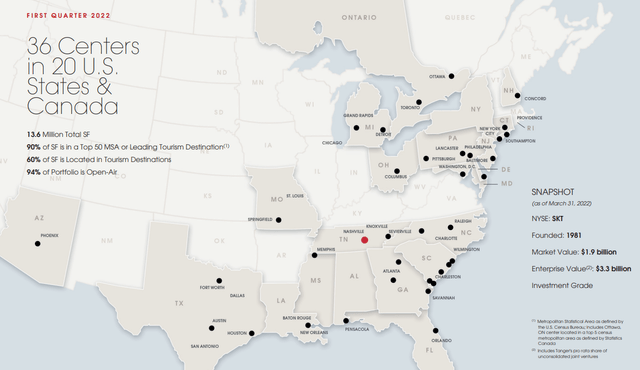

For those who don’t know, Tanger invests in outdoor shopping centers specifically containing outlet stores. These assets are focused primarily along the East Coast, and the company itself is headquartered in Greensboro, North Carolina.

Here are some quick stats about its properties:

- 36 are in 20 states and Canada.

- It boasts 13.6 million square feet of retail space.

- 90% are located in top 50 metropolitan statistical areas (MSAs) and leading tourist destinations

- 94% are open-air facilities.

As for Tanger itself, it earns money by owning and operating mall/outlet properties and leasing individualized spaces to interested parties. This involves a minimum base rent levels and payments of operational costs/expenditures (including taxes on property).

(SKT Investor Presentation)

Tanger’s top tenants include Gap (6.1% of ABR), Premium Apparel, PVH Corp. (PVH), American Eagle Outfitters (AEO), Under Armour (UA), and NIKE (NKE). Its 10 largest make up around 36% of annualized base rent (ABR).

That is a fair amount of concentration worth mentioning. Moreover, that number is higher than it was back in 2020. Then again, almost all of its tenants are extremely high-quality companies.

(SKT tenants – SKT IR)

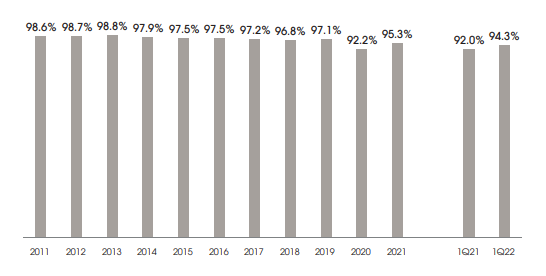

Plus, its current 94.3% occupancy rate and Q1-21 1.3%+ cash rent spreads for comparable leases show there’s still plenty of demand.

Now, occupancy is still down compared to historical figures. In 2013, for instance, it was boasting a solid 98.8%.

However, that metric and sales alike are showing positive growth. This leaves SKT in a strong position, both financially and in terms of its properties.

(Occupancy – SKT Q1 Investor Presentation)

This has left its bears – of which it has a few – in significant trouble. They’ve been flat-out crushed since Tanger’s pandemic lows.

Returns of 300%+ in less than two years speak for themselves.

Evaluating Tanger’s Current Position

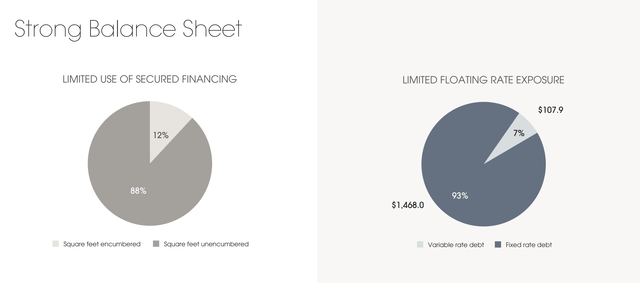

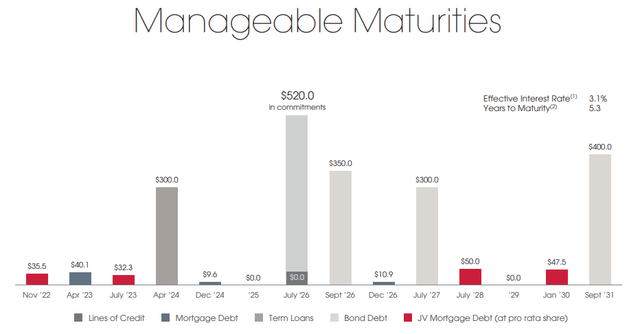

Tanger’s recent fundamental updates show us a very limited floating-rate exposure and very limited use of secured financing.

(SKT IR – SKT IR)

Despite all the issues, we still see SKT hanging on to an investment-grade credit rating. Admittedly, that’s by a thread at BBB-, last updated in February 2021. But it’s investment-grade nonetheless.

Besides, Tanger’s fundamentals have obviously improved and its credit outlook is stable. The company doesn’t have any sort of significant maturity until early 2024 in the form of a term loan.

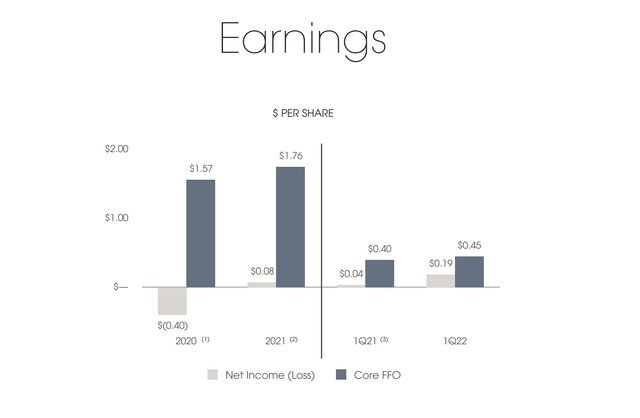

In terms of earnings and core FFO, SKT has reported significant improvements in the latest quarter of Q1-22. And in terms of net income, it’s also once again above the negative mark it reached in 2020.

(SKT IR – SKT IR)

Like most REITs, SKT was able to report very solid fundamentals and strong leasing momentum during the past quarter. Between that, occupancy, and a positive leasing spread, the company is seeing significant earnings growth.

This led not only to an improved outlook but a close to 10% increase in the company’s dividend.

Yes, that’s only a very small step toward Tanger’s pre-pandemic dividend of above $1.4/share. But it’s still an important step.

We’ll also point out that its results were well ahead of expectations… and that SKT increased earnings guidance – yet another step on the road back to positivity.

(F.A.S.T. Graphs)

A “Demanding” Business

Gas prices and other inflationary factors seem to have only marginally impacted demand. Tenant sales per square foot remain very strong on a trailing 12-month (TTM) basis – an almost 20% increase to its pre-pandemic comp of 2019.

Same-center net operating income (NOI) grew as well. And Tanger’s goal is to accelerate leasing even further by attracting new brands. Already, it reports that open-air shopping isn’t going anywhere.

Sorry bears. Again.

If anything, leasing momentum and the desire for expansion is expanding. This is evidenced by new brands to the portfolio – including but not limited to Wolford, St. John, Ulta Beauty (ULTA), and Regatta.

On the company’s Q1 earnings call, CEO Stephen Yalof said (emphasis added):

“Our focus on non-apparel and footwear tenants also continues as we sign leases with new F&B, furniture and home, and digitally native brands. These new additions deliver high-quality shopper visits by attracting a higher income shopper and a younger demographic.

“Over the trailing 12-month period ended March 31, we executed 1.8 million square feet of leases across 375 transactions, representing a 39% increase in space and a 42% increase in transactions from the comparable prior period, driven in large part by the strong renewal activity, approximately 45% of this GLA was executed in the first quarter of this year.”

It seems fair to say, then, that SKT’s pandemic troubles are fading. We’re even starting to see normalization and a path back toward the $2-per-share FFO level… perhaps in 2025-2026?

Its yield is currently 5%, which admittedly is a bit of an issue considering how it did cut its dividend two years ago. Many REITs that didn’t are today trading at lower multiples and higher dividends.

Ipso facto, they’re technically more attractive.

However, Tanger remains interesting – especially if you’re fully invested in higher-quality options.

SKT Stock Valuation

So now that we’ve discussed quality, let’s look at Tanger’s valuation… which isn’t as “great” as you might expect.

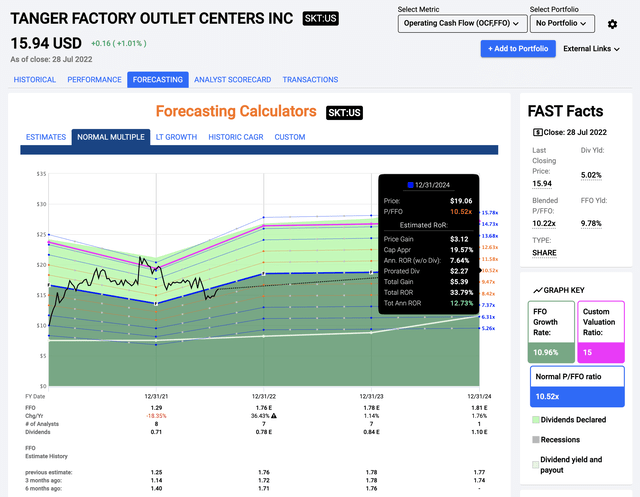

Compared to REITs like Highwoods Properties (HIW), Simon Property (SPG), and other REITs that are factually more qualitative – with higher credit rating, and shallower or non-existent dividend cuts – Tanger actually trades at a P/FFO multiple of 10.22x.

SPG and HIW trade below 10x – with higher yields than SKT.

How can this be?

Well, the market clearly expects some normalization out of SKT. To be more precise, it expects Tanger will revert to a pre-pandemic FFO per share of $1.76. That would put its FFO payout below 50% and generate a 36.5% year-over-year FFO-per-share increase.

If that happened, now would be a great time to buy in.

Beyond that, Tanger is expected to go pretty much nowhere in terms of FFO – below 2% per year, as costs come hammering home. Yet this still gives us an upside of 12.7% annually, or 33.8% until 2024, on a 10.5x P/FFO.

Again, with a 5% yield…? That isn’t exactly uninteresting.

If that earning stream does materialize, we can expect significant dividend increases too. We’re already up to $0.80 as a run rate, with $1.1 expected for 2024, implying a 7%yield.

Perhaps that’s part of why investors are willing to give SKT the benefit of the doubt and push it higher.

(F.A.S.T. Graphs SKT Upside – F.A.S.T. Graphs)

Now, Tanger is categorized as a regional mall operator. So it’s tracked with SPG and Macerich (MAC)… where it shows better coverage.

As of Q1-22, Tanger had leverage of 6.2x in debt/earnings before interest, taxes, depreciation, and amortization (EBITDA). That’s below the sector average of 7.7x, and its 5.6x net debt compares to 7.3x.

Tanger’s core FFO payout ratio is also lower at 40.6% compared to 43%.

In Conclusion…

It seems Tanger’s bears have quieted down for now, with plenty of analysts now labeling it a Buy. But growth beyond 2024 does remain an issue for us.

While we can expect FFO to normalize, we don’t see many catalysts for continued growth above 2%-3% annually. That’s despite how Tanger is expected to open a new 290,000 square foot property in the fall of 2023.

It’s by far the smallest of its peers, with a total market cap of around $3.3 billion – a minnow next to the whale that is SPG’s $75 billion. (Incidentally, SKT is a joint-venture partner with SPG in a few properties.)

Overall, we consider Tanger to be a great REIT that’s worthy of a Buy label. Though if you’re not already invested in quality alternatives, we’d suggest you look to fill that hole first.

Because, if we’re being honest, while this is a great company… there are many great REITs for sale at this time. Some of them have higher yields, cheaper prices, and better valuations.

Some of them even didn’t lower their payouts in the last few years.

That’s why we consider Tanger a Buy with a margin of safety of around 9% at a PT (price target) of $17.5. We do not think it deserves anything higher than that… but we also don’t think it deserves lower.

Open-air shopping isn’t going anywhere, and neither is SKT. The world keeps spinning, and Tanger keeps earning money.

By the way, Brad plans to interview Tanger CEO Yalof for iREIT on Alpha just after the Q2 earnings call. Make sure you’re in on it!

(SKT Investor Presentation)

Be the first to comment