FatCamera/E+ via Getty Images

Business Overview

Talkspace is a company that provides mental health services in a telehealth environment that went public in 2021 through a SPAC with Hudson Executive Investment Corp. that generated approximately $250m of cash for Talkspace. Since going public last year, Talkspace’s shares have declined 90%+, as it became the exact type of company investors didn’t want to invest in, even before the rising rate environment from the Federal Reserve, as growth at Talkspace was slowing going into the SPAC. Is it time to accumulate a position now that shares have sold off more than 90%? After my analysis below, my answer is no, but also to avoid a short given the buyout opportunity of the business.

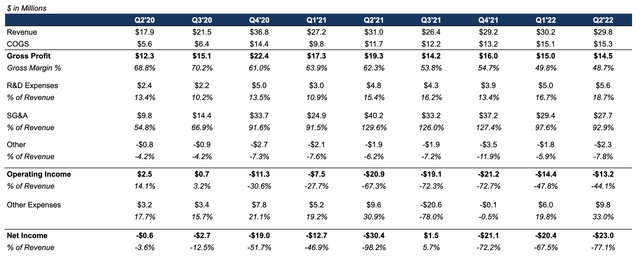

Company Financials

In the company’s earnings report in August, the company reported Q2 results with the below takeaways:

-

QoQ revenue growth for the business declined by 1%

-

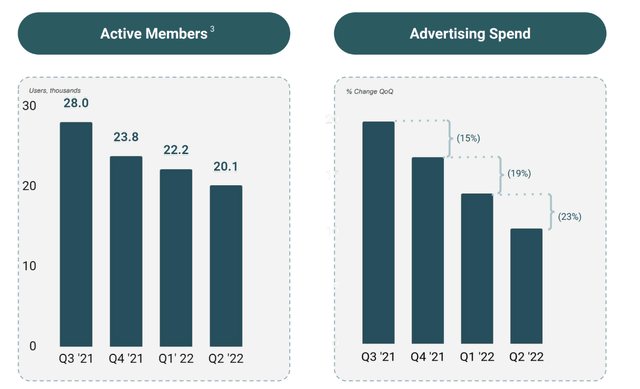

Operating income improved by $1.2m, or by 8.4%, primarily due to a 23% reduction in adverting spend that only resulted in 9% fewer B2C members (chart below)

-

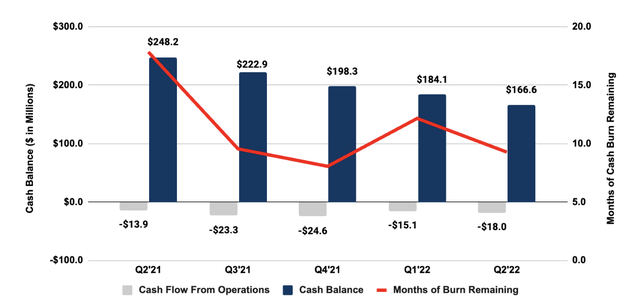

Burned $18m of cash in the quarter for operations, resulting in $167m of cash remaining on Talkspace’s balance sheet

Company Valuation

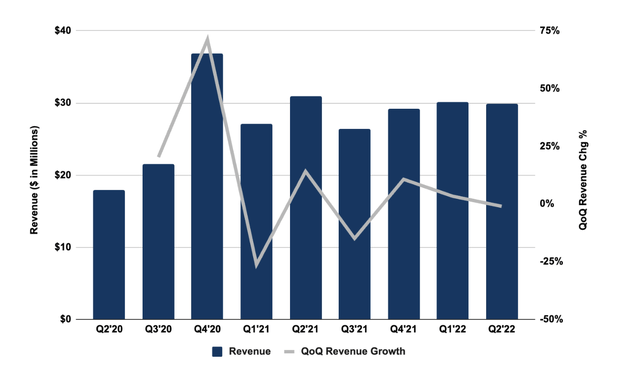

Since Talkspace went public in 2021, revenue growth has been difficult to come by. In the chart below, I analyzed the QoQ revenue growth of the business. Given the subscription nature of a business like Talkspace, analyzing revenue QoQ will show clearer trends for performance rather than analyzing YoY results, as Talkspace usage typically hasn’t been seasonal. In the chart below, absolute revenue numbers are represented as columns and QoQ growth is shown as the line chart.

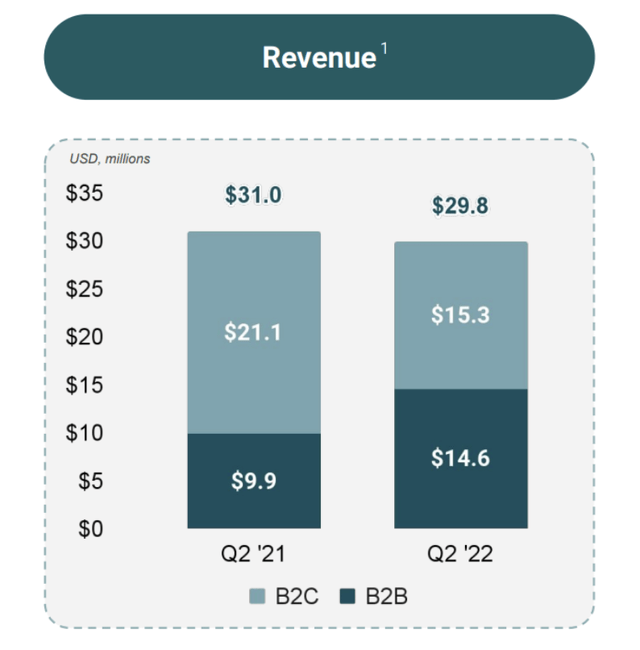

When looking at the business through this lens, revenue growth is uninspiring. However, under the surface, Talkspace is transitioning to be more focused on B2B business instead of B2C.

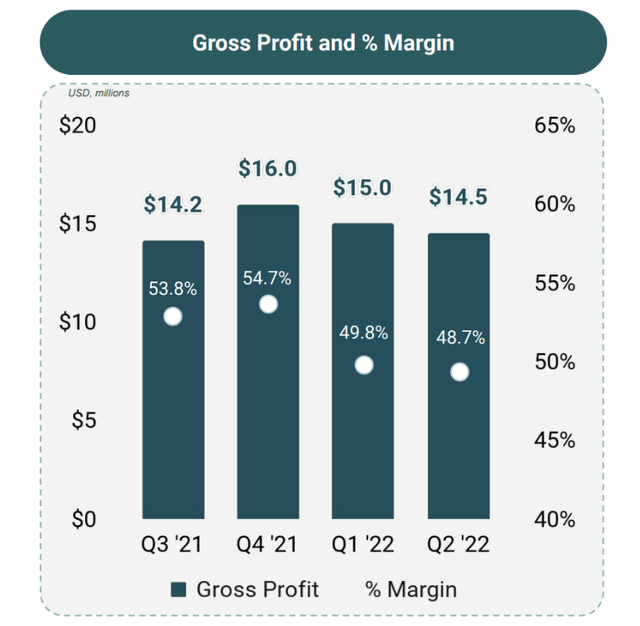

Talkspace doesn’t break out the gross margin from the business, but given that margins have come under pressure YoY, it’s reasonable to assume that the B2B business generates a lower margin but likely unlocks a larger addressable market, although competition is increasing.

Given the slowing revenue, compressing margin profile, and unprofitable nature of Talkspace, the business itself isn’t investable. Management’s highlights from the more recent quarter (below) also offered little hope for any change to the current course in its business.

The last point that stood out to me was where management mentioned that they have a “strong balance sheet enabling investments to accelerate revenue growth & boost cash flow.” When analyzing the business’s runway, Talkspace has roughly eight quarters of cash remaining, assuming run rates from the most recent quarter, which have been fairly consistent over the past five quarters.

Given the recent track record, Talkspace needs to demonstrate that they can materially grow revenue and decrease its burn rate to sustain operations.

Upside & Downside Risks

My rating on Talkspace is a hold due to the business’s extreme upside and downside risks, summarized below.

Upside

-

Management demonstrates an ability to increase revenue and decrease burn materially. However, given that Talkspace has yet to execute this since becoming public, the market would likely reward the results as a sign of future improved performance.

-

Due to being one of the first movers in the online therapy space, Talkspace has been able to design a recognizable brand name. Therefore, a buyout opportunity is a consistent possibility, especially given the current market cap of ~$150m.

Downside

-

The usual course of business continues, and the business either goes bankrupt or issues more equity to further extend its runway, diluting current shareholders

So while my rating is a hold, it’d be better defined as an avoid due to the extreme outcomes of the business.

Be the first to comment