Ivan Bajic/E+ via Getty Images

We’re coming on the four-year anniversary of my bullish call on United-Guardian Inc (NASDAQ:UG), and in that time, the shares have returned about 65% against a gain of about 61% for the S&P 500. A cynical person might suggest that I’m deciding to brag about this pick today because it’s finally profitable after spending several years in the dog house. Such cynicism is unwelcome and totally correct. Anyway, as a result of the recent spike in price, the company returned to my radar. I must now try to determine whether or not to add to my very small position here. I’ll make that determination by looking at the financial history here and by looking at the stock as a thing distinct from the underlying business.

It’s “thesis statement” time again, dear reader. This is the paragraph where I offer unto you the “gist” of my thinking, so you will be able to save yourself however much time it would take you to read 1,500 of my words. You’re welcome. I’m of the view that the dividend is reasonably well covered here, as evidenced by the very strong capital structure and the fact that the company consistently generates much more cash from operations than it invests in itself. The problem is that the shares are quite richly priced at the moment, and for that reason, I’m taking my small number of chips here off the table. I note that the company had a relatively good 2021, and that’s obviously impressed the market. It might also be worth noting, though, that 2021’s performance was materially worse than it was in 2013. Thus, if you’re an investor who needs to see any sort of growth from your investments, I think you’d be wise to avoid the name.

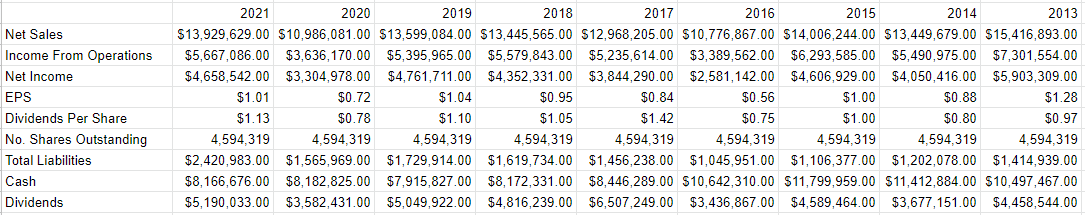

Financial Snapshot

The past year has been quite good for the company in my estimation. Relative to 2020, the top line is up by just under 27%, and net income is up a whopping 41%. When we compare the past year to 2019, a slightly less rosy picture appears. Revenue was barely higher in 2021 than it was in 2019 (up by 2.4%), and net income was slightly lower (down by 2.2%). In spite of that, the company has raised the dividend, and that dividend is now only 2.8% lower than it was in 2019.

Here’s a fun fact about this business, though. It’s one of the few that I’ve looked at that was actually less profitable in 2021 than it was in 2013. For instance, the top line in 2021 was about 9.65% lower than it was in 2013, and net income was about $1.244 million, or 21% lower. So, my advice is that if you’re a growth investor, this may not be the company for you.

Finally, I would normally spend some time addressing the sustainability of the dividend at this point, but I don’t think it is necessary in this case. The company has about 3.37 times more cash and marketable securities than it has total liabilities, so the capital structure here is rock solid. Additionally, the current cash hoard of ~$8.2 million swamps the latest dividend payment of ~$5.2 million. Also, the company has generated a $4.45 million in cash from operations and spent about $326,000 in cash from investing on average over the past two years. Given all of this, I think the dividend is secure, and thus I’d be willing to add to my small position if the price is right.

United-Guardian Financial History (United-Guardian investor relations)

The Stock

Some of you who follow me regularly know what time it is. It’s the point in the article where I start writing about risk-adjusted returns, and how a stock with a well-covered dividend like this can be a terrible investment at the wrong price. For proof of this, see the price performance of my bullish call on this name for the better part of the past four years. The company can make a great deal of money, but the investment can still be a terrible one if the shares are too richly priced. This is because this business, like all businesses, is an organisation that takes a bunch of inputs, adds value to them, and then sells them for a profit. That’s all a business is in the final analysis. The stock, on the other hand, is a proxy whose changing prices reflect more about the mood of the crowd than anything to do with the business. In my view, stock price changes are much more about the expectations about a company’s future, and the whims of the crowd than anything to do with the business. This is why I look at stocks as things apart from the underlying business.

If you thought I was going to simply make this point in the abstract and move on, you’d be wrong, dear reader. I’ll demonstrate the importance of looking at the stock as a thing distinct from the business by using United-Guardian itself as an example. The company released annual results on March 23rd. If you bought this stock that day, you’re up about 26.4% since then. If you waited until April 12th to pick a date totally at random, you’re down about 1.4% since. Obviously, not much changed at the firm over this short span of time to warrant a near 28% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did less badly than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks. I also think this episode is interesting because most of the return that drove this from “loss” to “gain” for me came over the past month, indicating how quickly fortunes can change in this game.

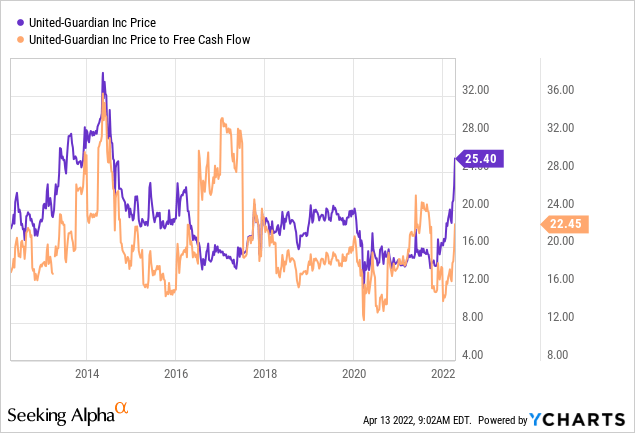

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, I wasn’t too excited by the price to free cash flow of 20.4 times. Things look even more expensive now, per the following:

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to United-Guardian at the moment suggests the market is assuming that this company will grow at a rate of about 6.5% over the long term. This is quite optimistic in my view, especially in light of the fact that net income is lower now than it was 9 years ago. Given all of this, I’m taking my chips off the table here.

Conclusion

This is an interesting business in many ways, and I think the dividend is reasonably well covered. Relatedly, this is one of the strongest capital structures I’ve seen in some time. The problem is that the shares have gotten ahead of themselves. I am of the view that a company that “grows” at this rate doesn’t deserve to trade at these levels. While I don’t think history repeats, the last time the shares traded at current levels, they went on to perform badly. While nothing’s inevitable, obviously, I’d rather disembark before that happens again.

Be the first to comment