Nina Shatirishvili/iStock via Getty Images

It’s been about a month and a half since I finally “pulled the trigger” and bought Boyd Gaming Corporation (NYSE:BYD), and in that time the shares are up just under 14% against a gain of about 4.2% for the S&P 500. If you guessed that I was going to use this return as an excuse to brag, well done. As the song says “I gotta be me”, so please strap in and get ready for some industrial grade bragging as I try to banish that pesky voice in my head that’s droning something about “pride goeth before destruction” or whatever. In seriousness, a stock trading at $60 is, by definition, a riskier investment than one trading at $52, so I thought I’d check back on the investment to see if it’s worth holding, buying more, or selling. I’ll make this determination by looking at the updated financial results, and by looking at the valuation. Finally, I wrote put options that did really well previously. I want to write about them because the performance here is yet another example of how these can help you generate great risk adjusted returns.

I imagine that you’re a very busy group of people, and so for that reason, I want to save as much of your time as possible, by providing you with a “thesis statement” paragraph at the beginning of each of my articles. In this paragraph, I’m going to give you the highlights of my thinking, so you can avoid the tedium of wading through the whole article. I’m all about trying to make your lives more pleasant, and it obviously shows in this summary paragraph. I’m of the view that Boyd Gaming has had an excellent financial showing over the past three quarters. Revenue is up nicely, and net income is up very nicely. Additionally, food and room expenses are actually far lower now than they were in 2019, which is surprisingly good in my view. That written, the good news is now “priced in”, and the shares are no longer screaming buys, so I’ll be taking my chips off the table. I may miss out on future upside, but I’d rather miss that party than run the risk of capital loss. Finally, I did very well by selling put options. If you’re unfamiliar with these powerful tools that help investors achieve excellent risk adjusted returns, I would recommend learning about them. Although I can’t recommend a similar trade today, I think having knowledge of these would be beneficial, as they’re tools that you can inevitably employ in the future.

Financial Snapshot

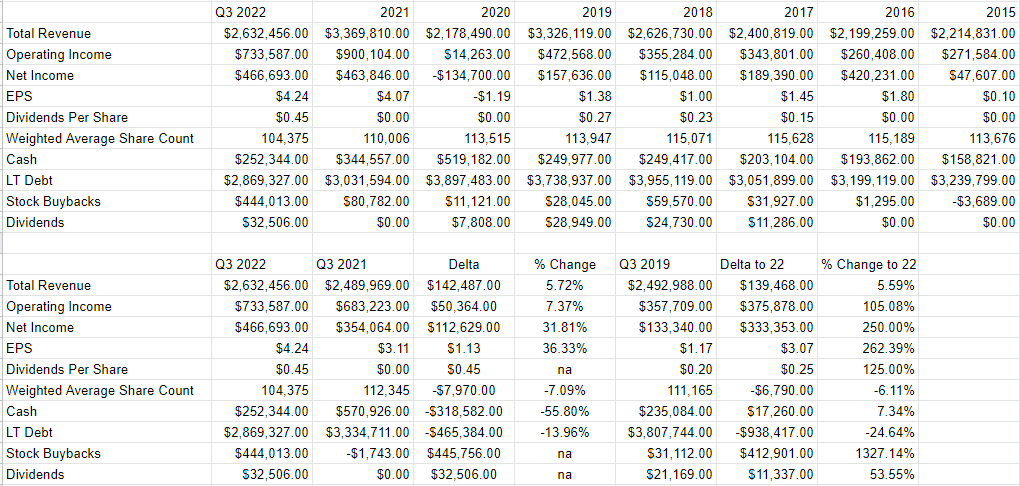

The financial results over the past three quarters have been excellent in my view. While the company managed to grow revenue by $142 million, or 5.7% relative to the same time last year, net income has exploded higher by 31.8%. This improvement was driven entirely by revenue gains. Food and beverage expenses were higher by 24%, and room expenses climbed 23% from the year ago periods, but prices charged swamp the uptick in expenses. Most interestingly, “food” and “room” expenses for the first three quarters of 2022 were down by 45% and 39% respectively. The company rewarded shareholders with this great performance by driving the dividend higher, which is now 125% greater than it was in 2019.

While the company grew sales and net income, the capital structure improved fairly massively. Specifically, long term debt today is about 14% lower than it was this time last year, and about 25% lower than it was in 2019. Cash on hand is down from last year, but is currently 7.3% higher than it was in 2019. Thus, there’s little to complain about in my view. I’d be very happy to buy more of this stock at the right price.

Boyd Gaming Financials (Boyd Gaming investor relations)

The Stock

My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price.” So, if you’re heading to the comments section to write about how my fastidiousness in this regard is self-harming, save yourself the effort because I’m well aware of the many times my caution has cost me. At the same time, I think it’s worth pointing out that I’m one of those people who believe that it’s better to miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for gaming services etc. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. I could drone on about “stocks versus companies” at length, but suffice to say that the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

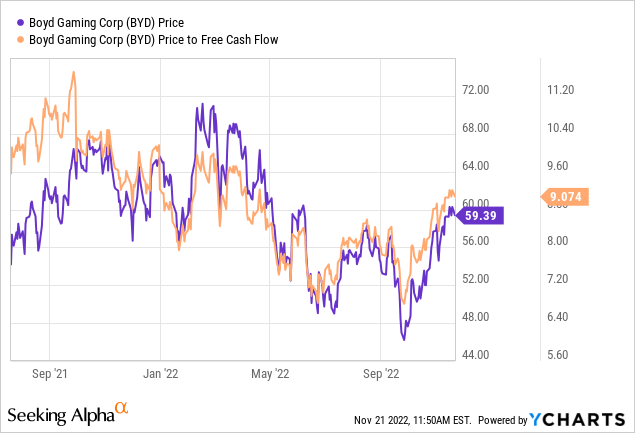

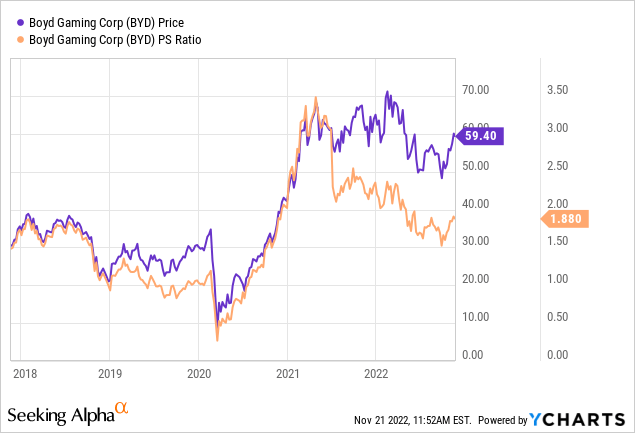

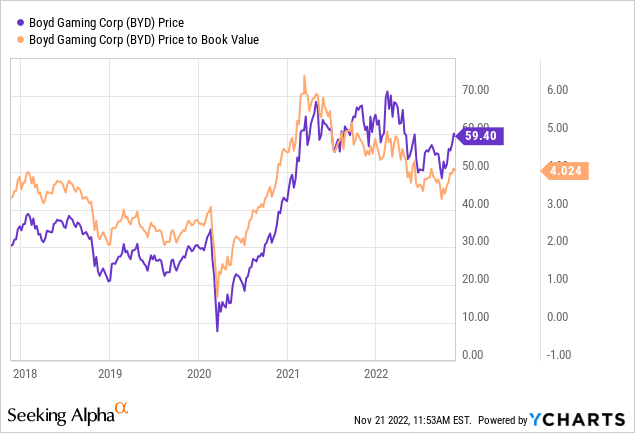

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you need to be reminded, I finally bought Boyd Gaming when shares were trading at a price to free cash flow ratio of 7.7, the price to sales was 1.7, and the price to book ratio was 3.66. Fast forward to the present, and the shares are now 17% more expensive on a price to free cash basis, 10.6% more expensive on a price to sales basis, and about 9.3% more expensive on a price to book basis, per the following:

Source: YCharts

Source: YCharts

Source: YCharts

So, the company has done very well, but the market recognises that fact. I’ll say that the shares aren’t the most expensive they’ve ever been, but they’re hardly “cheap” in any meaningful sense of the word.

Ratios of this sort are relatively unsophisticated, though, and for that reason, I like trying to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Applying this approach to Boyd Gaming at the moment suggests the market is assuming that this company will grow earnings at a rate of ~1.35% in perpetuity. While this isn’t an excessively optimistic forecast, it’s about 35% richer than it was when I last reviewed the stock.

Given the above, I’m of the view that the shares are neither cheap nor are they expensive. So, they are no longer a compelling buy in my view. As the stock price rises, the chance of capital loss increases, and so this is a far less compelling investment now than when I last reviewed the name. For that reason, and I’m not going to ask forgiveness for this pun, I’m going to be “taking my chips off the table.”

Options Update

I think my experience with Boyd Gaming offers yet another example of how deep out of the money put options can enhance returns while reducing risk. In terms of specifics, I sold 10 January 2023 puts with a strike of $42 for $1. In the missive before last, the premia had jumped to $2.60, and I would have been comfortable selling at that price also, obviously. I’m happy to report that these are currently bid at $0, so I think the trade’s worked out well enough. To remind readers of the dynamics of this trade, when I wrote the January 2023 puts, I was taking on the obligation to buy Boyd Gaming at a net price of $41 ($42-$1 received for selling the puts) between the time that I wrote the puts to the third Friday of January 2023. I considered this trade to be a “win-win” because the outcome was going to be positive no matter what happened. If the shares fall below $42 in price, I’ll be obliged to buy at a price of $41, which would be an excellent outcome in my view. If the shares remain above $42 over the next few months, I’ll simply pocket the premium, which is also a great outcome. This is why I’ve dubbed this type of trade with the very unoriginal title “win-win.”

While I normally like to repeat success, I can’t in this case because the premia are a bit too thin for reasonable strike prices in my view. For that reason, I’m going to sit and wait for the price to drop before I write more puts. This is the one challenge with this type of instrument. The shares can’t be so egregiously overpriced that you receive very little premia for reasonable strike prices. My final word of caution about these instruments is that you would be wise to avoid selling puts for the premia alone. If you sell higher strike prices, you may end up owning an overpriced stock, and that’s not a great outcome. Trust me on this, as it’s wisdom earned by painful experience.

Be the first to comment