DNY59/E+ via Getty Images

Hi Everyone,

Last August, I wrote an article about the Canadian preferred share market (which can be found here). I explained that while rate reset preferred shares benefit from rising interest rates and have the potential to generate substantial alpha (due to the retail-driven market), I also cautioned readers to be careful because the market was expensive and overvalued (at the time).

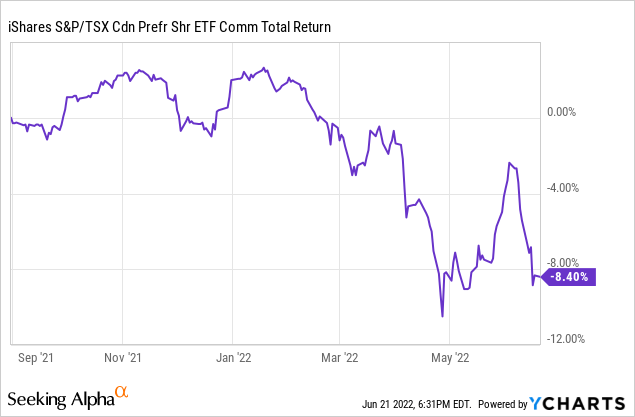

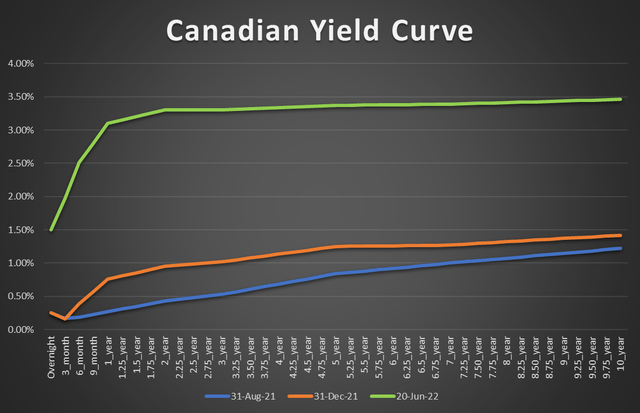

Since then, interest rates have risen far higher and faster than I or anyone else could have reasonably forecasted. Here is the Canadian yield curve as of when I published last August (blue line), at the end of the year (orange line), and now (green line):

The Canadian 5-year, which is the most important for rate-reset prefs, rose from 84bps in August to 125bps at the end of December and now is now at 337bps today. And yet the overall rate reset preferred share market has generated very poor returns:

There are two reasons for this. First, as I’ve already mentioned, the preferred share market was overvalued, with the closest thing I could find as “undervalued” being Enbridge preferred shares which were trading close to what I estimated to be fair value.

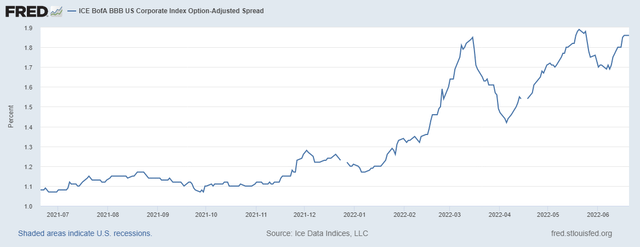

The second issue is that preferred shares are a hybrid security in the company’s capital structure. They sit above the equity holders but below all of the bond investors. This means that preferred shares are very sensitive to changes in credit spreads. And boy have credit spreads moved a lot since then. While I can’t get data on Canadian spreads, here is the US BBB OAS credit spread which is a good proxy for Canadian spreads:

Why Now?

The last year or so has been a tough time for Canadian preferred share investors, so why am I revisiting them now? Because there’s starting to be some very interesting opportunities in the sector.

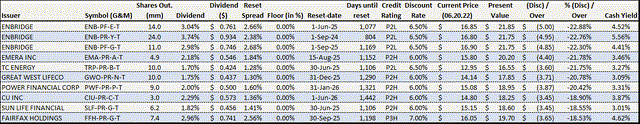

With the rise in yields and the absolute decline in share prices, there are now quite a few rate reset preferred shares that are undervalued. Here is a diversified basket of preferred shares that my model thinks are ~20% undervalued.

Enbridge preferred shares continue to remain undervalued. But there are also many new entrants such as TC Energy (formerly TransCanada Pipelines), Great-West Lifeco (a life insurance company), Power Corp (a life insurance/conglomerate), CU Inc (a utility), Sun Life (life insurance) and Fairfax Holdings (life insurance).

A diversified portfolio of these names would give you a ~4% cash yield (eligible dividends for Canadian investors) with the potential upside of ~$4/share in capital appreciation.

What Are The Risks

While there are opportunities to be had now, it’s always good to try and understand the risks which could make these rate reset preferred shares (and the broader market) even cheaper.

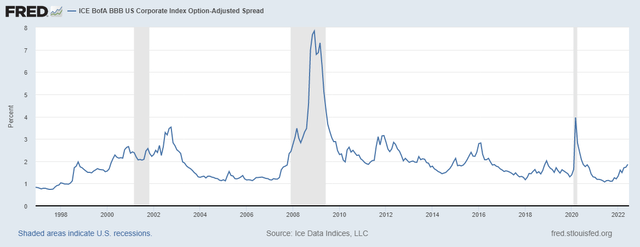

From where I’m sitting, I think there are two distinct risks that need to be considered. First, while credit spreads have widened from ~110bps to 185bps, they could expand much further. Here is the same credit spread chart, but going back ~25 years:

Leaving aside 2008 which is an anomaly (I hope), there have been 4 times now – dot-com bust, Euro debt crisis, 2016 near-recession, and the Covid crash – where credit spreads reached 300bps. With a (likely) recession on everyone’s mind, I think it’s prudent to assume that credit spreads will continue to widen.

The degree to how much they widen will completely depend on how severe the recession ends up being. I’m in the more dovish camp and think that the recession will be relatively mild and short-lived given the strength of the consumer balance sheet.

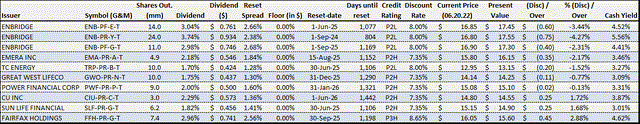

If I were to adjust my model by increasing the discount rate by 125bps (to mimic credit spreads reaching 300bps), we can see that the preferred shares that I highlighted above are now approximately fairly valued:

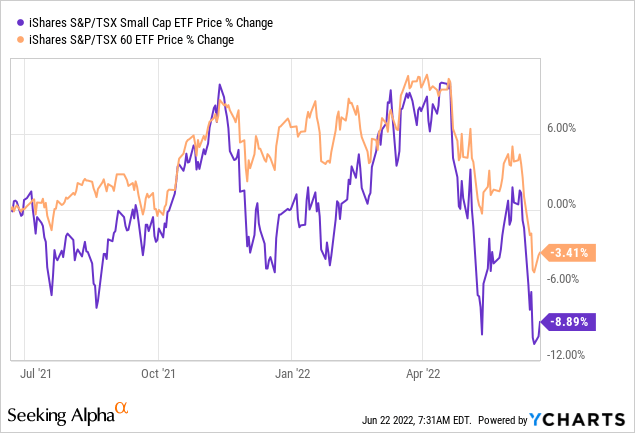

The second headwind is that central banks around the world are now withdrawing liquidity while raising interest rates. This has had a profound impact on less liquid markets. While it’s impossible for me to precisely say how much of an impact it’s had, there are some telling charts.

For instance, here’s the performance of the Canadian small-cap index versus the TSX 60 (the largest 60 companies in Canada):

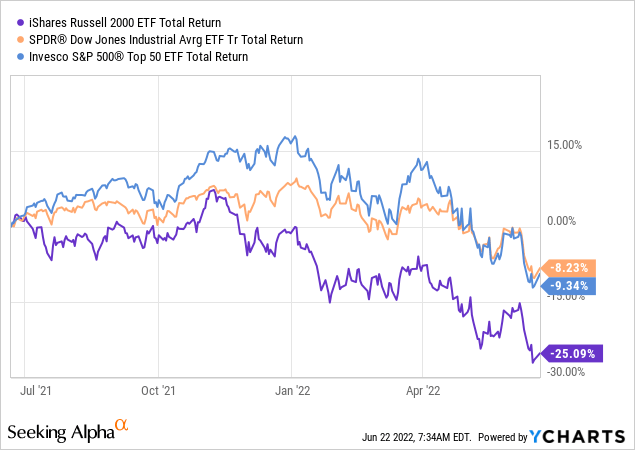

Canadian small caps have underperformed by close to 550bps, largely I believe due to liquidity and recession fears. And it’s not just a Canadian phenomenon either. In the US, it’s much the same story when you look at the Russell 2000 (IWM) versus the DJIA (DIA) and the S&P 50 (XLG) which are the largest 50 stocks in the S&P 500:

Wrapping it Up

So in summary, there’s real value to be had now in the preferred share market and the pref lines that I highlighted. But there are also headwinds that could in the short to medium term push preferred share prices down further (assuming they haven’t already been priced in).

With all that in mind, I would recommend taking a cautious approach and starting with 1/4 or 1/2 of your normal position size while keeping some cash on the sidelines to add to your positions later this year should the opportunity arise.

Be the first to comment