DNY59

Takeda (NYSE:NYSE:TAK) has all of the momentum going in the right direction for them right now. Free cash flows have finally broken out of the range they’ve been stuck in since 2000, the core business is holding steady, new approvals have the potential to be massive disruptors, and the pipeline is producing a lot of promising therapeutics. It’s not all sunshine, though, as much of the growth is fueled by acquisitions, and operating margins have been weighed on by restructuring costs, resulting in below-average ROE. On balance, though, the new opportunities in front of them are exciting enough that we believe they’re undervalued for what they offer.

Drug Developments

Vaccines

The Indonesian approval of Takeda’s Qdenga vaccine for the dengue virus is a critical opportunity for the company’s vaccine business.

Derek’s graduate school work involved developing biosensors to detect the different variants of dengue virus, so he understands the importance of this vaccine development. The disease is endemic in more than 100 countries in the tropics and sub-tropics, with cases spreading as far north as Europe, Afghanistan and southern Florida. There is no cure, and secondary infections often produce much more severe symptoms due to the virus’ serotype variants. The WHO estimates that half of the global population is at risk of infection, making a vaccine potentially game-changing for these parts of the world.

The only competing vaccine in this space is Sanofi’s (SNY) Dengvaxia, launched in 2015, which has some controversy surrounding its development and rollout. The vaccine ended up increasing the risk of severe complications in individuals who had never been infected with dengue, leading to the Philippines banning the vaccine and Sanofi changing the label recommending Dengvaxia only to those previously infected. Qdenga, according to Takeda, can be administered “regardless of previous dengue exposure and without the need for pre-vaccination testing,” providing prophylaxis to a much broader audience, including individuals from non-endemic parts of the world traveling to high risk areas.

The immediate revenue effects of Qdenga may be muted, but for the medium term it can really shine. Sanofi reported €55 million in revenue for Dengvaxia in FY2016, the one full year they had it in production, and most of that revenue is from the Philippine and Brazilian governments. Considering Indonesia’s current population (275 million) is almost on par with the Philippines (103.7 million) and Brazil (206.2 million) 2016 populations combined, similar revenue for Qdenga in 2022 (about ¥7.8 billion at current FX rates) would be a reasonable starting point; Takeda already has several medications that bring in annual numbers around that range.

Approvals in the rest of the world would bring in increased revenue for travel-based prophylactic vaccinations, along with expansion into the rest of Southeast Asia. In the best case, this revenue stream doubles to ¥15 billion in five years, which makes it a solid contributor to the business; in the worst, it stalls out like Dengvaxia, but given the improved safety profile that would probably take two or three years instead of immediately vanishing.

Qdenga’s other positive contribution is the potential for Takeda’s other vaccines under development, particularly TAK-426 for Zika, another mosquito-borne illness carried by the same mosquitoes as dengue. Epidemiological data for Zika is more limited than for dengue, but the total addressable market is the same due to the same vector for transmission. TAK-426 is in Phase 2 at present; Qdenga started Phase 2 trials in 2014, so we can project a similar timeline for TAK-426 to reach approval, maybe even shorter since Zika doesn’t have dengue’s repeated infection concerns. There is competition, however, including Moderna and the US NIAID, so the revenue gains might not be as strong.

All together, it’ll probably take five years before we see returns, and they’ll likely ramp up similarly but lower in magnitude due to competition, so ¥5 billion in 2027 growing to ¥10 billion by 2032 seems like the best case scenario to pair with Qdenga’s.

Core Portfolio

Takeda has a diverse set of focus areas, each of which is producing respectable revenue and has a steady pipeline maintained by lifecycle management and orphan drug compounds. Gastroenterology headlines the business thanks to flagship drug Entyvio, but all of their product lines have generated at least ¥100 billion in revenue for Q1 of FY2022:

| Total | 853.8 | 100 |

| Product Line | Q1 2022 Revenue (Billions JPY) | % of total |

| Gastroenterology | 270.4 | 31.67 |

| Rare Diseases | 181.6 | 21.27 |

| Neuroscience | 142.4 | 16.68 |

| Plasma-derived Therapies | 141.9 | 16.62 |

| Oncology | 117.5 | 13.76 |

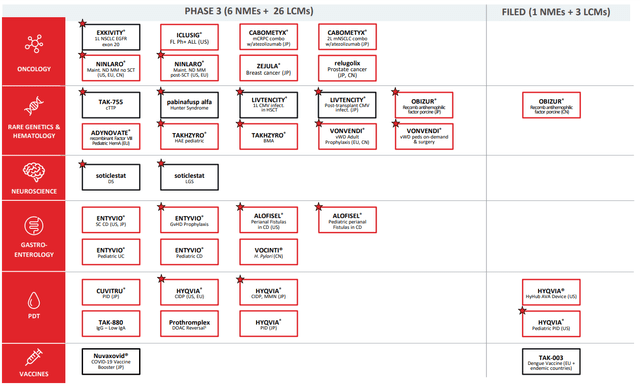

Aside from Qdenga, Takeda has two drugs, Obizur and Hyqvia, filed under new labels as of July 28, 2022. They have 36 Phase 3 clinical trials underway, 29 of which are new labels as part of lifecycle management, and 19 of which are orphan drugs eligible for subsidized clinical trial expenses and a guaranteed exclusivity period upon approval:

Further down the pipeline, most of the NMEs are in oncology and gastroenterology, which makes sense as anchors for the portfolio of the next ten years or so. The Q1 pipeline update also included four discontinuations, which is a sign that they’re not spreading themselves too thin either. The core business is mostly boring, but it’s a money-making, stable kind of boring which provides a solid baseline for the company to look down the line for its next phases.

One point of concern to note is the drop in year-over-year revenue from the oncology portfolio in Q1, which was attributed to competition with the multiple myeloma drug Ninlaro. There are a number of other therapies available, including Kyprolis from an Amgen (AMGN) subsidiary, Empliciti and Abecma from Bristol Myers Squibb (BMY), and Sarclisa from Sanofi, all of which have varying indications for prescription. Hemophilia treatment Feiba is also under pressure from competition, most notably a treatment from Roche (OTCQX:RHHBY) subsidiary Genentech.

The Business Side

A global company, for better or worse

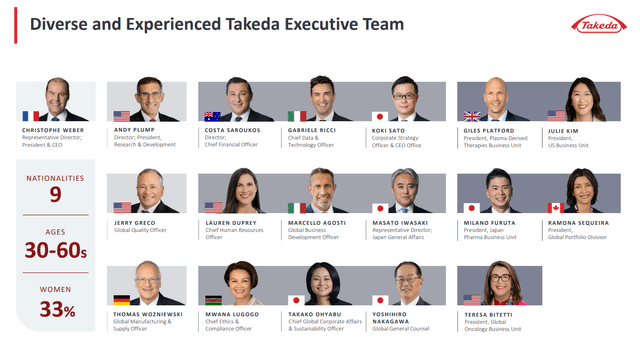

Takeda is not a conventional Japanese pharmaceutical company by any measure, which cuts both ways when it comes to their business performance. Their executive team is quite diverse in terms of gender, age and nationality:

Takeda 2021 Annual Shareholder presentation

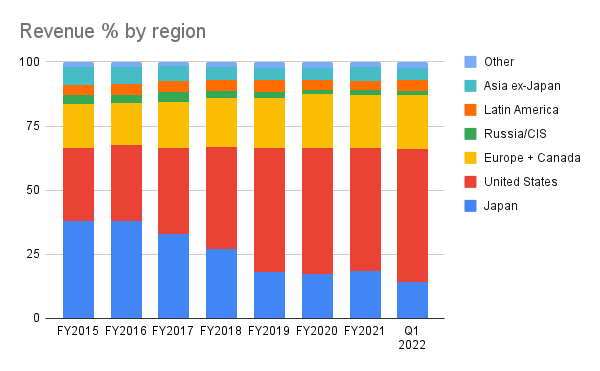

While most Japanese pharmaceutical companies operate outside of Japan as silent partners to better-known Western pharmaceutical companies, Takeda appears to be on equal footing when it comes to global sales and distribution, and the makeup of their executive team reinforces that image. In fact, since the Shire acquisition (more on that later), Japan has dropped to an 18% share of the company’s revenue by region from almost 40% as recently as FY2017:

Takeda Investor Relations page + Author’s own work

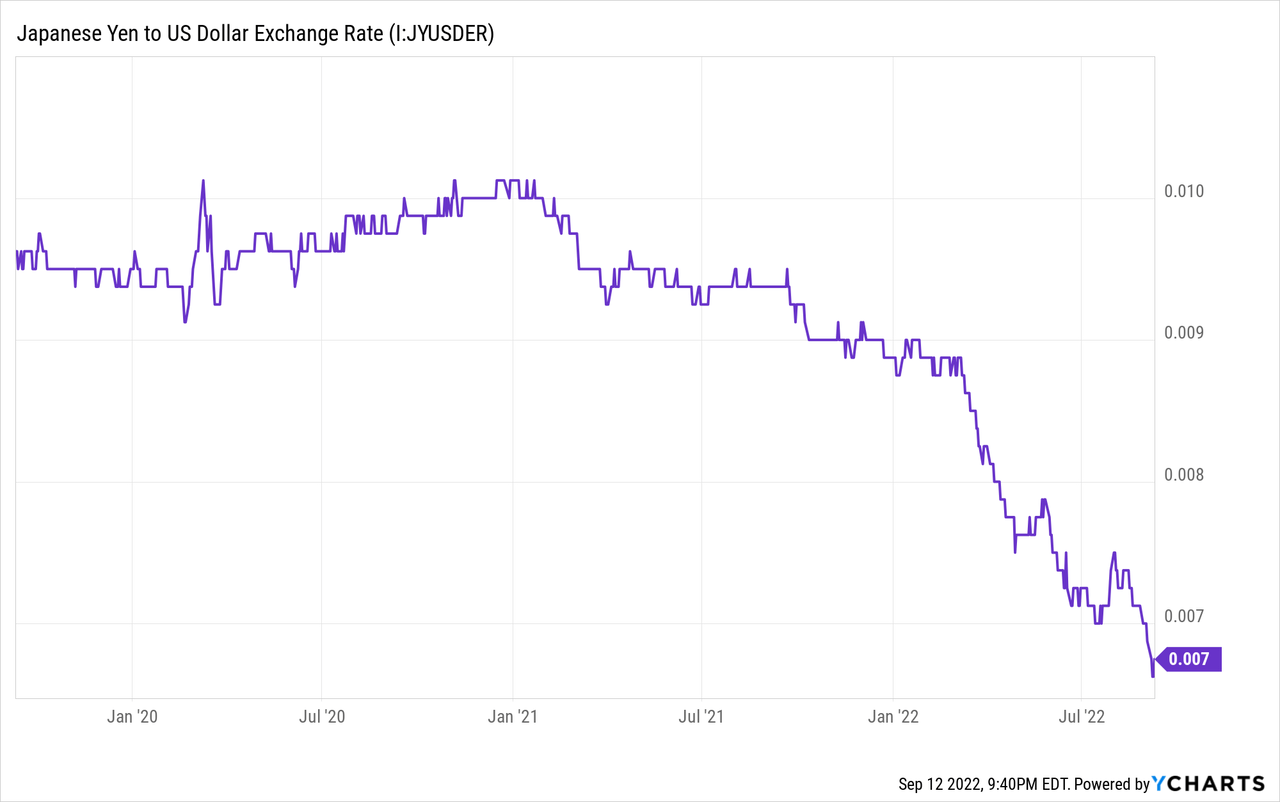

The global reach has taken its toll, however, as they recorded a net loss in Q4 of FY2021, due to increased sales and R&D costs. Meanwhile, the yen has depreciated beyond the expected rate the company used to model their FY2022 estimates (model: 1 USD = 119 JPY; as of Sep. 12, 2022: 1 USD = 142.63 JPY) and many of their weaker year-over-year comparisons in Q1 of FY2022 were attributed to the depreciating yen. The weaker yen does increase the appeal of Japanese products internationally compared to products from other regions, but for US-based investors it weighs on the cash being thrown off by the company.

Future focus for growth

Takeda has made it clear they want to grow their presence in China, and they are taking definitive action to make that happen. They have twenty-one unique medications currently approved for use in China. Two of their medicines, Entyvio and Walker (an acid suppressant), are included in the Catalogue of Drugs for China’s national basic medical insurance since 2020.

Internally, Takeda rearranged their executive org chart to break out China as a dedicated market, with China head Guohong (Sean) Shan reporting directly to the head of their Global Portfolio division. On Global Portfolio lead Ramona Sequeira’s biography, her purview is listed as including “regional business units, including, Europe and Canada, Growth and Emerging Markets, and China.” (emphasis added)

Publicly, Takeda has stated they want China to be their second-largest market by 2030, and they plan to launch “more than 15 innovative medicines” in the next five years. The slate of medicines is part of a larger five-year plan with the goal of benefiting at least 10 million patients in China.

Serial acquirer

There is also a pattern Takeda has demonstrated regarding their organic growth prospects that raises some concerns. Since the mid-2000s, Takeda has gone through cycles of “growth slows down, acquire a company, see increased revenues once the acquisition is fully integrated.” The most significant such acquisitions over that time period were:

-

Syrrx in 2005 – brought the hypoglycemia drug alogliptin and experience in x-ray crystallography

-

Millennium Pharmaceuticals in 2008 – brought Entyvio into the portfolio and formed the nucleus of Takeda Oncology

-

Nycomed in 2011

-

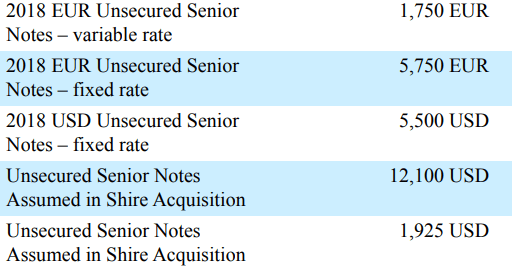

Shire in 2019, which entailed taking on quite a bit of debt

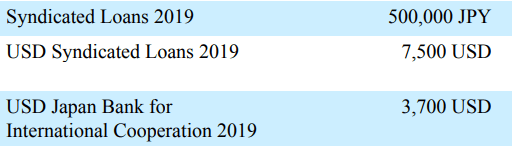

Although most of the debt originally obtained in association with the Shire acquisition appears to be no longer listed in their financial statements, either due to maturity or early redemption, they continue to carry the increased debt load:

Bonds issued for Shire deal. All amounts in millions. (Takeda FY2018 Form 20-F) Loans issued for Shire deal. All amounts in millions (Takeda FY2018 Form 20-F) Bonds outstanding for Takeda as of Q1 2022. Bonds associated with Shire deal highlighted. Carrying values in billions of JPY. (Takeda Q1 2022 Earnings Report)

While the Shire deal has made Takeda a much stronger global presence, whether they can consolidate that position is not a guarantee.

Competition

Takeda appears to enjoy a fair bit of moat for most of their business at present, but that does not mean they are a slam dunk of a pharma pick:

-

Amgen has a lot of immunology experience, and their pipeline includes therapeutics for ulcerative colitis, along with the multiple myeloma treatment Kyprolis from their subsidiary, Onyx Pharmaceuticals.

-

Bristol-Myers Squibb has two multiple myeloma therapies which compete with Ninlaro, two more NMEs for MM at phase 2, and Zeposia and deucravacitinib for colitis and Crohn’s disease in the pipeline.

-

Sanofi’s Sarclisa is deep in lifecycle management territory, putting pressure on Ninlaro, they have fitusiran for hemophilia in phase 3, and although their mosquito-borne illness vaccines didn’t bear out, they are continuing to push other contagious disease vaccines.

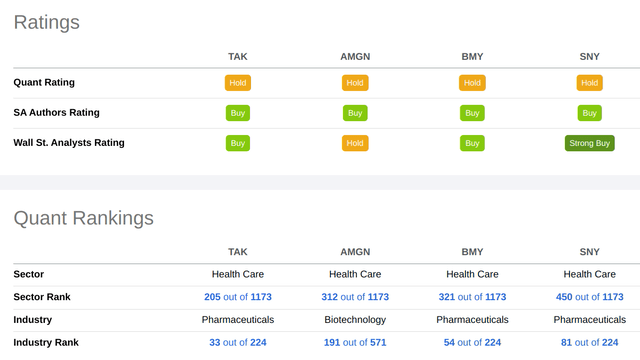

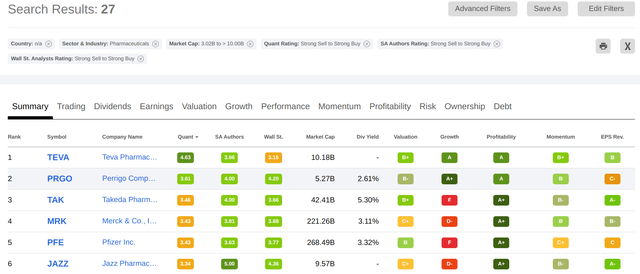

Of these four, Takeda has the highest ranking in the Health Care sector as measured by Seeking Alpha’s quant ratings:

In the Pharmaceuticals industry, for all companies with a market cap of over $3 billion, Takeda ranks third only behind two companies which specialize in generics, Teva (TEVA) and Perrigo (PRGO):

Valuation

Takeda has struggled with low operating margins and free cash flow, but they may finally be breaking out of those trends now. One of the reasons we passed on Takeda is their low ROE, 3.42% for the trailing twelve months. If we perform a DuPont analysis on the ROE, the biggest drag is their operating margin:

-

Tax burden = Net income / Pretax income = ¥197.39 B / ¥235.07 B = 84%

-

Interest burden = Pretax income / EBIT = ¥235.07 B / ¥341.90 B = 68.8%

-

Operating margin = EBIT / Revenue = ¥341.90 B / ¥3,591.87 B = 9.52%

-

Asset turnover = Revenue / Average total assets = ¥3,591.87 B / ¥13,127.81 B = 27.4%

-

Equity multiplier = Average total assets / Average total equity = ¥13,127.81 B / ¥5,664.27 B = 2.32

Takeda’s operating margin and ROE pale in comparison to the rest of the Pharmaceuticals sector, especially for companies of their size, but to their benefit, these numbers are positive, unlike the vast majority of small-to-mid-sized pharma companies.

Discounted cash flow analysis

Applying the Gordon growth model based on historical numbers is a bit tricky because Takeda’s owner’s earnings have been in decline for the last few years, giving us a negative time-weighted CAGR. When a company is in this situation, we usually fall back to their free cash flow numbers (also convenient for companies like Berkshire (BRK.A) (BRK.B), whose net income isn’t reflective of their operations due to large holdings of securities).

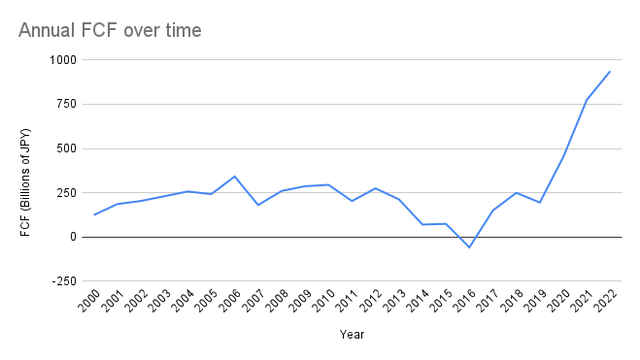

Takeda’s free cash flow has, interestingly, only recently broken out of a tight band in which it was stuck since 2000. The Shire acquisition has had the double-sided effect of increasing the cash flow from operations and dampening net income by adding depreciation and amortization charges. Capital expenditures are also increasing, but the net free cash flow has jumped tremendously in the most recent two years:

Yahoo! Finance + Author’s own work

That said, the time-weighted CAGR for free cash flow is just 2%, even with these positive recent two years. Starting from this most recent year’s free cash flow number of ¥937.07 billion and projecting 2% growth, we see the market currently pricing in a discount rate of 17.9%. Even for such slow growth, this discount rate feels exceedingly pessimistic given the business as a whole feels healthy.

We can spot them an additional point of growth based on the prospects for the vaccine business, and a discount rate of 16% feels more suitable for their current operations. Altogether, that implies a 22% premium to their current price, which comes out to $16.75 a share for TAK on the NYSE.

Dividend stability analysis

Others on Seeking Alpha have pointed out the appeal of Takeda’s dividend, so we would be remiss not to take a look at the prospects before we conclude. When we consider a company as a dividend play, we turn to Jim Sloan’s fragility analysis method to determine if the dividend is being supported by the business itself or if it’s being kept afloat using financial engineering: share buybacks to fluff EPS, taking out debt to finance dividends, etc. Here’s the relevant data for Takeda (all monetary numbers in JPY):

| Year | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Revenue (x1000) | 3,569,006,000 | 3,197,812,000 | 3,291,188,000 | 2,097,224,000 | 1,770,531,000 | 1,732,051,000 | 1,807,378,000 | 1,777,824,000 | 1,691,685,000 | 1,557,267,000 |

| EPS | 147.14 | 240.72 | 28.41 | 113.5 | 239.35 | 147.15 | 102.26 | -185.37 | 135.1 | 166.25 |

| Shares Outstanding (x1000) | 1,563,501 | 1,562,006 | 1,557,204 | 961,477 | 780,806 | 781,108 | 783,943 | 786,400 | 789,474 | 789,438 |

| Dividend per share | 180 | 180 | 180 | 180 | 180 | 180 | 180 | 180 | 180 | 180 |

| Payout Ratio | 122.33% | 74.78% | 633.58% | 158.59% | 75.20% | 122.32% | 176.02% | NM | 133.23% | 108.27% |

| FCF per share | 599.34 | 495.81 | 290.29 | 202.15 | 319.66 | 191.18 | -75.73 | 93.84 | 88.43 | 268.48 |

| Long-term debt (x1000) | 4,141,418,000 | 4,613,218,000 | 4,506,487,000 | 4,766,005,000 | 985,644,000 | 599,862,000 | 539,760,000 | 629,416,000 | 704,580,000 | 540,159,000 |

No major red flags are apparent: dividend has been held the same since 2009, share count and debt increased only due to the Shire deal, and even though the payout ratios exceed 100% on some occasions, the free cash flow for the last few years has been more than sufficient to cover it. The biggest concern with the dividend goes back to the FX rate between USD and JPY: since the payout is fixed in JPY, a weakening yen has the potential to silently erode US-based shareholders’ yield.

Conclusion

Takeda has carved out a space for themselves on the global pharmaceutical stage, and they are rapidly approaching what could be an inflection point for their business. Between the prospects of the vaccine business, the integration of the Shire acquisition, and moatiness for their key product line in gastroenterology, they are producing everything we’d like to see.

Meanwhile, their economies of scale don’t seem to be firing on all cylinders just yet, as evidenced by the net loss at the end of their last FY; the oncology business is under siege from other big pharma players, and their global fortunes do have some connection to the performance of the yen in the FX markets. Even so, the decades of anemic growth may be finally behind them, and if so, there’s easily 20% upside from where they are now.

Personally, we’ll stay on the sidelines. Our portfolio is maxed out for Japan and biotech at the moment. However, if you like the potential they are starting to show, if you think the yen is going to bottom out soon and the > 4% dividend yield looks promising, Takeda is a solid business to consider. They have the capability to keep the dividend steady for the foreseeable future and likely will provide some healthy capital appreciation in the process.

Be the first to comment