Alena Kravchenko/iStock Editorial via Getty Images

Before I start with the article, I want to introduce something new I am experimenting with: introducing a table of contents to provide framework and structure for readers.

Table of Contents:

- Company Background

- Thesis

- Asset Portfolio

- Zynga Merger

- Valuations

- Risks

- Takeaway

Company Background

Take-Two Interactive Software, Inc. (NASDAQ:TTWO) is a video game developer that publishes titles through Rockstar Games, 2K, Private Division, T2 Mobile Games, and now Zynga. The company sells its games through physical retail fronts, e-commerce platforms, digital download, and cloud streaming services. The games are playable on Microsoft, Sony, and Nintendo consoles, PC, and smartphones and tablets.

Thesis

Take-Two is a great business with an absolutely superb class of assets. The stock has fallen around 50% YTD due to uncertainty regarding its recent acquisition of Zynga and net losses posted in the prior and most recent quarter. Specifically, the company lost $1.54 per share and earned $1.4 billion in revenue, which fell short of expectations by $140 million.

At this price level (slightly north of $90), the stock is worth keeping an eye on as it could offer solid long-term returns when profitability normalizes, but is likely to be stagnant in the short-term. To be clear, I think Take-Two is an exceptional business. However, as investors, we have to be disciplined and only pay good or better prices, even for the best companies. I believe a stock price of around $70 represents a good price to reevaluate the stock as most of the negative effects from Zynga will be fully priced in at that level, barring any unforeseen circumstances.

Note: $70 is not an arbitrary number, it is based on one of my valuation scenarios down below.

Asset Class

I like to analyze a company’s book of assets to determine the quality of the products it is selling and the likelihood the business will achieve its sales goals. For those new to gaming, Take-Two is simply put, the cream of the crop. The company owns rights to AAA mega titles such as Grand Theft Auto, Red Dead Redemption, NBA 2K, WWE, Borderlands, Mafia, and many others.

Rockstar Games

Rockstar Games primarily creates action/adventure games and is the publisher of Grand Theft Auto, Red Dead Redemption, Max Payne, Midnight Club, and other popular franchises.

Grand Theft Auto V

GTA V has sold more than 165 million units since its 2013 launch and has generated over $6 billion dollars in sales. To put this in perspective, Avatar, the highest grossing movie has not even earned half of this amount at $2.8 billion.

GTA V accounted for 31% for FY 2022 revenue. The company’s five biggest titles (GTA, Red Dead Redemption, NBA 2K, WWE, Borderlands) account for over 83% of total revenue.

2K

2K creates a wide assortment of games and is the next biggest asset in the portfolio. The publisher’s flagship franchise is NBA 2K, followed by WWE 2K and PGA Tour 2K.

Private Division and T2 Mobile Games

Rounding out the asset portfolio are Private Division and T2 Mobile Games. The former creates additional console and PC games and the latter creates free to play mobile games, which generate in game sales.

Zynga Merger

Take-Two acquired Zynga in May 2022 for $12.7 billion financed by issuing $2.7 billion of debt with various maturities. The interest rates range from about 3.5% – 4.0%. The primary reason of acquiring Zynga was to expand Take-Two’s footprint in the mobile gaming sector, which is growing more rapidly than console gaming. Management’s vision for the company has changed and they want to redefine Take-Two as an interactive entertainment company rather than a console game company.

To provide some perspective on the mobile gaming sector:

The IDC reports that mobile gaming revenue will surpass $136 billion in 2022 versus $86 billion for both console and PC gaming combined. The mobile gaming sector is expected to grow at nearly twice the speed of console gaming. For comparison, global film revenue for 2019 (pre-pandemic) was about $43 billion. Clearly, there is an untapped market for Take-Two which they felt could be captured better by buying Zynga rather than creating an in-house publisher to develop mobile games.

Here are Take-Two’s expectations for the Zynga merger, per management:

- Establish Take-Two as one of the largest publishers of mobile games, the fastest-growing segment of the interactive entertainment industry.

- Unify highly complementary businesses, including Take-Two’s best-in-class portfolio of console and PC games and Zynga’s industry-leading mobile franchises.

- Create one of the largest publicly traded interactive entertainment companies in the world, with $6.1 billion in trailing twelve-month pro-forma Net Bookings for the period ended September 30, 2021.

- Transaction expected to deliver approximately $100 million of annual cost synergies within the first two years after closing, and more than $500 million of annual Net Bookings opportunities over time.

The reality is that mergers are difficult to assess and take time to see the results, whether they be good or bad. As it stands now, it is too early to see long-term benefits from the merger or if the current headwinds are short-term.

That being said, Zynga has a great portfolio of assets. Some of their popular games/franchises are, but not limited to: FarmVille, Words With Friends, 1010, Draw Something, and many others. Zynga has connected nearly a billion users worldwide, which shows the scale and penetration of their assets.

Valuations

I am going to provide valuations for five scenarios based on quarterly company guidance (including management’s forecasts about the merger), historical track record, and my own predictions. I emphasize that valuation is an art not a science, and no two investors will get the same result. My goal by providing five valuations is to give readers a model which best fits their own forecasts.

Q2 2023 Results

Take-Two missed expectations in its most recent quarter as the company posted a loss of $1.54 per share. Furthermore, the company lowered its FY 2023 revenue guidance down from $5.8 billion to $5.4 billion. The net cash position remain unchanged from the prior quarter. These facts are factored into the following valuations.

Scenario 1: Take-Two Without Zynga

First, I want to offer a baseline valuation of Take-Two if Zynga was not in the picture (aside from part of 2022). This gives us a “floor” price on the stock if Zynga neither adds nor subtracts any value to or from the business. I reiterate, this valuation is simply for frame of reference.

Stock Price Calculation (DocShah Capital)

Assumptions:

- Revenue growth is set to 8%.

- NOPAT is based off of an operating margin of 12% and tax rate of 13%. Capital Expenditures is set to $150MM and increase by $10MM a year.

- The terminal value is set to 2%.

Under these assumptions, Take-Two’s fair value about $59 per share.

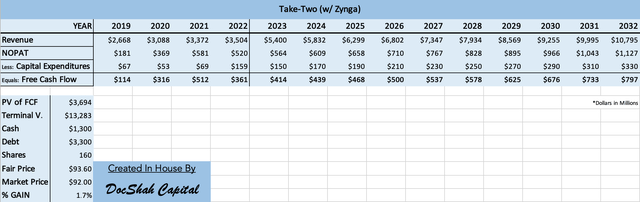

Scenario 2: Take-Two with Zynga

Stock Price Calculation (DocShah Capital)

Assumptions:

- Revenue growth is still 8%, but 2023 revenue starts at $5.4B based on company guidance.

- All other assumptions are the same as above.

In this scenario, if Zynga maintains Take-Two’s expected operating margins of 12%, but adds free cash flow, then the stock’s fair price is about $93 per share. In other words, the stock has already priced in the merger if margins do not change and FCF increases as the stock is already trading at $92 per share.

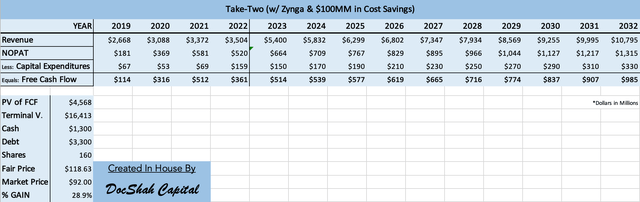

Scenario 3: Take-Two with Zynga and $100MM in Annual Cost Savings

Stock Price Calculation (DocShah Capital)

Assumptions:

- Revenue growth is set to 8% and 2023 revenue starts at $5.4B.

- NOPAT in years 2023 and 2024 have been increased by $100MM based on management’s comments that investors can expect $100MM in cost synergies within the first two years. $100MM in cost savings represents a 16.5% benefit to operating margins, which would make the new operating margin improve from 12% to 14%. As a result, a 14% operating margin has been applied along with the same 13% tax rate to calculate NOPAT.

- CapEx and the terminal value remain unchanged.

In this scenario, the stock has some upside as its fair value would be about $118 per share, representing a 29% potential return.

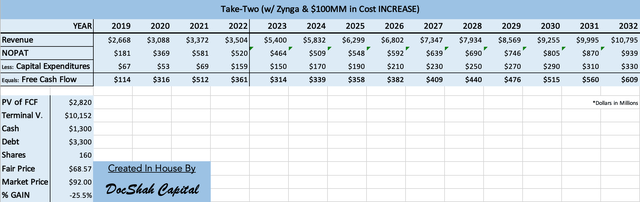

Scenario 4: Take-Two with Zynga and $100MM in Annual Cost Increases

Stock Price Calculation (DocShah Capital)

Assumptions:

- Revenue growth is set to 8% and 2023 revenue starts at $5.4B.

- NOPAT in years 2023 and 2024 have been decreased by $100MM based on synergy issues and higher related costs. $100MM in additional costs would make the new operating margin worsen from 12% to 10%. As a result, a 10% operating margin has been applied along with the same 13% tax rate to calculate NOPAT.

- CapEx and the terminal value remain unchanged.

In this scenario, the stock has downside as its fair value would be about $68 per share, representing a decline of 25% from its current level.

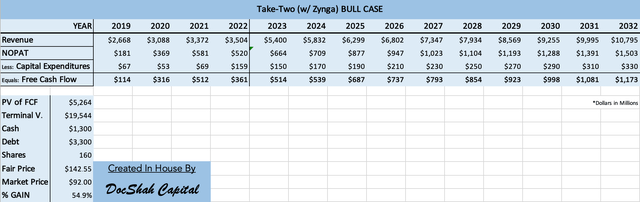

Scenario 5: Bull Case

Stock Price Calculation (DocShah Capital)

Assumptions:

- Revenue growth is set to 8% and 2023 revenue starts at $5.4B.

- NOPAT is based off the pre-merger historical operating margin of 16% and tax rate of 13%.

- CapEx and the terminal value remain unchanged.

In this scenario, the stock has solid upside as its fair value would be about $142 per share, representing a 55% return.

Note: The historical operating margin varies depending on your time frame. I took the conservative side of the last half of the decade.

Will Profitability Recover?

I have zero doubts Take-Two will return to profitability. Even though the current valuation is under stress, the underlying business is exceptional. Take-Two’s entire gaming catalog is essentially all AAA titles with massive sales and popularity. Grand Theft Auto is widely acclaimed as the single greatest franchise and piece of entertainment in history.

Personal side note: I am a video game player and I can confirm that Take-Two is in a league of its own. In my opinion, Take-Two is the ‘Apple’ of the gaming world. It would take a massive shift in consumer demand in order for profitability to not recover.

Interesting side note: Peter Lynch once talked about hidden assets on a balance sheet. The example he used was Disney and its plethora of iconic characters which become monetized by feature films, theme parks, merchandise, etc. At the time, most investors did not calculate the true value of Disney’s assets since the characters were hiding (in plain sight) on the balance sheet waiting to be brought to life. Take-Two has an outstanding cast of characters that might transition over to mainstream entertainment in a similar fashion one day. Considering Mickey Mouse alone is worth more than some companies entire market cap, Take-Two might have a similar avenue to generate additional profit.

Risks

There are a few important risks investors should consider if considering buying shares of Take-Two.

Zynga Merger Does Not Synergize

The most obvious risk is the possibility that Take-Two does not realize any synergies from its merger with Zynga; or worse yet, if the merger is a detriment to future earnings.

Five Games Make up 83% of Revenue

As stated earlier in the article: GTA, Red Dead Redemption, NBA 2K, WWE, and Borderlands account for 83% of Take-Two’s pre-merger revenue. If the sequels are not as well received as the prior editions, profitability would suffer. Realistically, I would not worry about this risk as these game titles are massively popular (and the bar to which other game developers aspire to emulate).

Mobile Game Competition

Mobile games are less sticky and more prone to fads. There are so many examples of extremely popular mobile games of the past which are no longer mainstream: Super Monkey Ball, Crash Bandicoot, Doodle Jump, Fruit Ninja, etc. There are few barriers to entry in this industry and as a result, there is an oversupply of games. Times change and the risk is that even though Zynga’s current library of games are quite popular, that may not always be the case.

Video Game Sales Remain Low

Video Game sales have slowed down in the last couple years after experiencing a one-time demand shock during Covid. If consumers, who have less disposable income due to the recession decide to spend their money on other forms of entertainment, future profitability will suffer.

Inflation

If inflation erodes operating margins, the valuation of the stock will be significantly lower.

For a full set of risks, please click here.

Takeaway

Take-Two is a superb company with a long history of great performance and rights to many of the most popular games in the world. It is no surprise that as a result the stock has historically traded at a premium to fair value. The merger with Zynga has caused some uncertainty to future expectations, which has caused the stock price to decline about 50% year to date.

Investors who are interested in buying shares must have confidence in two things: (1) Take-Two’s lineup of games, both console and mobile and (2) the Zynga merger will result in accretive gains to earnings. Personally, I have no doubts to the former. I have a “wait and see” approach with the latter.

I believe there are better risk/return opportunities in the market, many of which I have written about on my page. However, Take-Two is the ‘Apple’ of the gaming world in my opinion and I believe investors could make solid returns in the long-term. The outcome is a little murkier in the short-term.

Investors must continue to monitor the merger with Zynga to see if the synergies proposed come to fruition. If they do, the stock could trade hands at about $118-$142 per share, which represents a return of about 29%-55% from current levels. If the merger does not synergize, then shares could trade hands at about $68-$93, representing a decline of about -25% to breakeven. I believe a price point of $70 per share would be a time to reevaluate the stock.

Be the first to comment