Marko Geber

After the market closes on November 7th, the management team at video game developer Take-Two Interactive Software (NASDAQ:TTWO) is expected to announce financial results covering the second quarter of its 2023 fiscal year. Recently, financial performance for the company has been quite mixed. Although revenue has been strong, the expectation for bottom line results is discouraging. If this represents a new normal for the enterprise, shares of the firm do look to be rather pricey. But if we assume that financial performance can revert back to what it was in prior years, the overall potential for investors could be solid, making the enterprise a ‘buy’ for those who view its troubles as short-term in nature. But for those who, like me, are more conservative in their investing approach, a solid ‘hold’ is more reasonable right now.

Results around the corner

As I mentioned already, Take-Two Interactive Software is expected to announce financial results fairly soon. Because of this, it might be useful to understand exactly what analysts are anticipating. For starters, revenue is currently anticipated to be around $1.54 billion. This would represent a tremendous improvement over the $858.2 million the company reported in the second quarter of its 2022 fiscal year. For context, management forecasted revenue of between $1.37 billion and $1.42 billion. This increase though has not been due to organic growth. Instead, it should be driven by Take-Two Interactive Software’s acquisition of Zynga. Of course, this doesn’t mean that organic growth can’t be a part of the equation. It’s just that, with video game sales forecasted to fall by 1.2% this year globally, organic growth will not be possible for all players in this space.

On the bottom line, analysts are anticipating a net loss of $0.82 per share, with an adjusted net profit of $1.38. To put this in perspective, during the second quarter of the company’s 2022 fiscal year, the business generated earnings per share of $0.09. This translated to a net profit of $10.3 million. To understand why bottom line results might be suffering this year, we need only look at how the company performed during the first quarter of the year.

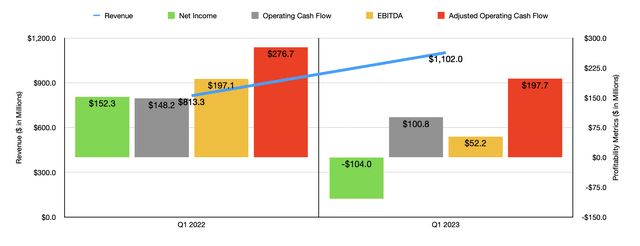

Author – SEC EDGAR Data

For starters, just like the second quarter is expected to be, revenue in the first quarter of 2023 came in strong at $1.10 billion. That compares to the $813.3 million generated the same quarter one year earlier. However, the company incurred a net loss of $104 million. That compares to the $152.3 million loss generated in the first quarter of 2022. Frankly, this pain came across the board. although the company’s gross profit margin improved from 59.5% to 60.5%, its selling and marketing costs skyrocketed from 12.8% of sales to 24.7%. Some of this increase came from a rise in stock-based compensation in that category from $8 million to $35.7 million. However, the company also said that marketing expenses rose because of titles resulting from its Zynga acquisition, such as Toon Blast, Merge Dragons!, Empires & Puzzles, and more. The company also saw higher marketing costs associated with its Top Eleven release and its NBA 2K franchise. Higher personnel costs resulting from the aforementioned acquisition also proved to be problematic.

There were, of course, other areas of pain for the company. General and administrative costs, for instance, rose from 12.8% of sales to 21.5%. Higher professional fees related to its acquisition of Zynga, as well as the integration of the business, were factors here. Another factor related to personnel expenses for higher headcount because of said acquisition. These same factors were also instrumental in pushing up research and development costs from 11.3% of sales to 15.7%. Collectively, the price increases across these three categories alone accounted for additional costs to the company, on a pre-tax basis, of $275.6 million. Even though these problems exist, management claims to be optimistic about the future. In addition to discussing potential new projects that could be instrumental in helping the company deliver over $500 million of annual net bookings opportunities on top of existing operations, the company also believes that it can generate around $100 million in annual cost synergies within the first two years after the close of said acquisition. So naturally, investors would be wise to keep an eye out on any development on this front. On top of showing up in the form of net income or loss, these items might also show up in cash flow figures. For context, operating cash flow for the company in the second quarter of 2022 came out to $135.4 million. If we adjust for changes in working capital, it would be higher at $216 million.

When it comes to the 2023 fiscal year in its entirety, management expects revenue of between $5.73 billion and $5.83 billion. At the same time though, they are forecasting the company to lose between $398 million and $438 million. If there is a bright side, it’s that operating cash flow should be over $710 million, while EBITDA is forecasted to be between $499 million and $548 million. To put this in perspective, in my most recent article about Take-Two Interactive Software and Zynga merging, I used figures provided by both companies to calculate adjusted operating cash flow of $1.41 billion and EBITDA of $1.66 billion. Clearly, higher costs are weighing on the company more than I anticipated.

Author – SEC EDGAR Data

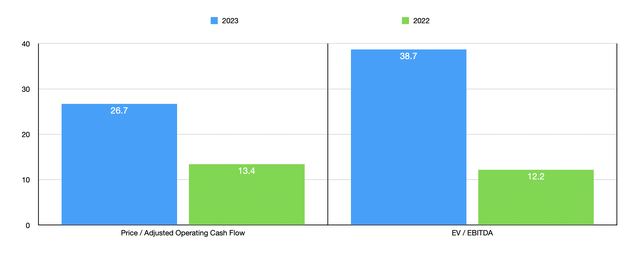

Whether the company can go back to its old levels of profitability or not would be incredibly important in determining whether shares are attractively priced or overvalued. For instance, if management achieves guidance for the current fiscal year, the firm would be trading at a forward price to adjusted operating cash flow multiple of 26.7. The forward EV to EBITDA multiple would be even higher at 38.7. By comparison, using the data from my prior article, these numbers would be 13.4 and 12.2, respectively. To put this in perspective, the greatest comparable that we can look at is the implied acquisition price that Microsoft (MSFT) paid for Activision Blizzard. The price to operating cash flow multiple on that deal was 20.2, while the EV to EBITDA multiple came in at 16.9.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Take-Two Interactive Software | 26.7 | 38.7 |

| Activision Blizzard (Buyout) | 20.2 | 16.9 |

Takeaway

Truth be told, Take-Two Interactive Software is in an interesting position right now. Fundamentally speaking, the 2023 fiscal year is likely to be disappointing. Management is working to cut costs, but it’s unclear whether the company could go back to the kind of profits that each standalone enterprise enjoyed. Naturally, this creates a very binary outcome for investors to ponder. Either shares deserve to be trading lower than they are today, or upside potential could be meaningful. Obviously, the company could fall somewhere in between there. But what I do know is that it lacks the kind of clarity that I personally value significantly in an investment prospect. Because of this, while I do recognize the company’s potential and I am a huge fan of the gaming industry, I do think a more appropriate rating for the company right now is a ‘hold’.

Be the first to comment