BING-JHEN HONG/iStock Editorial via Getty Images

Thesis

We present a timely update to our previous article on Taiwan Semiconductor Manufacturing Company Limited or TSMC (NYSE:TSM), given significant developments in the semi industry over the past two months. Even though we re-rated TSM, we encouraged investors to consider waiting for a pullback before adding more positions, as it was overbought.

We are pleased to update readers that the recent pullback in TSM has forced it to break below its June lows and could yet form another bullish reversal over the next few weeks. But unfortunately, the pessimism in semi stocks has continued to heap more misery on semi investors as the downturn seems to worsen.

TSMC has not been spared, given its exposure to the leading fabless semi players, facing significant consumer market turbulence. Furthermore, a recent report suggested that the weakness has permeated the data center and automotive segments, suggesting potential for lower utilization. Bloomberg’s report on TSMC’s most important customer Apple (AAPL) pulling back orders to increase iPhone 14 production led to further concerns about TSMC’s capacity.

Therefore, we believe that TSMC looks primed to withstand further near-term downside volatility. We assessed that TSMC’s valuation has likely reflected a significant level of damage if its estimates are not cut markedly. Hence, all eyes will be on management’s commentary on its medium-term outlook and capacity utilization, coupled with the impact on its gross margins.

We discuss the critical levels investors need to consider if estimates get cut markedly, resulting in further de-rating of TSM to de-risk its forward execution risks.

Notwithstanding, we are confident that the current levels are attractive for investors to continue layer in if they have been waiting for a significant pullback from August highs.

Accordingly, we reiterate our Buy rating on TSM.

Apple Stuns The Market

Bloomberg reported earlier today (September 28) that Apple informed its suppliers to adjust their production according to its original plans of 90M iPhones 14 for H2’22. Notably, the Cupertino company’s pre-order momentum has failed to gain traction. Furthermore, China’s sales were also weaker than expected, coming in below last year’s cadence for iPhone 13.

As a result, it caused some early panic in Asian markets, as investors parsed the damage to the earnings estimates of Apple’s leading partners, including TSMC.

The bad news from Apple followed yesterday’s (September 27) report from DIGITIMES, highlighting that TSMC’s leading fabless chipmakers are considering cutting wafer starts for 2023. Notably, industry sources noted the weakness seen in the consumer market has spread to the automotive, network IC, and data center segments.

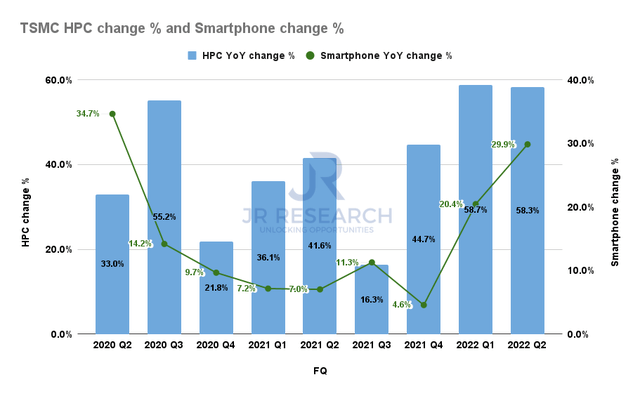

Therefore, we believe the market is assessing whether it could put TSMC’s high-performance computing (HPC) segment at risk, given the growth cadence seen in the past few quarters.

TSMC Revenue by platform change % (S&P Cap IQ)

As a reminder, HPC has been a significant driver of TSMC’s revenue growth over the past three quarters, as it notched a 58.3% uptick in its Q2 report. While TSMC has reiterated its FY22 guidance, we believe the market is assessing whether its FY23-24 growth momentum could be impacted, resulting in the company revising its forward guidance.

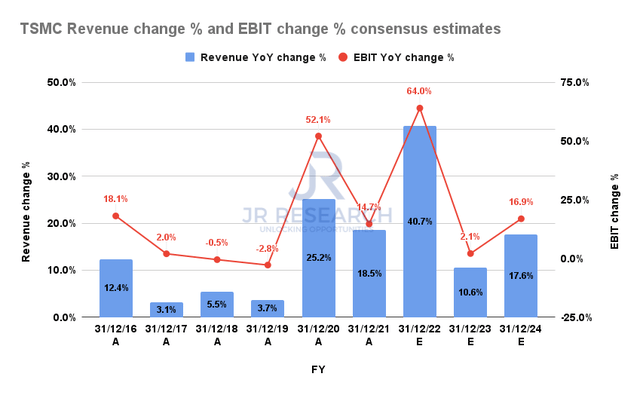

TSMC Revenue change % and EBIT change % consensus estimates (S&P Cap IQ)

Notwithstanding, we believe the consensus estimates (bullish) have already factored in a significant moderation in FY23’s growth cadence, as seen above. TSMC’s revised estimates suggest a revenue growth of 10.8% and an EBIT uptick of 2.1% in FY23.

The growth deceleration is similar to TSMC’s previous downswing in 2018 and 2019. Therefore, it’s critical for investors to assess whether the revisions are sufficient to account for a potential revision to its guidance.

Also, it’s crucial to analyze whether the market had adequately priced in further moderation in its forward estimates at the current levels.

TSMC’s Valuation Looks Well-Battered

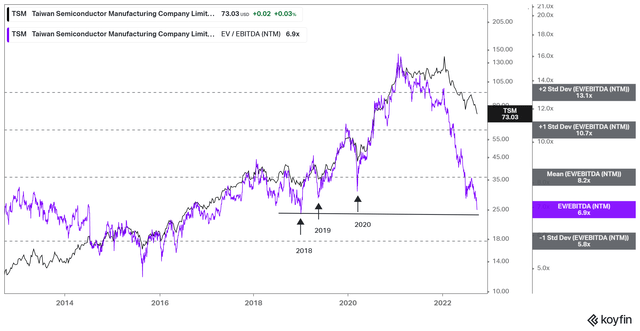

TSM NTM EBITDA multiples valuation trend (koyfin)

As seen above, the recent pullback sent TSM’s NTM EBITDA multiples down further to 6.9x, well below its 10Y mean of 8.2x.

Therefore, we deduce that the market has priced in significant damage to TSMC’s operating metrics at the current levels if the consensus estimates could be revised further within a range of 10%.

As seen above, TSM was supported resiliently at the current valuation zone for its previous downcycle over the past three years.

However, if the revisions result in a more than 10% cut from its current levels, TSM would likely need to fall further to de-risk its execution risks and allow its valuation to “catch up” with the current levels.

Therefore, we believe the price action over the next few weeks should unveil the market’s opinion over its anticipation of the impact on TSMC’s FY23-24 estimates.

Is TSM Stock A Buy, Sell, Or Hold?

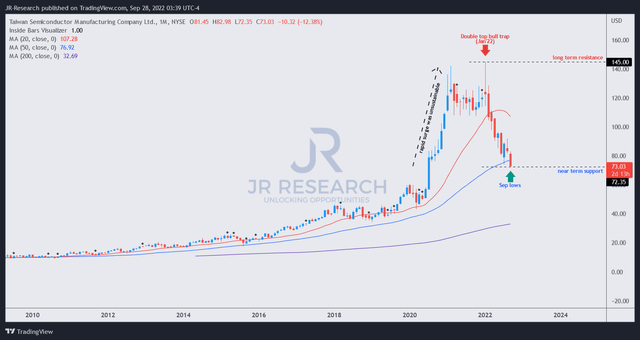

TSM price chart (monthly) (TradingView)

TSM’s September price action broke below its previous July lows. However, investors shouldn’t panic yet, as the resolution over the current levels has not been validated.

A bullish reversal could occur if it turns out to be a move to force out weak hands. Over the next two to three months, the resolution should be more apparent on whether the bears have sufficient momentum to force TSM down below its critical 50-month moving average support level (blue line).

We remain optimistic that TSM’s long-term support should continue to proffer robust buying upside to stanch the bearish momentum at the current levels. Moreover, the digestion from its Jan 2022 highs appears to be near completion, reflecting substantial damage that should have taken out a lot of weak holders over the year.

Therefore, we reiterate our Buy rating on TSM and urge investors to capitalize on the deep pullback to add exposure.

Be the first to comment