RiverNorthPhotography/iStock Unreleased via Getty Images

Thesis

We ourselves use a top-down investment approach. We use a market dashboard to take a 30,000-feet view first. We then decide where to look further – which sector, growth stocks, value stocks, bonds, or precious metals, et al. With this approach, the thesis of this article is twofold:

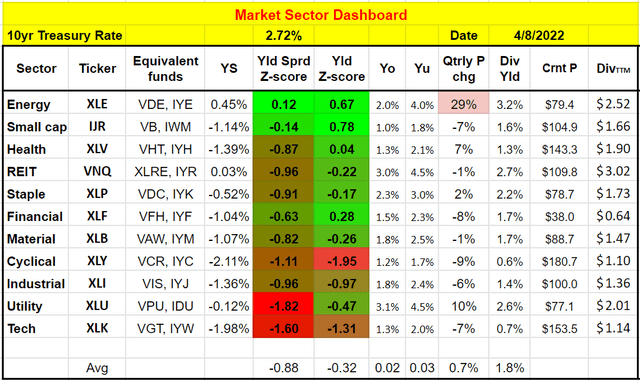

- The financial sector, represented by the Financial Select Sector SPDR Fund (NYSEARCA:XLF), is currently about fairly valued based on our market dashboard (and you are welcome to download it here), both its dividend yield and the yield spread relative to the risk-free rates are near the mid among all the sectors as you can see. The sector dividend yield is actually above its historical mean as indicated by the positive dividend yield Z-score.

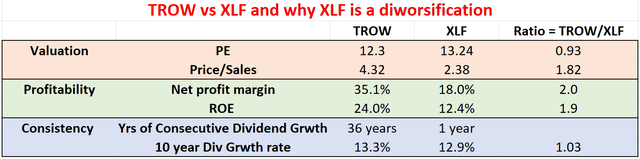

- However, as you can see from the second chart, compared to T. Rowe Price (NASDAQ:TROW), XLF is really a diworsification. T. Rowe Price provides superior profitability, consistency, and also valuation over XLF. Do not be alarmed by TROW’s higher price to sales ratio. If you consider that TROW’s net profit margin is more than twice that of the sector average, TROW’s price to sales ratio is actually lower.

- Particularly, if we use dividends as an approximation for owners’ earnings yield, TROW currently provides a yield about 1.3% above XLF (on TTM basis) or almost 1.7% above XLF based on FW yield, near the thickest level over the past decade. Note that the second chart is based on data provided either from Yahoo Finance or Seeking Alpha before the market close price on April 8. Given the large volatilities these days, these numbers might have changed a bit when you read this article.

We will elaborate on the above points immediately below.

XLF And TROW – Basic Information

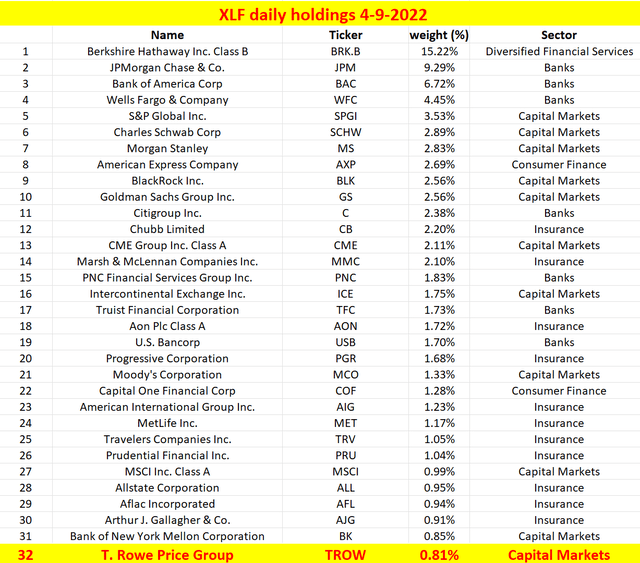

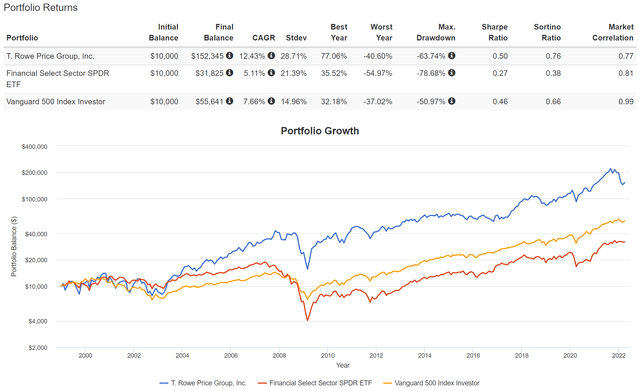

XLF is a popular (probably the most popular) financial sector fund. It invests in stocks of companies operating across financial sectors as you can see from the chart below. As of this writing, it holds a total of 67 stocks, and TROW is the 32nd largest holding, representing almost 0.8% of the total assets. TROW is a dividend champion, boasting an impressive streak of 36 years of consecutive dividend increases. As you can see in the second chart below, TROW has delivered higher returns than both XLF and the overall market by a large margin.

Also note that TROW actually suffered lower price volatility than the fund, in terms of worst year performance and especially maximum drawdown. The financial sector fund has suffered the worst year performance of almost 55% and a nerve-wracking maximum drawdown of 78% in the past two decades or so. In contrast, TROW’s worst year performance and maximum drawdowns had “only” been about 40% and 63%, respectively.

To me, this is a clear sign of the diworsification nature of the fund relative to TROW. Add in this case, the addition of a bunch of extra stocks does not even help with diversification. It actually made the price volatility even higher than holding TROW alone.

Source: author based on SPDR data Source: www.portfoliovisualizer.com

TROW’s Superior Profitability

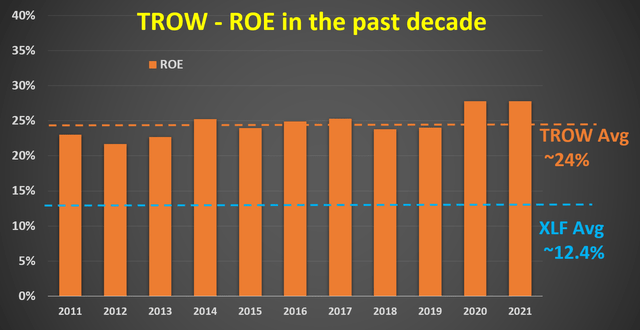

The following chart shows TROW’s profitability in terms of ROE (return on equity). The ROE here is shown based on the annual financials provided by Seeking Alpha. As can be seen, the ROE of TROW is on average about 24%. And also note the remarkable consistency of the profitability. Its ROE only fluctuated within a very narrow range around the mean over the past decade, the hallmark of a business with a stable moat. And also note that its current ROE is not only healthy in absolute terms but also higher than its long-term average by almost 400 basis points.

In contrast, XLF’s profitability is less impressive. As shown in the chart at the beginning, its net profit is about half as TROW. And its return on equity is also about only half of TROW’s.

Looking forward, I am expecting TROW’s superiority over the sector to further expand given its scale and integrated business model. As mentioned in my earlier article:

- In TROW’s segment of business (custodian and wealth management), trust and reputation are major assets, if not the most valuable asset. The company has a long-standing reputation in the financial community that tracks back to its founding in 1937. And the reputation and trust accumulated by TROW over its long history cannot be easily reproduced by its competitors.

- It also enjoys a wide moat due to its scale and efficiency. The amount that is under management/custodial is mind blogging – about $1.5T for TROW. To put things in perspective, the GDP of Canada, which boasts the top 10 GDP in the world, is about $1.7T in 2021.

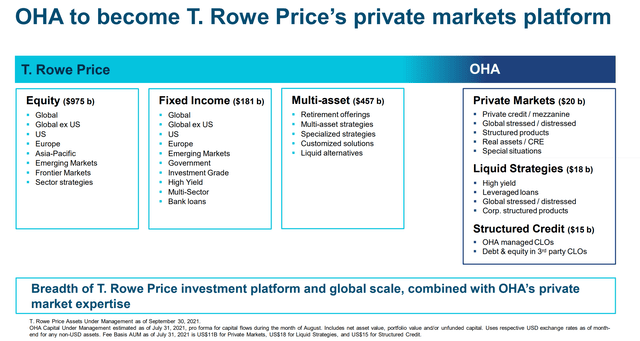

At the same time, TROW has also been active in the acquisition front to seek inorganic growth. It recently completed the purchase of Oak Hill Advisors, an alternative investment manager. As you can see from the chart below, Oak Hill oversees a total of $53 billion of capital. Although the total capital is relatively minor compared to TROW’s humongous portfolio, the acquisition should help TROW expand its private market offerings, which are in demand with clients seeking portfolio diversification. I am optimistic about the resonance and synergies between the breadth of TROW’s investment platform and the global scale with Oak Hill Advisor’s private market expertise.

Dividends As A Measure Of Owners’ Earnings

Now on to valuation. As mentioned in the second chart at the beginning, despite its superior profitability and scale, TROW is actually substantially undervalued relative to XLF. In terms of PE or dividend yields.

Another effective way to evaluate their valuations is by their dividend yield, and an effective way to evaluate their relative valuations is by their dividend yields either relative to each other or relative to the risk-free rates. Details of these concepts and approaches have been provided in our earlier article. Dividends yields and yield spread are what we first check before making any investment decisions. We’ve fortunately had very good success with this approach because of:

- The common PE or Price/cash flow multiples provide partial and even misleading information due to the differences between accounting earnings and owners’ earnings.

- Dividends provide a backdoor to quickly estimate the owners’ earnings. Dividends are the most reliable financial information and least open to interpretation. In investing, we always prefer a simpler method that relies on fewer and unambiguous data points rather than a more complicated method that depends on more ambiguous data points.

- The dividend yield spread (“YS”) is based on a timeless intuition. No matter how times change, the risk-free rate serves as the gravity on all asset valuations and consequently, the spread ALWAYS provides a measurement of the risk premium investors are paying relative to risk-free rates. And similarly, the yield spread between two securities always measures their risk premium relative to each other. A large spread provides a higher margin of safety and vice versa.

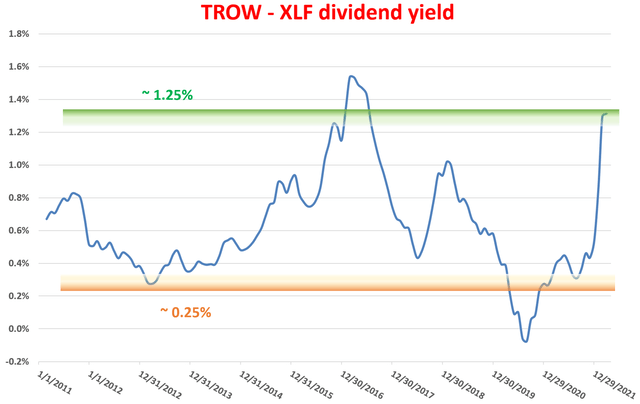

Based on the above understanding, the following chart shows the yield spread between TROW and XLF. The dividend yield is calculated using the TTM dividends and based on quarterly averaged prices. These calculations did not include the special dividends that TROW has paid in the past.

As can be seen, the spread is positive most of the time because TROW has consistently paid a higher dividend yield than XLF in the past. Furthermore, you can see that the spread is bounded and tractable most of the time. The spread has been in the range between about 0.25% and 1.25% the majority of the time during the past decade. Such a tractable YS suggests that when the spread is near or above 1.25%, TROW is significantly undervalued relative to XLF (i.e., I would trade XLF for TROW). These are times when TROW is severely undervalued relative to XLF – the market is willing to sell TROW at a yield that is 1.25% above the sector. And vice versa.

You can see the screaming buy signal for TROW during 2016 and 2017 when the yield spread surged above 1.4% – and this is why our dashboard and the yield spread are the first things we look at when we make our investment decisions.

As of this writing, the spread is about 1.3% on a TTM basis and almost 1.7% on a FW basis, close to the thickest end of the historical range over the past decade as you can see, suggesting that TROW is substantially undervalued relative to XLF.

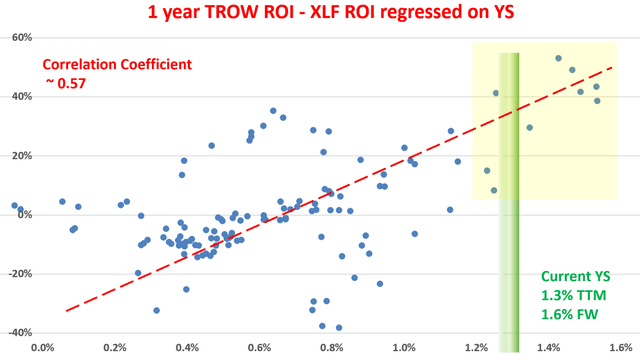

For readers familiar with our analyses, you know that the short-term returns are closely correlated with the yield spread for funds or stocks that have demonstrated stable earnings powers and dividends. And as you can see from the chart below, it is also true for TROW and XLF. This chart shows the 1-year total return (including price appreciation and the dividends – both regular and special dividends) from TROW minus that from XLF when the purchase was made under different yield spreads. In other words, this chart shows the alpha from TROW relative to XLF at different yield spreads. You can see that there is a clear positive trend and the Pearson correlation coefficient is a quite strong 0.57, meaning that a thicker YS always signals a lower risk of owning TROW relative to XLF.

And future returns have been correlated with the YS. In particular, the screaming buying opportunities during 2016 and 2017 are shown by the few data points on the far-right side of the charts. And you see the outsized alpha in the next 1 year (almost all above 40%). In general, also shown in the yellow box, when the yield spread is above 1.25% or so as aforementioned, the alpha in the next one year has been all positive and quite large (almost all above 10%).

As of this writing, the yield spread is 1.3% on a TTM basis and almost 1.7% on a FW basis. It is close to the thickest level of the historical spectrum in a decade and signals that the valuation of TROW is substantially compressed compared to XLF, corroborating the assessment from the PE analysis shown above.

Summary And Risks

Investors often face the choice between an individual stock and a sector fund, especially investors who like a top-down approach like us. When looking for stock ideas, we first use a sector dashboard to identify the promising sectors and dive into that sector to research individual stocks.

In the case of the financial sector:

- The financial sector is currently a fairly valued sector shown by our sector dashboard (and you are welcome to download it here). Represented by XLF, both the dividend yield and the yield spread relative to the risk-free rates are near the average level both in absolute and relative terms.

- However, a better choice would be TROW, a dividend champion in this sector. In our view, the XLF fund (or financial sector funds in general), is a diworsification of TROW. In this case, the addition of a bunch of extra stocks probably is even worse than diworsification considering that XLF has actually suffered worse price volatility and drawdowns than holding TROW alone.

- TROW provides superior profitability, consistency, and also valuation over XLF. In particular, in terms of PE multiple, TROW is undervalued by about 7% relative to the sector. And in terms of YS, TROW provides a dividend yield of about 1.3% to 1.7% above XLF, near the thickest level over the past decade.

Finally, we want to point out the risks of our approach before closing. The risks unique to TROW have been detailed in our earlier writings and won’t be repeated here. Here we want to highlight the risks associated with the financial sector and our general approach described in this article:

- The financial sector faces macroscopic risks now. The Ukraine/Russian conflict is a big near-term uncertainty. The duration and eventual outcomes of the conflict (as with any geopolitical conflict) are totally uncertain. It could generate substantial impacts on both the global overall financial markets and individual stocks in unpredictable ways. The interest rate uncertainties represent another major microscopic risk. The risk-free rates act as the gravity for all asset valuations, and the financial sector and also TROW respond especially sensitively to the risk-free rates.

- Choosing one stock over a sector fund could reduce the diworsification risk, but it could increase concentration risks. In the end, it is a matter of personal investment style and individual belief of what risk is. The argument could be made both ways. You could argue that the probability for ~60 stocks to all fold is significantly lower than the probability for one stock to fold. But you could also argue that the stronger and more profitable stock would be the last one to fall in any given sector.

- Yield spread measures the RELATIVE risk premium and does not guarantee an ABSOLUTE positive return. It is a reliable method to accumulate more of the given securities (whether an equity or bonds) in terms of SHARES, but not in dollar amounts. The dollar amount worth is determined by both how many shares you hold (which the yield spread can help) and their prices (which the yield spread cannot predict).

- Lastly, as detailed in our earlier article, dividend yields do not always reflect business fundamentals due to several factors such as tax law, political climate, the composition of the market index, et al. As a result, we do not directly use the yield spread in our investment or asset allocation decisions. In practice, we first adjust for the above corrections and then use the adjusted yield spread in our investment decision. But the data and approach illustrated here is the first place we check.

Be the first to comment