gorodenkoff

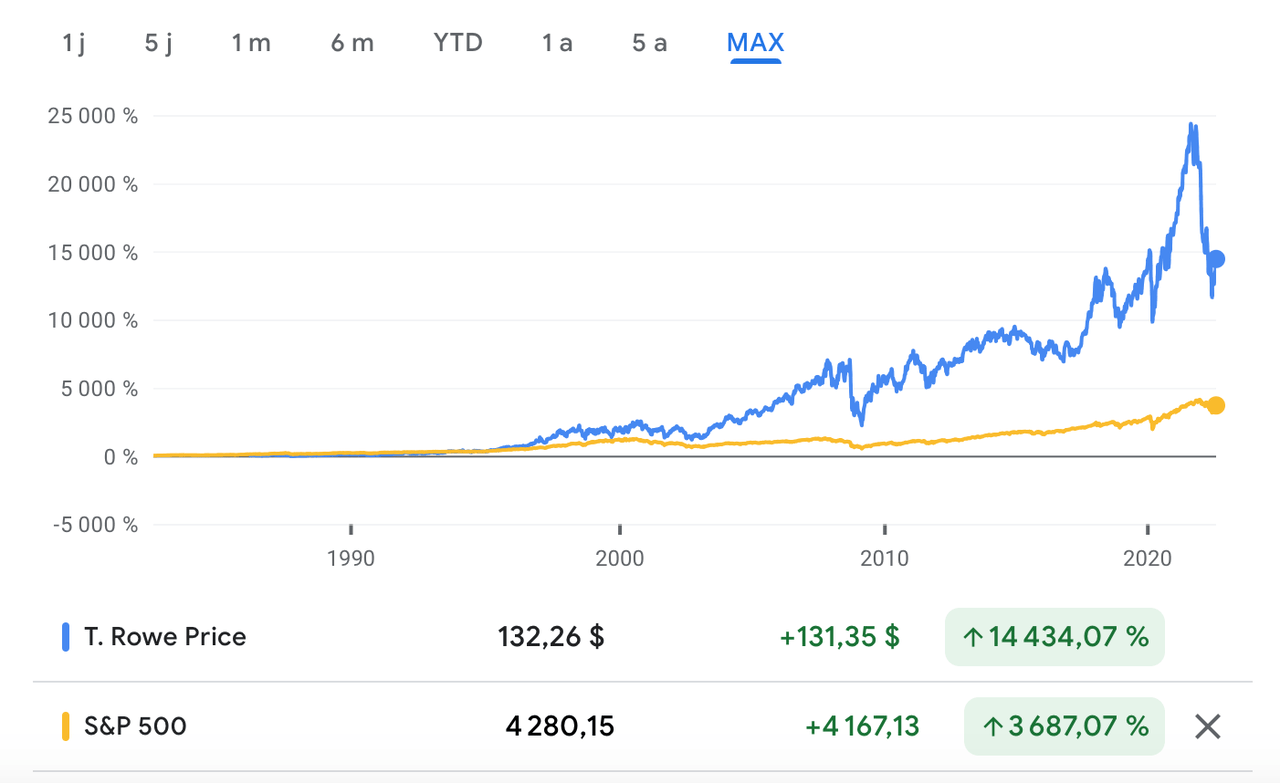

Since listing in 1986, the T. Rowe Price Group, Inc. (NASDAQ:TROW) has grown by over 14,434%, compared to over 3,687% for the S&P 500. Factoring in dividends, T. Rowe Price has compounded wealth by 16,432.5% across that period, giving investors an annualized total stock return of nearly 20% a year. Over a 30-year period, the company has grown revenue at 135 per year, diluted GAAP earnings per share (EPS) by 17% a year, and dividends per share by 16% per year. Despite that stellar record, year-to-date, the company is down some 30%, compared to nearly 11% for the S&P 500. The company is trading at very attractive valuations, and underlying economics of the company and industry suggest that the company can continue to grow strongly.

Source: Google Finance

What T. Rowe Price Does

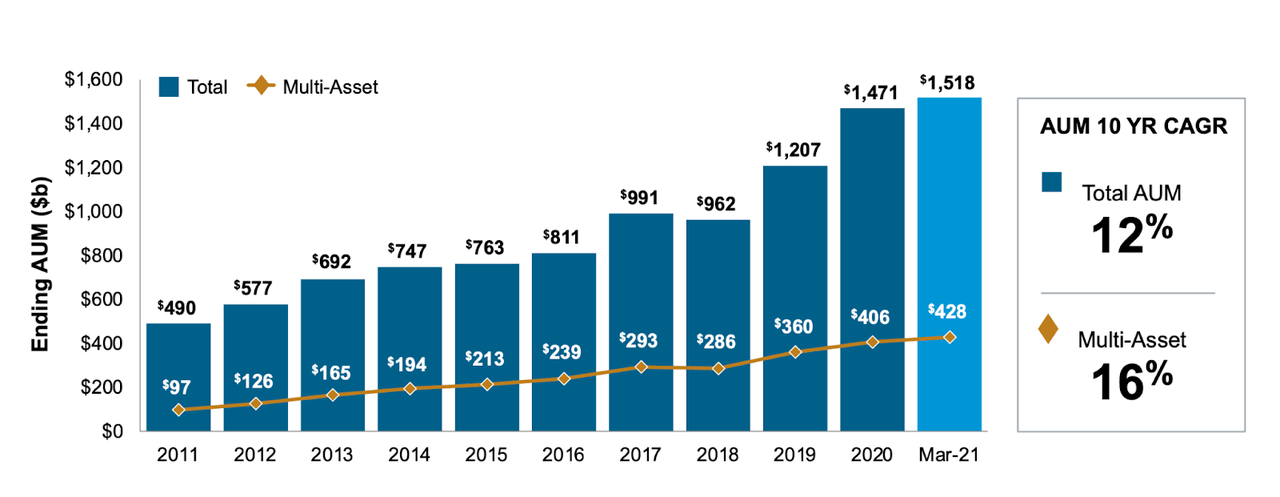

Founded in 1937 by T. Rowe Price, the company is an iconic name in finance. The company is the eighteenth largest fund manager in the world by assets under management (AUM), with $1.31 trillion in AUM, according to its Q2 2022 results. Over the last decade, AUM has compounded by 12% over year.

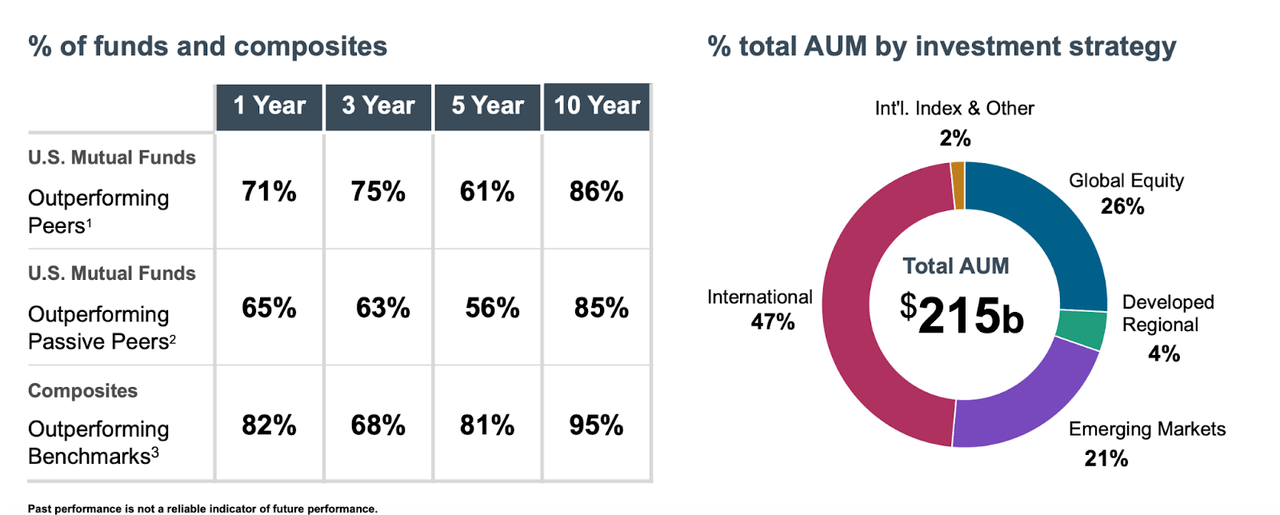

Source: 2021 Investor Day

With offices in 16 countries around the world, T. Rowe’s Price’s services are through its U.S. mutual funds, subadvised funds, separately managed accounts, collective investment trusts, and products, according to its 2021 annual report. The company also provides some clients with administrative services. The company’s AUM is invested as follows: $700 billion in equities, $171 billion in fixed income, $396 billion in multi-asset strategies, and $43 billion in alternative products managed by recently acquired Oak Hill Advisors.

High Performing Funds

As a fund manager, AUM flows depends on market conditions and fees. Fees vary by product, but have an average of 0.45%. Fees are in secular decline across the industry. T. Rowe Price notes that fees have come under pressure as passive investing has taken market share from traditional active strategies. It is still possible to grow investment advisory fees, as a function of the growth of AUM, but active managers do not have the competitive advantages needed to raise fee levels.

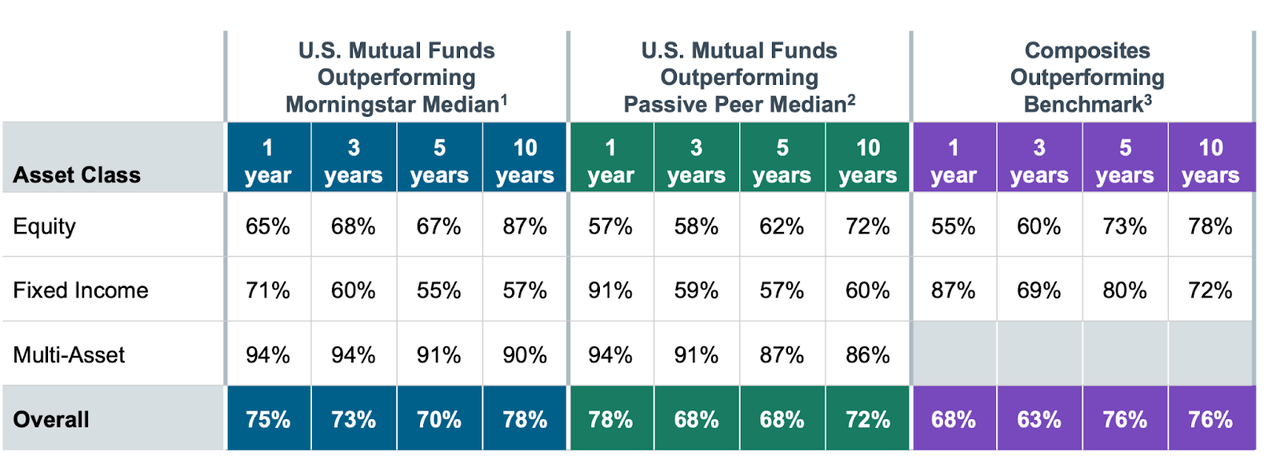

Consequently, success for T. Rowe Price and other fund managers are more and more dependent on their ability to generate results in excess of those offered by passive investments. This has the effect of increasing inflows of funds, raising fee income, and retaining existing funds.

It’s encouraging then, that the company’s products are outperforming their benchmarks, defying the tendency of large funds to experience deteriorating returns.

Source: 2021 Investor Day Source: 2021 Investor Day

Long-Term AUM Will Rise

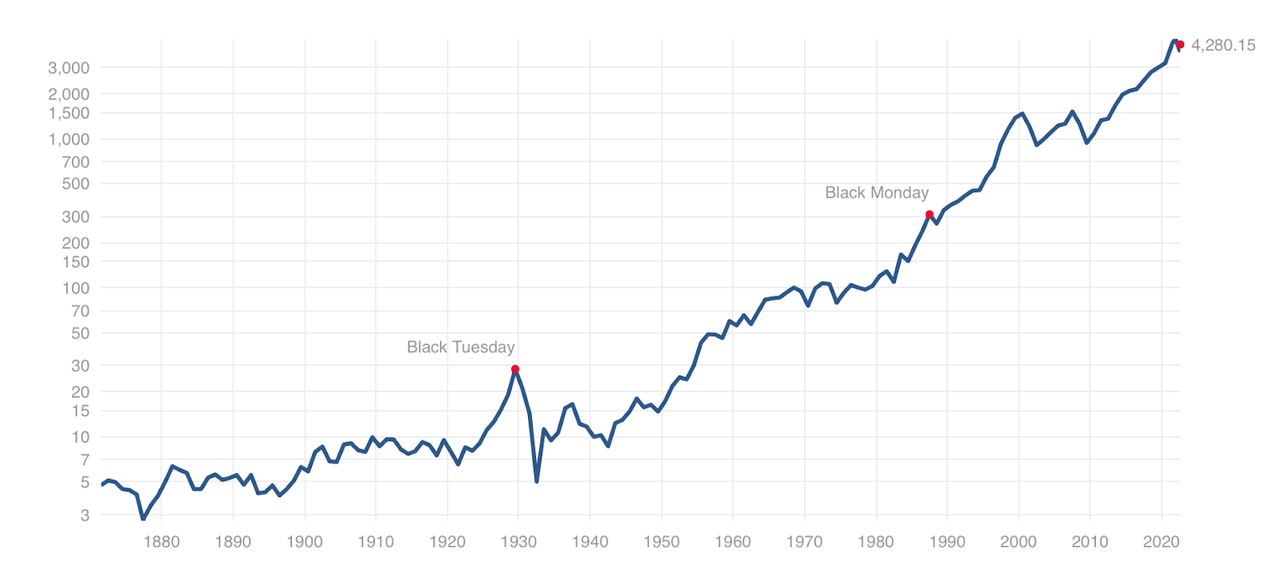

Although stock markets are subject to boom-and-bust cycles, as Jeremy Siegel’s work has shown, over the long run, stock markets tend to rise in value. Of course, this is assuming that a fund’s strategy doesn’t blow the fund up. This is clear from looking at a chart of the S&P 500.

Source: Robert Shiller

We can count on this fact because of three things:

-

Governments have increasingly created a floor for stock market prices, and shown that they are ready to come in and support markets whenever they feel prices have come down too far. This increases the liquidity of the markets, because every investor is assured that they will always have someone to sell their stocks to.

-

Moreover, over the last eight centuries, interest rates have been in secular decline, and this has made equity markets more attractive and investing in them more attainable.

-

Although demand for equities is rising, supply for equities is much more inelastic, and this puts further upward pressure on equity market prices.

The combination of these factors means that a prudently managed fund such as T. Rowe Price does not have to experience a growth in inflows for it to grow AUM, because in the long run, market prices will rise.

Emphasis has to be placed on a fund’s ability to stay in the game, i.e. not blow up.

T. Rowe Price should be able to maintain a high foundation for their AUM and revenue. This is because its clients face switching costs from looking for alternatives to T. Rowe Price. Getting a new partner means undergoing new rounds of due diligence, assuming the risk that things won’t work out with the new partner, and perhaps even going a period without an investment partner. So long as the company delivers a modicum of performance, it has room to screw up, especially when it comes to pension funds.

Although passive investment vehicles have wiped the floor with active managers, there are still clients who want to earn returns in excess of what passive investment vehicles offer. Further, the market is not always right. Although the market is in near-equilibrium most times, there are occasions when it is far-from-equilibrium, and active managers exist to exploit those opportunities. Active managers are not headed toward Armageddon.

In terms of risk management, the company’s portfolio is diversified across different strategies, and its value investing philosophy ensures that the company at least has a margin of safety when it buys assets. Furthermore, the company believes, and I agree, that conditions are changing in favor of value stocks. In a world of stagflation, I think it’s likely that growth’s post-2008 period of outperformance has come to an end.

Valuation

The company generated free cash flows (FCF) of nearly $3.137 billion in the trailing twelve months (TTM), and has an enterprise value of $27.94 billion, giving it an FCF yield of nearly 11.23%. This is far in excess of Treasury yields, and indicates that the company’s underlying and stock performance is likely to be high in future. It also shows that the company’s FCF, which has grown from nearly $826 million in 2012, to $3.137 billion in the TTM period, is on offer at a very attractive valuation.

In addition, T. Rowe Price is trading at a price-earnings (P/E) ratio of 12.75, compared to a 5-year average of 15.07. According to data from Aswath Damodaran, the industry has a P/E ratio of 72.9. In addition, the S&P 500’s P/E ratio is 21.63. The company is very clearly trading at a discount to its historic value, the industry average and the market.

Conclusion

T. Rowe Price is a storied name in the fund management industry. It has shown itself to be a compounding machine, easily beating the results of any stock market index. Its products have been similarly successful, assuring the company of a long-term advantage in building its AUM. Given secular trends, the company can tolerate a stagnant AUM inflow, giving it a strong support for growth. The company is trading at a very attractive valuation and is a must-buy for long-term investors.

Be the first to comment