CROCOTHERY/iStock via Getty Images

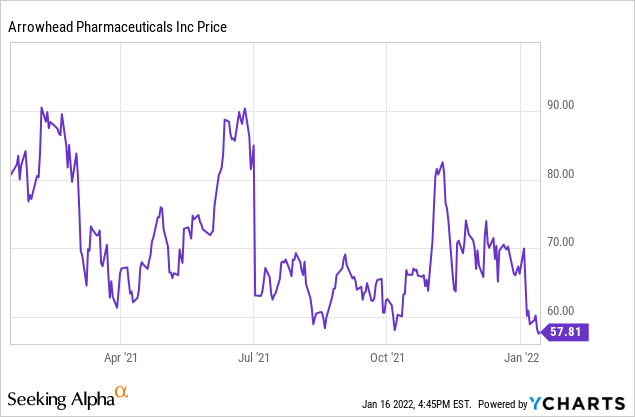

Arrowhead Pharmaceuticals (ARWR) is near its most attractive price since mid-2020. That makes it a good time to evaluate the company for its future potential. Because Arrowhead is a clinical-stage (no FDA approved drugs yet) biotech company developing new therapies, it does carry risks. It also has a market capitalization of near $6.0 billion, quite a sum for a company that is not guaranteed to get therapies approved by regulators. This article will focus on the potential of the Arrowhead pipeline. While Arrowhead has not completed any clinical program yet, I believe that its RNAi therapy platform has been derisked by the FDA approval of other RNA therapies by companies like Alnylam (ALNY) and Ionis (IONS). I believe that it is likely that by the end of this decade Alnylam could have several commercial RNAi therapies generating substantial total revenue. In the meantime, it is also possible that it will be acquired by one of the large, diverse pharma companies, as happened with rival Dicerna (DRNA). Dicerna became one of my best-performing stocks in 2021 when it was acquired by Novo Nordisk (NVO).

ARO-APOC3 for Familial Chylomicronemia Syndrome

On January 12, 2022, Arrowhead announced it had initiated a Phase 3 study of ARO-APOC3 for FCS (Familial Chylomicronemia Syndrome), a lipoprotein lipase deficiency that leads to very high triglycerides in the blood. ARO-APOC3 inhibits the production of apolipoprotein C3, a regulator of triglyceride metabolism. The disease itself is rare, but ARO-APOC3 is also being tested in patients with SHTG (severe hypertriglyceridemia), and in a Phase 2b study in patients with mixed dyslipidemia. While I do not see potential revenues for chylomicronemia as being large, a successful Phase 3 trial followed by regulatory approval in this indication would pave the way for label expansion into the other indications. Also, it will be competing with Ionis’s Waylivra (Volanesorsen), which was approved for FCS in the European Union in 2019, and which generated less than $15 million in revenue in Q3 2021.

The latest data for ARO-APOC3 was presented at the American Heart Association in November 2021 and was encouraging. The drug reduced APOC3 by 98% and triglycerides by 91%. Safety appeared good.

ARO-HSD licensed by GlaxoSmithKline

Arrowhead has been able to finance itself in part by licensing some of its potential therapies. In late November 2021, it licensed ARO-HSD to GlaxoSmithKline (GSK). Arrowhead will receive $120 million upfront (probably in Q1 2021) and could receive an additional $30 million if a Phase 2 trial is commenced and $100 million more if a Phase 3 trial gets underway. Then $190 million if sales begin, plus tiered royalties.

ARO-HSD is being tested for treatment of NASH (nonalcoholic steatohepatitis), a liver disease that has proven hard to treat with drugs. If approved by regulators this could have a very large number of patients as it affects over 3% of the adult population in the United States. Annual revenues could be well over $1 billion, generating substantial royalties for Arrowhead. Weighing against getting too excited about that is that we have yet to see the data from the current Phase 1 trial.

ARO-AAT (TAK-999)

The Phase 2/3 SEQUOIA trial, a potentially pivotal registrational study of ARO-AAT, completed enrollment of its Phase 2 portion in July 2021. Patients receive around 2 years of treatment. ARO-AAT is a second generation subcutaneously administered RNAi therapeutic for a rare genetic liver disease associated with alpha-1 antitrypsin deficiency. The RNAi treatment is being co-developed with Takeda Pharmaceutical (NYSE:TAK) as TAK-999. Arrowhead is to receive a $300 million upfront payment and potential milestones, plus royalties. The therapy has been granted orphan and fast track designation by the FDA and orphan designation in the EU. Interim data from a separate, open label study was released in November at the American Association for the Study of Liver Disease annual meeting.

AATD, or alpha-1 antitrypsin deficiency, is rare, affecting about 1 in 2,500 people of European descent. It is not a quick killer, but smokers having it have an average life expectancy of just 50 years. A highly effective drug would command orphan drug pricing, so might generate substantial revenue. Novo Nordisk gained a competing pipeline candidate with its acquisition of Dicerna. So there is a race on to treat AATD, and there is no guarantee Arrowhead will be the winner, though it appears to be ahead in its trial timeline.

JNJ-3989

In November 2021 new clinical data for JNJ-3989 (AASLD abstracts, page 17) for Hepatitis B was presented by Janssen. The results were positive, with a dose-dependent response. Arrowhead licensed the RNAi therapy to Janssen, a division of Johnson & Johnson (JNJ). Back in August 2020 Arrowhead presented Phase 2 JNN-3989 data suggesting that, combined with nucleoside analog JNJ-6379, the therapy has the potential to provide a functional cure for chronic Hepatitis B. 48 weeks after the last dose, 39% of patients had minimal levels of HBV surface antigen. Chronic HBV affects about 390 million people worldwide, despite a vaccine being available since 1991. A common treatment is Viread [by Gilead (GILD)], now also available as a generic drug, but it is not a cure.

Under the October 2018 agreement with Janssen, Arrowhead received $175 million upfront and a $75 million equity investment. Arrowhead became eligible to receive another $3.5 billion in milestone payments, of which $1.6 billion is tied to the HBV license and $1.9 billion is for option and milestone payments for up to 3 additional RNAi therapeutics developed for targets chosen by Janssen. Arrowhead is also eligible for royalties if there are commercial sales, but the percentage range was not stated.

A separate investigational therapy, JNJ-75220795 was recently licensed by Arrowhead to Janssen as a potential NASH treatment. A $10 million milestone payment was paid for Phase 1 study work.

AMG 890

AMG 890 or Olpasiran reduces production of apolipoprotein A, a key component of lipoprotein(A), which is genetically linked with increased risk of atherosclerosis and related cardiovascular diseases. That risk is independent of cholesterol and LDL levels, so is still there even when cholesterol is successfully lowered. Amgen (NASDAQ:AMGN) acquired a worldwide, exclusive license from Arrowhead in September 2016. Atherosclerosis is one of the most common forms of heart disease, affecting almost everyone by age 65 to some degree. To be a success AMG 890 would have to reduce lipoprotein(A) significantly more than niacin, which may offer a 20% to 30% reduction, and which has side effects at an effective dose. Data from the Phase 2 study is expected in the first half of 2022.

Because of the potential size of the market, AMG 890 could be a blockbuster if approved by regulators. Strong Phase 2 data could significantly increase the perceived value of Arrowhead. However, consider Amgen’s Repatha experience. This PCSK9 inhibitor, which reduced cholesterol levels in hard-to-treat patients, was brought to market in 2015. Revenue from the drug ramped much more slowly than expected due to resistance from insurers.

Q3 2022 Results and Cash Runway

Noting that for Arrowhead calendar Q3 is fiscal Q4, net loss for the quarter was $141 million or $1.36 per share, a pretty steep loss for a company of this size. Yet the cash and equivalents balance was only down $32 million sequentially to $645 million. The burn rate will fluctuate by quarter because of highly variable licensing milestone payments. Likely when the December 2021 quarter is reported we will get some guidance on the extent of the cash runway.

Conclusion

In addition to the more advanced drugs mentioned above, Arrowhead has an extensive drug pipeline and the ability to generate more candidates from its RNAi platform. The basic RNA interference for therapies idea has been validated by several drugs now. So hopefully it is now a matter of waiting for the crucial Phase 3 results that should lead to commercial sales, if they are positive. Meanwhile, the cash situation looks good despite the high spend rate, as cash is raised by more deals and milestones, rather than by issuing new stock.

As I described above, some of the potential therapies are for smaller or even orphan drug markets, and so may not generate much revenue. Others like Olpasiran and JNJ-3989 could serve massive markets. It is also hard to predict how Arrowhead products will perform against competitors. We just have to wait for the clinical results. Based on the positive data in the trials so far, the approval and commercialization of other RNAi therapies, and the total size of the potential markets, I would guess that Arrowhead will eventually see royalties and sales revenues well above $1 billion per year in its future. Timing is hard to predict, but 2025 to 2027 for a major revenue ramp seems possible. Given the stock price of $57.81 is now near a 52-week low, this would seem to be a good time to accumulate the stock. That assumes you are a long-term investor and understand the risks. A short-term joyride could come from acquisition, as happened with rival Dicerna in 2021.

Be the first to comment