RiverNorthPhotography

Introduction

It is not often that a company of this quality is valued at a fair valuation. A recent slowdown in the stock market has brought the market value of T. Rowe Price Group, Inc. (NASDAQ:TROW) back to attractive prices.

T. Rower Price is a global investment management firm located in America with offices and employees worldwide. The company offers a wide range of financial services to individuals, financial intermediaries and institutions. They are among the leading investment management firms in the world, while being consistently ranked among the top of asset managers.

Fundamentals

When you review T. Rowe Price’s financial numbers, it doesn’t take long to realize that this is a quality company with a wide moat.

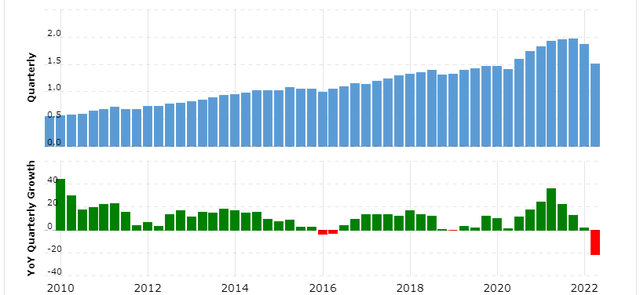

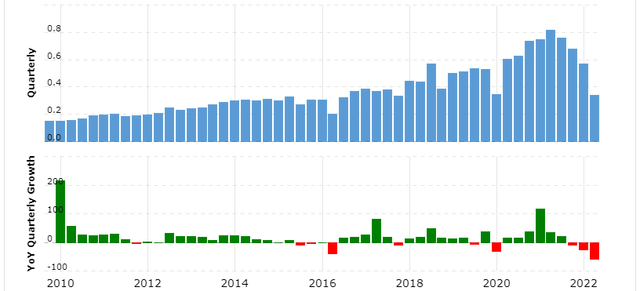

The company has consistently managed to grow the top line by ~11.2% per year on average. Impressively, this is not a result of large acquisitions or taking on large amounts of debt, but rather a result of prudent capital allocation.

T. Rowe Revenue (Macrotrends.com)

The prudent allocation of reinvested earnings is directly reflected in the steadily increasing net profit margin, which in turn has caused net income to grow faster than revenues. For a company of such size to increase the return on invested capital is very impressive.

Capital allocation

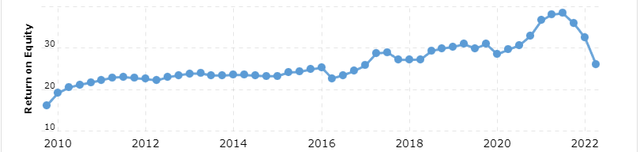

T. Rowe Price has had a consistently high ROE typically in the 20-30 percent range, which has recently normalized after rising to +30%. This is a very high ROE that clearly shows signs of proper reinvestment of earnings.

It is important to realize that the high return on equity is simply not a result of a declining equity base, but rather sustained with an equity that grows each year. Of course, not all earnings are reinvested back into new equity at such a high rate.

Return on equity (Macrotrends.com)

Excluding the occasional special cash dividends that T. Rowe sometimes pays, the dividend payout ratio has averaged ~40% of earnings. The money spent on the dividend will therefore not be reinvested, but instead paid out to investors at a valuation that currently yields ~3.6%.

The remaining ~60% of earnings are mainly reinvested back into the business. As the average ROE is ~25%, the reinvested earnings should contribute ~15% a year to the book value per share growth, but in reality it will be lower due to the small amount of share buybacks not contributing the same plus the occasional special cash dividends.

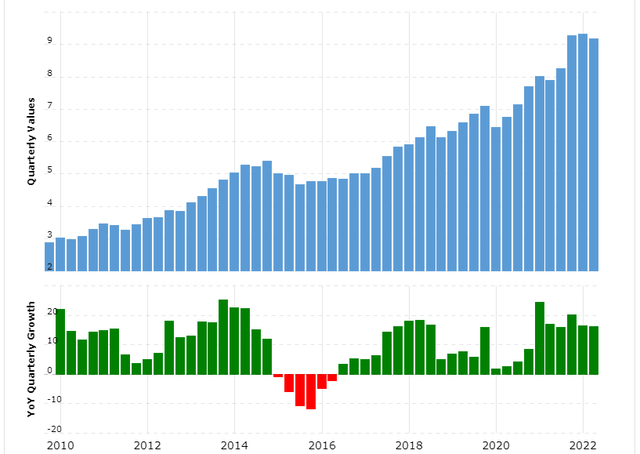

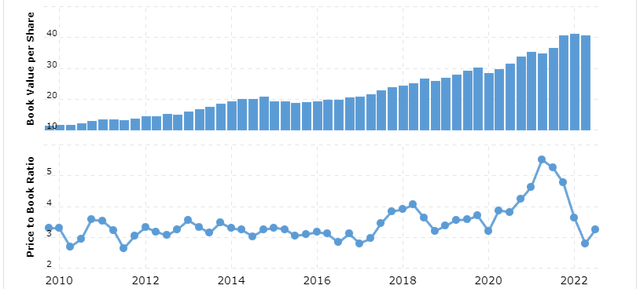

T. Rowe equity (Macrotrends.com)

Book value per share has grown ~11% per year on average, and has risen in recent years, as the ROE has improved. The growth is largely a result of earnings being reinvested back into new equity, but also due to a small amount of share buybacks. Assuming that the business is bought at a reasonable price/book ratio, the expected annual return is ~11% + the current dividend yield.

Book value per share (Macrotrends.com)

Valuation

I will often use a 15 earnings multiple as a guideline for intrinsic valuation. Whether or not a stock should have a higher multiple depends largely on the company’s financial health and earnings growth. In the years following the Dot-com bubble, T. Rowe Price saw steady growth of +20% per year, giving them a decent multiple of ~20. Since the company’s growth never fully recovered after the financial crisis, a lower multiple of ~15 began to be used.

Since the company has no debt, plenty of cash on hand, and is able to grow ~11% per year on a per share basis, I think its current multiple of 15 is a fair valuation.

Stock chart

Quick disclaimer. A technical analysis by itself is not a good enough reason to buy a stock, but combined with the fundamentals of the company, it can greatly narrow your price target range when buying.

As with a majority of consistently growing companies, T. Rowe Price seems fairly predictable based on the stock chart. The company has rarely gone below its 50-month moving average, which is typically an area where I expect it to be attractive. I believe this time is no different as the fundamentals seem solid and the valuation attractive.

I would only expect the 200- monthly moving average to be touched, should a major crisis occur or the company’s fundamentals rapidly deteriorate.

Monthly timeframe chart of TROW (Tradingview.com)

Final thoughts

As the company has no debt, lots of cash on hand and can grow ~11% a year on a per share basis, I believe its current 15 multiple is a fair valuation.

T. Rowe Price Group is a well-established dominant company with a large moat. The company’s cash on hand far outweighs their small amount of debt, setting them up to capture future success.

Assuming they can continue to reinvest ~60% of earnings back into the business at their average ROE rate, then the underlying business will grow ~11% per year. Add the current 3.6% yield on top, and mid-double digit returns seem likely. The fact that the stock is currently below its 50-month moving average and that it trades at a multiple of 15 adds to the stock’s attractiveness.

Be the first to comment