Khanchit Khirisutchalual

Overview

System1, Inc. (NYSE:SST) is undervalued at its current share price as of the date of this writing. A poor farmer found out that his hen could lay golden eggs. From that time, his fortunes changed. In this case, System1, Inc. is the hen that lays golden eggs. People are the lifeblood of every business. As a company that specializes in customer acquisition, SST is of immense value to any company. That said, as an investor, valuation matters. SST at this current valuation does have an alright risk/reward, in my opinion.

Business description

System1, Inc. occupies a position of prominence as a customer acquisition platform. They look for, find, and bring their advertising clients and their own products high-value customers.

Attractive advertising industry

The stakes in advertising are higher than before. The business that can drive and convert the most customer traffic gets to remain relevant in the market. As for those businesses that cannot, they are swept away by the competition.

Yet, reaching and attracting their target customers can be quite a high hurdle for advertisers. As advertising has departed from older mediums such as print, television, and radio, digital advertising has taken a place at the forefront of the industry. This represents new, uncharted territory for most advertisers. But in the future, both the number of digital advertisers and the amount they spend are likely to grow.

Digital marketing stands out as a complex network that is constantly mutating and evolving. Digital algorithms are updated, more sophisticated advertising networks are discovered, technology infrastructures change like the weather, and regulatory policies favor the customer’s data privacy at the expense of the advertiser. Because of this, advertisers are under a lot of pressure to find a good audience so they can get their money back from advertising.

Another snag in the advertising industry is the ever-changing customer trends. No one can guarantee what a customer might be interested in by the next day. Even with well-documented data analysis, advertisers are taken aback when the same advertisement that worked days before is rejected by the same audience days later. Since SST is aware of these problems through the data it has collated, it is only right that it be able to propose lasting solutions.

Some of the key industry trends that are worth highlighting are:

- Advertisers Have Significantly Shifted Their Budgets from Traditional Media to a Diverse Array of Digital Channels: Having shifted the direction of their spending from traditional media to a vast array of digital channels, this has provided advertisers with a variety of options, helping them to target and measure campaigns effectively. It has taught businesses—more than ever—why they should prioritize market research and data analytics. As time flows, digital marketing will continue to thrive.

- Better Execution Against Highly Fragmented Audiences: System1, Inc. has the ability to better deal with highly fragmented audiences. Individual use of the Internet is becoming more fragmented because of the differences in consumption patterns. In a world where a considerable number of people have access to personal devices, one finds it increasingly difficult to accurately pinpoint behavioral tendencies. This is where SST comes in handy.

- Automation of Ad Buying: The need for automation came as a result of the increased speed and complexity of digital marketing. Computer algorithms that use extensive data sets are now being used to make shopping easier for customers. Buying decisions are easier to make when the process of buying is made easy. Hence, the need for automation. This helps advertisers compare bid prices, finding out which one delivers more value to them.

To summarize these points, traditional advertising companies are focused on their ability to be creative and disburse advertising budgets across platforms. The downside is that they are not sophisticated enough to employ superior technology in attracting high-value customers. Advertising consultants may offer advice, but there is an extent beyond which such advice can’t work anymore. You must now deploy cutting-edge technology.

SST RAMP technology

SST owes its business success to the RAMP technology, which has helped them process over 15 million advertising campaign optimizations and collect 5 billion rows of data across 50 advertising verticals.

The purpose of this technology is to identify potential customers, determine their purchasing patterns, and monetize them through building a relationship with advertising networks. For a share of the revenue generated, RAMP helps advertising networks direct customer traffic to SST’s website, then helps them monetize the traffic.

RAMP is able to match customer demand with the appropriate business to meet that demand. This data, context-enriched, helps SST make money for their different clients.

High focus on first party data is an advantage

RAMP takes advantage of its first-person data to qualify customer demand, which will make monetization easy and effective. This data set is combined with the timeline of a certain ad in any niche to ensure a clear perception of the customer and the advertising network. Through its efficiency, SST has been able to build a vast set of first-party data, with a database of over 500 million search queries and 315 million keywords. With this, SST is able to target the right audience with the right message. The advertising companies gain a deeper understanding of their customers’ behavior and tailor their marketing to be in line with it.

SST has an omni-vertical service offering

RAMP works across vertical customer divisions, exploiting consumer data based on his buying behavior. It is intended to facilitate various forms of monetization such as display and search advertising, lead generation, video, e-commerce, and subscriptions. This platform adds massive value to the digital marketing landscape.

Forecast

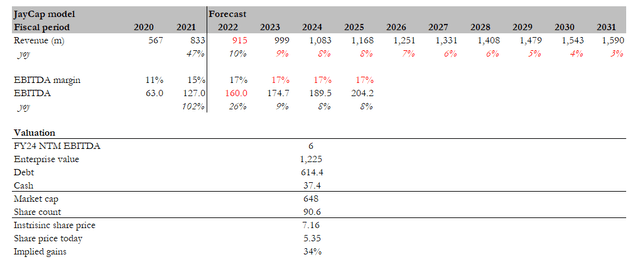

Based on my investment thesis, I expect SST to continue growing as it continues to execute and gain market share. That said, I believe the valuation is not cheap today based on the model. My forecast is based on growth declining to a long-term inflationary rate of 3% in the 10th year, and margins remaining flat from FY22 to be conservative. What I want to show readers here is that, at this valuation, investors need to gain comfort that if revenue starts to decelerate, margins must inflect quite a bit in order to justify a decent IRR.

Based on my assumptions and a NTM EBITDA of 6x (where it is currently trading at), I came up with an intrinsic value of $7.16 in FY24. This is 34% more than the current share price of $5.35.

Red Flags

Google is a meaningful portion of revenue

System1, Inc. has to rely on Google (GOOGL) (GOOG) to perform its activities. They display and syndicate paid listings provided by Google. SST is not self-sufficient in all its data collation, market research, and campaign tracking activities. It is only able to operate on such a large scale as it does because of its agreement with Google, sharing revenue with the giant search engine. Termination of the agreement by Google could have a seismic impact on the business.

Reliance on other marketing channels

Consumer traffic is acquired by deploying the capabilities of acquisition marketing channels. These marketing channels provide immense amounts of first-party data that improves the predictive power of RAMP. With this data, SST can deliver relevant traffic to their advertisers. Any break in relationships with these acquisition marketing channels will see the business, finances, and results of operations severely affected.

Conclusion

As of the date of this writing, I think SST is undervalued at its current share price. Through its manifold technology and systems, SST prides itself in its ability to deliver and monetize high-value customers. Personally, I like the business and industry tailwinds, and the current valuation presents an opportunity to benefit from them.

Be the first to comment