AsiaVision

The Worries Are Still Unfounded

It’s only been one quarter since I last reviewed Synchrony Financial (NYSE:SYF) but it’s been a rough one for the stock. It has traded down 20% from $40 to around $32. The share performance is completely out of line with company performance, where purchase volume and loan balances have both grown faster than inflation over the past 4 quarters.

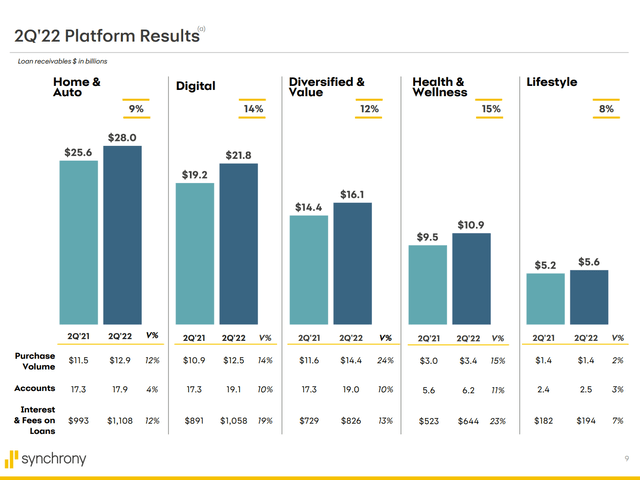

2Q 2022 Earnings Slides (Synchrony Financial)

Synchrony added or renewed 25 card programs this quarter, more than making up for the loss of the BP (BP) and Gap (GPS) card programs.

On the earnings call, management noted that the customer is still spending. Their data shows that 2/3 of consumers still have all or a portion of their stimulus payments from last year remaining. Inflation is causing consumers to rotate spending from discretionary to non-discretionary categories, but not reduce spending overall. Credit quality remains good with no uptick yet in delinquencies and charge-offs, even though the company expects these to increase in the second half.

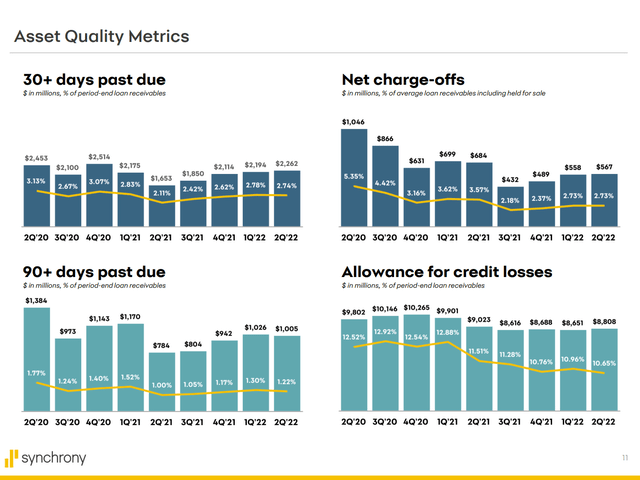

2Q 2022 Earnings Slides (Synchrony Financial)

If charge-offs do increase, Synchrony is partially hedged by the terms of their Retailer Share Arrangements, which give back less money to card partners in that case.

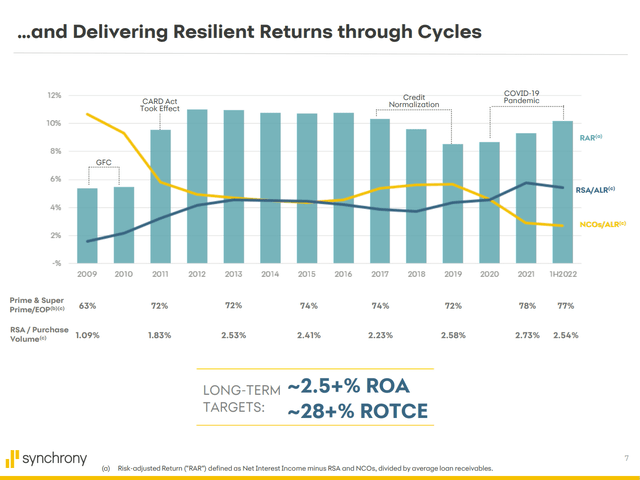

2Q 2022 Earnings Slides (Synchrony Financial)

Although Synchrony expects charge-offs to increase to about 3.5% of loans in the second half of the year, the excellent performance in the first half takes the fully year average guidance down to 3.15%. The bank also guided the RSA forecast to the low end of the range at 5.25% of loans. Synchrony is also holding the line on expenses, with no upward revision to guidance despite inflation.

Synchrony has been conservative with their dividend, increasing it by only $0.01 in the upcoming quarter to $0.23, which is still a 2.9% yield thanks to the recent drop in the share price. More impressive is their buyback program, where the bank has reduced share count by 7.5% since the end of 2021. Synchrony still has $2.4 billion of buybacks authorized, which could reduce share count by another 15%. I expect them to take around a year to complete this.

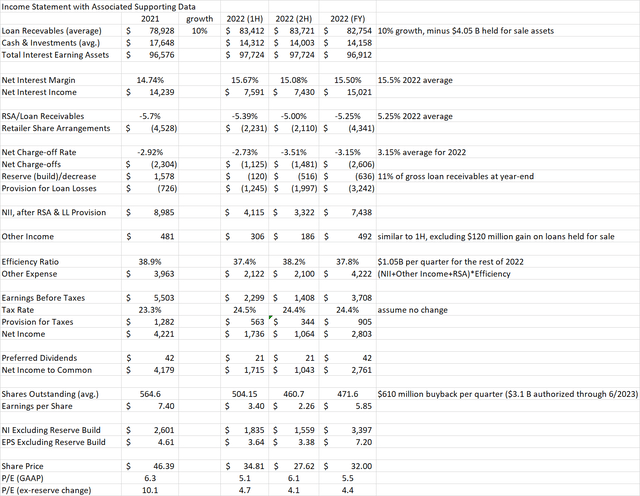

As you will see in the model below, Synchrony should be able to earn $5.85 per share this year even with an uptick in loan loss reserves to 11% of loan receivables. At $32, the stock has a crazy low P/E of 5.5 times this year’s earnings. While earnings would go lower in 2023 in the event of a recession, Synchrony remains well-capitalized and able to weather a downturn with a 15.2% Common Equity Tier 1 capital ratio and 20% liquid assets including undrawn credit facilities. The low multiple is still unjustified which leads me to give Synchrony stock a rare Strong Buy rating.

Financial Model Update

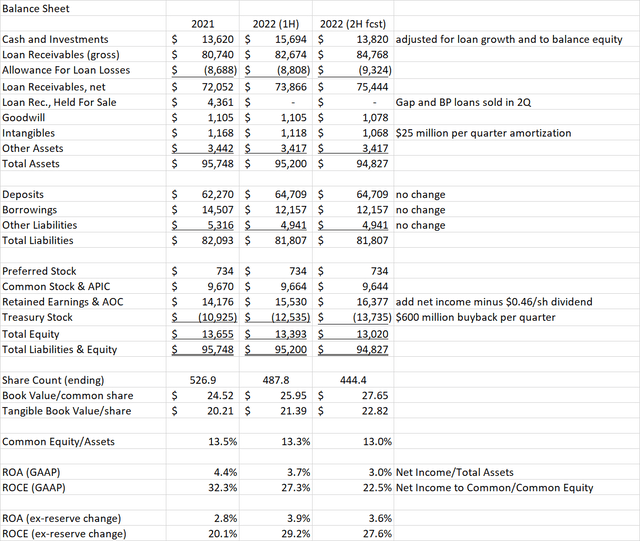

Starting with the balance sheet, my main assumption change from last quarter is that I am more conservative on loan loss reserves, taking the year-end forecast up to 11% of receivables from 10.2% last quarter.

The stock is also cheap on a price/book basis, although it was an even bigger bargain on 6/30/2021 when it traded at $27.62. That represented a P/B of only 1.06 based on 1H actuals. The year-end book value is estimated at $27.65/share which would be a P/B of 1.16 based on recent price of $32, still attractive.

Return on assets and return on common equity are still attractive at 3.0% and 22.5% by the end of 2022, but down from my estimate last quarter due to the higher reserve build. Excluding the change in reserves, ROA and ROCE would have improved from 2021 levels.

Author Spreadsheet (Data source: Company guidance and author estimates)

On the income statement, I am using company guidance of 15.50% net interest margin on the loan receivables mentioned above. This is the high end of the prior guidance range. The bank also provided the guidance of 5.25% retailer share arrangement costs and 3.15% charge-offs as a percent of loans. This is the low end of prior guidance. Operating expenses remain $1.05 billion per quarter. Buybacks are as described above, resulting in the 471.6 million average share count for 2022, lower than my last estimate because the bank can now buy back more shares for the same dollar amount. The resulting EPS of $5.85 is lower than 2021 and my last estimate due to the loan loss provision build this year compared to big reserve releases last year.

Author Spreadsheet (Data source: Company guidance and author estimates)

Good Deals Across The Capital Structure

Synchrony also has a preferred issue (SYF.PA) with a 5.625% coupon now trading at $19.59 for a current yield of 7.25%. The preferred is callable starting on 11/15/2024 at par value of $25. While I wouldn’t expect a call in the current interest rate environment, it could happen if rates go down. With $734 million outstanding, the preferred is only around 5% of total equity. Also, preferred dividends are only about 1.5% of forecasted net income this year. The BB- rating from S&P seems too low given this excellent coverage.

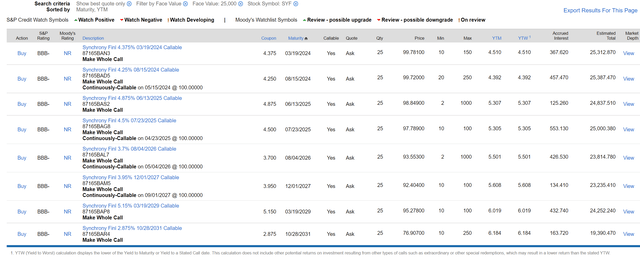

Synchrony also has a number of bonds available with maturity dates from March 2024 (YTM 4.5%) to October 2031 (YTM 6.2%). These bonds are rated BBB- by S&P and are a good deal now while the middle part of the yield curve is elevated.

Finally, Synchrony offers good savings account rates such as 2.65% for a 19-month CD and 1.4% for a high yield savings account. These can be opened online, and it is easy to set up ACH transfers to other banks or brokers.

Conclusion

SYF share price is down about 20% since last quarter due to worries about an upcoming recession having an impact on consumer spending. In the 2Q 2022 earnings release, we see that the consumer is still paying their bills on time, even as they are buying more and starting to carry a higher balance. The organic growth in loan receivables combined with new programs is more than offsetting the lost interest income from the recently sold BP and Gap loan portfolios. Inflation is causing consumers to rotate into non-discretionary purchases, but total spending remains strong. Most consumers still have a cushion of savings from last year’s stimulus payments.

The loan receivables growth is the main driver of earnings, which is enabling Synchrony to continue buying back large quantities of shares, helping EPS and book value per share. This is true even with a more conservative estimate for loan loss reserve builds in the second half of 2022. The bank should earn $5.85 per share this year which puts the P/E at a ridiculously cheap 5.5 times 2022 earnings. While earnings could dip in the event of a recession, the bank remains well capitalized with good liquidity to make it through. After rating SYF a Buy last quarter, nothing has changed about the company fundamentals. Only the stock is 20% cheaper. This makes SYF a Strong Buy. If you are still not convinced about the common stock, there are other securities higher up the capital structure that also offer attractive returns including preferred stock, bonds, CDs and savings accounts.

Be the first to comment