onurdongel

Highlights

With a >$11bn backlog for its warehouse automation system, which I see as revolutionary technology, and a highly experienced management team, I believe Symbotic Inc (NASDAQ:NASDAQ:SYM) is well-positioned for long-term growth and can quickly reach EBITDA/FCF breakeven. SYM’s present price is a little steep, but I believe there is still a lot of potential for the company to grow and prosper, so long as management continues to carry out its strategic initiatives.

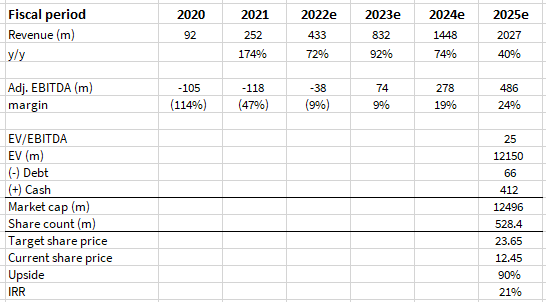

At today’s valuation, assuming SYM hits its guidance, there is ~90% upside over the next 3 years, or 3 years 21% IRR.

Company description

SYM is in the automation business, primarily in developing innovative tools for the robotic automation of case and pallet handling in massive storage and distribution facilities. Its automated system aims to reduce overhead costs and increase productivity in the supply chain by speeding up the flow of commodities. SYM has spent >$700 million developing its platform and currently has over 400 granted or pending patents. Multiple well-known stores employ this system, including Walmart (WMT), Albertsons (ACI), and Target (TGT). In May 2022, SYM and WMT said that they would add 188 modules to each of WMT’s 42 regional distribution centers as part of their partnership.

Thesis

SYM operates in a big TAM that gives it sufficient runway to grow

SYM’s first aim is to target the North American warehouses of the 10 biggest brick-and-mortar enterprises across five main verticals, which the company says represents a $133 billion market potential in the United States:

- Grocery

- Food distribution

- CPG

- Textiles and apparel

- General goods

SYM also estimated an additional $121 billion in revenue from its secondary verticals:

- Home improvement products

- 3PL

- Non-food CPGs and refrigerated frozen goods

- Auto-parts

Looking abroad, SYM also anticipates expanding to Europe and Canada, which, according to the company, provides an additional $83 billion in TAM. SYM says its total addressable market is $393 billion across over 6,500 worldwide distribution hubs.

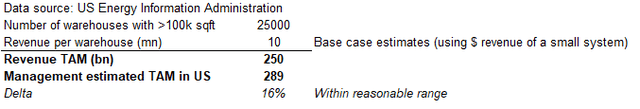

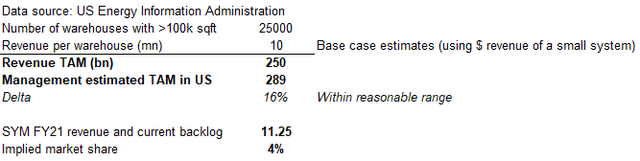

My top-down analysis suggests that management estimates are rather sensible: using data from the US Energy Information Administration, there are 25K large warehouses (defined as warehouses with >100k sqft) in the US. Applying the revenue of the smallest system would easily suggest a TAM of >200bn (if we assume a mix of small and large systems implemented).

Own analysis

As of FY21 SYM has revenue of ~$250m and a current backlog of ~$11bn. Assuming SYM were to execute successfully on all of its backlog with no further growth, it implies SYM only has a low-single digit market share.

Own analysis

TAM growth is underpinned by several growth tailwinds

Several things, like the growth of e-commerce, the rise of stock-keeping units, and the cost and availability of workers, suggest that the market for industrial automation systems may become a big one.

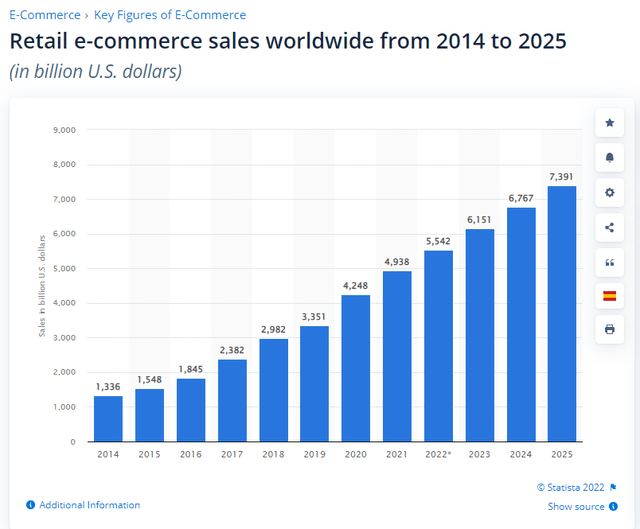

I believe that the ongoing growth of e-commerce will support the long-term development of warehouse and distribution center operations, as we can see from the growth in the total number of warehouses in the US, from over 15k in 2008 to over 19k in 2020. I believe that in order to handle the higher volumes, there will be a need for both ongoing activities at warehouse and distribution centers and more sophisticated systems. Over the next years and decades, I believe eCommerce will keep growing and its penetration rate will keep rising. One simple example is that Amazon eCommerce is still growing at a rapid rate even after years of tremendous growth. We are not near the end yet.

Statista

Automated warehouse solutions solve complexity and operational pain points

More efficient automated storage solutions need to be created in order to deal with the difficulties of maintaining a growing inventory of SKUs. Customers have become used to a broader variety of product choices and needs as a result of the proliferation of e-commerce, putting additional strain on warehouses to handle a greater variety of SKUs and a higher rate of product turnover. In addition, the rise of e-commerce has necessitated the use of several distribution channels for brick-and-mortar retailers, including in-store, online, and pick-up in-store locations, as well as reverse logistics for product returns. As more products are sent via more channels, the complexity of warehouse and distribution center operations has increased, necessitating increasingly automated solutions. Time and security concerns have also been exacerbated by inefficiencies in the warehouse and storage business. The proliferation of increasingly automated warehouse technology would be a problem solver in that it improves warehouse operations’ efficacy.

Automated warehouse solutions lift the burden of labour costs and scarcity. The rising cost of labor and the resulting lack of skilled personnel is another key reason for adopting more automated solutions in the warehouse and storage sector. The pandemic and current all-time-low unemployment levels are a serious problem for the sector, as it is for many others. Warehouse labor costs have increased as a result of a lack of available workers, which has resulted in the average hourly wage in the logistics industry having increased by over 20% since 2015 to $22. According to the US BLS, job turnover has also gone up a lot, reaching 20% in the transportation, warehousing, and utilities sectors between 2017 and 2021, while it only went up 9% for all non-farm workers over the same time period.

SYM strong base of customers supports long-term growth

Big-box stores like WMT, ACI, and TGT are among SYM’s most important clients. Among them, SYM has a deep relationship with WMT. The most important aspect of this WMT arrangement, in my view, is that it provides SYM with a solid backlog, which provides strong cashflow visibility and facilitates the planning of reinvestments. WMT’s focus on omnichannel distribution has also helped SYM make and test its breakpack system for handling single items.

As of FY21, 67% of all sales came from WMT, making them the company’s top client. Since 2015, SYM has collaborated with WMT, and in 2017, the two companies reached a deal to merge their respective technologies. In September of 2021, WMT contracted with SYM to roll out 80 modules at 25 of the retailer’s 42 distribution sites. For SYM, this contract was a significant chunk of their $5.4 billion order backlog. In May 2022, WMT and SYM announced that their partnership would be expanded to include all 42 of the retailer’s regional distribution facilities, adding a total of 188 modules. The result of this expansion is a $6.1 billion increase in SYM’s order backlog. The bonus offer comes with a breakpack, which can be picked up at any of the 42 distribution centers.

The technology behind SYM’s breakpack prototype is still in development, but it will eventually be able to atomize cases to the item level. By making e-commerce fulfillment and other omnichannel activities easier, this technology could help SYM reach a larger audience than before. This would expand its market beyond traditional distribution centers that supply brick-and-mortar shops.

Meanwhile, ACI and Target are two of SYM’s other big customers. They only make up a small part of SYMs backlog right now, but they could become bigger opportunities in the future.

Financials and valuation

I believe SYM is a long at the current valuation. My model assumes SYM can hit its FY25 guidance (as stated in the SPAC deck). Over time, the company’s strong top-line growth (which is supported by its $11 billion backlog) will help improve margins. However, this will depend on how quickly it can ramp up (convince clients to start projects so that revenue can flow), and this will be something to keep an eye on.

Assuming SYM hits guidance (as per SPAC presentation), which I think they can, it implies 90% upside from today’s price, or 21% IRR over 3 years. I do note that I assume SYM exits at 25x EBITDA in FY2H, 1x higher than its peer group over the past year. SYM should trade at a higher premium because of its fast growth and large number of well-known clients.

Own model

Risks

Over reliance on WMT and other big-box retailers

As WMT makes up the majority of SYM’s backlog, a slowdown in the pace of buildouts will greatly impact SYM’s ability to hit guidance. Aside from the risk that comes from what WMT does, the speed of buildouts also depends on how well SYM does its job, which could be affected by many things, like the weather.

The organic rate of innovation

We live in a world where technology advances before us in real time. While SYM has a leading product today, it is hard to underwrite SYM as the only product that can solve the problem it addresses. Increased competition in the industry could, over time, render SYM obsolete.

CAPEX cycle

In a way, SYM LT growth (pace of deployment) is dependent on the CAPEX of its customers, which in the current rising rate environment and macro uncertainty, could force customers to pushback on any deployment to stack up liquidity in the event of a major recession.

Conclusion

SYM has a revolutionary product that solves a significant pain point for many industries, which gives it sufficient runway to continue growing. At the onset (today), SYM has already earned the trust of big-box retailers such as WMT and TGT, which are major sources of cash flow as they provide SYM with an $11 billion backlog of orders. If SYM can meet the goals set by management over the next few years, I think the upside from the current price is very appealing.

Be the first to comment