marrio31/iStock via Getty Images

Introduction

We review our Hold rating on Swedish Match AB (OTCPK:SWMAY) (referred here as “SWMA”) after Philip Morris (PM) extended the acceptance period for its tender offer again to November 4.

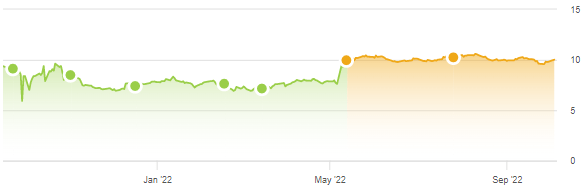

We downgraded our rating on SWMA from Buy to Hold in May, after the share price rose to SEK 100.95 following the SEK 106 per share offer from PM. Since then shares have risen another 8% to SEK 109.45, mirroring a similar depreciation of the Swedish krona against the U.S. dollar, with its (unofficial) U.S. ADR remaining largely flat:

|

Librarian SWMA Rating vs. U.S. ADR Price (Last 1 Year)  Source: Seeking Alpha (05-Oct-22). |

We think the current PM offer will almost certainly fail, as three investors opposed to the offer have effectively reached the 10% ownership needed to block it. PM would need to raise its offer substantially for it to succeed, despite recent executive comments downplaying the likelihood of this happening. However, PM’s commitment to its dividend will likely limit its ability to pay more, and other potential routes to enter the U.S. market have opened up. We continue to believe PM’s offer materially undervalues SWMA shares, but also see the possibility of PM walking away, which could create a more attractive entry point. For this reason, we reiterate our Hold rating, meaning SWMA stock should be avoided for now.

Offer Acceptance Period Extended

Philip Morris announced a further extension of the acceptance period of its offer on Tuesday (October 4), from October 21 to November 4. We believe the extension itself has little deal implications.

PM’s stated reason for the extension was that it now expects the European Commission review of the transaction to take until late October. Sources quoted by Reuters on the same day claimed that “the EU antitrust enforcer does not see any competition issues arising from the deal, but that a final decision has not been made”. The transaction has already satisfied U.S. anti-trust requirements, after the mandatory waiting period expired in late June without objections.

In the same announcement PM disclosed that only 0.51% of SWMA shares have accepted the offer to date. However, shareholders have little to gain by indicating their acceptance early, and can in any case rescind any acceptance up to the last day of the offer period. We do not see this percentage figure a meaningful indicator.

Effective 10% Blocking Minority

More meaningful is that three key shareholders now effectively hold the 10% needed to block the deal, which means Philip Morris’ offer will almost certainly fail in its current form.

PM’s offer is conditional on a 90% acceptance from all SWMA shareholders. The 90% figure is crucial because, under Swedish law, an acquiror can only force other shareholders to sell their shares if it is holding 90% or more of the shares. Conversely, minority shareholders can block any bid if they hold 10%.

Key shareholders opposed to the PM offer have effectively reached the 10% threshold in the past few weeks. Activist investor Elliott Management disclosed in regulatory filings that it has built a 7.25% stake as of September 30. Framtiden Management, an U.S. investment firm with “about 1%” (14.5m shares) of SWMA announced their opposition in a public letter on September 21. Bronte Capital, an Australian hedge fund also with around 1% (15.1m shares), has opposed the offer from the start.

These three firms, based on their disclosed numbers, own 9.25% of SWMA. According to a Bloomberg report (subscription required) in September, other hedge funds have also bought into SWMA, with Davidson Kempner and HBK “both approaching the 5% level” and hedge funds in total owning “at least 25%” of the shares.

The current PM offer thus stands almost no chance of succeeding.

Framtiden’s letter stated they “would find it hard to justify parting with … Swedish Match for much less than SEK 200 / share”, while Bronte Capital CIO John Hempton had opined that a private equity buyout would work at SEK 175. On the other hand, both are longstanding shareholders, so some of the newer holders who bought SWMA as a merger arbitrage opportunity may settle for a lower price.

Philip Morris Comments on Offer

Recent comments by Philip Morris executives have downplayed the likelihood of its offer being raised.

PM CEO Jacek Olczak, speaking to a Reuters reporter on September 29, said that:

No (we have not considered withdrawing the offer) – what I’m saying is that the offer which is out there — the 106 SEK (per share) with 90% acceptance etc – is a good offer.”

According to Reuters, Olczak “declined to comment on whether Philip Morris would increase its offer”.

Olczak also said in a Bloomberg interview (subscription required) that:

Some people are seeing this as the only option. Swedish Match has a strategic importance to us but my strategy does not hinge on Swedish Match.”

Similarly, speaking at an investor conference on September 6, CFO Emmanuel Babeau said:

The only thing I can do today in front of you is to repeat the offer, which we believe is incredibly compelling for all the stakeholders of Swedish Match… Remember, it’s a 40% premium versus where the share price was trading before the offer. And since then, let’s be very clear. The market has been rather under pressure. The economy is under tremendous pressure and doubt and volatility.”

Unfortunately PM’s ability to pay more may be constrained, including by the commitment to its dividend.

PM Dividend and Leverage Constraints

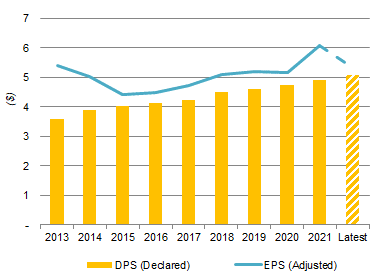

Philip Morris’ dividend stands at $5.08, implying a Payout Ratio of 95% even at the top of its 2022 guided Adjusted EPS of $5.23-5.34 (excluding $0.67-0.71 from Russia and Ukraine, which are unlikely to contribute after 2022).

PM earnings are under pressure from the strong U.S. dollar and the pending exit from Russia. Short-term declines in PM’s EPS due to a strong USD are not unprecedented – Adjusted EPS fell from $5.40 to $.42 in 2013-15:

|

PM EPS and Dividends (Since 2013)  Source: PM company filings. |

Management has repeatedly described PM’s dividend as “sacrosanct” and indicated a willingness to fund it by debt during temporary shortfalls, and dividend growth continued even in 2013-15 (though with the Payout Ratio not exceeding 92%, compared to 95% now). However, new debt incurred to acquire SWMA could make things too difficult.

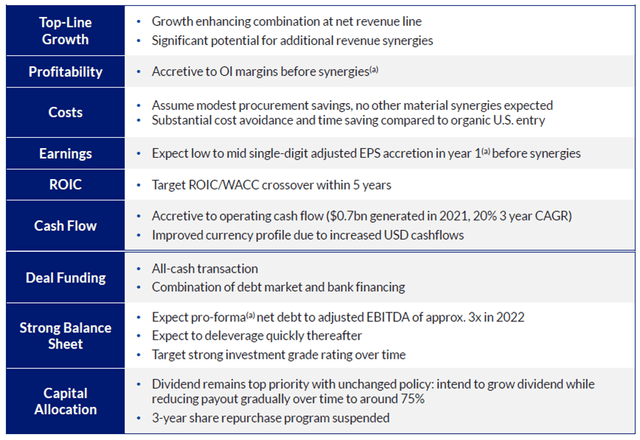

When the offer was announced in May, PM expected the transaction to be “low to mid single-digit” accretive to Adjusted EPS “in year 1 before synergies”, and for acquisition debt to push Net Debt / EBITDA to “approximately 3x in 2022”:

|

PM SWMA Offer Highlights  Source: PM SWMA offer presentation (11-May-22). |

The “low to mid single-digit” EPS accretion could push the Payout Ratio down to 90% at most. The stated goal was “to grow dividend while reducing payout gradually over time to around 75%”.

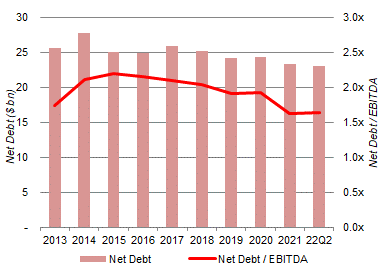

PM has no official leverage target, but is committed to an investment grade rating on its debt, and we believe management prefers Net Debt / EBITDA to be below 2x. This ratio last peaked at 2.23x at Q1 2025. Share repurchases were suspended that year and did not resume until after Q2 2021, when Net Debt / EBITDA had fallen back to 1.74x, helped by PM reducing its Net Debt in dollar terms in that period:

|

PM Net Debt & Leverage (Since 2013)  Source: PM company filings. |

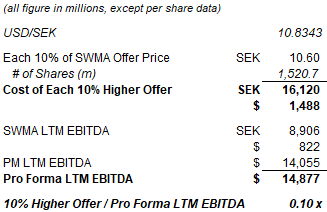

With 1.52bn SWMA shares outstanding, and a pro forma last-twelve-month EBITDA of $15.0bn, each 10% increase in PM’s offer would cost approximately $1.5bn, or another 0.1x in Net Debt / EBITDA:

|

Cost of Higher SWMA Offer (Estimated)  Source: Company filings, Librarian Capital estimates. NB. LTM figures are as of Q2 2022 and include Russia/Ukraine contribution. |

With global macro uncertainty affecting Emerging Markets, currencies, and debt markets, we expect management to want to leave some headroom in its leverage ratios, potentially to finance dividend growth through difficult years, limiting PM’s ability to raise its SWMA offer.

The actual post-deal Payout Ratio and leverage could be better once synergies materialize. However, they could also be worse, at least temporarily, if the dollar continues to strength (SWMA’s business is one-third non-U.S.), if Emerging Markets deteriorate further due to high energy prices, or if the FDA’s plans to ban flavored cigars progress faster than expected (U.S. Cigars contributed 23% of SWMA’s EBIT in 2021).

Other U.S. Entry Routes Opening

SWMA is an attractive business on its own, but part of its value to PM is also as an entry route platform into the U.S. Other ways to enter the U.S. market have recently opened up.

PM can now acquire Juul, still the #2 e-vapor player in the U.S. market. Altria (MO), who spent $12.8bn to acquire a 35% stake in Juul in 2018, opted to terminate its non-compete with the company on September 29. Per the terms of the original agreement, this means Altria has lost its pre-emption rights, Board designation rights and other consent rights. Altria is now left with one independent director on Juul’s seven-member board. In addition, Juul is reportedly now exploring a Chapter 11 bankruptcy process (according to a Wall Street Journal article on October 4, subscription required), which would render Altria’s existing equity worthless and open the way for new bidders.

PM can also acquire Njoy, the #3 e-vapor player in the U.S. (albeit with just a 3% market share) active in disposables. Njoy has reportedly been in a process to raise new financing or sell itself since July (as reported by the Wall Street Journal, subscription required). Njoy last raised financing in 2020 with a $2.77bn valuation, and (unlike Juul and Imperial Brands (OTCQX:IMBBY)) has received Marketing Granted Orders for some of its major e-vapor products.

Swedish Match Valuation

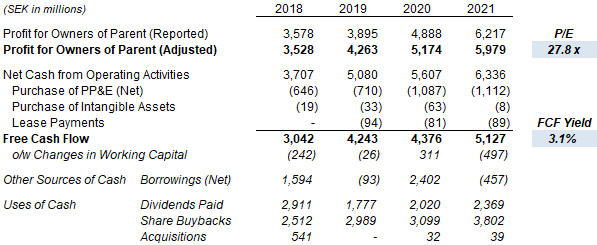

At SEK 109.45, with respect to 2021 financials, SWMA stock is trading at a 27.8x P/E and a 3.1% Free Cash Flow Yield:

|

SWMA Net Income, Cashflow & Valuation (2018-21)  Source: SWMA company filings. |

The current dividend is SEK 1.86, representing a Dividend Yield of 1.7%.

Conclusion: Is Swedish Match A Buy?

We continue to believe PM’s bid materially undervalues Swedish Match, and investors opposed to the bid now hold enough shares to block it.

However, PM’s ability to pay more is constrained by management’s commitment to its dividend and investment grade rating. There is a material possibility that PM will walk away in our opinion.

If PM were to walk away, we expect SWMA shares to correct significantly, as a significant number of current holders likely bought into it specifically as a merger arbitrage opportunity.

The most likely outcomes are therefore either a limited increase in PM’s offer, or a more attractive entry point for long-term investors. We would avoid SWMA stock for now, and reiterate our Hold rating.

Be the first to comment