sematadesign

Pinterest (NYSE:PINS) soared after reporting earnings that quelled the concerns of Wall Street. While the social media company continues to struggle keeping users gained during the pandemic, the results were “good enough” and showed that the app retains relevance even as users spend more time away from their mobile devices. The stock has gotten so cheap that it trades lower than pre-pandemic levels even though the company retains a cash-rich balance sheet and continues to generate positive cash flows. While growth is likely to remain muted in the near term due to tough comps and a difficult online advertising market, the stock is too cheap here. What’s more, the presence of activist investor Elliott Management may cause the stock to outperform in the near term in hopes of a potential takeout.

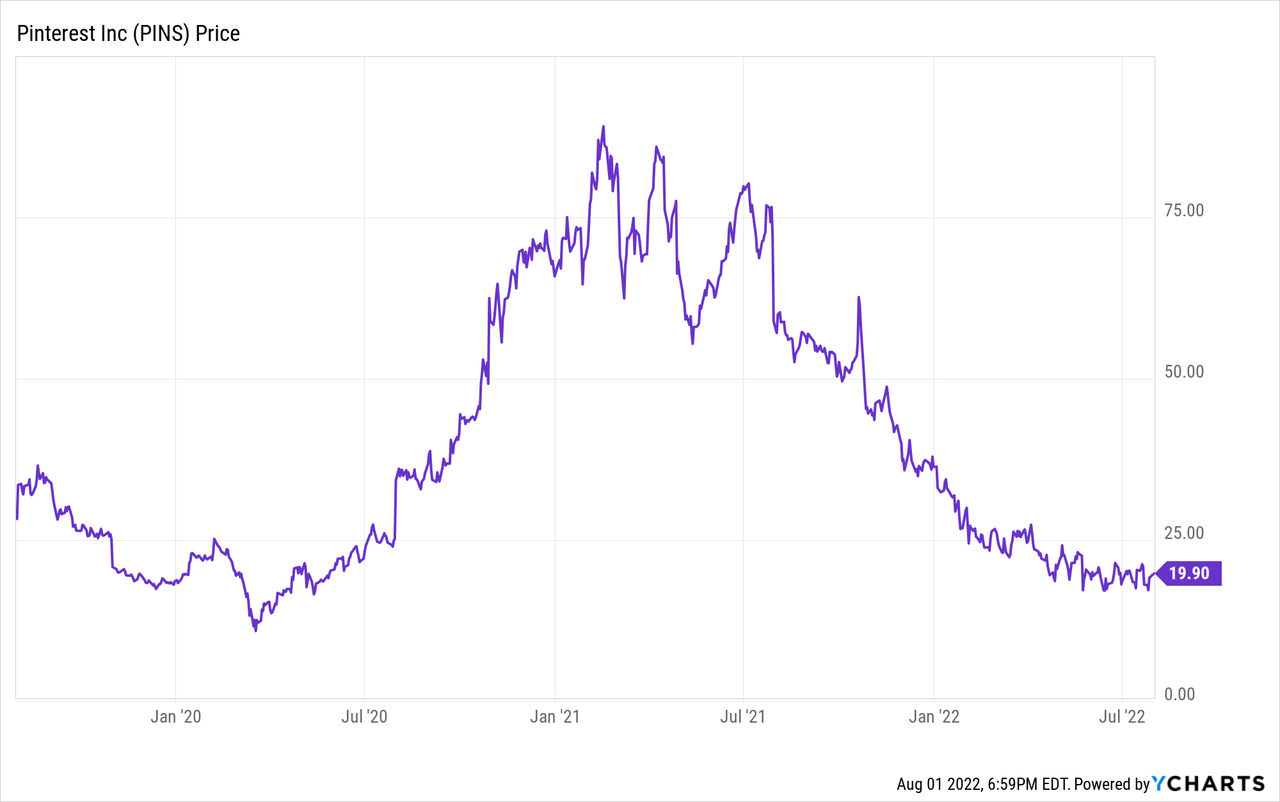

PINS Stock Price

PINS peaked just above $89 per share in early 2021 but has given up all those gains and more. The stock traded below $20 per share heading into the earnings report.

I last covered PINS in March where I rated the stock a strong buy on account of the strong balance sheet and low valuation. The fundamentals have remained steady even in light of macro-headwinds.

PINS Stock Key Metrics

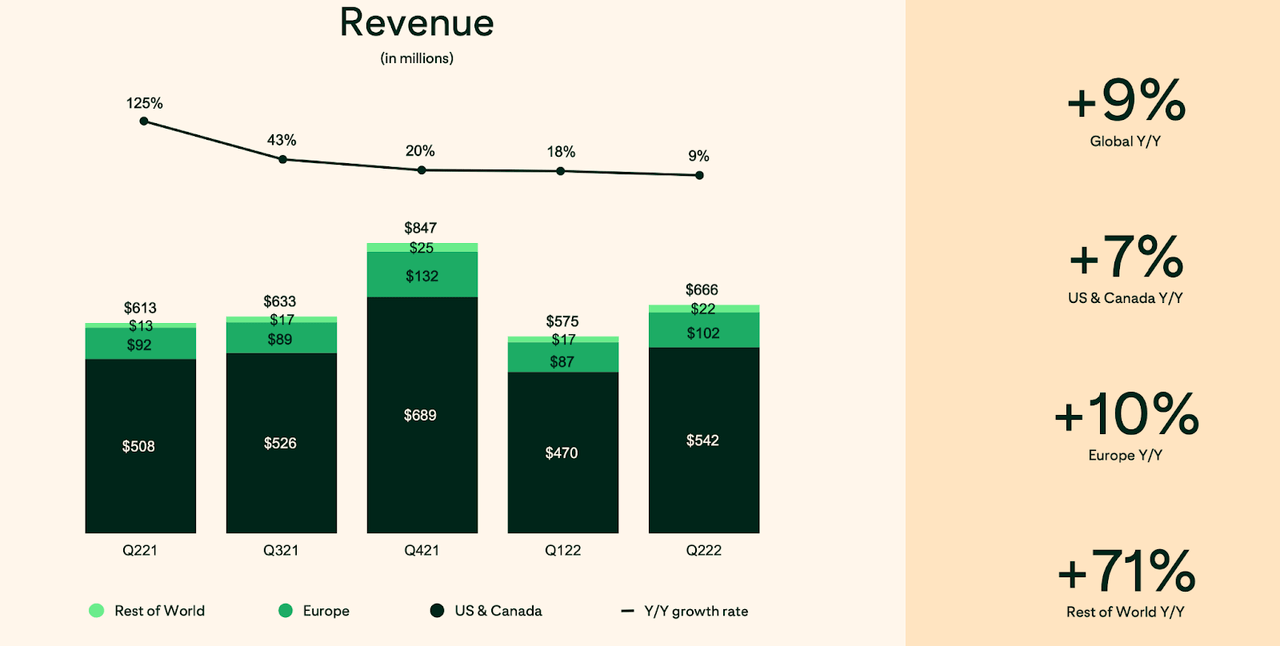

PINS showed 9% revenue growth this past quarter, continuing several quarters of decelerating growth.

2022 Q2 Presentation

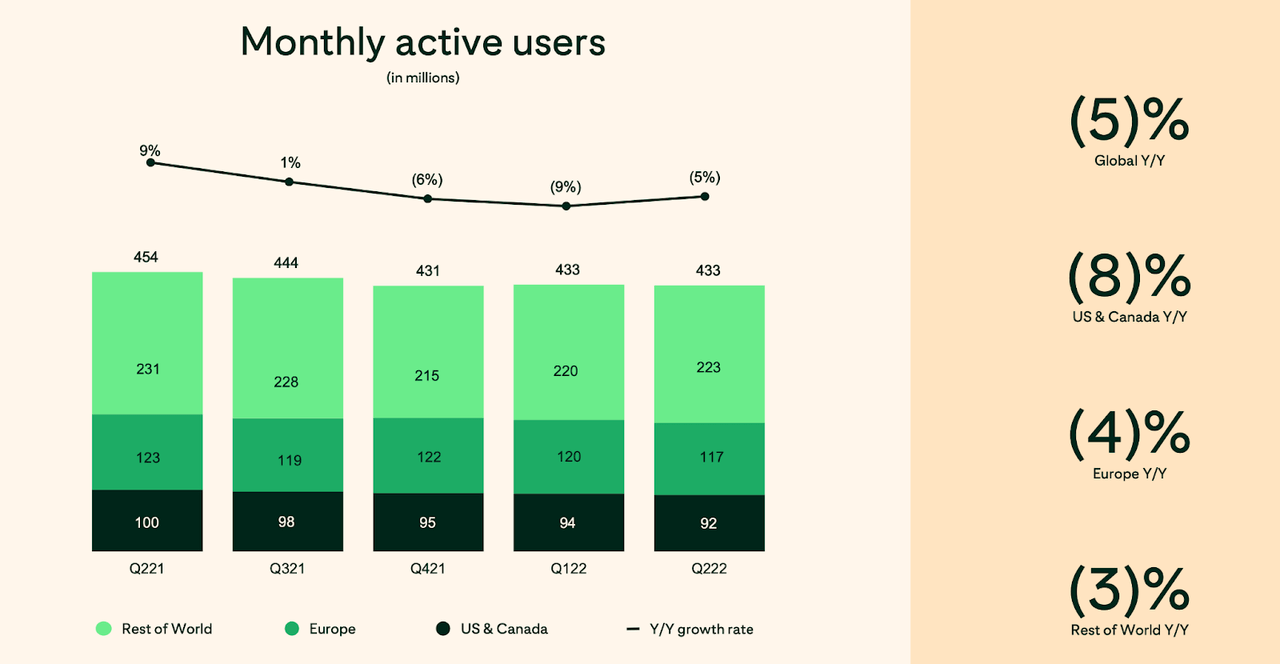

The main issue has been retaining users. Monthly active users (‘MAUs’) declined 5% year over year, but users in US & Canada declined by 8%.

2022 Q2 Presentation

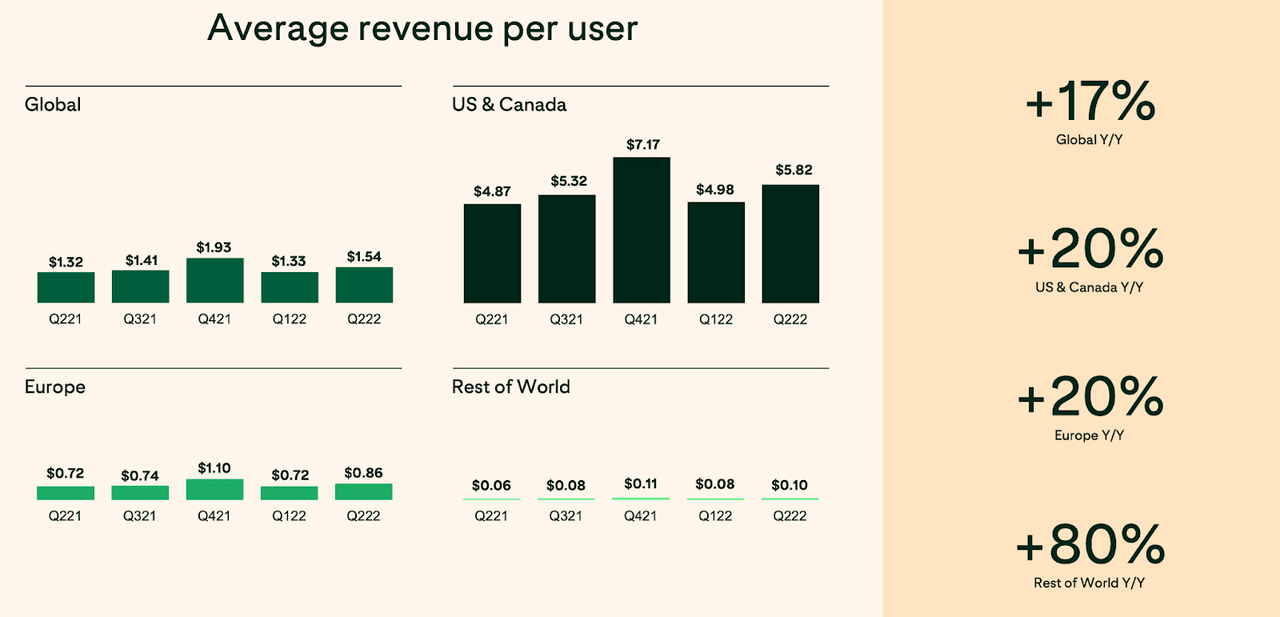

That had an outsized impact on overall revenue growth because US & Canadian users generate the largest average revenue per user (‘ARPU’). Even so, PINS was able to offset struggling MAUs growth with solid ARPU growth.

2022 Q2 Presentation

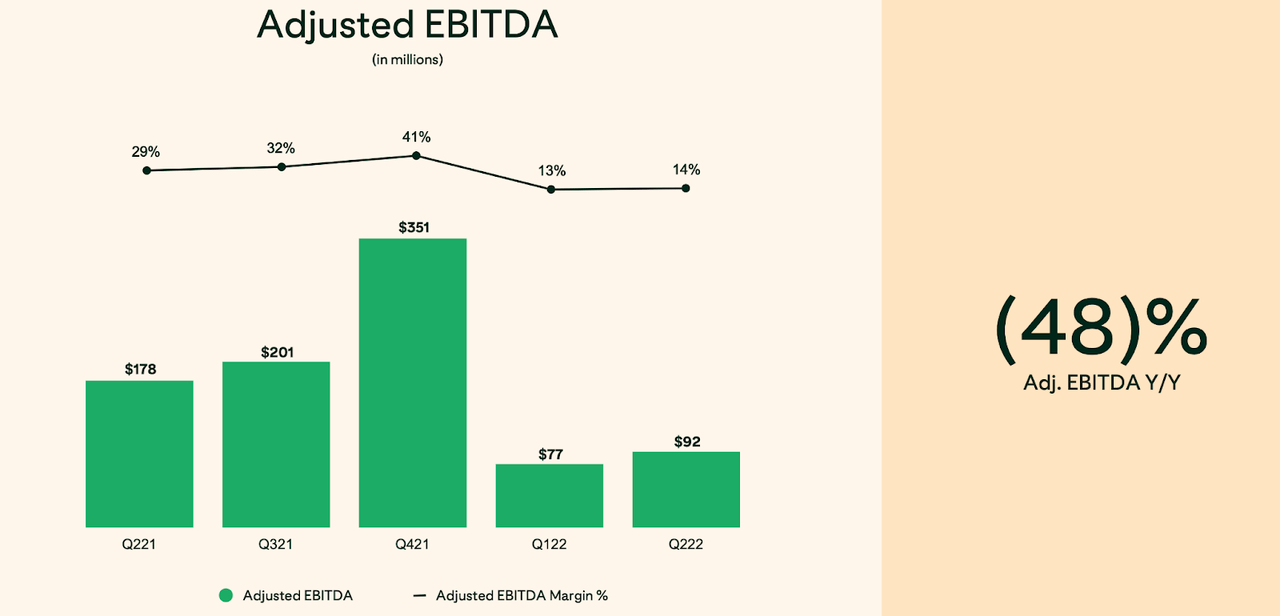

PINS saw its profit margins deteriorate from the stellar 29% to just 14% in this quarter.

2022 Q2 Presentation

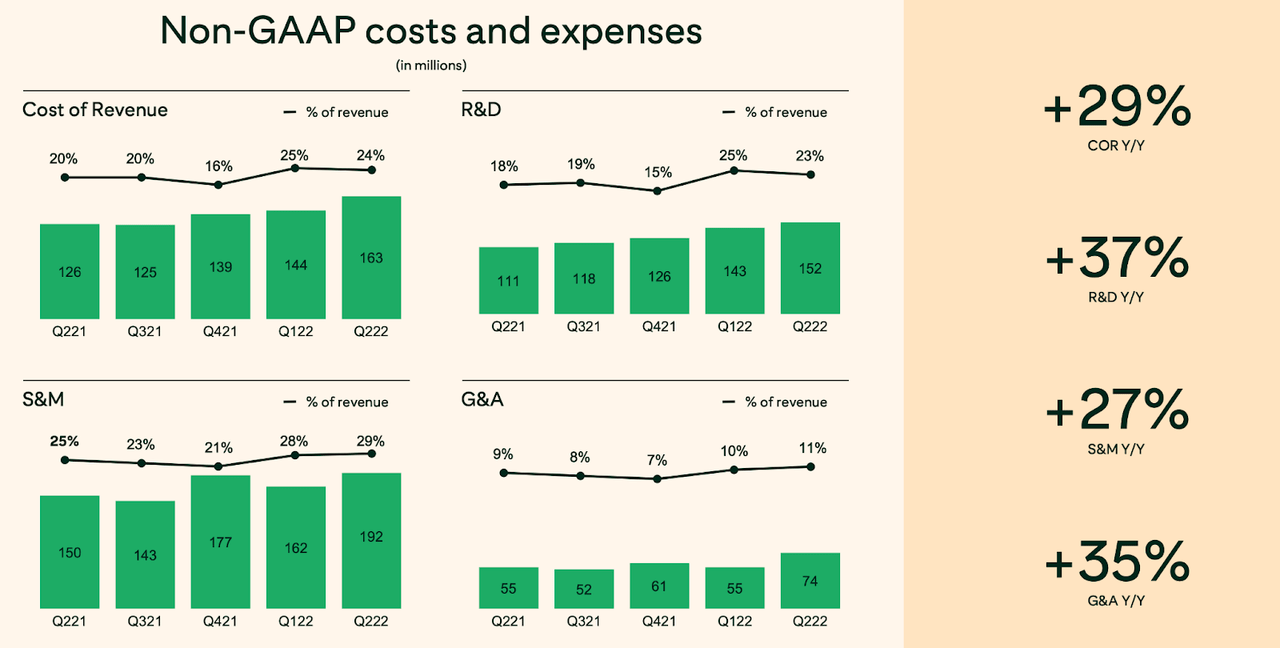

The margin deterioration appears to be mainly due to heavy investment in growth, as R&D expenses jumped 37% year over year.

2022 Q2 Presentation

Looking forward, PINS expects mid-single digit revenue growth in the next quarter (inclusive of foreign exchange headwinds). While that growth outlook is by no means optimistic, it is still respectable considering the great struggles seen across the online advertising landscape.

Net cash stood at $2.6 billion in the quarter – making up 20% of the market cap.

Is PINS Stock Undervalued?

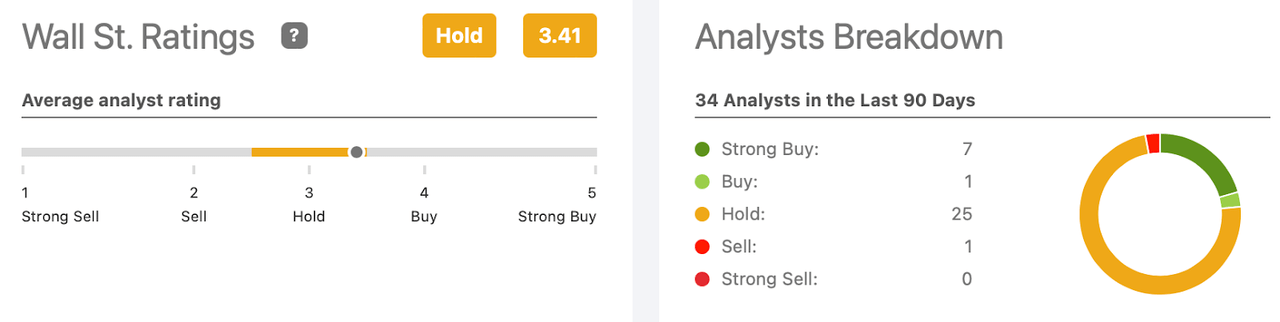

Wall Street appears to have given up on the stock – perhaps right when the stock is about to rally. Analysts have an average 3.41 out of 5 hold rating.

Seeking Alpha

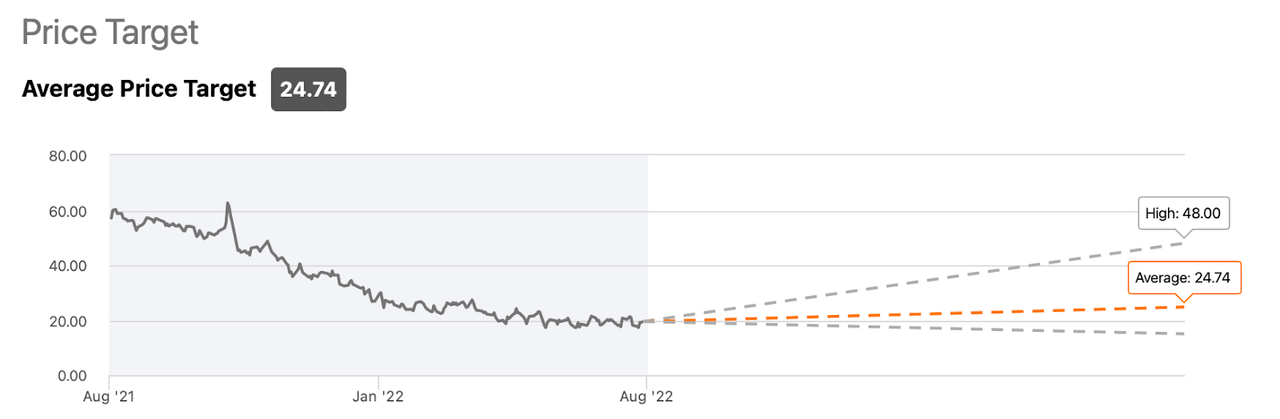

The average price target is $24.74 per share, reflecting minimal upside.

Seeking Alpha

I expect PINS stock to rally as analysts eventually lift their price targets.

Is PINS Stock A Buy, Sell, or Hold?

Prior to releasing earnings, PINS was trading around 4.5x sales and 23x forward earnings.

Seeking Alpha

Considering PINS’ stellar profit margins today, I could see the company sustaining at least 30% net margins over the long term. Assuming 14% long-term growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 6.3x sales, reflecting at least 38% potential upside. But there is reason to believe that the company can return to stronger growth rates – it appears that some investors agree. Famed activist investor Elliott Management has taken a position in the company and voiced support for the new CEO Bill Ready. With the stock trading so cheaply, it would make sense to seek a sale of the company. There is also the potential for a private equity takeover as I suspect that the company could theoretically pull back on growth investments to show outsized net margins. These possibilities may help the stock outperform tech peers in the near term due to the potential for catalysts. The biggest risk here is that of losing relevance. If it turns out that Pinterest was just a fad and the company is unable to stop the bleeding in MAUs, then I am doubtful that growing ARPU would be enough to sustain the growth trajectory – growing ARPU would also become increasingly more difficult from a lower user base. The strong balance sheet and cash flow profile should insulate the company from financial risk amidst a difficult economy, but the stock may remain volatile in spite of the low valuations. I continue to rate the stock a strong buy as it is trading too cheaply – while this is not a perfect growth story, the risk-reward skews heavily upward.

Be the first to comment