izusek/E+ via Getty Images

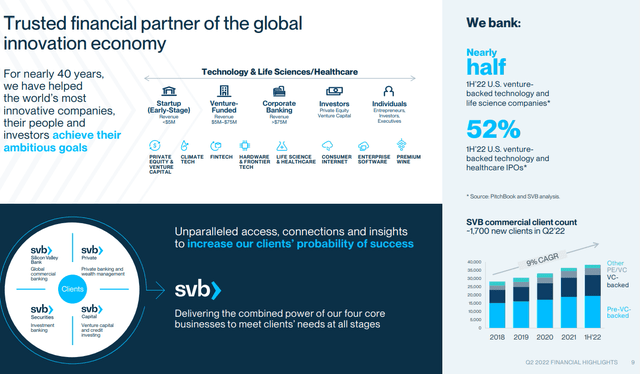

SVB Financial Group (NASDAQ:SIVB) is diversified across several segments of investment and commercial banking, capital markets, and wealth management. With roots in Silicon Valley, the group has specialized in working with technology and life sciences companies as its core client base. Indeed, this exposure has driven strong growth over the last several years, culminating with a record 2021 where total client funds nearly doubled. Fast forward, the story this year has been a deep selloff in the stock amid the broader market volatility and slowdown in lending.

The company just reported its latest quarterly results which missed expectations while management also cut full-year guidance. That being said, the stock is already down more than 40% year to date and looks interesting at the current level for a potential rebound. The long-term growth story remains in place, and despite the near-term headwinds, overall fundamentals are solid with compelling underlying value.

SIVB Earnings Recap

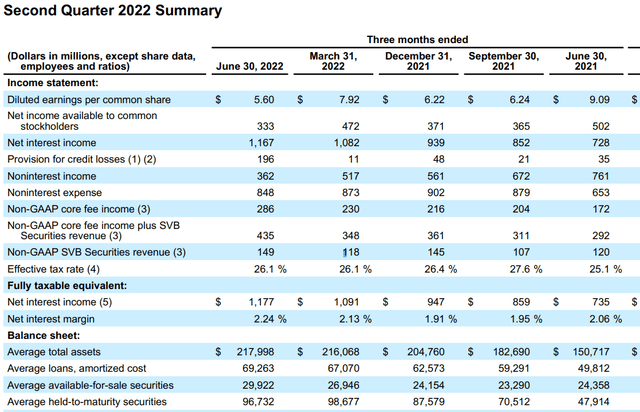

Q2 EPS of $5.60 representing a net income of $330 million, was down from EPS of $9.09 in the period last year and also $2.08 below the market estimates. A large part of the earnings miss to consensus was based on a larger provision for credit losses, with SIVB charging $196 million compared to $35 million in the period last year citing the more challenging economic outlook. Revenue of $1.5 billion, climbed by 2.7% year-over-year and was also softer than expected.

Management explains the financial market environment including rising interest rates and economic uncertainty limited activity in areas like venture capital investments and IPOs. With private tech companies as an important client category, this group has faced liquidity challenges with increased burn rates which have further translated into pressure on the bank’s balance sheet growth.

The trends were reflected in weaker key operating and financial metrics. Average total client funds, as a measure of on-balance sheet deposits and off-balance sheet client investment funds, decreased by -2.6% y/y to $386 billion. Period end loans balance at $71 billion was down -3.3% from Q2 last year. Non-interest income of $362 million declined from $517 million in Q1 highlighting the challenges.

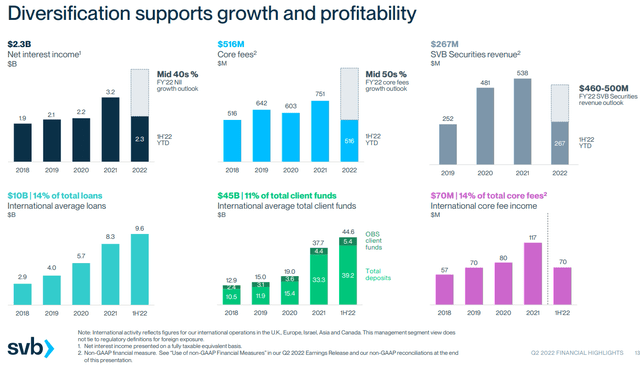

One strong point has been the trend higher in net interest income which reached $1.2 billion in Q2, up from $0.7 billion in Q2 2021. Here SIVB is benefiting from both the larger deposit base as well as the trend in rising rates that at least help mitigate some of the other weaknesses. Separately, “core fees” reflecting income from the more basic financial services and wealth management activity has climbed, reaching $286 million compared to $149 million last year. This also includes the boost from the company’s 2021 acquisition of “Boston Private Financial”.

Overall, it’s important to place some of these results in the context of the exceptional 2021. Conditions have slowed but the takeaway is that the underlying growth and profitability are in place.

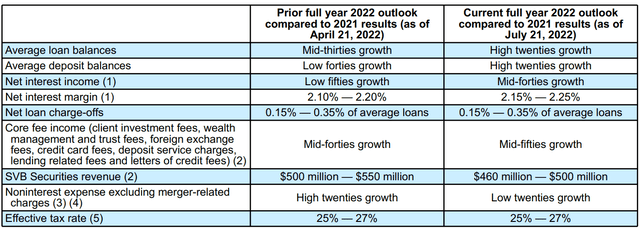

The other development this quarter was an update to full-year guidance. SVB Financial Group is revising lower its growth targets for average loan balances and average deposit balances to the “high twenties”, compared to the prior forecast in the “mid-thirties” and “low-forties” for each metric respectively. The biggest impact is a softer net interest income growth in the “mid-forties” compared to the “low-fifties” published at the time of the Q1 earnings report. Again, the changes reflect a recognition of the economic landscape compared to the stronger outlook at the start of the year.

Is SIVB A Good Stock?

The attraction of SIVB is its differentiated profile as a banking specialist dealing with tech and life sciences industries. Simply put, SIVB has built a reputation for understanding the unique needs of this segment and companies specifically choose to partner with the bank. SIVB notes that it worked with nearly half of all U.S. venture capital-backed tech and healthcare IPOs in 2021 highlighting its market reach.

By this measure, it’s clear that everything from record inflation, to the Fed tightening cycle, and global growth concerns have been a major headwind for the bank this year given that high-growth tech has been the most volatile market segment.

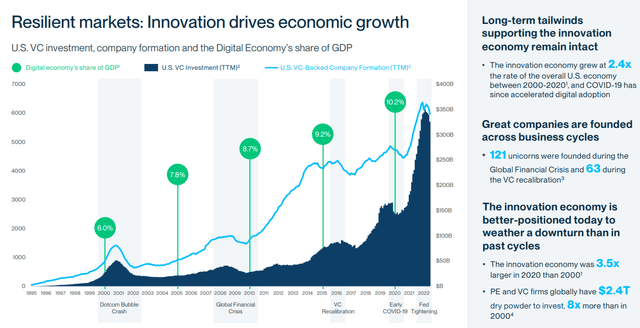

The way we’re looking at the stock is that the bullish case will need both the macro conditions to stabilize and sentiment towards the “innovation economy” to improve. SIVB makes the point that the secular trends in technology have been resilient over the last 30 years with all indications that the high-level trends like digitalization, cloud computing, next-gen communications, and fintech are still in the early stages of global adoption. The point here is to say we expect conditions to recover eventually.

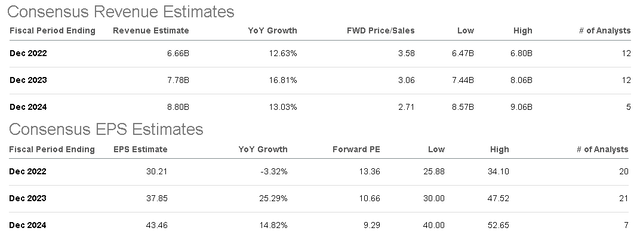

According to consensus estimates, SIVB is expected to reach EPS of $30.21 this year which represents a decline of 3% from 2021. Looking ahead, the forecast for top-line growth averaging 14% through 2024, can generate a rebound in EPS climbing 25% next year and 15% in 2024. The core assumption here is that market conditions will at least stabilize, with the U.S. economy avoiding any time of deep recession scenario.

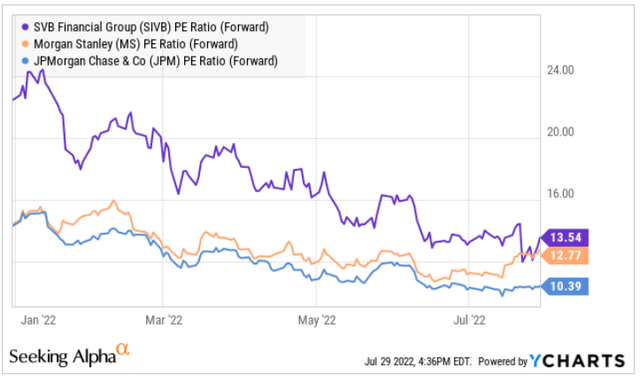

As it relates to valuation, it’s worth noting that SIVB is trading at a forward P/E of 13.5x, comparable to mega-cap investment banking leaders like Morgan Stanley (MS) at 12.8x or JPMorgan Chase & Co (JPM) at 10.4x. The distinction here is SIVB’s materially stronger long-term growth outlook over the next several years which we believe warrants a premium.

SIVB Stock Price Forecast

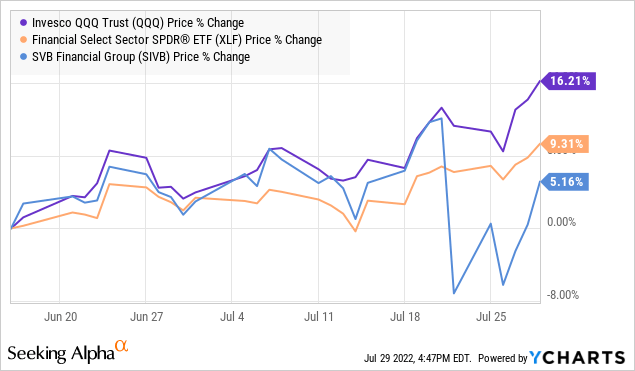

Favorably, the market action in recent weeks has turned decisively more positive based on what we view as a shifting market narrative. Compared to the major macro disruptions in the first half of the year, indications that inflation can trend lower would provide some confidence that the Fed’s strategy is working. As long as economic conditions remain stable, with continued labor market strength, a “soft landing” scenario playing out would support business lending activity and consumer confidence as a positive tailwind for the broader economy.

The Nasdaq-100 (QQQ) as a tech and growth company benchmark is up over 16% from its lows while The Financial Select Sector SPDR ETF (XLF) has rallied 9% over the period. With SIVB lagging thus far with just a 5% gain, our call is that we see room for SIVB to outperform going forward as a more high-beta trade capturing trends in both financials and tech.

Final Thoughts

We rate SIVB as a buy with a price target for the year ahead of $525 representing a forward P/E of 17.5x on the current consensus 2022 EPS. This is a case where despite the more difficult operating conditions, we sense that the market has gone too far in discounting this innovative banking leader. With an optimistic macro-outlook, the upside here is that SVB Financial Group is well-positioned to regain operating momentum alongside a recovery in the tech sector which may open the door for earnings to rebound higher.

The main risk to consider would be a scenario where economic forecasts deteriorate further. We also want to see some stability in long-term bond yields as supportive to credit markets. Monitoring points over the next few quarters include the trends in net interest margin as well as the loan balances growth.

Be the first to comment