Henrik Sorensen/DigitalVision via Getty Images

Published on the Value Lab 10/19/22

Suzano (NYSE:SUZ) is a company that we continuously follow, and ahead of earnings, we give some opinions in light of the pressures from Russian export bans. In short, Russia has prohibited the export of birch in retaliation to Western sanctions, and this means that production of soft pulp materials is going to get quite a bit more expensive with Russian feedstock accounting for about 10% of fibre supply. While this has a negative effect on Suzano, we believe its advantaged Brazilian geography gives it access to substitute feedstocks, where competing capacity in other geographies may struggle to keep production flows up. Limits on pulp production capacity will generate higher margins – the environment should be good for Suzano after its downtime is up.

Exposure to Birch

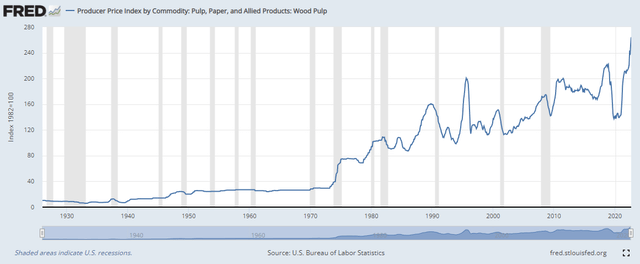

Price differentials between softwood and hardwood pulp had been rising, and now with the prohibition on the export of Russian birch that trend is likely to see a reversal, with birch-based pulp prices likely to come down. Products affected are hygiene products, things like toilet paper, and any soft paper-based materials. About 20% of Suzano’s sales are from paper products that quite intensively use softwood pulp, with the rest being the production of just pulp for other manufacturers to use to make their products. Suzano pulp is both soft and hardwood based. Pulp has already shot up on these latest developments as pulp producers pass on more costs on top of rising logistics and energy costs.

Naturally, rising input prices could be an issue for Suzano, but why do we think that on balance Suzano is going to end up seeing margin expansion and not margin contraction on these developments?

Firstly, scheduled downtime is coming in for a lot of producers of pulp, and this is going to mean lessened pulp production capacity. Suzano counts themselves among this number. Moreover, with 10% of the softwood coming out of markets some of this downtime is going to be protracted at facilities where insufficient feedstocks can be acquired. This is where Suzano is advantaged. First of all, they are a major producer of Eucalyptus-based pulp, common in the rainforests, and therefore already have a lot of hardwood access. Since this access is local, and Suzano has benefited from low-cost assets as a consequence of its geography, it will not be forced into downtime by market conditions. This will put it in a position in the medium term where its capacity is part of a more scarce landscape, and it also means its feedstock for hardwood pulps is going to be more isolated from Russian export ban pressures as their geography will be more isolated by the distance. In other words, the proportionate increase in pulp prices will not be met with the same proportionate increase in feedstock prices for Suzano in our opinion.

Remarks

We should note to investors that Suzano is putting some major facilities into downtime for Q4, meaning in the results following the coming ones some weeks of downtime at Aracruz will impact volumes. Since other producers are likely to be instituting downtime at the same time, since cycles are in phase ever since the pandemic, marginality should be protected in that period, and the benefits of lengthened downtime by competitors as production becomes less economical will likely materialise more substantially into 2023.

Macroeconomic risks are still a concern, and Suzano is valued as a total commodity player. Their PE is measly at less than 4x, even though they’ve actually just started paying a dividend that should be yielding around 3.6%. A reversal in the goods market is going to eventually create volatility in Suzano earnings, which had rocketed during COVID-19 and have been plateauing the last four quarters. The low PE reflects that. Nonetheless, a 30% earnings yield is massive, and with geopolitical pressures from Russia on feedstocks for competitors likely creating a beneficial situation for Suzano, there is a certain runway of payback before one would expect serious pressures on Suzano margins. We think it’s an interesting play right now.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment