Love Employee/iStock via Getty Images

Shares of Sutro Biopharma (NASDAQ:STRO) have lost 68% since my December 2020 article extolled the advantages of its cell free ADC platform. At the time, I considered the stock to be a Buy after promising initial data for STRO-002 in ovarian cancer that seemed indicative of broad applicability.

Over a 3-year timeframe, shares have lost one-third of their value as lead drug candidates move forward in the clinic and big pharma collaborations made significant progress.

After a reader mentioned this name, I decided to revisit given my interest in the ADC space, differentiated technology and advancements particularly with partnered efforts.

Another point influential in my revisiting was the phase 3 success of ADC peer ImmunoGen (IMGN), whose drug mirvetuximab is limited to FRα-high expressors whereas in the past I noted that Sutro’s STRO-002 appears to have a more broadly-applicable profile (though with significant tolerability challenges). Lastly, the China licensing deal made this name even more interesting given terms (respectable $40 million upfront cash payment) and specific language (plans now in the works to try the STRO-001 in indications of TNBC and NSCLC). This was followed by Astellas iADC pact including $90M upfront payment.

Chart

Figure 1: STRO weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares rise to a high of $28 in early 2021 on heels of early data for STRO-002 in heavily pretreated ovarian cancer patients. From there, shares have fallen to a low in the mid- single digits and appear to have bottomed. My initial take is that the current valuation offers investors an attractive point of entry, but as I have less confidence in the internal pipeline and more in partnered efforts, I think this is a multi-year story that will require significant patience and long-term mindset.

Overview

Reflecting on my December 2020 article, here are our previously stated keys to the bullish thesis:

-

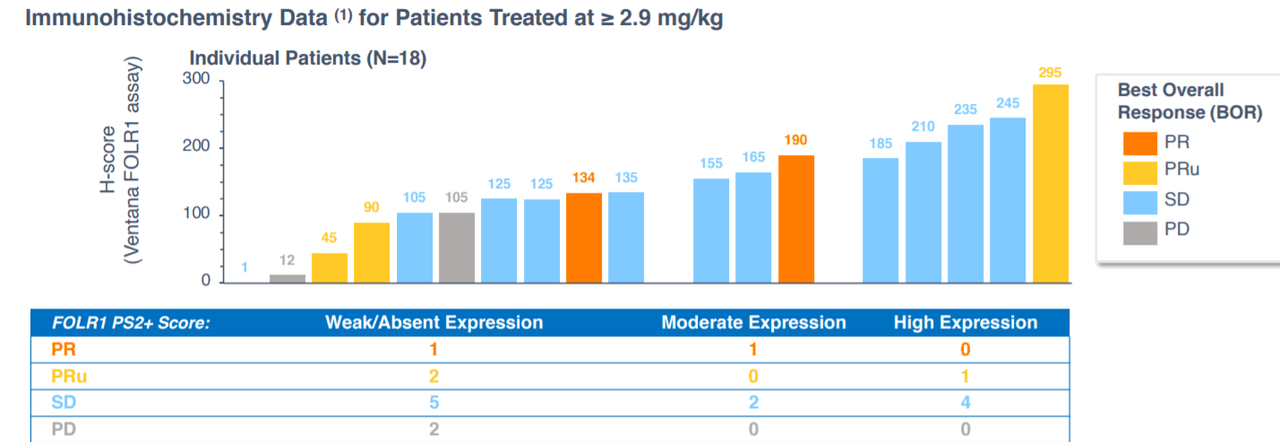

Initially, Sutro’s lead solid tumor program targeting folate-receptor alpha (FRα) did not interest me given that the target was plagued by a history of failures. I was also aware of ImmunoGen’s mirvetuximab flunking a prior pivotal study and giving it a second try via registrational study in just the FRα high population. However, Sutro’s clinical readout for STRO-002 attracted my interest given impressive response rate and durability in a very heavily pretreated population (lends credence to management commentary that the drug is best-in-class as they did not have to stratify or enrich for FRα high expressors). On the con side, however, therapeutic window could be narrower than it originally appeared given the neutropenia events requiring dose reduction.

-

Per my notes on Evercore presentation and KOL call, I came away with the impression that CEO Bill Newell was a straight shooter who clearly outlined benefits of the company’s cell free protein synthesis technology versus more traditional CHO or E coli cells (poor mechanism for discovery and scaling to commercial production). Cell free approach allowed the company to make many versions of a molecule rapidly, finding the best site of attachment and then varying linker & warhead to achieve optimal drug profile). Importantly, this approach allows them to rapidly scale and move forward (speed in the clinic).

-

The purported advantages of this approach were apparent in STRO-002 data, (much greater tumor killing effect as drug doesn’t get removed when it’s internalized, has relatively fast clearance rate and half life of 2.5 hours versus 35 to 40 hours for the competition). They are able to get the molecule into the tumor microenvironment, do its job and minimize bystander effect to achieve a much better toxicity profile. Per initial phase 1 data update in all comers, 87% of adverse events were grade 1 or 2 (very manageable). Women in the study had 5 prior lines of therapy and life expectancy of 6 to 9 months (population you would NOT expect to see much activity in). Mid 20s response rate was quite promising in that light, not to mention duration of women on the study (including those with stable disease receiving clinical benefit for 12 weeks or longer). We compared these results to ImmunoGen’s mirvetuximab, which saw far fewer responses in dose escalation study and considerably less durability. Given 002’s initial data, I expected even better response/durability in earlier lines of therapy.

-

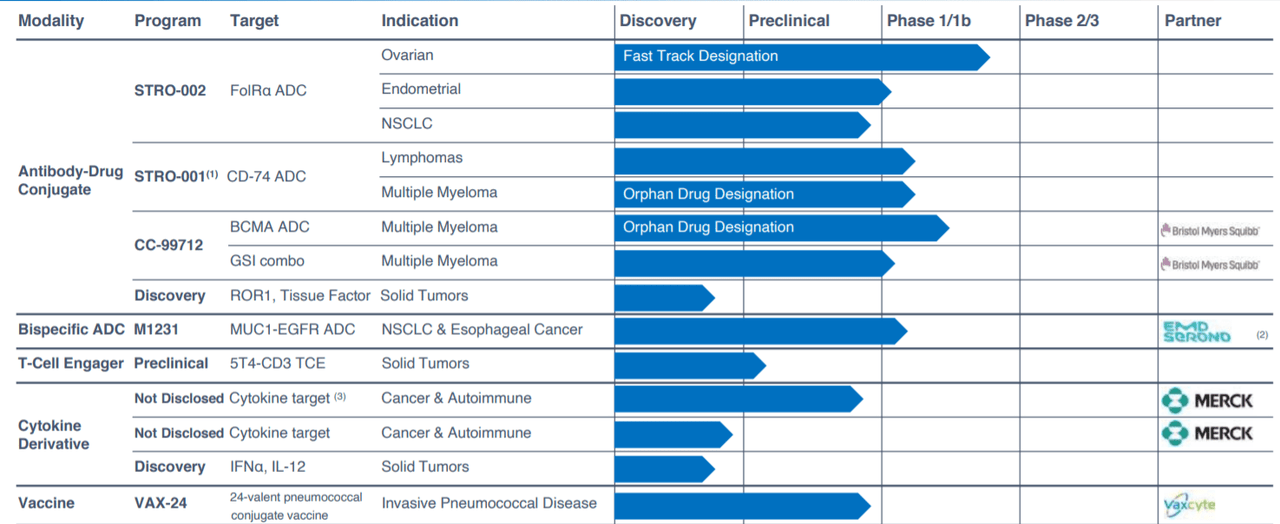

One partnership that caught my attention was EMD Serono’s EGFR-MUC1 bispecific ADC, which would be the first time in history that a bispecific, dual targeted ADC entered the clinic. The objective was to get away from the well-known toxicity profile of EGFR and preclinical data in NSCLC & esophageal squamous cell carcinoma showed complete tumor kill. Merck (MRK) collaboration in the area of cytokine derivatives continued to steadily move forward, with the big pharma company exercising option to extend research term.

-

Lastly, I reminded readers that the company owned 1.6 million shares of Vaxcyte (PCVX) along with a 4% royalty.

Corporate Slides

Figure 2: Pipeline (Source: corporate presentation)

As can be seen above, pipeline has expanded considerably since last time we revisited. Additionally, enterprise value of around $500 million has fallen considerably over the past year (to less than $100 million) despite clinical progress achieved.

Select Recent Developments

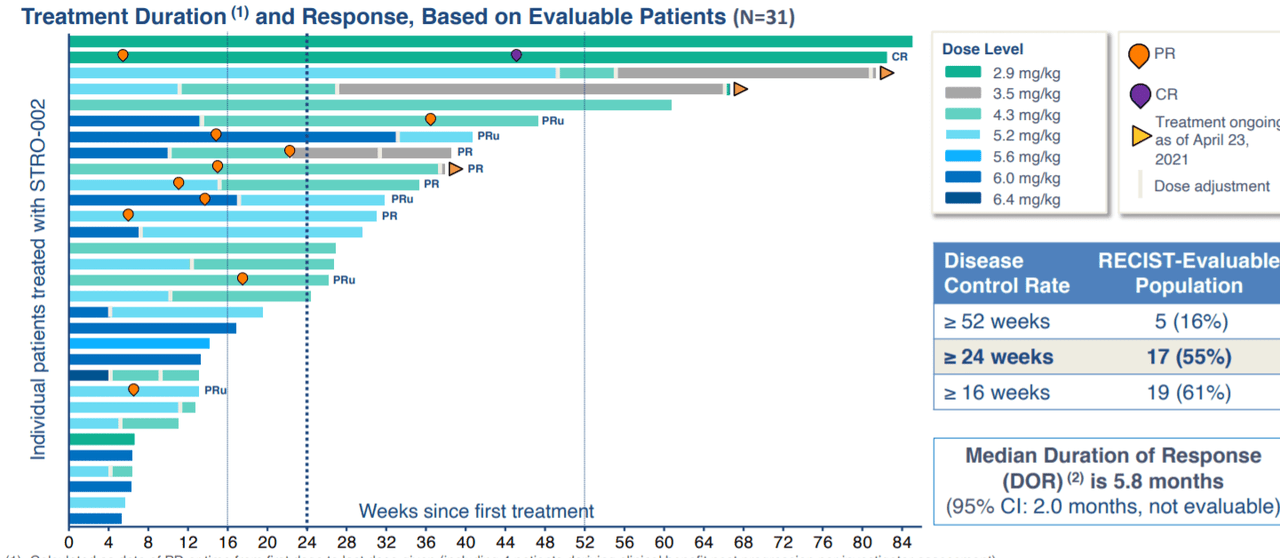

In May of 2021 the company shared additional dose escalation data for STRO-002 in patients with advanced ovarian cancer. Again, keep in mind these were heavily pretreated (6 prior lines of therapy). Of 31 patients, there was 1 complete response and four confirmed partial responses (5 unconfirmed PRs as well). Median progression free survival was 7.2 months, and again 86% of treatment emergent adverse events were Grade 1 or 2. Most common Grade 3 and 4 AEs were neutropenia, arthralgia, fatigue, neuropathy and abdominal pain (all manageable with treatment, dose reductions or dose delays). Dose limiting toxicities were observed at higher dose levels (6 mg/kg and 6.4 mg/kg) in two patients.

Corporate Slides

Figure 3: STRO-002 treatment shows promising signs of durability in dose escalation trial (Source: corporate presentation)

Corporate Slides

Figure 4: Anti-tumor activity observed across various FolRa-expression levels, suggestive of STRO-002 addressing a broader opportunity than its competition in FRa (Source: corporate presentation)

In August the company appointed Jane Chung as Chief Commercial Officer (served prior as President of AstraZeneca, Canada). Later on in September, leadership team was expanded as well, with Nicole Chieffo joining as VP of Clinical Operations (formerly Sr Director, Oncology Global Operations Head at Janssen) and Werner Rubas joining as VP of Preclinical Operations (served prior at Nektar Therapeutics).

On September 30th, it could be considered a green flag that Merck decided to extend research term for the first cytokine derivative program under 2018 collaboration agreement with Sutro. The two companies are pursuing a second candidate as well (uses different approach for the same target).

Flash forward to December, where it appears that nonclinical data shows STRO-001 might not be as dead in the water as I thought it was (showed potential for CD74 in adult and pediatric AML and ALL). Additionally, STRO-002 was shown to have therapeutic potential in a rare, pediatric AML subtype expressing RolRa (CBFA2T3-GLIS2 fusion AML), in which preclinical model showed complete leukemia clearance.

Of more material impact, December’s China licensing deal for STRO-002 with Tasly Biopharmaceuticals had interesting terms, including an impressive $40 million upfront cash payment (up to $345 million in milestone payments along with tiered, double-digit royalties). As noted prior, I found it highly interesting that language in the press release highlights potential to expand into additional oncology indications of NSCLC and TNBC (both of which represent sizeable opportunities that other FRα-targeting peers have not made inroads on).

On January 5th the company reported interim data on its dose expansion study of STRO-002. ORR was 33% in 33 RECIST evaluable patients across all FolRa expression levels and both dose levels. However, ORR was 47% in 17 patients who started at the 5.2mg/kg dose level (keeping in mind some could not tolerate it and were stepped down to 4.3mg/kg). Interestingly enough, ORR of 40% was observed for patients with TPS score greater than 25%, which represents about 70% of the advanced ovarian cancer patient population (quite broad).

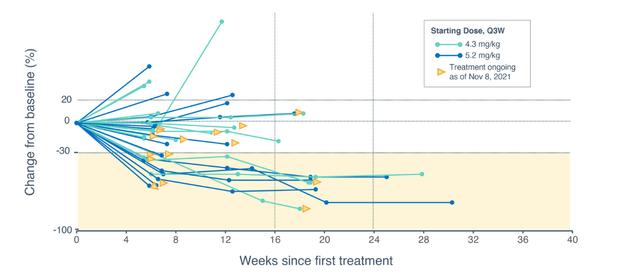

Figure 5: Change in sum diameters for target lesions over time (Source: corporate presentation)

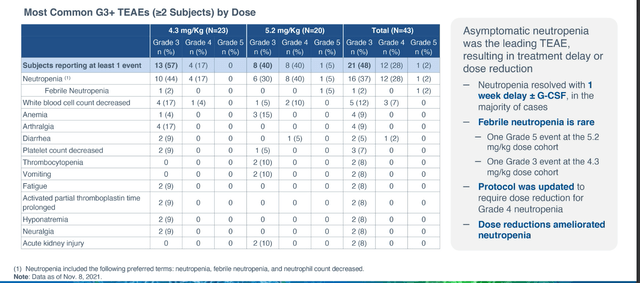

While the company touted “no new safety signals”, it’s still worth mentioning that the AE of note was neutropenia leading to treatment delay or dose reduction. However, the majority of these cases were asymptomatic and resolved with 1 week dose delay or standard medical treatment including use of G-CSF. It is a cause for concern that there were multiple cases of febrile neutropenia (one Grade 5 at 5.2 mg/kg, one Grade 3 at 4.3 mg/kg).

Figure 6: Emerging safety profile for STRO-002 (Source: corporate presentation)

Moving on to June 27th, Sutro announced global collaboration with Astellas Pharma focused on development of novel immunostimulatory ADCs. The simple goal here is to bring new therapies to patients who do not respond to existing immunotherapies. iADCs will combine an antibody with a small molecule compound that induces immunogenic cell death in addition to an immune activating molecule, which in turn has the potential to boost anti-cancer action. Development will be pursued for 3 distinct biological targets, with each partner bringing unique expertise to the table (Sutro’s being advanced technologies for drug linkers to antibodies and linkable cytotoxins). Importantly, Sutro is receiving $90M upfront and remains eligible to receive up to $422.5M in milestones for EACH product candidate along with tiered royalties ranging from low double-digit to mid-teens on worldwide sales. Management wisely retained the option to share in costs and profits for developing candidates in the US (commonly known as “co-development” option). This should not be overlooked, as commonly I see these smaller partners retain such options for perhaps one candidate involved in a particular deal but rarely as in this case for all of them.

Lastly, on July 26th the company announced first patient had been dosed in phase 1 study of investigational candidate (novel cytokine derivative therapeutic) resulting from the collaboration between Sutro and Merck. Sutro received a $10M milestone payment and more importantly this represents important thesis progression as this partnership originated in July 2018 and is seeing its first drug candidate move forward in the clinic.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $191.6M (does not include $90M upfront payment from Astellas) as compared to operating expenses of $47.5M. I assume annual cash burn of $200M, which puts the company at just 1.5 years operational runway with current resources.

At JMP presentation in June, CEO makes the following points:

- 6 clinical programs in development today, two of which are proprietary. They expect to integrate CDMOs into manufacturing as the company makes its way into late-stage studies.

- History of ADC field has been one of peaks and valleys. In past 5 years they’ve gained more understanding on how to optimize ADCs and get the desired targeted tumor kill with manageable safety profile. Goal is to attain superior efficacy and safety to chemotherapy, which is typically the alternative standard of care.

- Some ADCs are based on older technology, but chemistry and linkers used in Gen1 molecules are not state-of-the-art (heterogeneous mixtures). Competitors, including in ovarian cancer, use an average drug-antibody ratio because some species in vial are competent to do what they are supposed to do and others are not competent (i.e. some molecules with DAR of 4, some with 2 and not potent enough to get cell kill). Sutro believes that average is perhaps good enough in some circumstances, but far from optimal. Company believes homogeneity will allow them to have broader therapeutic window than competition along with better cell kill (optimized to do the job they want it to do, designing a better molecule and proving it in the clinic).

- For STRO-002 dose expansion phase, they are exploring two doses (5.2mg/kg and 4.3mg/kg). They are within therapeutic window of molecule with potential differences between efficacy and safety. Final data will be reported before year end. They hope to establish in platinum-resistant ovarian cancer population with up to 3 prior lines of therapy, that they can get robust response rates with good durability and meaningful progression-free survival for patients who do not respond. TMPS score above 25% is the ideal cutoff they’ve identified where patients have greater likelihood of responding to therapy (40% ORR versus low double digit response rate below this score). This break point gives them about 70% of market opportunity, perhaps as much as 80%.

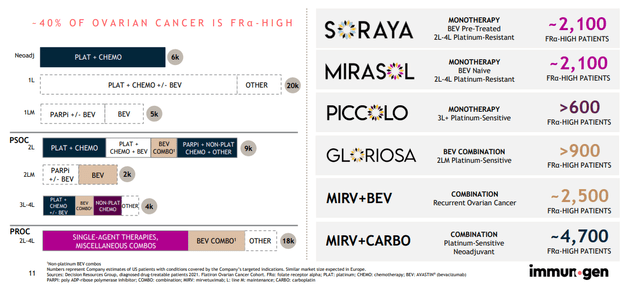

- One competitor (ImmunoGen) identified a narrow therapeutic window for their molecule (6 mg/kg dosing regimen, as 7 mg/kg was too toxic and below 6 lacked efficacy). They also determined that they needed to use IHC assay and stick with only high expressors (smaller market opportunity). ImmunoGen reckons that allows for around 30% of the total market.

Figure 7: ImmunoGen estimated market opportunity in FRa-high patients (Source: corporate presentation)

- For STRO-002, they’ve already had FDA meeting regarding inclusion/exclusion criteria, patient selection, dosing strategy, path forward & pivotal trial design, etc. Conclusion is that they have the opportunity to do a registration-directed study with potential accelerated approval pathway depending on the quality of the data. That study will likely start in early 2023.

- As for bevacizumab combo study ongoing, bevacizumab is used much earlier in therapy (not reserved for late line). Almost 2/3rds of ovarian cancer patients are treated with bevacizumab in initial lines of therapy. They don’t believe 1+1=5, in other words toxicity effects are not additive between the two agents. They started combo study at lower dose to ensure tolerability was there, then escalate up. Data will likely come in 2023.

- Analyst makes an important question for STRO-001 (go/no-go decision), given that multiple myeloma and NHL treatment landscape is shifting and increasingly crowded. They’ve seen promising early data including 1 CR and 2 PRs in 7 DLBCL patients along with decent safety profile (no ocular toxicity in either agent). 001 looks quite safe, they are still seeking efficacy signals at higher doses and it’s been hard to recruit more patients recently (now enrolling ex-US where patients have less access to other treatments and have had fewer cycles of therapy). BioNova deal for 001 covers rest of costs to get to recommended phase 2 dose (using other people’s money instead of burning company resources up).

- As for other partnered efforts, Bristol’s (BMY) BCMA ADC continues to be optimized but CEO otherwise is not informed on how or if they will proceed forward. EMD Serono has initiated development of their MUC1-EGFR ADC and data is expected next year. Partner Merck is on the cusp as well with cytokine ADC. They’ve received almost $500M from partnerships and each one is about to have a product in the clinic.

- At end of Q1 they have $192M in bank, run rate takes them into 2H 2023. Final STRO-002 data analysis from expansion study will be single most important value driver, per Newell.

Moving onto the virtual deep dive into iADC efforts, here were the key takeaways for me:

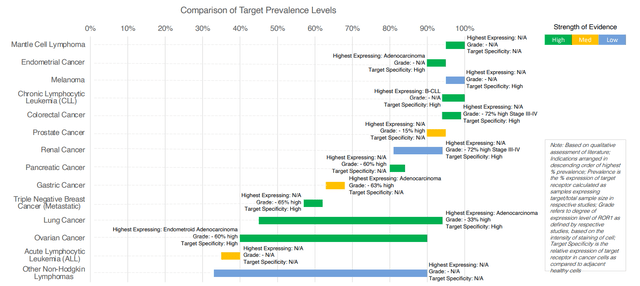

- ROR1 ADC is pursuing a target widely expressed a broad range of tumor types. STRO-003 (ROR1) will be their 7th product candidate to enter the clinic. ROR1 is an attract target due to its role in cancer progression and its specificity of expression on tumors (restricted on normal tissue so low potential for on-target toxicity). ROR1 is broadly expressed across heme malignancies as well as solid tumors including NSCLC and breast cancer. Prostate cancer for example has 90% and above prevalence (15% high grade, the lower that number is the more potent and efficient the ADC has to be).

- Other targets are active in preclinical pipeline, including Liv-1, PTK7, CEACAM5, Tissue Factor, etc. These are antigens management is very interested in at the moment (looking at them as both monospecific or potentially bispecific to combine with one another).

- As for Q&A, management states they’ve had a lot of interest from potential partners for their technology (not just Astellas). They are “open for business” and look forward to continuing discussions (sounds like more deal flow in the works). In regard to competitive data for ROR1 on the horizon, the company is still waiting to see how VelosBio data turns out in coming year or two. Readers may recall that VelosBio was acquired by Merck for $2.75 billion price tag for its ROR1 ADC in late 2020. At the time, data was scant but promising nonetheless (7/15 mantle cell lymphoma patients with complete responses, 4 of 5 patients in DLBCL cohort with complete responses). Merck had plans to move into triple negative breast cancer and non-small cell lung cancer, at the time. Sutro believes their epitope overlaps if not being identical to the VelosBio antibody (sounds like lack of differentiation here). They will be following the VelosBio program closely and this appears to be a “fast follower” situation where there’s room for more than one winner.

Figure 8: ROR1 broadly expressed across wide range of tumor types (Source: corporate presentation)

As for accumulated deficit, $334M as of December 31 seems quite reasonable for a company founded back in 2003 (well managed balance sheet and partnerships chipping in to offset cash burn).

As for prior financings, December 2020 offering took place at $21 per share (3x upside from current levels).

As for competition particularly in the FRa space, I’d like to point to data from MORAb-202, which was the subject of $3.1 billion joint development deal between Eisai (OTCPK:ESALF) (OTCPK:ESALY) and Bristol Myers ($650M upfront, up to $2.45 billion in milestones). MORAb-202 produced an impressive 52% ORR in higher dose cohort of Japanese PROC (platinum resistant ovarian cancer) patients. Importantly, here efficacy was seen IRRESPECTIVE of FRa levels. Median PFS was an impressive 8.2 months (I believe the bar was set at around 4 to 5 months by ImmunoGen). On the con side, the most common TEAE was interstitial lung disease (ILD)/pneumonitis at both dose levels (Cohort 1: 37.5% [n=9; 8 with grade 1, 1 with grade 2]; Cohort 2: 66.7% [n=14; 6 with grade 1, 7 with grade 2, 1 with grade 3]), which is a rough adverse event for patients to have to deal with. Responses were also observed in breast, endometrial and non-small cell lung cancer (phase 1/2 studies are now pursuing these indications).

As for institutional investors of note, Biotechnology Value Fund owns a 6.8% stake and Suvretta Capital owns a 5.4% stake. CEO Bill Newell also has a bit of skin in the game with 116,000 shares (though I consider that to be a small position on the whole).

As for management team, Chief Commercial Officer Jane Chung most recently served as President and General Manager of AstraZeneca Canada since 2019 and prior to that as Vice President and Head of U.S. Immuno-Oncology franchise. Chief Medical Officer Molina served prior as Vice President of Oncology Scientific Innovation at Johnson & Johnson’s California Innovation Center.

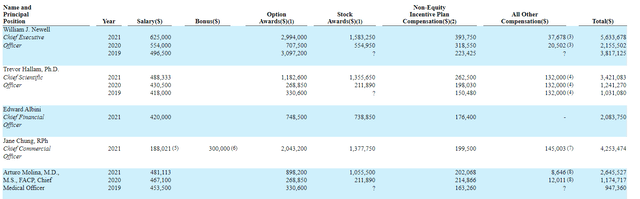

Moving on to executive compensation, cash component certainly seems reasonable for a company this size and options award package is on the skinny side as well. The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Figure 8: Executive compensation table (Source: proxy filing)

Moving on to IP, patent portfolio consists of 22 issued patents in the US and 186 patents issued in ex-US jurisdictions, along with 33 US pending applications and 83 patent applications pending ex-US. Issued patents as well as those that could be issued are expected to expire between 2030 and 2042 (STRO-002 patents expire between 2037 and 2042).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), consider that the BMS collaboration was inked in 2014 and given the target in a highly crowded field (BCMA), I would not be surprised to see it cancelled.

Final Thoughts

To conclude, Sutro Biopharma represents an attractive platform technology story in the lucrative ADC space that continues to attract my interest as an investor. Uniquely, in the medium term I find partnered efforts (Merck, Serono, Astellas (OTCPK:ALPMF)) to be more interesting as early data sets emerge. On the other hand, internal efforts are of less interest to me given crowded landscape for STRO-001 and potential toxicity challenges (though addressable) for STRO-002 coupled with significant competition from MORAb-202. I almost think of Sutro as providing mutual fund-like exposure to the ADC space given multiple shots on goal. It’s certainly plausible that as partnered efforts progress, cash burn is reduced substantially or even gets to near break-even.

For readers who are interested in the story and have done their due diligence, STRO is a Buy ONLY below the $6 level IN MY VIEW, as I would not chase this one and consider it less attractive than other ROTY candidates with clearer path to market for internal assets.

From an ROTY perspective (focus on next 12 months), IF I have sufficient dry powder on hand and STRO falls below $6 level, it’s possible I accumulate a pilot position and potentially add to it as clinical data confirms our thesis.

As for risk rating (1=low, 5= high), I put this one in the middle of the range at 3 given partnered efforts that help offset (to a degree) risk taken on with internal drug candidates. Significant competition in ovarian cancer and FRα space are causes for concern, as is the fact that VelosBio is ahead of them with the ROR1 target. Partnerships could suffer setbacks and I continue to think efforts in BCMA with BMY could be nixed. Also, I think that the window for accelerated approval in ovarian cancer could close due to competition. While management maintains that there’s a path forward for STRO-001 especially in ex US markets and China, I would not be surprised to see this drug candidate get discontinued as well given all the innovation and new drugs approved for these heme indications.

Reflecting on our selection criteria for ROTY holdings, one negative here is that I don’t see a clear & efficient path to market for STRO-002 in ovarian cancer.

While as an investor I leave price targets to the analysts, I do look at a blend of technicals, enterprise value, upcoming catalysts and future prospects to provide a realistic guess of potential upside in the medium term. I think a return to the $15 level (where gap down occurred to start 2022) seems realistic if partnerships produce positive early to mid-stage data in coming year(s). This would represent market capitalization of around $700 million and enterprise value of ~$400 million, which still seems cheap for a company operating in the lucrative ADC space with multiple shots on goal in the pipeline (which by then would have further progressed in the clinic, particularly STRO-002 into late stage studies in ovarian cancer with possible shot at front-line indication if they can get safety under control).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. Look forward to your thoughts in the Comments section below. Lastly, be aware that all of my articles appear first to members of the ROTY community.

Be the first to comment