PeopleImages

We introduced SurgePays (NASDAQ:SURG) in an article in mid-August this year and the investment thesis is straightforward:

- The company is rapidly gaining subscribers for its mobile broadband service.

- The stock is only discounting a fraction of this.

The company offers a host of services for the underbanked, mostly from third parties to local shops. While this is an interesting corner of the market that is difficult to reach, these generally generate low gross margins.

However, the company’s fate has changed dramatically with the arrival of the ACP (Affordable Connectivity Plan), which was part of the bipartisan infrastructure and aimed at solving the digital divide.

The ACP subsidizes broadband to the tune of $30 per month and up to $100 for a tablet for households that are below 200% of the Federal poverty guidelines or on a Federal program (like SNAP).

That is, SurgePays is getting paid by the Government for hooking people up to their MVNO service (mobile virtual network operator), using AT&T (T) and T-Mobile’s (TMUS) wireless backbones.

The market for this is huge, about 48M U.S. households, a figure that could very well be larger if one adds immigrants qualifying for the WIC program (as they’ll automatically qualify for ACP as well).

The company has barely begun to scratch the surface of that market opportunity although it is enrolling subscribers at a fast pace:

And on October 5, they announced that they had surpassed 200K subscribers, in fact, they mentioned reaching 220K subscribers, which is already exceeding their year-end target of 200K subscribers with almost 3 months to go.

Compelling financials

It looks like even our earlier assessment of 250K+ subscribers by year-end was too conservative. The financial implications are pretty important, considering the following:

- 220K subscribers at $30/M produce a run rate of $79.2M a year.

- At 50%+ gross margin that’s $40M in gross profit.

- With OpEx below $15M a year that produces an operating profit of $25M.

- With 18.1M shares fully diluted (12.4M shares and 5.7M warrants) that’s a run rate of almost $1.4 EPS.

These are run rates, not FY22 projections, these will be lower as the company started the year with just 30K subscribers, and they make one-time costs for getting these subscribers as well:

- Up to $45 per subscriber, although subscribers gained online are considerably cheaper.

- The company gains roughly $15 per sold tablet, a one-time gain.

So the net acquisition cost per subscriber is about $30 and it can take 3-60 days for the government to vet the subscribers and pay the company. There are other ways they’re boosting the financials.

For instance, the company is throttling high data users (Q2CC):

we noticed that our higher data users were driving up average usage costs. So we went back to our carriers. We negotiated a new wholesale plan, which would ensure that no user could use beyond the cost of $15 per month to us. By pushing heavy users to this plan, we can now hedge costs, which should allow us to drive our average cost back down to around $12 per month. Our estimates show this would be an immediate impact of roughly $100,000 in savings per month.

This will improve gross margins towards 60% (for their mobile broadband business). Then there is this (Q2CC):

we purchased a client relationship management, or CRM, software platform that we had been using as a central nervous system for managing our wireless business. The CRM houses customer information, is integrated with underlying wireless carriers, manages the plans and metering, the customer service, compliance, billing and is connected to the FCC’s database clearing house. We were expensed for this service on a per subscriber basis. And as subscribers increased, our costs also increased.

Apart from lowering cost (as they were expensed on usage previously for this service) this should also help allay concerns about fraud and they could even turn it into a profit center by selling the CRM services to competitors (there are already 6 of these using the platform).

One should also take on board that the company is quite recession-proof, worsening economic circumstances actually increase the pool of potential users, although it is also likely to lead to some increase in attrition.

We think the company will be able to boast really compelling financials fairly soon. This year won’t be spectacular given they started the year with just 30K subscribers and the one-off cost still weigh pretty heavily on such a small base of subscribers.

But next year will be quite a different story. They will start the year with at least 250K subscribers and quite possibly close to 300K. That is, they’ll start the year at a run rate of $100M or so with gross profits at $50M+ and nearly $2 in EPS.

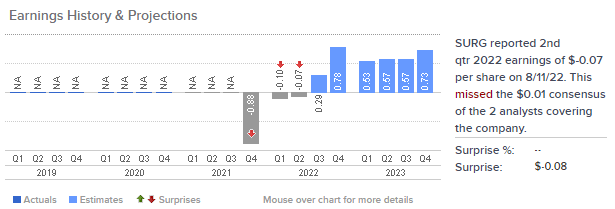

Then add what they can add in subscribers during the year and we could see the company exiting 2023 with 400K+ subscribers and a $150M run rate and $3+ EPS. So it can’t be a surprise that FY23 EPS estimates from analysts are at $1.9-$2.4 (even if we think the Q4/22 estimate is overblown).

CNBC

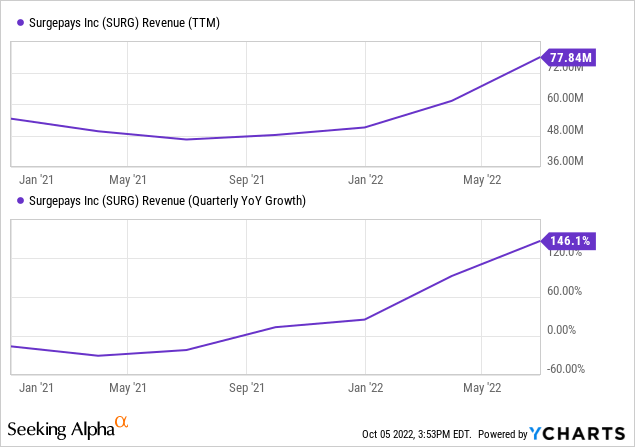

Revenue is of course a lagging indicator but that too is rising fast:

And there is a great deal of operational leverage as expenses are growing much slower (SG&A growth was just 11%).

There is no sign that the take-up is slowing down anytime soon, in fact, it could very well be accelerating. The company has a cash bottleneck, in the form of the number of tablets they could buy, which limited subscriber growth.

Since they’re paid by the government, they could monetize their receivables fairly cheaply to lessen this bottleneck, but given the rapid rise in subscriber number, this problem will wither fairly soon as the increasing amount of subscribers provides a steady and increasing monthly cash flow.

The receivables financing or cash flow will enable them to buy bigger quantities of tablets in advance, which will get them a discount as well as removing the main bottleneck (Q2CC):

then I can look and see a price that’s closer to $72 to $75, which is huge. It doesn’t sound like much saving $10 to $15 a tablet, but when you’re looking at 30,000, 40,000, 50,000 a month, that’s a significant difference.

Risks

We see several risks

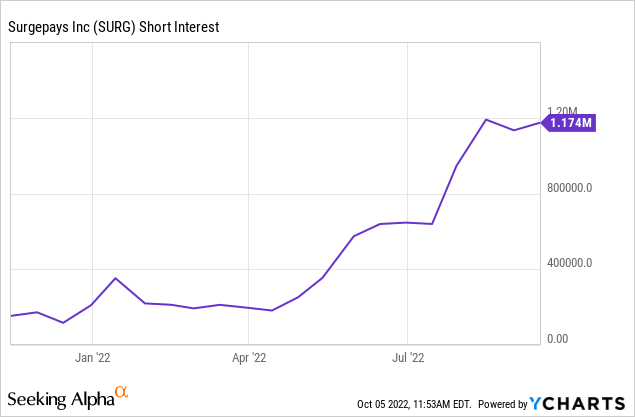

- Shorts

- Politics

- Fraud

- Accounts receivables

- Competition

It should be noted that the company has invited an increasing short position:

We have to admit we find that a little puzzling as it’s difficult to argue with the math we set out above. It seems pretty unlikely to us that management is making these numbers up, given that insiders hold half of the company’s shares with the CEO alone good for 1/3 of outstanding shares.

That leaves the two other risks. There were stories about fraud:

Most households are eligible for ACP support based on the subscriber’s own participation in a qualifying federal program like SNAP or Medicaid. However, many other subscribers are eligible through a Benefit Qualifying Person (BQP)-another household member, such as a child or dependent, who meets one of the ACP eligibility requirements.

And identity:

More than 1,000 households in Oklahoma used the identity of a single 4-year-old to obtain free or discounted internet service from the U.S. government, part of a broader wave of suspected fraud now raising new questions about Washington’s attempts to close the digital divide.

But the figures involved are small, the quote above is a single flagrant abuse and there are a few others but in all:

In its alert, issued Thursday, the inspector general acknowledged the total amount of improper payments “remains low” – but stressed that the data show “use of this flagrant technique is steady to increasing, particularly for certain providers.”

SurgePays isn’t likely to suffer from this as they have safeguards in place in the form of a third-party compliance company so we’re not worried about this.

The risk that the ACP program will end or be curtailed is a little more serious, but that remains to be seen:

- The bill enjoyed bipartisan support.

- Internet access has become a crucial service for seeking jobs, education, finances, and even healthcare, as the pandemic showed. Cutting off people at the lower end, especially in rural America where broadband service competition is sparse and expensive, isn’t a vote winner.

See for instance Brookings (our emphasis):

Early in the IIJA debate, Republican senators insisted that they would not support “soft” infrastructure, consisting of services designed to help people. Broadband turned out to be a major exception: The $65 billion broadband appropriation included $17 billion to support low-income persons seeking to purchase broadband, as well as digital literacy programs and other critical services for new users. In fact, the percentage of “soft” infrastructure spending in the final bill was more than double the percentage of earlier Democratic versions of the broadband provisions. A third way the broadband debate was different is that, unlike many issues which have been increasingly viewed through a racialized lens, here the issue was less racialized than in the past.

So even Republicans seem on board with the ACP and it helps that it’s essentially a voucher program favored by conservative think tanks.

Accounts receivables are increasing considerably ($3.2M at the end of 2021, $5.6M at the end of Q1/22 and $8.3M at the end of Q2/22) which could generate some concerns. However, this is money owed by the government in the form of ACP subsidies, it shouldn’t be a cause for concern in our view.

Competition

There is plenty of competition as there are some 13M people on ACP already, but the market is large enough for SurgePays to keep adding subscribers with three-quarters of the market still up for grabs.

SurgePays can leverage its network of local shops in areas of underbanked communities, this is what they built and specialized in before this wireless boom.

They set up tents with signs of ‘free internet’ on their parking lots and they can basically sell as many tablets as they have.

The other advantage is their CRM system (ShockWave) they just bought, but there is more. They have two types of competitors, bigger companies and smaller ones. On the first (Q2CC):

Some of the other larger wireless companies are not going to tablet route. They’re simply doing the SIM only, and then hoping that folks already have a tablet that they could put that SIM card in and use that to get their access to the Internet. I believe this market is an instant gratification market. Anytime somebody could see a tablet that’s valued at $150 or so, and if you walk away with that tablet in hand, I think we’ll always get that customer.

And on the smaller competitors (Q2CC):

The wireless companies who are attempting to do it the same way we are not able to do it at the scale that we are because they’re not capitalized like we are. So we very rarely, if ever, this is the reports we get back from our frontline folks, very rarely do we ever see or, let’s say, we get boxed out or bump into competitors out there on the street.

Valuation

The company is highly likely to produce $2 in EPS next year and a considerable amount of free cash flow. The stock is simply severely mispriced, in our view.

Conclusion

The company is about to generate significant amounts of free cash flows which be plowed back into their other businesses (for instance starting to flock their own products – management mentioned telehealth in the community stores, generating much higher margins) and building out their network of community shops serving the underbanked population.

They have built an interesting position in this segment (see our previous article) and they are expanding their network of participating stores.

Meanwhile, the shares are very cheap even if the growth in their mobile broadband business would come to a halt, having already achieved a run rate of $80M in revenue and well over $1 EPS. But there is no sign of that and we see no reason it should.

With the severe undervaluation, we think the shares are ripe for a short squeeze.

Be the first to comment