Chinnapong

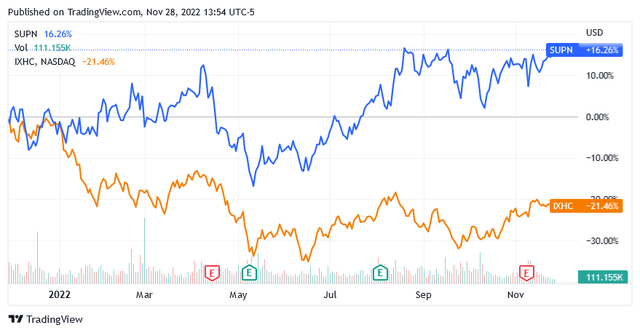

Supernus Pharmaceuticals Thrashed The Healthcare Sector Over Past Year

Among healthcare stocks, Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN) has performed remarkably well over the past year, beating the benchmark NASDAQ Health Care Index (IXHC) by more than 35%.

The market seems excited about the company’s portfolio of innovative treatments for diseases of the central nervous system, which offers significant growth potential for the company.

However, as competition increases, there is uncertainty about the market prospects for one of the company’s products, and perhaps shareholders should consider holding this stock until the situation becomes a little clearer.

Supernus Pharmaceuticals, Inc.

Headquartered in Rockville [Maryland], Supernus Pharmaceuticals is a biopharmaceutical developer of treatments for central nervous system disorders.

Supernus Pharmaceuticals markets products approved for the treatment of epileptic seizures, headaches, attention deficit hyperactivity disorder [ADHD], and hypomobility and dyskinesia in Parkinson’s disease patients. This portfolio also includes cervical dystonia, chronic sialorrhea and drug-induced extrapyramidal reactions in adult patients.

As for the product development portion of the portfolio, Supernus Pharmaceuticals is working on various innovative treatments targeting the same central nervous system disorders or various other disorders affecting the brain and spinal cord.

According to the third quarter 2022 earnings report, Supernus Pharmaceuticals is currently generating revenue from the sale of the following products.

Trokendi XR, Oxtellar XR, GOCOVRI, Qelbree, APOKYN and others including MYOBLOC, XADAGO and Osmolex ER.

Conditions Treated by The Products

The prescription drug Trokendi XR is based on the active ingredient topiramate and is used to treat migraines not only in adults but also in adolescents aged 12 years and older.

The drug is also used to treat certain seizures caused by epilepsy in people aged at least 6 years.

The prescription drug, branded Oxtellar XR, is approved for the treatment of partial seizures caused by epilepsy in patients aged 6 and older.

Oxtellar XR-based therapy to treat the condition may indicate Supernus Pharmaceuticals’ product alone or in combination with other medications.

Based on the main active ingredient amantadine, GOCOVRI is a prescription drug used in the form of extended-release capsules to treat dyskinesia in patients with Parkinson’s disease. Patients also receive either levodopa or levodopa in combination with other drugs. The drug combination is intended to boost the dopamine effect in Parkinson’s patients’ brains.

In medical terminology, dyskinesia refers to either a striated muscle disorder whose movement is abnormal and involuntary or to smooth muscle organs [e.g., bile ducts] whose contraction is abnormal.

Levodopa is a drug stimulator of specific brain receptors to compensate for the supply of endogenous dopamine that is depleted in the central nervous system of patients with Parkinson’s disease.

Dopamine is an organic compound that is responsible for akinesia [absence, loss, or impairment of the ability to move freely] and tremors in Parkinson’s disease patients when it is deficient due to degenerative lesions in certain areas of the brain.

GOCOVRI was added to the Supernus Pharmaceuticals portfolio in November 2021 following the acquisition of Adamas Pharmaceuticals, Inc., a specialty pharmaceutical company based in Emeryville, California.

Based on viloxazine, Qelbree is a prescription medication that comes in extended-release capsule form to treat ADHD not only in adults but also in children who are at least 6 years old.

Also, the company website says: “Qelbree may increase suicidal thoughts and actions, in children and adults with ADHD, especially within the first few months of treatment or when the dose is changed.”

Attention deficit hyperactivity disorder [ADHD] is commonplace among children with neurodevelopmental disorders. Therefore, the condition is usually diagnosed in individuals during childhood, and there are not a few cases where it is prolonged in adults.

Children with ADHD may not be able to pay attention to things or control impulsive behavior [i.e., act without first considering the possible consequences of their behavior], or may be exceedingly active.

Based on the active ingredient apomorphine, APOKYN is a brand-name prescription drug used in people with advanced Parkinson’s disease, in whom the condition causes acute and intermittent episodes of mobility impairment. These episodes of reduced mobility are referred to as “off” episodes and, according to the company’s website, consist of oral levodopa drug therapy not working properly while it takes some time before the next dose can be taken. It is also not known whether or not APOKYN-based therapy is safe in children, other than producing significant effects.

MYOBLOC is indicated to provide relief from the severity of abnormal head posture and neck pain in adults with cervical dystonia. MYOBLOC is also indicated for the treatment of adults chronically affected by sialorrhea.

Patients suffering from cervical dystonia or spasmodic torticollis may experience the involuntary contraction of the muscles in their neck, and often this condition can be very painful. This causes the head to turn sideways uncontrollably, but it can also tip forwards or backward.

In medical terms, sialorrhea is an increase in salivation, also known as ptyalism or hypersalivation. The symptom may be due to either direct stimulation of the salivary glands as they attempt to secrete either medicinal [e.g., mercury, iodine, bromine] or toxic [lead] substances, or irritation of the salivary nerves.

XADAGO is a prescription drug that can be used with either levodopa or carbidopa in combination therapy to treat adults with Parkinson’s disease who have the symptom of “off” episodes.

The prescription drug Osmolex Er is based on the active ingredient amantadine and is used daily in the form of prolonged-release tablets for the treatment of extrapyramidal reactions in Parkinson’s disease adult patients in whom the condition is induced by another treatment.

The term “extrapyramidal effects” refers to movements that were once voluntary and have become uncontrollable in individuals taking certain medications, such as antipsychotics.

Financial Results for the Third Quarter of 2022

For the third quarter of 2022, total revenue increased 19% year-over-year to $177.4 million, driven by higher prescriptions and sales of Qelbree combined with higher sales of GOCOVRI.

Qelbree recorded another 50% year-on-year increase in prescriptions in the third quarter of 2022 to 94,328, while net product sales increased 65% year-on-year to $18.3 million.

Regarding Qelbree, the company said in its Q3 2022 earnings call that the product’s gross-to-net ratio went slightly down in Q3 because of fluctuations from quarter to quarter. They are also in talks with several pharmacy managers in hopes of reaching certain contractual parameters that will ensure their gross-to-net ratio stays within the company’s target of 50% to 55%.

The company sees a lot of potential for Qelbree as the product appears to continue to differentiate itself from other treatments in terms of satisfaction from physician feedback, attracting patients from all segments of the market.

GOCOVRI reported a 16% year-over-year increase in net product sales to nearly $28 million in the third quarter of 2022 from the level reported by the acquired Adamas Pharmaceuticals Inc. in the prior-year quarter.

There is significant potential for GOCOVRI, as the company emphasized during the earnings call. The product does not focus on one symptom but rather targets two or more aspects of Parkinson’s.

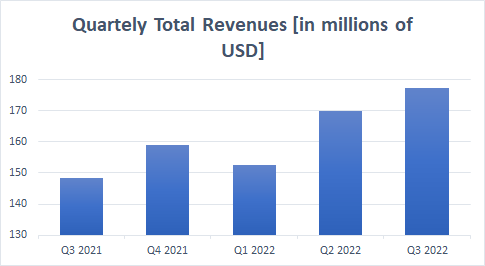

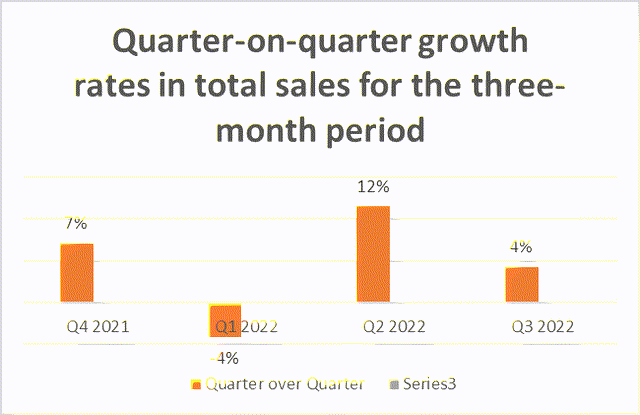

As the chart below shows, total revenue has continued to grow quarter over quarter.

Source: Seeking Alpha

But due to a 14% year-on-year decline in Trokendi XR sales of $69.6 million, accounting for 40.3% of total product sales, the revenue growth rate has slowed down significantly from Q2 2022 to Q3 2022, which is a concern for shareholders.

Regarding Trokendi XR, the company hinted at market erosion for this product in its Q3 2022 earnings call, in which it forecasts a 90% erosion before the end of 2023 due to generic entry.

A second generic will also be launched, but the company could not say exactly when as the timing is subject to a 180-day exclusivity status for 4 strengths for which the generic has already been approved.

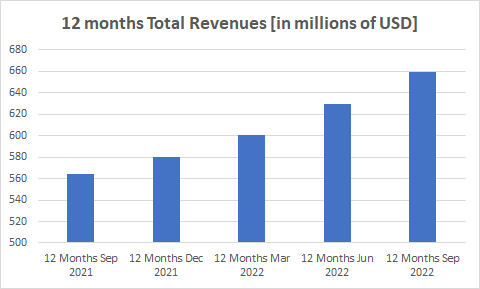

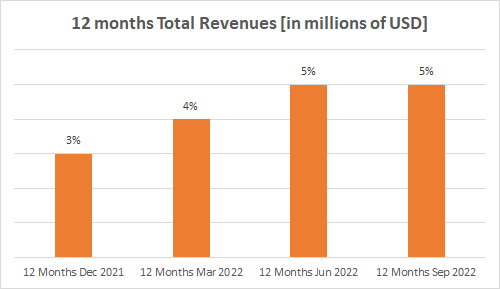

The following two charts analyze total Supernus Pharmaceuticals revenue on a trailing 12-month basis.

Source: Seeking Alpha

Both charts clearly show that despite the increase from quarter to quarter, the growth rate was flat in Q3 2022 compared to Q2 2022 due to the Trokendi XR decline.

Source: Seeking Alpha

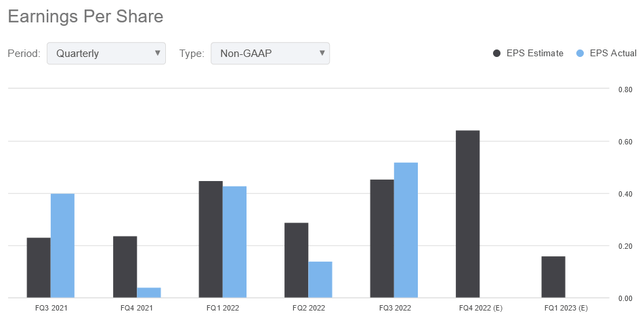

For the third quarter of 2022, Supernus Pharmaceuticals posted pro forma earnings of $0.52 per share, beating analysts’ median forecast by 6 cents. In the same quarter of 2021, the company reported pro forma earnings per share of $0.40.

The Portfolio Of Products Under Development

Supernus Pharmaceuticals is required to answer specific questions regarding an apomorphine [APOKYN] infusion device, designated SPN-830, for the ongoing treatment of “off” episodes in patients with Parkinson’s disease before submitting an amended application for marketing authorization [NDA] to the U.S. Food and Drug Administration [FDA].

The company received a Complete Response Letter [CRL] last month, but the questions to be answered appear to relate to the labeling and manufacturing process and not to the device’s effectiveness and safety.

The timeline for the FDA to review the amended NDA should be around half a year after receipt.

SPN-820, the name of a potential treatment for resistant depression in adults, is being evaluated in the second phase of a clinical trial that is now focused on efficacy and safety.

While SPN-817, the name of a potential treatment for patients experiencing seized seizures due to severe epilepsy, is scheduled to begin the second phase of a clinical trial sometime this quarter.

Company Earnings And Sales Outlook

Looking ahead to the full year 2022, the company expects operating income to fluctuate between $35 million and $45 million from the prior range of $20 million to $40 million. Instead, total sales are expected to be between $650 million and $680 million, compared to $640 million to $680 million previously.

The Financial Condition

To continue operations and support the development of potential Parkinson’s treatment candidates, the company had $392 million in cash on hand coupled with a 12-month leveraged free cash flow of $165 million as of Sept. 30, 2022.

The balance sheet appeared to be burdened with a total debt of about $444 million.

Debt far exceeds cash on hand, but the company seems to be able to easily sustain this financial burden as the interest expense is offset by operating income.

As of Q3 2022, Supernus Pharmaceuticals, Inc generated a 12-month operating income of $48.3 million versus a 12-month interest expense of $11.4 million determining an interest coverage ratio of 4.2. Investors usually like a ratio of at least 1.5.

However, Supernus Pharmaceuticals’ Altman Z-score of 2.16 indicates gray areas, meaning that Supernus Pharmaceuticals’ balance sheet might be affected by some form of financial distress.

If the rate is below 1.81, the company is classified as at risk of insolvency.

While an Altman Z-Score of 3 or greater indicates safe areas that do not imply a likelihood of financial failure.

Therefore, Supernus Pharmaceuticals’ financial position could be better.

The Stock Valuation

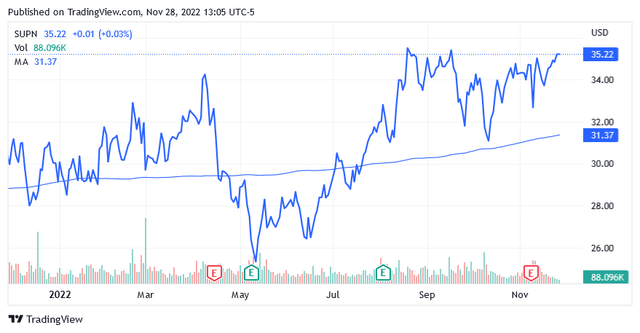

Shares of Supernus Pharmaceuticals traded at $35.22 as of this writing for a market cap of $1.9 billion and a 52-week range of $24.95 to $36.08.

The stock is not trading low compared to its recent market valuations as the stock price is standing well above the long-term trend of the 200-day simple moving average of $31.37 while being in the second half of the 52-week range.

Additionally, the stock has a P/E Non-GAAP [TTM] of 31.13 versus the industry median of 18.

The stock may also be slightly overvalued aside from not trading low.

The P/E Non-GAAP [FWD] of 19.42 is more attractive than most competitors, given the industry median of 19.70.

But this last comparison can be misleading as there is a risk that the financial indicator will not fully explain the market erosion for Trokendi XR. This factor is causing sales to lose some momentum and the company is unable to estimate this factor with sufficient accuracy at this time.

This could put some downward pressure on the share price and the market could create a more attractive entry point to increase exposure to this stock, whose portfolio holds growth potential.

Conclusion

The stock has a portfolio of interesting novel treatments for central nervous system disorders with significant growth potential.

However, market erosion for Trokendi XR may push the stock price well below current levels.

Given this risk, I’m not taking a more bullish stance on the stock, but a hold rating at the time of writing.

Be the first to comment