Hispanolistic/E+ via Getty Images

Super Micro Computer, Inc. (NASDAQ:SMCI) offers high-performance server and storage systems covering everything from enterprise data centers, cloud computing, artificial intelligence, 5G, and edge computing applications. The company is unique for designing and manufacturing the majority of its hardware in the U.S. which it believes represents an advantage compared to some larger global competitors. While the industry has been challenged by supply chain disruptions and concerns over a looming post-pandemic slowdown, Super Micro is putting up some impressive growth trends. The company has found success with its new line of innovative systems which are in high demand among major customers.

This is a stock that benefits from solid fundamentals including a strong growth outlook and climbing profitability. An ongoing push by the company into more tech services should be positive for the stock adding to earnings momentum. We are bullish on SMCI which looks particularly interesting on the selloff with a good combination of value and upside potential.

SMCI Financials Recap

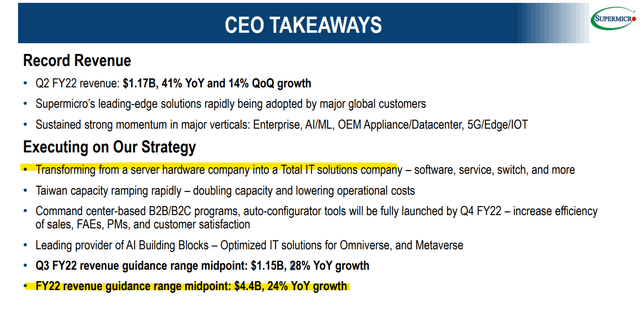

The company last reported its fiscal Q2 results in early February with EPS of $0.88 which beat expectations by $0.10. Revenue in the quarter at $1.2 billion climbed 41% year-over-year and was also 14% above the Q1 result, highlighting the operating momentum. Management cited large orders from new and existing global customers.

While the gross margin of 14% was down from 16.4% in Q2 last year, which benefited at the time from some one-off cost gains, the result was up from 13.4% in the prior quarter. Profitability has been supported through an effort at cost control, considering operating expenses as a percentage of sales fell to 9.6% from 11.9% in the period last year. Operating income at $51 million increased 36% y/y and is also up 18% through the first six months of the fiscal year.

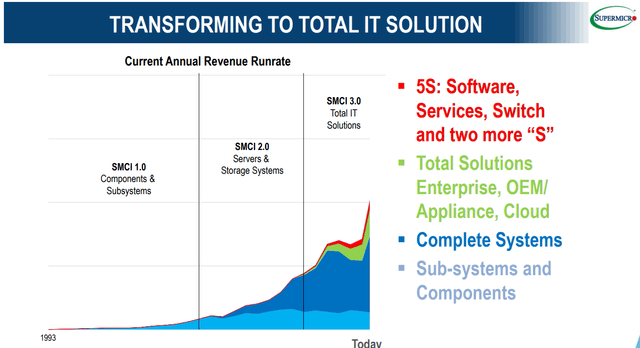

An important theme for the company is an ongoing transformation from just server hardware into more integrated IT solutions. The idea here is to bundle more services including security and cloud software. The expectation is that this category can add a few hundred basis points to the overall gross margin going forward. The strategy is already paying off. By industry verticals, the company is finding momentum in areas like 5G and telecommunications customers with more high-tech equipment, which now represent 12% of total revenues compared to just 5% in the period last year.

In terms of guidance, management is targeting full-year revenue of around $4.4 billion, representing a 24% increase over fiscal 2021. On the earnings side, the company expects GAAP EPS of “at least” $2.77 while the non-GAAP adjusted EPS forecast of $3.20, if confirmed, would be an increase of 31% compared to $2.44 last year.

Finally, we note that Super Micro ended the quarter with $247 million in cash and equivalents against $316 million in debt. Considering EBITDA over the past year at $166 million, we view the net debt to EBITDA leverage ratio under 0.5x as reflecting an overall solid balance sheet position.

SMCI Stock Price Forecast

With a market cap of just $1.8 billion, Super Micro Computer stands out as a high-quality small-cap with a proven history of being able to compete with much larger competitors. The latest quarterly growth above the industry average growth suggests the company is gaining market share. Part of that considers its smaller size as an advantage, being able to more quickly react to market trends and incorporate new technologies.

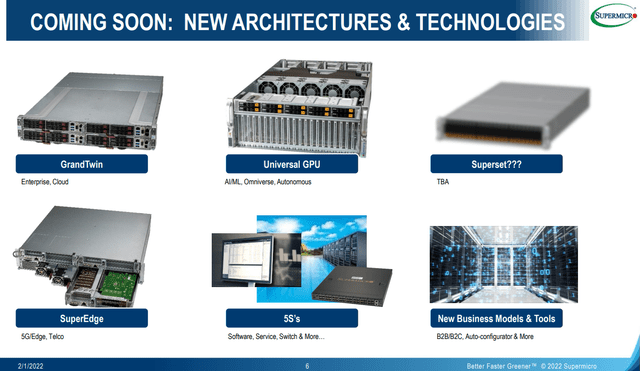

Recent product launches like its industry-leading edge-to-cloud solutions and what it refers to as a “groundbreaking” universal GPU server system are examples of its continuing innovation that help it differentiate itself in the market for what are sometimes seen as commoditized devices. Longer-term, the ongoing transformation into more services with a “complete IT solution” will present cross-selling opportunities for existing client relationships while expanding the addressable market.

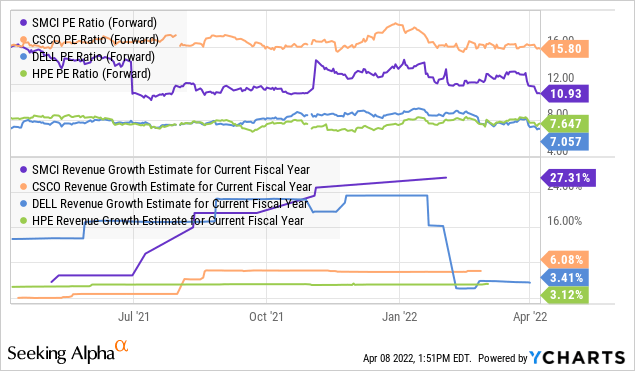

The attraction here is the outlook for revenue and EPS growth this year at 24% and 31% above 2021, each respectfully, which we believe is based on company-specific execution that goes beyond macro and industry trends. Management cites mega-cap tech stalwarts like Cisco Systems Inc (CSCO), Dell Technologies Inc (DELL), and Hewlett Packard Enterprise Co (HPE) as competitors within the company’s annual report.

We note that SMCI trading at an 11x forward P/E multiple looks like a good value next to this group compared to CSCO at 16x. While SMCI trades at a premium compared to HPE and DELL closer to 7.5x, SMCI benefits from a significantly stronger growth outlook while the other companies are struggling to move the needle beyond single-digit momentum.

Final Thoughts

We rate SMCI as a buy with a year ahead price target of $45.00, representing a 14x multiple on the current consensus fiscal 2022 EPS. Our price target was a level the stock traded at as recently as early January and our thinking here is that a series of solid quarterly reports through the rest of the year will allow the stock to regain positive momentum. While a date is not yet confirmed, the fiscal Q3 report expected in early May could be an upside catalyst for the stock if it is accompanied by positive guidance.

We view SMCI as simply undervalued given its strong fundamentals and the recent selloff in shares can represent a new buying opportunity. The stock is down about 26% from its recent highs and approaching what we see as a strong level of technical support around $35.00 per share.

In terms of risks, the company remains exposed to global macro trends. A deterioration of the global macro environment with the possibility of a slowdown in business investment spending would likely represent a bearish headwind for the company. The gross margin will be a key monitoring point going forward.

Be the first to comment