KanawatTH

SU: Underperformed Its Oil & Gas Peers YTD

Suncor Energy Inc. (NYSE:SU) has continued to outperform the S&P 500 (SPX) (SP500) in 2022, as SU posted a YTD total return of 24.8%. However, it has underperformed its peers listed in the Energy Select Sector SPDR ETF (XLE), which posted a YTD total return of 56.7%.

Therefore, the market appears tentative over the operational prospects of Suncor’s well-integrated business. Suncor has a massive oil sands segment and a significant reserve base. The company believes that its portfolio is better-positioned than its pure-play E&P peers, as Interim President and CEO Kris Smith accentuated:

This is a significantly lower-risk model than a typical pure-play E&P operator who are successful and ongoing drilling program every year to maintain production. Suncor has bitumen inventory to maintain production well into the future with an overall decline rate of 5%. Volatile pricing has little impact on earned PV in the long run. We have large reserves with long-life fixed assets, making our free cash flow robust and sustainable. (Suncor Investor Day 2022)

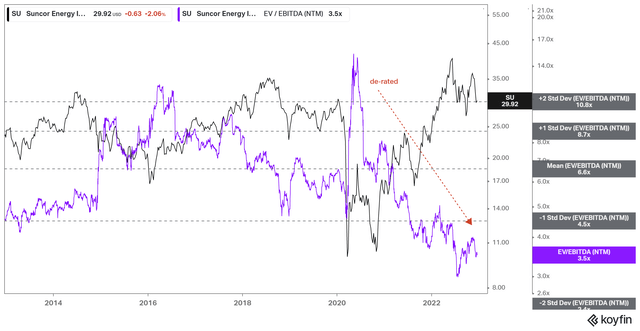

SU NTM EBITDA multiples valuation trend (koyfin)

However, we noted that the market had not re-rated SU in 2022, likely in anticipation of a weaker energy market backdrop. In addition, the underlying oil and gas market has continued to weaken since Q3, which could continue to impinge on SU’s ability to deliver another spectacular year in 2022 (relative to its 10Y total return of 2.6%).

Global Macroeconomic Headwinds Intensified

The IMF cautioned in early December that the global economy could weaken further. Fed Chair Jerome Powell and the FOMC’s hawkish stance through 2023 have also intensified the headwinds that could tilt the US economy into a deeper recession. The European Union has also followed suit in raising interest rates to combat inflation, even though the EU is likely already in a recession.

Energy bulls remain steadfast, holding on to their thesis that OPEC+ is the strategic anchor to stanch further rapid price declines. However, WTI crude oil futures (CL1:COM) have continued to come under pressure since its previous 2M+ per barrel per day production cut. Notwithstanding, OPEC+ has also maintained that they would closely monitor the demand/supply backdrop, so further cuts cannot be ruled out.

The market’s reaction to Russia’s oil price cap has been relatively “nonchalant” so far, as Russia has successfully managed to divert its oil flows to China and India. Notwithstanding, oil analysts and agencies have touted China’s recent COVID reopening moves as they raised their 2023 forecasts, seeing upside potential.

China’s Upside Potential Could Be Overstated

Despite that, Bloomberg highlighted in a recent commentary that China’s oil demand didn’t crumble in 2022. With industrial production still hampered in the near term, as it deals with a rapid surge in COVID cases, WTI crude oil futures may not benefit from the near-term spike in demand, as these analysts postulated. Bloomberg articulated:

China’s Covid reopening won’t be enough to save the oil market. Apparent domestic oil demand hasn’t appreciably expanded since hitting a plateau in early 2021. For one thing, transport simply isn’t as dominant as it is elsewhere. In fact, the only factor that’s prevented China’s crude oil consumption from hitting a fresh record [in 2022] has been a precipitous collapse in asphalt production. That’s reason to think even a rapid removal of Covid-Zero restrictions now won’t be sufficient to cause a sudden rebound in demand early next year. This would require an improvement in global growth, as well as a change in Chinese domestic conditions. – Bloomberg

As such, we believe the Street’s consensus (bullish) in a deceleration in Suncor’s revenue and profitability growth through FY24 is credible. With a potential global recession over the horizon, we believe the market needs to reflect these challenges. As such, it could partially explain why the market “refuses” to re-rate SU higher, despite its remarkable performance in 2022.

Notwithstanding, with a much-improved balance sheet, it should enhance the company’s credibility maintaining its firm commitment to buybacks and dividends.

Takeaway

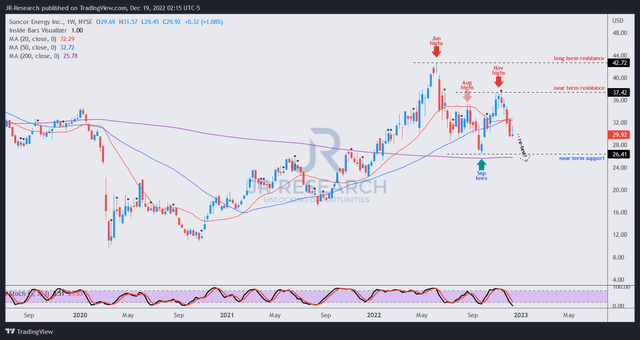

SU price chart (weekly) (TradingView)

While we believe near-term downside volatility in SU cannot be ruled out, we see its September lows as a potentially strong support to fend off renewed bearish attacks.

Also, SU’s relative undervaluation against its oil and gas peers could proffer a defense against further downside volatility, even if the underlying energy markets weaken further. SU last traded at an NTM EBITDA of 3.5x, well below its peers’ median of 5.11x (according to S&P Cap IQ data).

With SU having pulled back nearly 20% from its November highs (in price-performance terms), we are more constructive on the reward/risk at the current levels.

However, we caution investors that further downward pressure to re-test its September lows cannot be ruled out. Hence, investors should be prepared to layer in accordingly, leveraging on dollar-cost averaging opportunities.

Revising from Hold to Buy.

Be the first to comment