sefa ozel

Introduction

Despite the booming oil and gas prices earlier in 2022, the share price of Suncor Energy (NYSE:SU) was lagging behind their peers but as my previous article highlighted, a low share price is not your enemy given their focus on share buybacks. Following the release of their third-quarter results, it seems timely to provide a follow-up analysis that considers what is on the horizon for the year ahead, which sees their capital allocation strategy effectively leveling up in 2023 and offsetting any recession that may possibly lay ahead.

Coverage Summary & Ratings

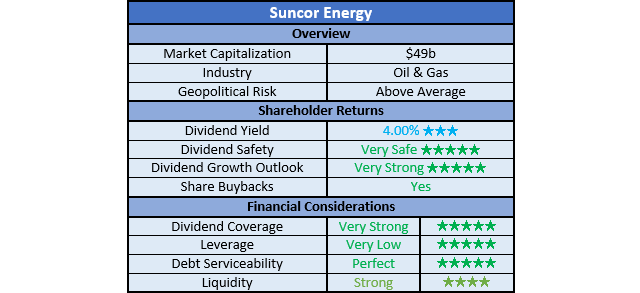

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

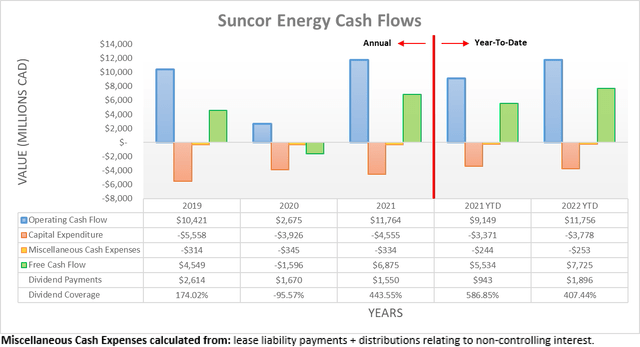

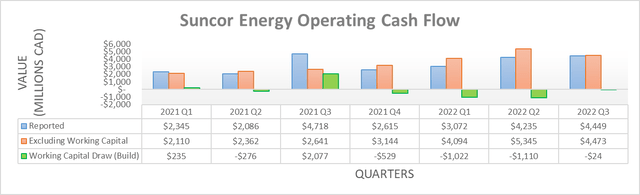

Quite unsurprisingly, the good times continued during the third quarter of 2022 as oil prices remained very strong by historical standards, despite otherwise softening versus their booming triple-digit levels during the second quarter. As a result, their operating cash flow during the first nine months reached C$11.756b, which is up from C$7.307b during the first half. Despite representing a very strong C$4.449b increase for only one quarter, if compared against 2021, their cash flow performance thus far into 2022 may initially seem rather disappointing with the first nine months of 2021 seeing operating cash flow reasonably close at C$9.149b, even though it was accompanied by significantly lower oil prices.

If digging deeper, thankfully this was merely due to sizeable working capital movements and not poor financial performance. After being aggregated across the first nine months of 2022, they saw a working capital build of C$2.156b, whereas the same period of time during 2021 saw a draw of C$2.036b. In the case of the former, it reduces their reported operating cash flow, whereas naturally in the case of the latter, it obviously does the opposite. If these are removed from their results, it sees their underlying results for the first nine months of 2022 at C$13.912b and thus well above their previous equivalent result of C$7.113b during the first nine months of 2021. Meanwhile, if looking into their quarterly results, their underlying operating cash flow for the third quarter of 2022 was C$4.473b and thus down modestly versus the second quarter that saw a result of C$5.345b, as their financial performance softened in tandem with oil prices.

Thus far the fourth quarter of 2022 is off to a solid start that if continued, should see their financial performance land somewhere around its level from the third quarter. The bigger and more important question is what lies ahead in 2023 and whilst there are many moving parts to the economy and uncertainties, it seems the question of a recession is now more so a matter of when, not if. Even though there are various bullish variables within the oil market itself, such as the upcoming European sanctions on Russian seaborne oil exports and possible easing of the zero-Covid-19 policy in China, it nevertheless is undeniable that weaker economic conditions will pose a very strong headwind to oil prices.

This is not suggesting a full-fledged crash is inbound, more so that risks are skewed towards the downside in the foreseeable future. Since it is difficult to make a compelling bullish case for 2023 and possibly even 2024, it would be prudent for investors to ensure their investments are still desirable without the recent booming oil prices. Whilst short-term returns are largely driven by catalysts, in the medium to long-term, returns are driven by acquiring shares that offer desirable value, such as displayed via their free cash flow yield.

In my view, I feel that 2021 represents a suitable middle-of-the-road scenario because the weakness earlier in the year was offset by the strength later in the year. When their accompanying free cash flow of C$6.875b is compared against their current market capitalization of approximately $49b, it sees a very high free cash flow yield that is slightly above 10%, given the current CAD to USD exchange rate of $0.75. Even if oil prices soften significantly as economic conditions deteriorate, this means they should still produce ample free cash flow to make their shares desirable via facilitating shareholder returns, along with continued deleveraging. Admittedly, the short-term might still be bumpy but at least they are also poised to see their shareholder returns leveling up, as per the commentary from management included below.

“Depending on commodity prices, we expect to increase our allocation to share buybacks to 75% by the end of Q1 2023, and this will complement our 4% dividend yield.”

– Suncor Energy Q3 2022 Conference Call.

They plan to increase their shareholder returns upon reaching various net debt targets, the next of which being C$12b that sees 75% of their excess free cash flow after dividend payments directed towards share buybacks, as per slide nine of their third quarter of 2022 results presentation. After reaching this point, it will subsequently increase to 100% upon hitting their net debt floor of C$9b at some point in the future, which may eventuate during 2023 but this will depend upon the yet-to-be-known operating conditions. When combined with their desirable free cash flow yield, I feel this sufficiently boosts the appeal of their shares to offset any recession that may possibly lay within the next twelve months.

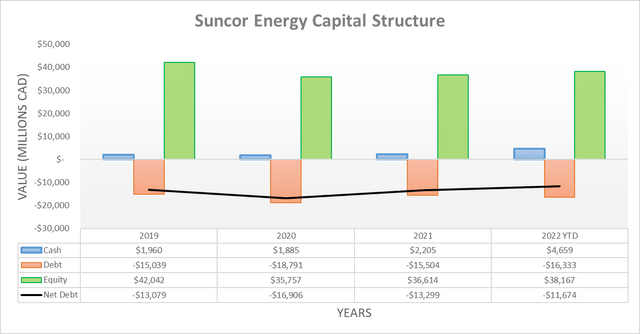

Another quarter goes by and once again, their net debt ticks lower with it now landing at C$11.674b versus where it ended the second quarter at C$12.791b, thereby representing another billion-dollar-plus decrease across merely one quarter. Whilst already positive, the strengthening USD posed a C$723m headwind that actually hindered this decrease via boosting the value of their debt in CAD terms, as per their third quarter of 2022 results announcement.

If including their lease liabilities as practiced by management for the purpose of their capital allocation strategy, their net debt is now C$14.584b and thus sees only circa C$2.5b of deleveraging remaining before reaching their interim C$12b target and thus leveling up their shareholder returns. Since they slashed almost C$2b of net debt during the third quarter excluding currency impacts, their guidance to reach this point during the first quarter of 2023 seems quite realistic, even considering their upcoming acquisition.

When looking ahead, they are acquiring a further stake in their Fort Hills project for C$1b, which they expect to close during the first quarter of 2023. Whilst this slightly delays reaching C$12b of net debt from late 2022 to early 2023 and thus leveling up shareholder returns, it will permanently increase their free cash flow slightly higher and thus year by year, shareholders will benefit. If looking elsewhere, their balance sheet sees C$1.083b of assets held for divestitures but these are accompanied by C$761m of associated liabilities, thereby netting out to only a relatively insignificant C$322m.

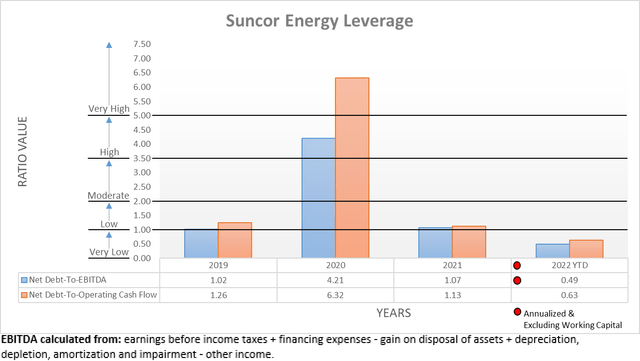

Despite their financial performance softening modestly during the third quarter of 2022 versus the second quarter, their leverage still trickled ever-so-slightly lower thanks to their lower net debt. As a result, they now see a net debt-to-EBITDA of 0.49 and a net debt-to-operating cash flow of 0.63, which are both below their respective results of 0.51 and 0.68 following the second quarter and obviously remain well beneath the threshold of 1.00 for the very low territory. If a recession were to strike during 2023, these would likely climb higher as their financial performance further softens, although at least they would be starting from a rock-solid base. Plus, as they scale their share buybacks accordingly with their free cash flow, their net debt should continue trending lower until they reach their C$9b floor, thereby putting downward pressure on their leverage.

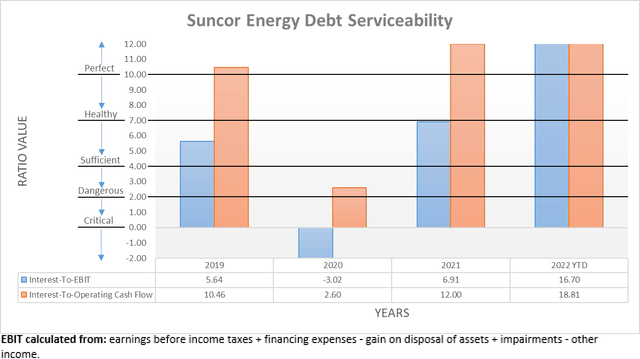

Not only does reducing their net debt benefit their leverage, it also carries important benefits for their debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. Reducing their net debt provides a shield in the event of softer financial performance because recession or not, it seems interest rates are far more likely to be higher in 2023 than 2022. At least as things stand right now, they are already well positioned with perfect interest coverage of 16.70 and 18.81 compared against their accrual-based EBIT and cash-based operating cash flow, respectively.

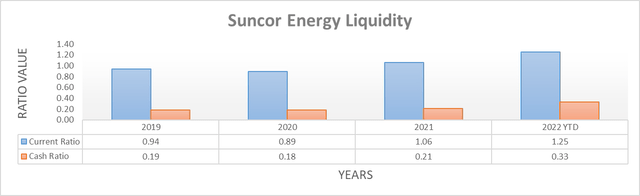

After seeing their already strong liquidity improve during the first half of 2022, this continued into the third quarter with their respective current and cash ratios hitting 1.25 and 0.33, thereby modestly above their previous respective results of 1.10 and 0.12 following the second quarter. Whilst they will always fluctuate going forwards, similar to their leverage, this provides a rock-solid base to endure whatever the future holds. Thankfully, reducing their net debt also helps mitigate future refinancing needs because as an oil sands company, they face medium to long-term threats from ESG concerns that see fewer financial institutions willing to extend credit, despite what might otherwise have been an appealing deal.

Conclusion

No one can see the future and following the events of the last few years, the outlook is increasingly difficult to ascertain with operating conditions varying significantly in both directions. Despite the bullish variables within the oil market itself, a possible recession during 2023 creates a very strong headwind but thankfully, they are months away from leveling up their shareholder returns. More importantly in the medium to long-term, their shares still trade with a desirable double-digit free cash flow yield based upon their middle-of-the-road results for 2021 and thus I still believe that maintaining my buy rating is appropriate. If not for these variables working together to offset any recession, my rating would have otherwise been lower, as was recently the case when reviewing their peer, Cenovus Energy (CVE) whose comparable free cash flow yield was far less, as my other article discussed.

Notes: Unless specified otherwise, all figures in this article were taken from Suncor Energy’s SEC filings, all calculated figures were performed by the author.

Be the first to comment