spooh/E+ via Getty Images

A Quick Take On Sun Country Airlines

Sun Country Airlines (NASDAQ:SNCY) went public in March 2021, raising approximately $218 million in an IPO that was priced at $24.00 per share.

The firm operates a fleet of cargo and passenger aircraft in the United States.

For SNCY, I’m in a wait-and-see mode and want Q1 results on how seriously rising fuel costs are impacting the company’s operating income.

I’m on Hold for SNCY over the short term until we learn more.

Company

Minneapolis, Minnesota-based Sun Country was founded to offer a variety of airline transportation services to persons and cargo operators via its fleet of Boeing 737-NG aircraft.

Management is headed by Chief Executive Officer Jude Bricker, who has been with the firm since 2017 and was previously COO of Allegiant Travel Company and a finance manager at American Airlines.

The company’s primary offerings include:

-

Scheduled passenger service

-

Charter passenger service

-

Cargo transport for Amazon (AMZN)

The firm seeks leisure-oriented passengers and markets through online and offline means, including through its booking engine Navitaire.

For its cargo operations, the firm pursues an ‘asset light’ approach, which can result in better returns during difficult economic periods, like the COVID-19 caused passenger travel downturn.

Market & Competition

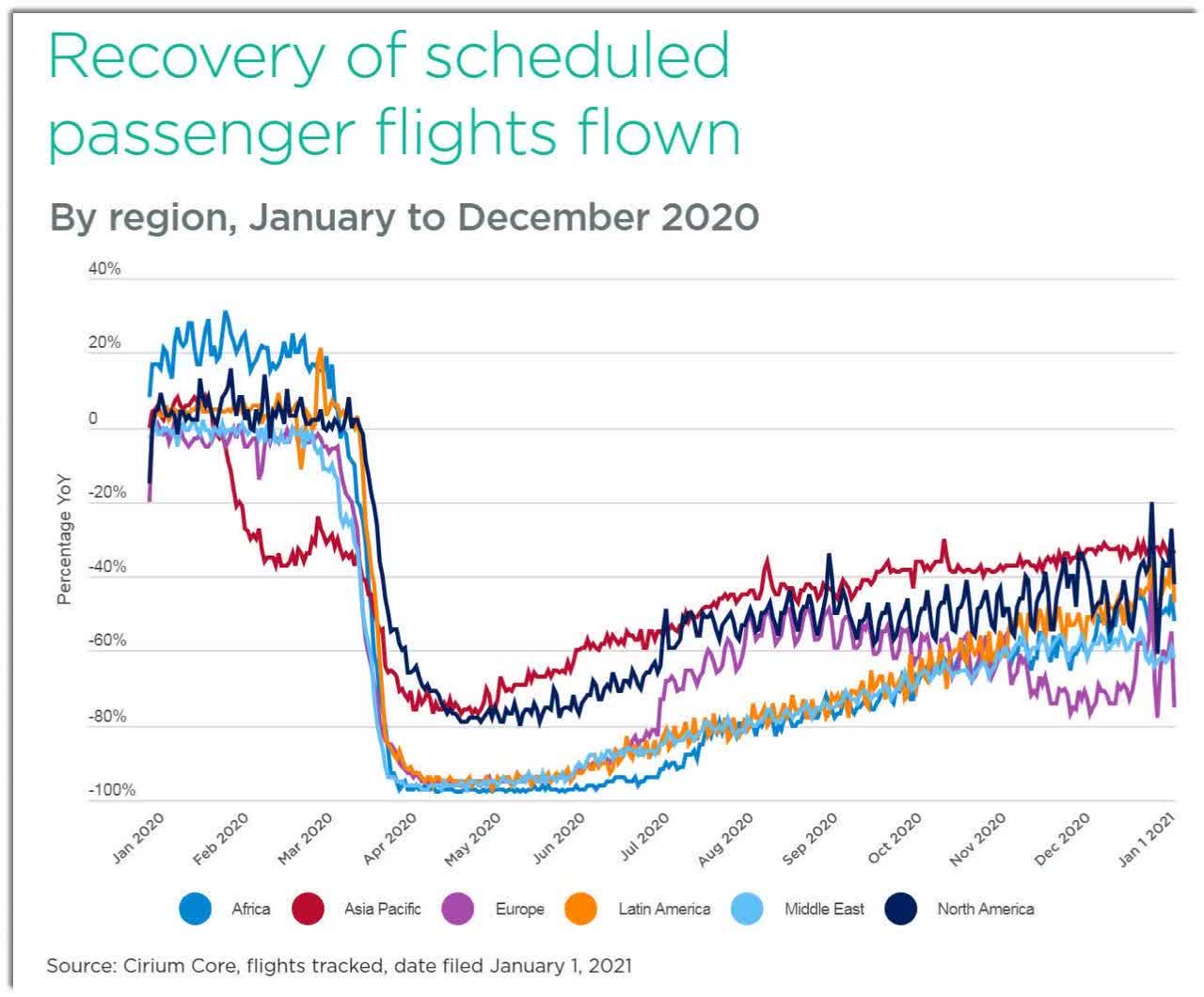

According to a 2021 market research report by Cirium, from January 1, 2020, to December 20, 2020, airline flights dropped from 33.2 million in 2019 to 16.8 million in 2020.

That represents a drop of 49% as the aviation industry was severely impacted by the COVID-19 pandemic.

The chart below shows the drop in flights as well as the slow rebound as 2020 progressed:

2020 Passenger Flights (Cirium)

Also, the Asia Pacific region rebounded the fastest while Europe ended the year with the slowest rebound by region.

Major competitive or other industry participants include:

-

New airlines

-

Ultra low cost carriers, like Allegiant (ALGT) and Frontier (FRNT)

-

Legacy network airlines

SNCY’s Recent Financial Performance

-

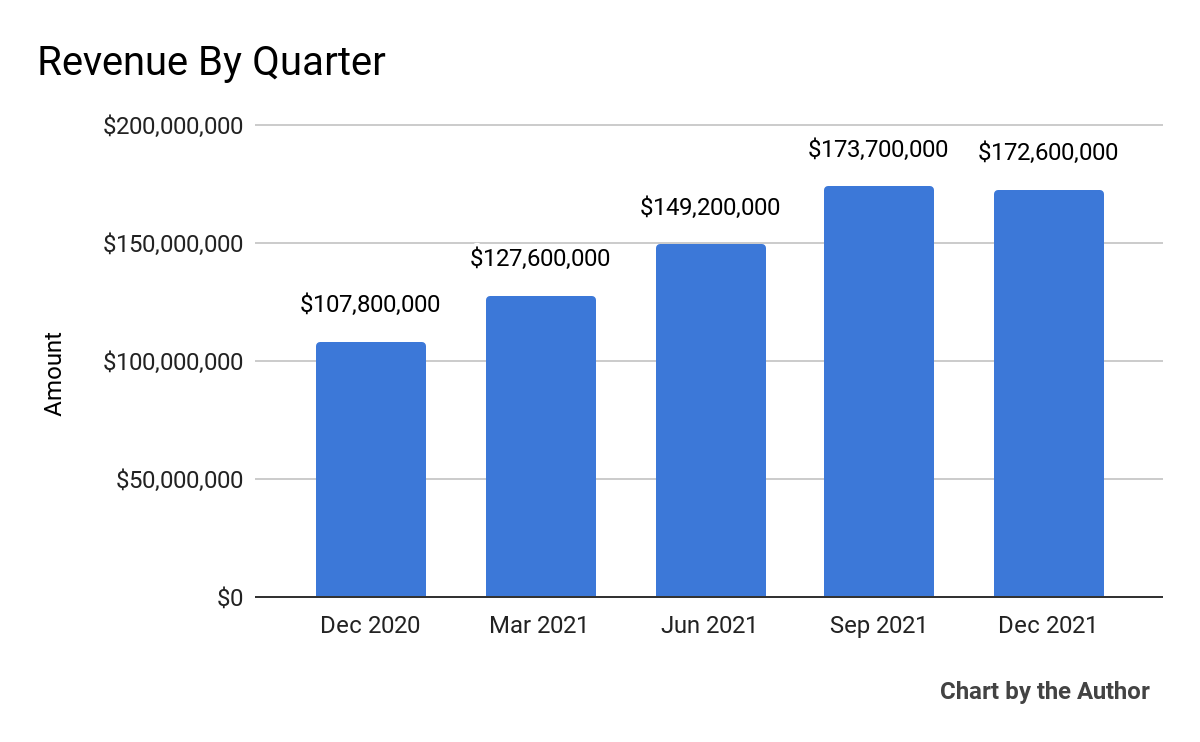

Topline revenue by quarter has risen impressively over the past 5 quarters:

5-Quarter Total Revenue (Seeking Alpha and The Author)

-

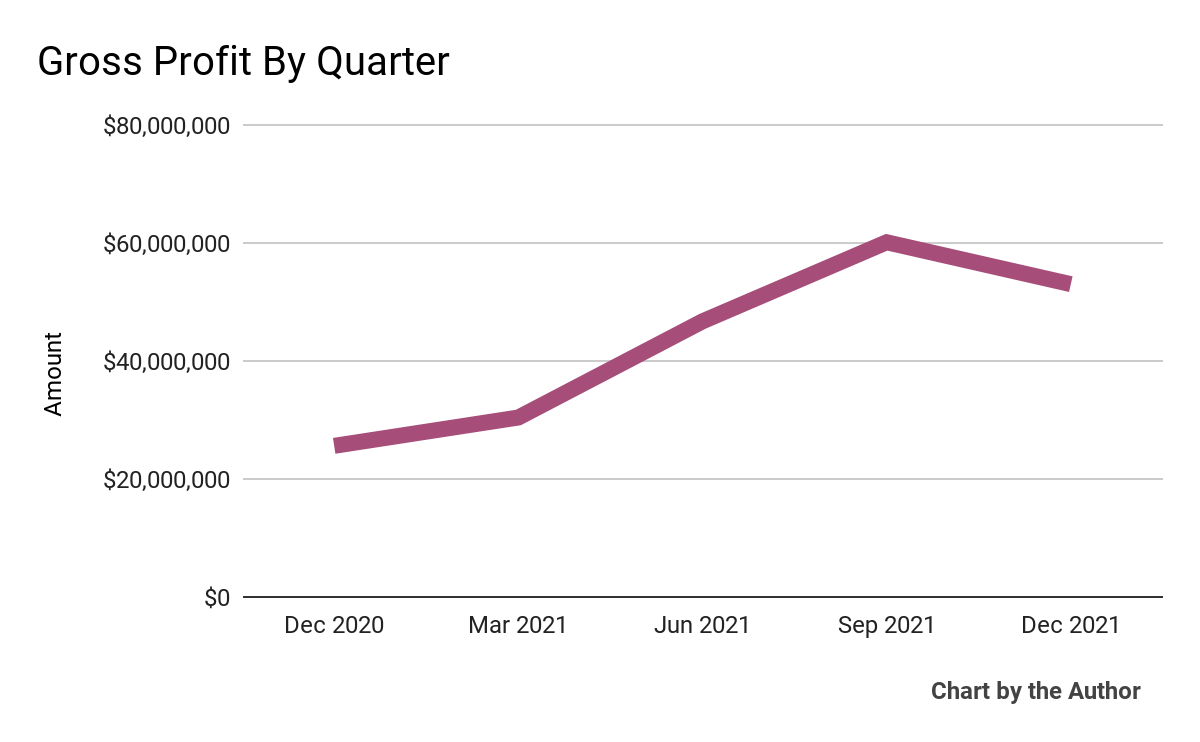

Gross profit by quarter has followed roughly the same trajectory as topline revenue:

5-Quarter Gross Profit (Seeking Alpha and The Author)

-

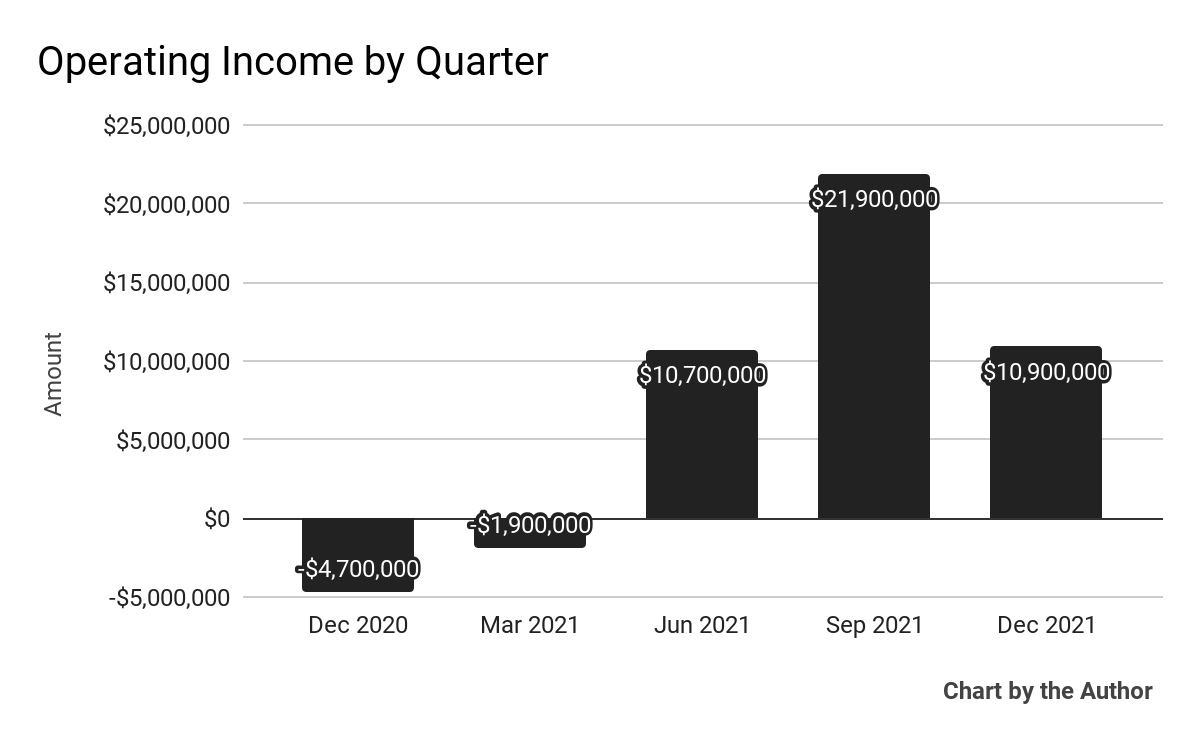

Operating income by quarter has grown as well, although less significantly as 2021 came to a close:

5-Quarter Operating Income (Seeking Alpha and The Author)

-

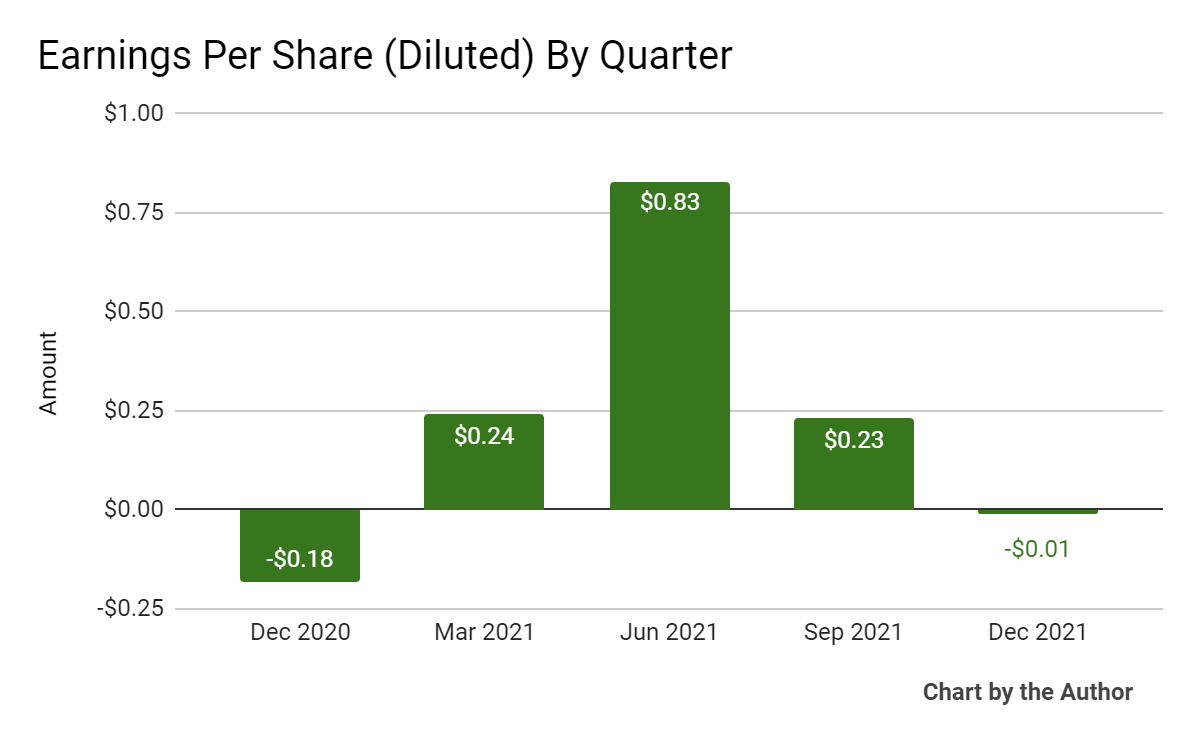

Earnings per share (Diluted) have been highly variable over the past 5 quarters:

5-Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

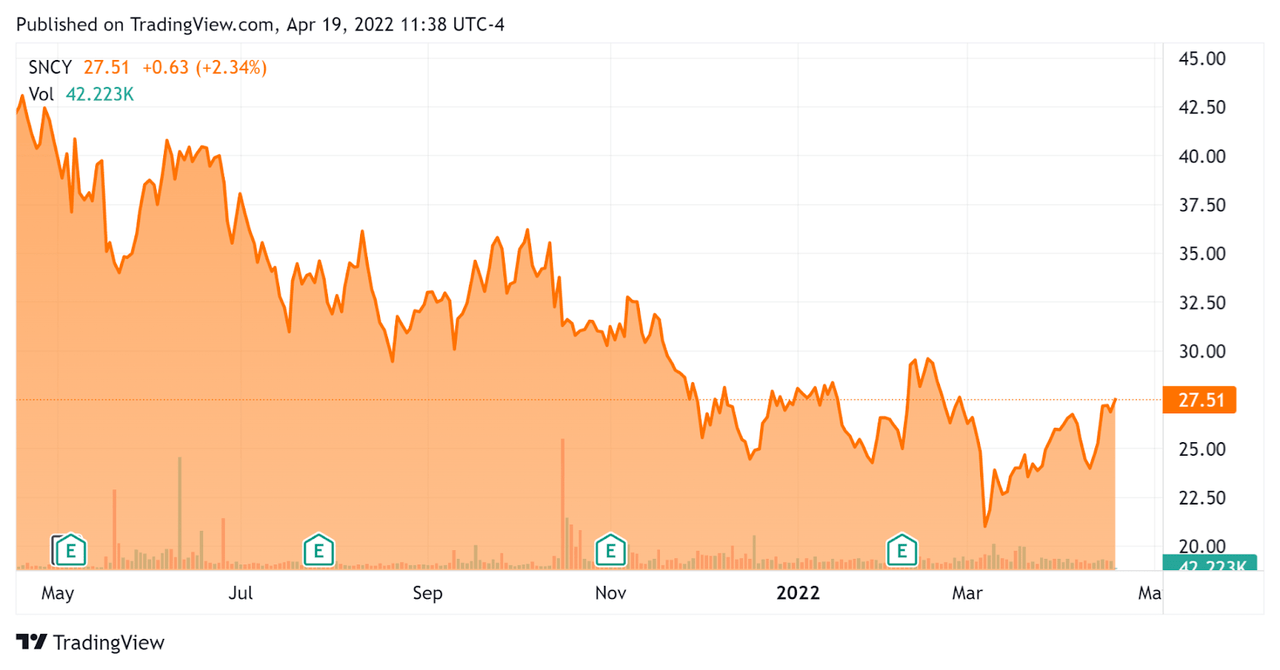

In the past 12 months, SNCY’s stock price has dropped 34.1 percent vs. the U.S. S&P 500 index’ rise of 6.9 percent, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation Metrics For SNCY

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$1,570,000,000 |

|

Enterprise Value |

$1,800,000,000 |

|

Price / Sales |

2.38 |

|

Enterprise Value / Sales |

2.90 |

|

Enterprise Value / EBITDA |

18.68 |

|

Free Cash Flow [TTM] |

$11,100,000 |

|

Revenue Growth Rate [TTM] |

55.18% |

|

Earnings Per Share |

$1.29 |

(Source)

As a reference, a comparison to several peer airlines shows Sun Country to have produced superior financial results in recent periods in many respects, perhaps explaining why investors are valuing the firm at higher valuations than other low cost carriers.

Commentary On SNCY

In its last earnings call, covering Q4 2021’s results, management highlighted the firm’s asset-light business model and its flexible, multi-segment business model as ‘unique among airlines due to the predictability of our charter and cargo businesses.’

CEO Bricker believes this results in structural advantages that enable the firm to better withstand exogenous shocks to one segment or another.

However, the airline is not immune to challenges such as labor shortages and fuel price rises.

The company is hiring across all major labor areas and is raising wages to compete, resulting in increased operating costs.

Fuel cost inflation has been a worry, although management says it has cycled out of less efficient airplanes to partially offset higher costs, although one-third of its operations has what it terms ‘pass-through fuel economics.’

As to its financial results, notably, per aircraft ownership expense has dropped by 22% since 2019.

Its CASM (Cost per Available Seat Mile) finished 2021 at an adjusted $.0644 and management expects an adjusted CASM in 2022 ‘lower than the $0.0631 we achieved in 2019,’ and that is even taking into account the impact of its new pilot labor agreement.

Looking ahead, the first quarter of the calendar year is typically the firm’s strongest quarter, and management expected to have the highest level of available seat miles due to growing consumer demand.

Indeed, demand has been growing from the author’s admittedly limited sample of west coast airports, which has seen growing security lines and frequently nearly full aircraft since the beginning of March.

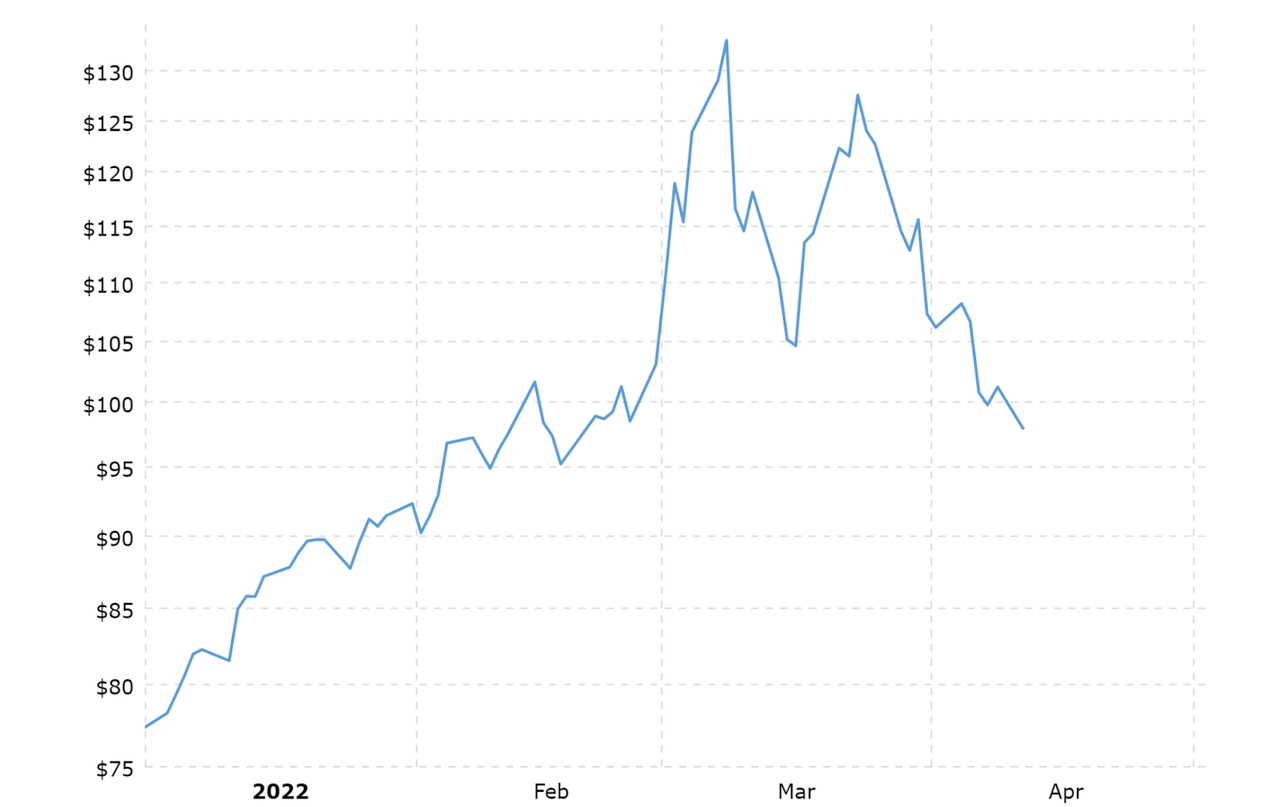

However, fuel costs have risen sharply in the wake of the war in Ukraine, as the chart of Brent Crude shows below:

MacroTrends (2022 Brent Crude Price History)

The primary risk to the company’s outlook is continued high fuel prices and increasing labor costs as airlines compete for employees to handle increasing demand as the pandemic wanes and travel restrictions are lowered.

Compared to peers, SNCY is richly valued by investors who have pushed the stock up 30% from its March 7 low of $21.00.

The question for investors now is whether the summer months will produce growth that the firm can handle with labor shortages and high fuel costs.

I’m in a wait-and-see mode and want Q1 data on how seriously rising fuel costs are impacting the company’s operating income.

I’m on Hold for SNCY over the short term until we learn more.

Be the first to comment