ThamKC/iStock via Getty Images

Introduction

It’s time to talk about agriculture. This time we’re not looking at a specific crop, a fertilizer company, or one of my favorite machinery companies. No, we’re focusing on ethanol production. Ethanol is a cornerstone of modern agriculture as it supports crop prices and because it’s a key ingredient for a lot of productions further down the supply chain.

After I have covered The Andersons (ANDE) a lot in the past few months – and prior to that – people asked me to cover a company that is exclusively focused on ethanol. Now is a great time to focus on a stock I had on my radar for a while: Green Plains Inc. (NASDAQ:GPRE). This Nebraska-based ethanol company is transforming itself into a well-diversified ethanol producer that goes down multiple related supply chains thanks to a wide variety of value-added products. It allows the company to boost margins, free cash flow, and reduce debt. Moreover, thanks to a strong agriculture tailwind, the company is getting an additional boost. If we incorporate the company’s growth plans, I have to conclude that GPRE is way too cheap.

Let’s look at the details!

What’s Green Plains?

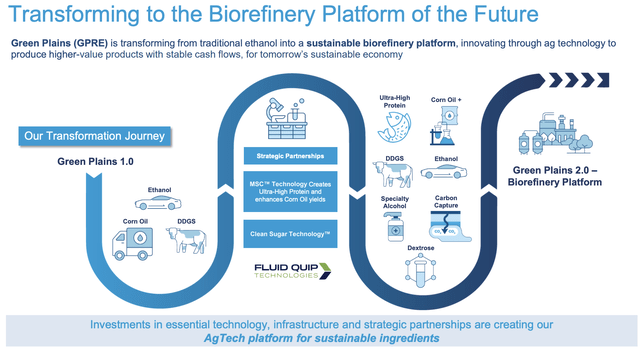

With a market cap of $1.9 billion, Green Plains is one of America’s largest ethanol producers. Founded in 2004, the company is now becoming more than a company just focused on ethanol. The company is working on an impressive transition from a commodity-processing business to a value-add agricultural technology company focusing on creating diverse, non-cyclical, higher-margin products.

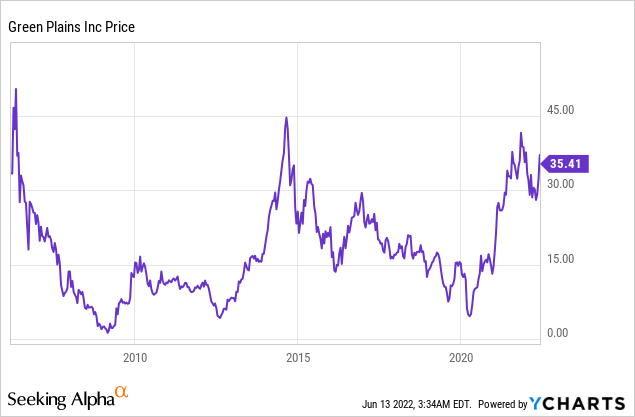

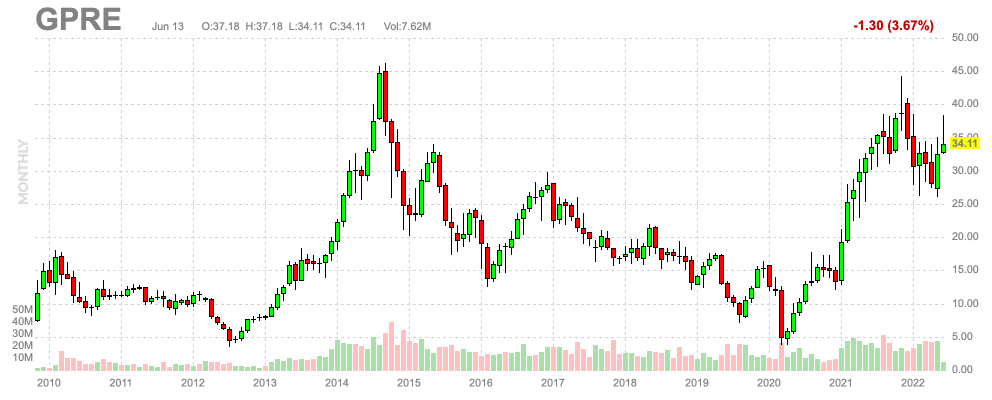

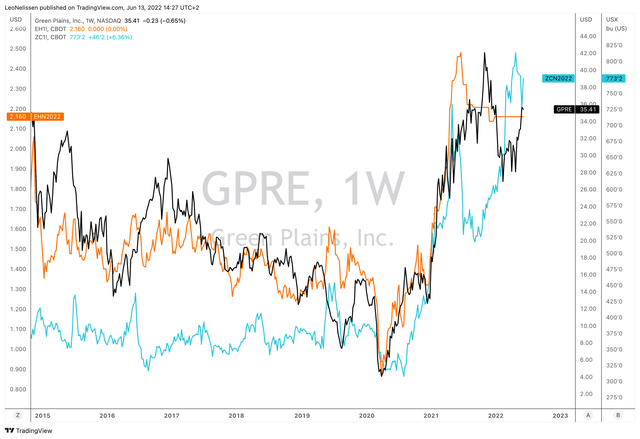

This is happening all over the place as commodity processors don’t want to rely on commodity pricing anymore. For example, using Green Plain’s stock price history, we see steep drawdowns and steep rallies. These price movements follow commodity prices almost in lockstep as commodity processing is about one thing: margins. For example, in the current environment, some fertilizer companies are reporting exploding sales despite lower volumes.

Right now, being a commodity processor, producer, or distributor is quite “nice.” However, that will change as commodities will come down eventually. At that point, it’s important to have a business that operates in higher-margin segments.

In 2020, the company bought a majority stake in FQT (Fluid Quip Technologies). According to Green Plains:

The acquisition capitalizes on the core strengths of each company to develop and implement proven, value-added agriculture, food and industrial biotechnology systems and rapidly expand installation and production across Green Plains facilities, as well as offer these technologies to the biofuels industry.

The company also owns 48.9% of Green Plains Partners LP, a master limited partnership, which manages the company’s primary downstream storage and logistics of ethanol production.

Taking these things into account gives the company three business segments. Note that I added the percentage of total 2021 sales to the quotes below. I also left out the partnership as it brought in less than $5 million in 2021 sales. According to the company:

Ethanol Production (76%). Our ethanol production segment includes the production of ethanol, including industrial-grade alcohol, distillers grains, Ultra-High Protein and corn oil at 11 ethanol plants in Illinois, Indiana, Iowa, Minnesota, Nebraska and Tennessee. At capacity, our facilities are capable of processing approximately 330 million bushels of corn per year and producing approximately 1.0 billion gallons of ethanol, 2.5 million tons of distillers grains and Ultra-High Protein and 290 million pounds of industrial grade corn oil, making us one of the largest ethanol producers in North America.

Agribusiness and Energy Services (24%). Our agribusiness and energy services segment includes grain procurement, with approximately 27.0 million bushels of grain storage capacity, and our commodity marketing business, which markets, sells and distributes ethanol, distillers grains, Ultra-High Protein and corn oil produced at our ethanol plants. We also market ethanol for a third-party producer as well as buy and sell ethanol, including industrial-grade alcohol, distillers grains, Ultra-High Protein, corn oil, grain, natural gas and other commodities in various markets.

Note that I highlighted a few parts in the quotes above as ethanol production comes with a lot of by-products. For example, distiller grains (DDGS), and related oils/proteins are valuable input for a lot of other production processes – the higher-margin opportunities GPRE is after.

The overview below shows how the company is expanding from the basic three ethanol output products (ethanol, corn oil, DDGS), to a wide variety of products related to corn, including ultra-high protein feed, higher-quality corn oil, specialty alcohol, and dextrose.

What this does is add new markets to the company’s customers. This includes pet-related, aquaculture, and dairy/poultry industries requiring high-quality food input.

It also gives the company a bigger footprint in renewable energies as corn oil is a major component of low-carbon diesel. Dextrose can be used in chemical processes like the production of bioplastics, synthetic biology, and others.

Last but not least, the company is participating in carbon capture, which is an emerging way to get rid of carbon dioxide.

According to the company:

[…] three of our biorefineries entered into a long term carbon offtake agreement with Summit Carbon Solutions (SCS), a subsidiary of Summit Agricultural Group. The SCS carbon capture and sequestration project will create the infrastructure to transport carbon dioxide to North Dakota for deposit into geologic storage

With that said, let’s include numbers in this discussion.

The Value Of Green Plains

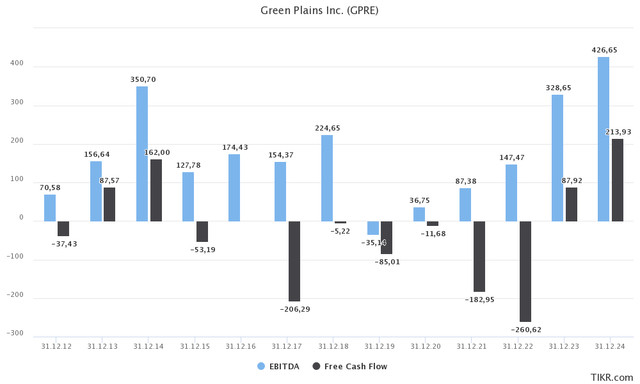

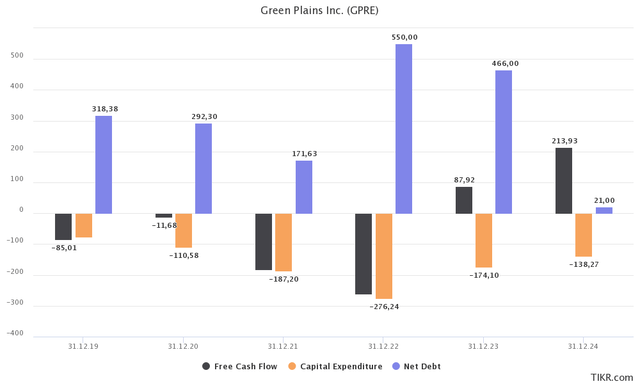

First of all, the chart below shows what analysts expect going forward. In 2024, the company is expected to do close to $430 million in adjusted EBITDA with $214 million in free cash flow. Prior to the pandemic, the company’s EBITDA was choppy and lower with free cash flow constantly dipping into negative territory due to volatile net income as well as higher investment requirements. For example, this year, the company is expected to spend $280 million on CapEx, a new all-time high. After that, CapEx is expected to gradually decline, opening up opportunities to accelerate free cash flow.

The graph below shows that falling CapEx is boosting free cash flow, which means the company could technically speaking, end up with zero net financial debt in 2024.

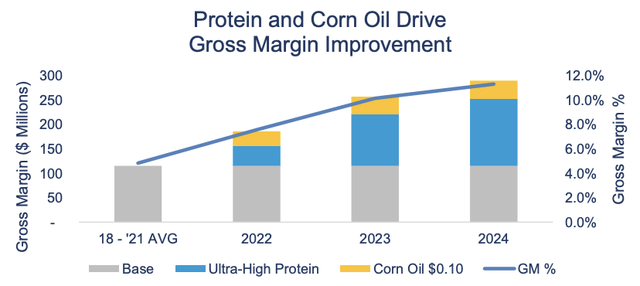

Based on that context, the company is looking at significant margin improvements thanks to products that go further down the value chain. Ultra-high protein products can add between $0.15 and $0.21 per galling in additional EBITDA on a $0.50 per gallon investment. This is one of the drivers that could push gross margins from less than 5% between 2018 and 2021 to almost 12.0% in 2024.

With regard to the company’s transition (and the EBITDA data I just showed), more than 50% of the company’s transition will be completed in 2022. This includes the company’s facilities in Central City, Mount Vernon, and Obion. Next year, the company will complete Tharaldson, Madison, Superior. The remaining capacity will be brought online in 2024, which covers an additional 162 thousand tons of ultra-high protein capacity. Note that these facilities are also listed in a table in this article if you scroll down a bit.

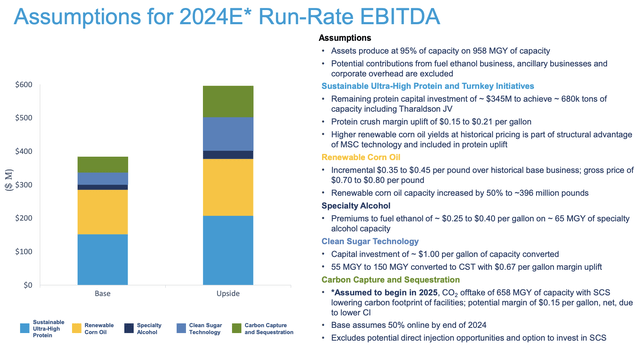

Moreover, what’s interesting is that analysts expect the company to do $470 million in EBITDA in 2024. This seems to be fairly in the middle of the company’s base and upside cases.

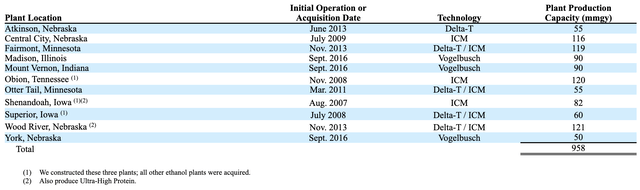

This is under the assumption that assets produce at 95% capacity, which should cover roughly 910 million gallons of capacity. The total available capacity is listed below:

With that said, let’s look at additional tailwinds – beyond the company’s control – and the valuation.

Valuation

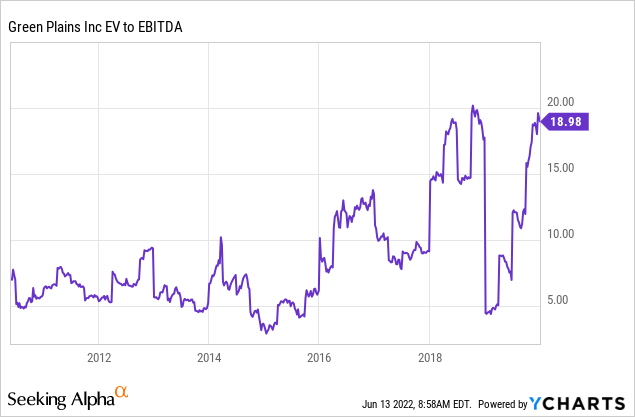

GPRE is becoming less dependent on margins, which will stabilize its stock price – meaning reduce volatility and downside during commodity/energy bear markets. However, margins are still the driver of any ethanol-related company, no matter how far down the value chain its products go.

Since early 2020, GPRE benefits from a raging agriculture bull market. This has fueled corn prices to almost $8 per bushel ($773 per 100 bushels in the chart below) with ethanol prices reaching $2.20 per gallon. It’s a favorable environment for pricing, which boosted GPRE’s stock price from $4 in 2020 to currently more than $35.

It also helps the company that we’re in an energy crisis as I explained in a recent article. Demand is strong while supply is subdued. This has kept oil prices high even as China imposed major lockdowns. In general, agriculture is moving in lockstep with agriculture.

For example, comparing oil and corn gets us this interesting graph:

CME Group

Reasons that contribute to this are that higher energy prices cause fertilizer prices to rise, making planting more expensive, as well as the fact that roughly 40% of corn is turned into ethanol, which is also an “energy” product.

Related to this, Biden announced higher ethanol requirements for refineries to combat energy inflation. According to the Wall Street Journal:

“By requiring petroleum refiners to blend larger volumes of low-cost biofuels like ethanol, today’s actions will put downward pressure on gas prices and provide economic relief to American families facing record high pump prices,” Renewable Fuels Association Chief Executive Geoff Cooper said.

In its announcement, the EPA said it would require refiners to add 18.84 billion gallons of ethanol and other biofuels to be blended into gasoline for 2021—down from a mandate of 20.09 billion gallons previously set for 2020.

Meanwhile, ethanol inventories have fallen significantly, adding to higher production requirements to satisfy demand.

CME Group

Under these circumstances, I’m fairly sure that the company can reach 2023 and 2024 analyst targets.

So, let me give you a few numbers (a lot of them are already covered in this article).

GPRE has a $1,900 million market cap. It also has $150 million in minority interest as a result of its majority stake in i.e., FQT. 2023 net debt is expected to be $470 million. This gives us an enterprise value of $2,520 million, which is 7.6x 2023 EBITDA ($330 million).

If we use 2024 numbers, we use $430 million in expected EBITDA and just $20 million in expected net debt. This gives us a multiple of 4.8x EBITDA.

2024 is more than 2 years from now, but I still believe it’s fair to use these numbers given that the main driver of 2024 growth will be the company’s transformation, which is going according to plan right now.

With that said, given higher margins, I think GPRE should trade between 7-8x EBITDA, meaning between 60% to 80% upside between now and 2024/2025.

Needless to say, there are risks tied to that optimistic outlook. Commodities can come down, the company could run into trouble expanding its facilities, regulatory things could change, or we could see a prolonged recession.

Takeaway

Green Plains is an attractive ethanol play with significant growth in products that go further down the supply chain. Over the next 2-3 years, the company will be turned into a free cash flow powerhouse with the capability to quickly reduce net debt and options to invest in new businesses, distribute cash to shareholders, and/or related projects.

FINVIZ

Moreover, the company gets support from strong energy and agriculture markets, thanks to supply issues that emphasize ethanol production volumes and margins.

Given all circumstances, I believe that GPRE should not trade below $55 in 2024/2025 – potentially above $60 if agriculture margins remain strong.

However, bear in mind that GPRE will remain volatile and highly sensitive to margins and economic growth expectations. Take this into account before trading and/or investing in GPRE or any of its peers.

(Dis)agree? Let me know in the comments!

Be the first to comment