Baris-Ozer/iStock via Getty Images

Introduction

When last discussing the overleveraged and struggling Summit Midstream Partners (NYSE:SMLP), they were oddly talking about undertaking mergers and acquisitions despite their preferred distributions being suspended, which seemed to be jumping the gun and as a result, did not bode well for their critical deleveraging, as my previous article warned. Since one year has now elapsed, it seems timely to provide a refreshed analysis, which sadly sees their common unitholders getting squeezed out of their earnings and assets by the preferred unitholders and debt holders.

Executive Summary & Ratings

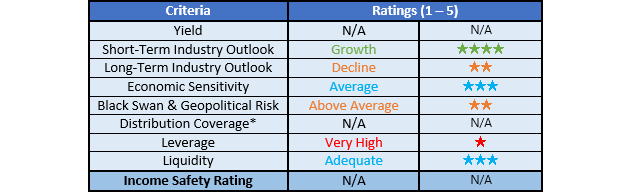

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

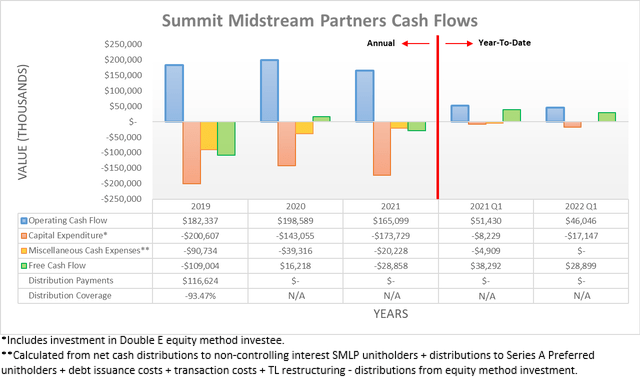

After struggling through 2021 with their operating cash flow of $165.1m down significantly versus its result of $198.6m during 2020, the first quarter of 2022 offered no improvements. In fact, their operating cash flow of $46m was down another 10.47% year-on-year versus their previous result of $51.4m during the first quarter of 2021. Although already disappointing, if removing the temporary impacts of working capital movements, their underlying operating cash flow was only $33.6m during the first quarter of 2022 and thus down a very significant 30.76% year-on-year versus their previous equivalent result of $48.5m during the first quarter of 2021. When looking elsewhere at their accrual-based results, they also share this disappointing performance, as the table included below displays.

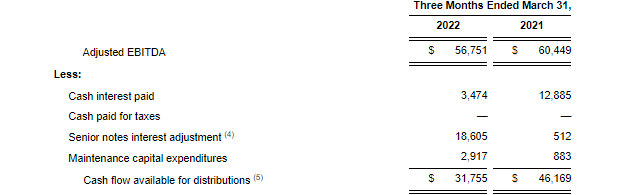

Summit Midstream Partners First Quarter Of 2022 Results Announcement

It can be seen that their adjusted EBITDA of $56.8m for the first quarter of 2022 was down 6.12% year-on-year versus its previous result of $60.4m during the first quarter of 2021. Meanwhile, their cash flow available for distributions, which is also commonly known as distributable cash flow was down a very significant 31.22% year-on-year to $31.8m versus its previous result of $46.2m during these same two periods of time. Unsurprisingly, this is very similar to the decline that their underlying operating cash flow endured and when examining the reconciliation included above, the single biggest contributor was the additional burden of their interest expense following their subsequently discussed debt refinancing during 2021.

The first quarter of 2021 saw interest paid and incurred of $12.9m and $0.5m respectively, thereby making for a total of $13.4m, whereas the first quarter of 2022 saw these two at $3.5m and $18.6m respectively, which sees a new total of $22.1m. This now sees an additional cost of $8.7m per quarter and essentially means that their common unitholders are being squeezed out of their earnings by the debt holders. Meanwhile, their guidance for the remainder of 2022 is not looking any better despite promising the highest free cash flow in history, as the table included below displays.

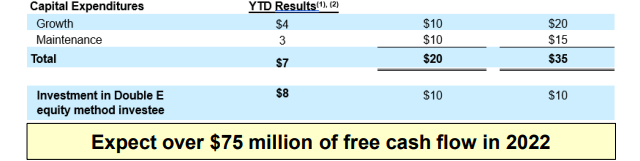

Summit Midstream Partners May 2022 Investor Presentation

On the surface, at least $75m of free cash flow for 2022 may sound positive, especially since their highest result during 2019-2021 was only $16.2m but when digging deeper, sadly this is not the case because it merely stems from lower capital expenditure. If aggregating the $27.5m midpoint of their capital expenditure guidance for 2022 with their forecast $10m guidance for their Double E equity investment, which is practically capital expenditure, it sees a total of $37.5m, which is down massively versus its previous level of $173.7m during 2021. Given their accompanying guidance for free cash flow of $75m, it implies operating cash flow of $112.5m for 2022 and thus once again down even further versus their already weak result of $165.1m during 2021. Since this equates to merely $28.2m per quarter, it means that their weak underlying cash flow performance during the first quarter of 2022 is effectively guided to continue throughout the remainder of the year. Whilst their guidance notes to expect over $75m of free cash flow, anything in excess of this estimation should only be relatively minor because if their results were going to be $20m+ higher, obviously management would have quantified this higher guidance to help support their suppressed unit price.

Even though being squeezed out of their earnings is already bad enough, their common unitholders are also being squeezed out of their assets by the preferred unitholders. They redeemed Series A preferred units by issuing common units during 2021, which amounted to 538,715 units and thus represented a dilution of circa 9% against their outstanding common unit count of 6,110,092 at the start of 2021. Despite already being painful, it was nothing compared to the first quarter of 2022, as they issued 2,853,875 new common units to redeem more Series A preferred units, as the table included below displays.

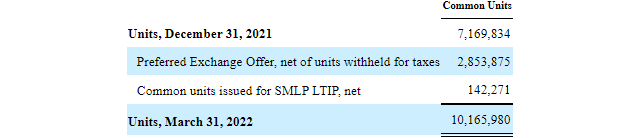

Summit Midstream Partners Q1 2022 10-Q

It can be seen that after starting 2021 with 7,169,834 they subsequently issued 2,853,875 new common units to redeem 77,939 of their Series A preferred units, which represents a circa 40% dilution or phrased another way, common unitholders gave up 40% of their assets to the preferred unitholders. To make this even more painful, it did not even solve their preferred equity problem, as they still have a further 65,508 Series A preferred units remaining. Since these carry a par value of $1,000 per unit, it would require issuing another $65.5m of common units to redeem these the same way, plus a further $15.5m to make their unpaid distributions that have been accruing since being suspended. Even if their preferred unitholders did not seek any discount, this total of $81m would amount to a massive dilution of circa 60% on their current market capitalization of approximately $132m.

This level of dilution makes this path seem unlikely and every quarter their Series A preferred units are left unaddressed, they grow more burdensome. Their distribution rate of 9.50% sees annual commitments of $6.3m per annum that accrue and compound at 9.50% whilst suspended, thereby creating a rapidly growing cash burn that further sees their common unitholders squeezed out of more and more of their future earnings if their preferred distributions are reinstated. Even if their common unitholders endured another massive 60% dilution to redeem these preferred units, it would still not address their subsidiary Series A preferred units that despite the annoyingly similar name, sit on their balance sheet in addition to these ‘normal’ Series A preferred units discussed thus far.

Quite unsurprisingly, these subsidiary Series A preferred units also see their distributions suspended and similarly, they are progressively seeing their common unitholders squeezed out of their future earnings. These carry a distribution rate of 7.00% with their unpaid distributions giving rise to paid-in-kind units, which are effectively new preferred units added onto their existing balance and compound as they incur more distributions. When the first quarter of 2022 ended, they had 93,039 of these subsidiary Series A preferred units that also carry a par value of $1,000 per unit, which means a minimum cost of $93m to redeem and even ignoring their previous preferred units, would incur a massive dilution of circa 70% to redeem via new common units.

Whilst common unitholders are likely hoping that all of their preferred units can see their distributions reinstated soon, thereby putting an end to this compounding and working towards redeeming them via internally generated cash inflows, this does not look promising. They are suspended due to their overleverage and thus will require material deleveraging before being reinstated, which sadly, they have not been making sufficient progress towards.

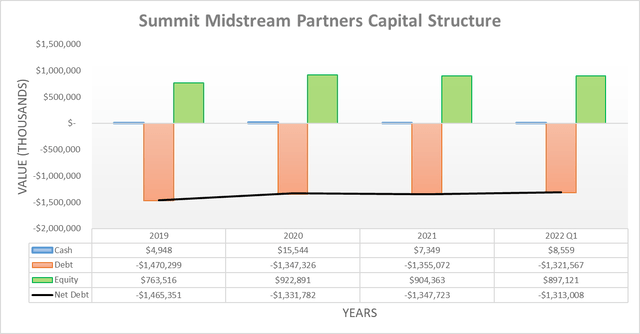

Considering their goal is deleveraging as quickly as possible, it seems very lackluster to see their capital structure effectively unchanged with their net debt of $1.313b barely decreasing versus its previous level of $1.332b as far back as the end of 2020. Meanwhile, they have recently announced a $75m divestiture of their Delaware basin assets, although even if this were to hypothetically cause no loss of earnings, this would still barely help their leverage given that it only amounts to a tiny 5.71% of their net debt. This also bodes relatively poorly for their free cash flow guidance for 2022, which also at circa $75m and thus barely moves the needle against their formidable leverage.

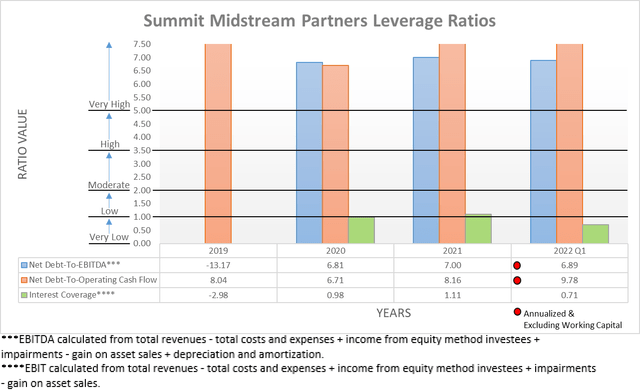

When turning to their leverage, unsurprisingly, it also followed the same path as their net debt to merely trend sideways with their net debt-to-EBITDA of 6.89 practically unchanged since their previous results of 7.00 and 6.81 at the end of 2021 and 2020 respectively. Unsurprisingly, these are clearly well above the threshold of 5.01 for the very high territory and even if they were to reduce their net debt by circa 10% on the back of their divestiture and free cash flow, they would obviously remain within the very high territory and thus sees little relief in sight. Meanwhile, their net debt-to-operating cash flow continues fluctuating with their cash flow performance, most recently climbing to a seldom-seen level of 9.78 on the back of their previously discussed weak underlying operating cash flow, which bodes very poorly for their ability to deleverage.

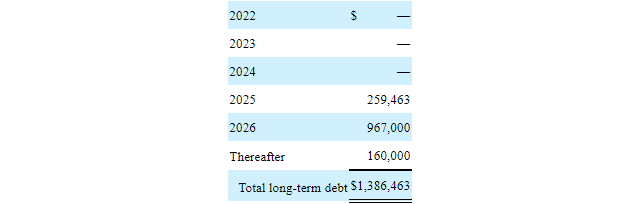

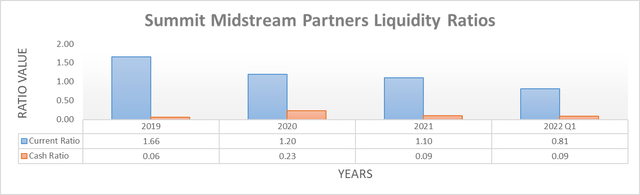

If they have one bright spot, it would have to be their liquidity that is now adequate with a current ratio of 0.81 and a cash ratio of 0.09. When conducting the previous analysis one-year prior, they were staring down the barrel at the vast majority of their debt maturing during 2022 but thankfully, it was subsequently refinanced and thus now sees no maturities until 2025, as the table included below displays. Despite resolving their weak liquidity, the $700m of 2026 secured notes they issued to help refinance their 2022 senior notes carry a burdensome 8.50% interest rate, which as previously discussed, now hinders their cash flow performance.

Summit Midstream Partners 2021 10-K

Conclusion

Despite their debt refinancing buying breathing room to hopefully avoid bankruptcy, it sees their common unitholders squeezed out of their earnings by debt holders whilst also doing nothing to ease the pain they also feel as they are further squeezed out by the preferred unitholders, which are bit by bit gaining more and more of their assets and earnings. Disappointingly, their lack of deleveraging sees little relief in sight and thus I believe that downgrading to a sell rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Summit Midstream Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment